Alisa Davidson

Revealed: July 11, 2025 at 10:40 am Up to date: July 11, 2025 at 9:58 am

Edited and fact-checked:

July 11, 2025 at 10:40 am

In Transient

Bitcoin enters Q3 2025 with rising momentum. Stimulus-driven macro shifts, political realignment, mining industrialization, and ESG scrutiny converge to reshape BTC’s market, that means, and worth trajectory.

Bitcoin’s position in 2025 can’t be diminished to cost charts. It’s not a speculative experiment or contrarian hedge. It’s now a gravitational drive pulling in capital, ideology, infrastructure, and environmental discourse. This 12 months, Bitcoin is formed not simply by what it does, however by what it symbolizes.

As of July 11, 2025, BTC trades at $117,877 — up over 85% YTD. However behind the worth motion lies a deeper construction: a mixture of macroeconomic strain, political signaling, technical momentum, and institutional repositioning. The Bitcoin ecosystem is turning into extra advanced {and professional} — but in addition extra weak. What as soon as moved on the fringes of finance is now more and more pushed by its core.

Political Danger and the Bitcoin Narrative in 2025

Bitcoin’s current momentum displays not solely danger urge for food and halving cycles, but in addition rising affect from state conduct.

A New Fiscal Period: The “Large Stunning Invoice”

On July 4th, Donald Trump — now re-elected and gearing up for his second main coverage time period — introduced a sweeping fiscal stimulus initiative unofficially dubbed the “Large Stunning Invoice.” Whereas the official define spans infrastructure, protection, and tax restructuring, the central subject isn’t the content material — it’s the dimensions of deficit financing.

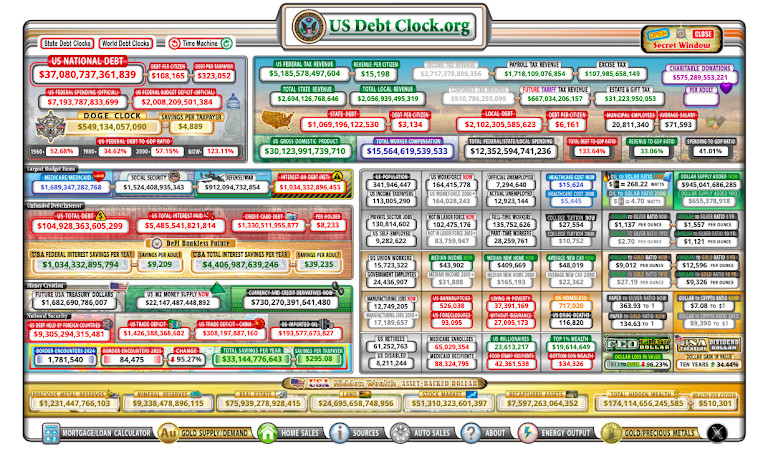

U.S. nationwide debt is now projected to exceed $40 trillion by This autumn 2025, up from $34 trillion only a 12 months earlier. Treasury issuance is ramping up sharply. Actual yields proceed to float downward, formed by implicit financial lodging and political incentives to suppress the price of capital.

This stage of borrowing is unprecedented. It marks a structural shift in how america approaches debt issuance and capital markets.

Capital allocators are beginning to deal with this shift not as a passing anomaly, however as a mirrored image of deeper considerations. Confidence in fiat currencies is more and more seen as inseparable from the steadiness of the political programs behind them. Bitcoin, underneath these circumstances, reclaims its position as a strategic hedge towards each inflation and institutional decay.

This context will not be a replay of 2020. That was reactive debt growth in response to a worldwide well being disaster. In 2025, the growth is deliberate — an act of financial doctrine. And markets are responding accordingly, positioning into scarce, decentralized options like Bitcoin as political danger bleeds into financial credibility.

Elon Musk and the America Occasion: Bitcoin as Image

The second main political catalyst got here on July 5, when Elon Musk declared the formation of a brand new political entity: the America Occasion. In a tweet seen by over 45 million customers inside 24 hours, Musk mentioned:

When requested whether or not Bitcoin could be part of the social gathering’s financial coverage, Musk’s response was unequivocal:

This wasn’t simply one other crypto endorsement. It cemented Bitcoin as a wedge subject: a automobile for opposition, riot, or decentralization — relying on perspective.

In combining fiscal volatility with ideological realignment, the U.S. has inadvertently reintroduced Bitcoin into the political bloodstream. This time, not as a fringe software, however as a story anchor for libertarian id and post-fiat economics.

For markets, the implications are clear: BTC isn’t merely a commodity. It’s now a proxy for political belief — or its absence.

Market Forecast: BTC Value Situations and Technical Alerts

Bitcoin’s surge towards $110K is not speculative noise. It’s a structured transfer — and merchants are watching it intently. A number of unbiased analysts now align round key bullish eventualities, however additionally they warn: this isn’t a assured breakout. It’s a unstable staircase.

Analyst Predictions and Value Targets

A number of crypto macro analysts are converging round a mid-term bullish thesis. Among the many most referenced within the present cycle:

@cas_abbe: Recognized for making use of Wyckoff-based fashions, he lately charted Bitcoin in the midst of a “power-of-three” formation. This construction implies a three-phase breakout, at present in its growth section.

His projected transfer: $135K–$150K by mid-This autumn, contingent on a weekly shut above $110K.

@JavonTM1: A pattern-based dealer who recognized an inverse head-and-shoulders breakout forming over a 6-month chart window.

In keeping with his mannequin, affirmation at $111K–$112K would set off an upward cascade focusing on $140K as a primary cease, then retesting ATH territory.

Each analysts stress that technicals should sync with macro liquidity. In 2021, retail momentum did the heavy lifting. In 2025, it’s ETF flows and institutional demand that decide thrust.

RSI, MACD and Value Construction

Past value targets, market construction is exhibiting basic bullish well being — albeit cautiously.

RSI (Relative Energy Index):

RSI reads 73.36 on the every day chart — signaling an overbought situation. This stage displays robust demand, but in addition requires warning, as traditionally, readings above 70 typically precede short-term pullbacks.

MACD (Transferring Common Convergence Divergence):

The MACD line sits at 2,174, properly above the sign line (1,237), confirming a robust momentum section. The crossover occurred in late June, signaling a possible continuation of the rally.

Quantity Profile:

On-chain and alternate knowledge present heavy accumulation between $94,000 and $99,000, primarily by institutional actors. This zone is now appearing as a stable technical and psychological ground. Liquidity is deep, retracements have been shallow, and volatility is narrowing.

This doesn’t assure a parabolic transfer — nevertheless it creates a structural ground that provides technical merchants confidence to place towards $125K–$135K.

Probabilistic Situations

The bullish outlook will depend on affirmation:

A confirmed breakout and shut above $118,000 opens the trail to $125K–$135K. This zone is now the important thing magnet for bullish positioning.

Nonetheless, failure to carry above $112K may set off a short-term correction again towards $98K–$100K, the place buy-side liquidity stays sturdy.

$150K is feasible in 2025, however contingent on two variables:

Sustained ETF inflows, which stay above $300M every day.

Political tailwinds, significantly associated to deficit spending and Bitcoin-positive regulatory narratives.

In brief, Bitcoin is climbing — not exploding. And the subsequent few weeks will check whether or not conviction can stand up to coverage volatility and institutional pacing.

Institutional and Strategic Funding Conduct

Bitcoin is not primarily pushed by retail traders. In 2025, ETFs, household places of work, sovereign funds, and company treasuries are absorbing accessible provide quicker than exchanges can rotate it—reshaping provide dynamics and market conduct.

ETF and Treasury Dynamics

For the reason that launch of U.S. spot Bitcoin ETFs in January 2024, institutional demand has surged:

ETF holdings now whole roughly 1.234 million BTC, up from about 660,000 BTC in February 2024—a achieve of +86% in 16 months.

These holdings symbolize roughly 5.9% of Bitcoin’s mounted provide, given U.S. ETFs at present management ~1.25 million BTC.

In early July, U.S. spot ETFs recorded over $1.04 billion in web inflows in simply three days, equal to ~9,700 BTC.

BlackRock’s IBIT ETF holds ~700,000 BTC, about 62% of Satoshi’s stash, and is on tempo to succeed in 1.2M BTC by Could 2026, including ~40K BTC/month

Company treasuries are additionally accumulating:

On-Chain Provide Affect

Institutional inflows are reshaping on‑chain metrics, exhibiting clear developments towards long-term accumulation:

Bitcoin Mining: Effectivity, Enlargement, and ESG Challenges

Bitcoin mining has advanced into an industrial-scale, geopolitically important sector. Public corporations are consolidating energy, reshaping vitality dynamics, and integrating with grid operators.

Publish-Halving Consolidation

Industrial Power Technique

Main public miners now handle vitality at scale and optimize operations through grid integration:

Miners are additionally deploying grid arbitrage methods—shutting down or scaling again throughout peak demand to obtain utility credit—shifting from technical effectivity to energy-market savvy.

Sustainability Metrics: The place the Ecological Debate Actually Stands

Bitcoin’s annual vitality consumption at present sits at roughly 132 TWh, primarily based on the Cambridge Bitcoin Electrical energy Consumption Index (CBECI) as of June 2025. To place that in perspective, it consumes extra energy than Argentina or Poland—international locations registering round 155–172 TWh/12 months.

But vitality consumption alone fails to seize the total image. In keeping with a 2024 CoinShares report, between 52 % and 58 % of this vitality now comes from renewable sources—together with hydroelectric energy (notably from Paraguay and Canada), U.S. wind and photo voltaic, and geothermal vitality in Iceland and Kenya. Cambridge’s personal CBECI methodology additionally highlights the growing share of low-carbon vitality inputs .

This shift will not be educational—it has regulatory penalties. Within the U.S., the Environmental Safety Company now mandates quarterly vitality audits for any mining facility over 5 MW, as outlined in its 2024 Sensible Sectors steerage. In Texas, the grid operator ERCOT formally treats mining outfits as “controllable masses”, enabling them to take part in peak-demand mitigation packages. The EU’s MiCA framework launched ESG classifications into crypto markets, encouraging transparency—even when Bitcoin-specific laws stay underneath dialogue.

Nonetheless, criticisms persist. A peer‑reviewed MIT examine reveals that even massive public miners within the U.S. emit on common ~397 gCO₂/kWh—similar to grid averages—calling into query any blanket claims of carbon neutrality. And resulting from inconsistent reporting requirements, allegations of “greenwashing” proceed, particularly from amenities in jurisdictions with looser oversight .

So, whereas Bitcoin’s vitality consumption stays massive, the evolving vitality combine and rising institutional oversight recommend a transition—albeit one nonetheless shadowed by knowledge opacity and uneven regulation. For traders and policymakers alike, the query is not whether or not mining consumes vitality. It’s how successfully it’s shifting towards sustainable practices with out shedding transparency.

What’s Subsequent for Bitcoin in H2 2025

Bitcoin enters the second half of 2025 bolstered by structural power—ETF inflows above $1 billion/week, 73% of provide managed by long-term holders, and alternate reserves close to multi-year lows. A confirmed ground at $110K and a breakout above $112K may propel BTC towards $125K–$135K by This autumn, as projected by Cas Abbé and Javon Marks.

However the broader check lies in its capability to perform as infrastructure, not merely hypothesis. Michael Saylor lately captured this in a publish on X:

That distinction issues. As regulatory frameworks tighten—via EPA-mandated audits, ERCOT grid integration, and ESG benchmarks—Bitcoin should validate its neutrality, transparency, and resilience.

Its political alignment with new actions provides additional publicity. Be it as a hedge, image, or asset, Bitcoin’s subsequent trajectory will depend on balancing decentralization with institutional legitimacy.

H2 2025 received’t be about whether or not Bitcoin can soar—it’s about whether or not it could maintain its position as a decentralized asset inside a structured monetary and regulatory atmosphere.

Disclaimer

Consistent with the Belief Undertaking tips, please word that the knowledge offered on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional data, we propose referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.