Victoria d’Este

Revealed: July 28, 2025 at 10:14 am Up to date: July 28, 2025 at 10:15 am

Edited and fact-checked:

July 28, 2025 at 10:14 am

In Temporary

Regardless of Bitcoin reaching $124k in July, ETH and TON have been range-bound, with the main target now on what’s coming in August.

So right here we’re on the finish of July, and it’s been a kind of months the place you blink and Bitcoin’s at $124k, then blink once more and also you’re trapped in a sideways field. In different phrases, BTC hit contemporary all-time highs earlier this month, and ever because it’s been vary metropolis. Identical goes for ETH and even darkish horse TON. The query now isn’t “what occurred,” it’s “what’s coming in August.” Let’s break that down coin by coin.

Bitcoin (BTC)

Bitcoin’s executed one thing form of lovely this month, however then left us all pissed off. It pushed by means of $120K, grabbed liquidity above and under, and now it’s simply floating. For over per week, it’s been pinned between ~$115K and ~$120K, which on the one hand suggests uncertainty – however on the opposite, it screams accumulation. In the event you ask us, good cash doesn’t accumulate on the high in the event that they suppose the celebration’s over.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

And there’s been actual information driving this chop: Spot ETF inflows slowed down (we had 12 straight inexperienced days earlier than that).

Spot Bitcoin ETFs see outflows after 12-day influx streak. Supply: SoSoValue

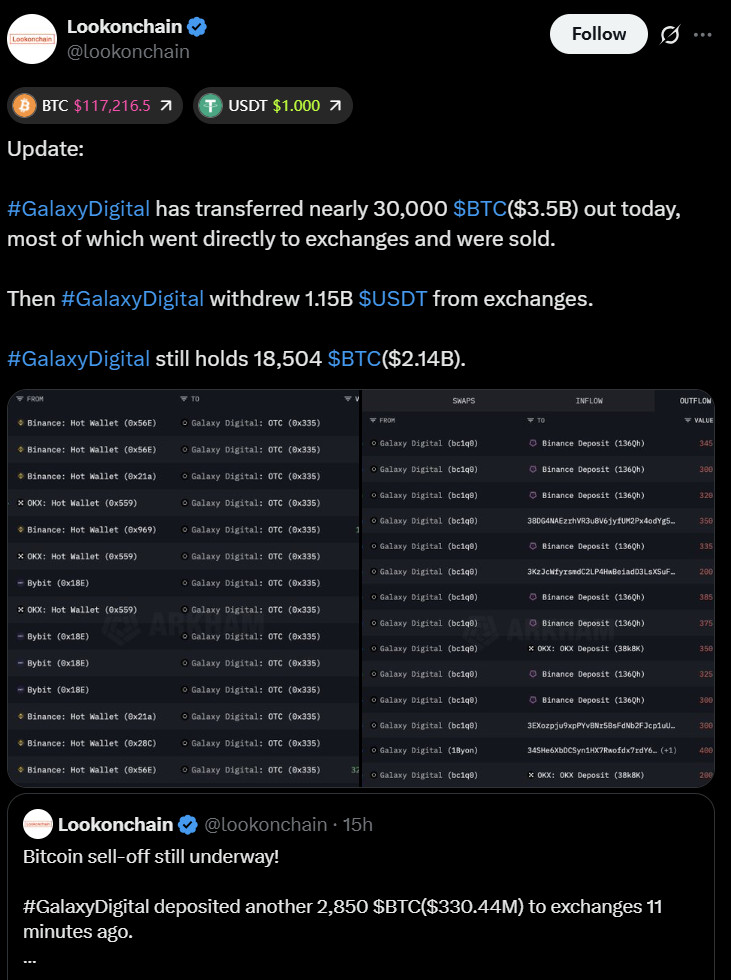

Galaxy Digital dumped billions in previous BTC, and retail form of ghosted after the July fireworks.

Supply: Lookonchain

However general the market held up. Value didn’t collapse. That tells us demand is actual, and perhaps extra affected person than anticipated.

In the meantime, regulatory winds are blowing in from DC and Tokyo. The GENIUS Act simply gave stablecoins a transparent regulatory lane within the US.

Supply: Cointelegraph

Japan’s XRP-for-coffee program (effectively, technically Aplus and SBI’s point-to-crypto plan) exhibits how seamlessly crypto is slipping into client finance.

Souce: Cointelegraph

As you possibly can see, we’ve had plenty of main crypto-specific developments this July. And it’s as if all of that’s constructing as much as one thing, isn’t it?

So, let’s face it: that tight BTC vary goes to snap – and never gently. All of the volatility compression factors to an enormous transfer brewing. If bulls can push above $123K with quantity, we may simply be a leg towards $135K. But when that $115K ground provides? A check of the excessive $100Ks isn’t off the desk. Both means, August won’t be boring.

Ethereum (ETH)

In the meantime, ETH is quietly having itself a good time. It’s methodically pushing again towards $4K whereas Bitcoin takes a breather. On the 4H chart we see a consolidation adopted by a gradual grind upward.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

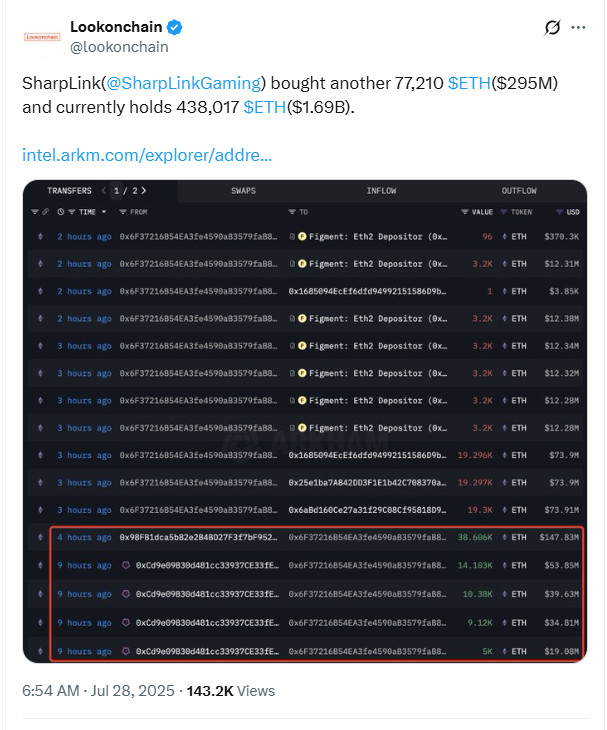

And, most significantly, all that has been buoyed by a firehose of institutional demand. For one, SharpLink purchased almost $300M value of ETH.

Supply: Lookonchain

Subsequent, BitMine’s gunning for six million ETH in treasury.

BitMine is the biggest Ether treasury agency after its newest buy. Supply: Strategic Ether Reserves

And don’t overlook about ETF flows: therse haven’t simply held regular – they’ve outpaced Bitcoin for days now.

Ether ETFs’ internet influx up to now six days hit $2.39 billion. Supply: Farside Traders.

You could possibly argue ETH is doing what BTC used to do: lead the good cash. And perhaps that’s true – a minimum of, for now. Its provide is tightening, its staking ecosystem is sticky, it’s bought ETFs, DAOs, and DeFi builders treating it like precise digital infrastructure.

However – honest warning – sentiment is getting frothy. RSI’s nearing overboughts, and social chatter is getting euphoric. And everyone knows what occurs when Twitter begins calling $9K targets unironically. So in August, we would lastly get the showdown: does ETH break $4K with authority, or will we get a “wholesome” intestine test again towards $3K?

And let’s not overlook that, if Bitcoin breaks up, ETH is nearly assured to comply with – perhaps even outperform. But when BTC fumbles, ETH may bleed tougher within the brief time period. Both means, as a crypto dealer you have to be watching ETH like a hawk.

Toncoin (TON)

In the event you’ve been monitoring TON recently, you’ve most likely observed it’s not doing something flashy on the charts. Value-wise, it’s been inching again up after the mid-July dip, sitting round $3.40 now, holding the 50 SMA on the 4H. Not precisely a headline transfer, but additionally not a breakdown.

TON/USD 4H Chart. Supply: TradingView

What’s extra attention-grabbing – and ever extra related for those who’re considering forward to August – is what’s been taking place across the token.

First up: TON Pockets is now stay for U.S. Telegram customers. Yeah, it’s solely the non-custodial model for now, however that is the primary time U.S.-based Telegram customers can work together immediately with TON by means of the app. That opens a door, and whereas it’s not going to maneuver the worth in a single day, it’s a kind of issues that might quietly scale if customers really have interaction with it.

Then there’s some ‘larger image’ form of stuff. Kingsway Capital is reportedly making an attempt to lift $400 million to construct out a TON treasury reserve.

Supply: Bloomberg Regulation

You may’ve seen related strikes in ETH and BTC – this matches that very same development of establishments constructing crypto positions, only a layer deeper down the stack. The truth that TON’s even within the combine says quite a bit about the way it’s being seen by ‘that’ facet of the market.

Supply: Crypto Every day

And for those who’ve been keeping track of Telegram updates, there’s been a gentle drumbeat of adjustments that quietly tie again to TON. Gifting is now restricted to Premium customers, and Telegram is testing a brand new “fee score” system tied to star purchases – mainly gamifying in-app spending. Even Pavel Durov jumped on this week with a submit about username scams and requested individuals to message him immediately… for five,000 stars. It sounds a bit on the market, but it surely reinforces one thing vital: Telegram is monetizing, and TON is a part of the rails.

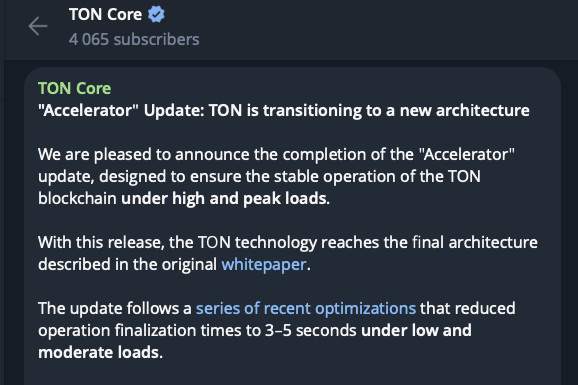

Supply: TON Core on Telegram

Lastly, below all this, the community bought a technical improve – Accelerator – which brings it nearer to the structure specified by the unique whitepaper. It introduces new node roles and improves how the community handles excessive load. Not a market mover per se, however positively a readiness transfer.

Remaining ideas – So, August?

Let’s be trustworthy. Most of us are sitting on positions and observing charts, questioning when this vary breaks. That’s the factor about post-ATH chop: it’s psychologically brutal, as a result of you understand a breakout’s coming, however not when. The excellent news is, August is nearly assured to ship motion. There’s no crystal ball, however right here’s the good take: keep agile, watch funding charges and ETF flows, and don’t go to sleep on altcoins like TON which are constructing even when nobody’s watching. As a result of the following massive leg normally begins the second everybody appears away.

Disclaimer

In keeping with the Belief Mission tips, please be aware that the knowledge offered on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation if in case you have any doubts. For additional info, we advise referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.