Joyful FOMC day to those that have fun!

At this time’s the day the US Fed drops its choice on rates of interest – and it’s occurring quickly, at 2 PM ET.

Sadly, we received’t be round when the information hits… and sadly x2, we’re off for the remainder of the week too. The juicer’s taking a break 😮💨

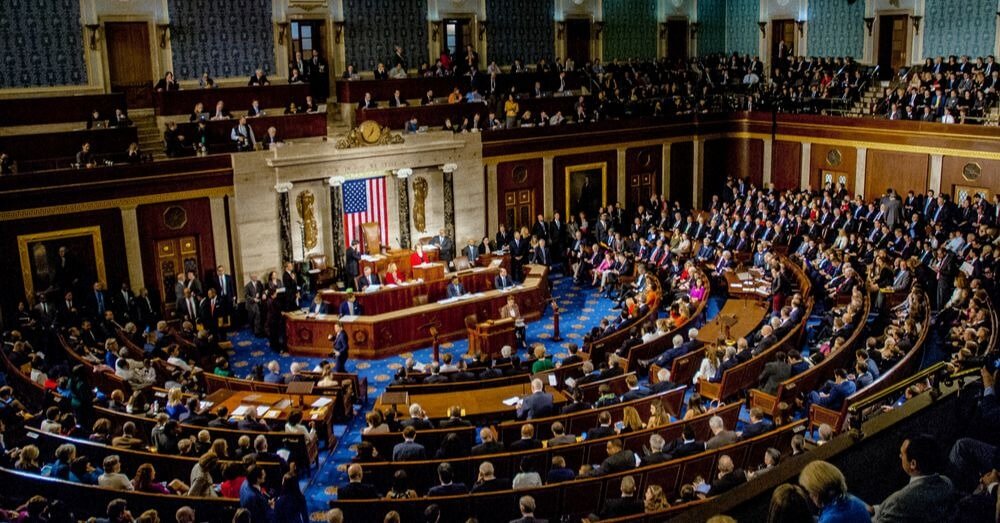

Supply: @Decu0x

However it is best to undoubtedly control the headlines later immediately, as a result of regardless of the Fed decides and Chair Jerome Powell says afterward within the press convention would possibly transfer the markets.

👉 In the event that they reduce charges, markets would possibly rally. Decrease charges = cheaper borrowing = more cash sloshing round = danger belongings like crypto get some love.

👉 In the event that they hike, that’s often bearish. Increased charges = tighter liquidity = much less risk-taking.

👉 In the event that they preserve charges unchanged (which most individuals anticipate), that could possibly be a light optimistic. As a result of when the result is predictable, uncertainty decreases, and markets like that.

That stated, even when the choice is precisely what everybody expects, this may solely clear up one layer of uncertainty.

What comes subsequent is dependent upon Powell’s tone within the press convention.

If he hints that price cuts are far off or sounds extra fearful about inflation, that would carry volatility into the image.

Sadly x3.

And Bitcoin’s in a spot the place any shock might actually change issues.

Based on Bitcoin Vector, whereas the general construction nonetheless leans bullish, costs haven’t damaged down, and the setup seems to be good – it’s missing momentum.

In different phrases, there aren’t sufficient consumers to push the value by way of.

So, what’s subsequent?

👉 If BTC can break above $120.5K, that may doubtless affirm one other leg up;

👉 Nevertheless, if it drops, $112.5K is the subsequent massive help degree – a value the place consumers would possibly present up and cease the autumn. If it breaks beneath that degree, issues would possibly get uglier.

Total, Bitcoin’s present state is like that second while you textual content somebody you want and you aren’t getting a reply for 12 minutes.

Are they busy? Did they only ghost you? Are they typing an extended, considerate message? You don’t know.

That’s the vibe: not crashing, not pumping, simply hanging out, ready.

It wants a motive to make a transfer, and immediately’s Fed information could be the factor that lastly pushes it someway.

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)