Bitcoin is holding agency above the $115,000 stage after a number of days of buying and selling beneath it, signaling renewed power out there. The bullish tone is constructing as Ethereum posts huge features and altcoins start to point out sturdy strikes over the previous few days. For some analysts, this could possibly be the beginning of the long-awaited altseason; for others, it’s merely the remainder of the market catching as much as Bitcoin’s earlier rally.

Associated Studying

Prime analyst Axel Adler famous that Bitcoin’s worth is now buying and selling near its all-time excessive, with the BTC Z-Rating (Worth, 30/365) sitting round +1.5σ above its one-year norm. This studying is effectively beneath the +2.5σ stage sometimes related to overheating, suggesting that whereas momentum is powerful, it’s not but at excessive ranges. The present atmosphere provides a good backdrop for potential upside, with room for the market to broaden additional earlier than reaching overheated situations.

With altcoins gaining traction and Ethereum’s rally including gas to the market’s optimism, the approaching days may decide whether or not it is a sustainable breakout or simply one other part of consolidation earlier than the subsequent main transfer.

On-Chain Exercise Nonetheless Lags Behind Worth

In accordance with Adler, Bitcoin’s present market setup is exhibiting a constructive backdrop however with some necessary caveats. Adler factors out that the Adjusted Worth Divergence (APD) stays adverse close to −1.5 after rebounding from native lows round −2. This metric means that Bitcoin’s worth remains to be outpacing on-chain exercise, though the hole between the 2 is narrowing. In different phrases, whereas worth momentum is agency, the community’s transactional exercise and utilization haven’t but totally caught up.

This discrepancy creates an fascinating dynamic for the market. Adler explains that the bias nonetheless favors worth, which means momentum is being pushed extra by investor positioning and sentiment than by on-chain fundamentals. For the rally to achieve extra structural assist, a more healthy setup would see APD transfer towards zero. This might occur in certainly one of two methods: both community exercise will increase considerably whereas worth strikes sideways or posts modest features, or Bitcoin’s worth cools off to higher align with present utilization ranges.

Importantly, Adler warns in opposition to decoding APD shifting towards zero as a direct purchase or promote sign. As an alternative, it represents an indication of normalization — some extent the place market worth and underlying community fundamentals are higher aligned. For now, Bitcoin’s technical and macro backdrop stays bullish, however sustained long-term progress will probably require the community to meet up with worth motion.

Associated Studying

Bitcoin Worth Holds Key Help Close to $115K

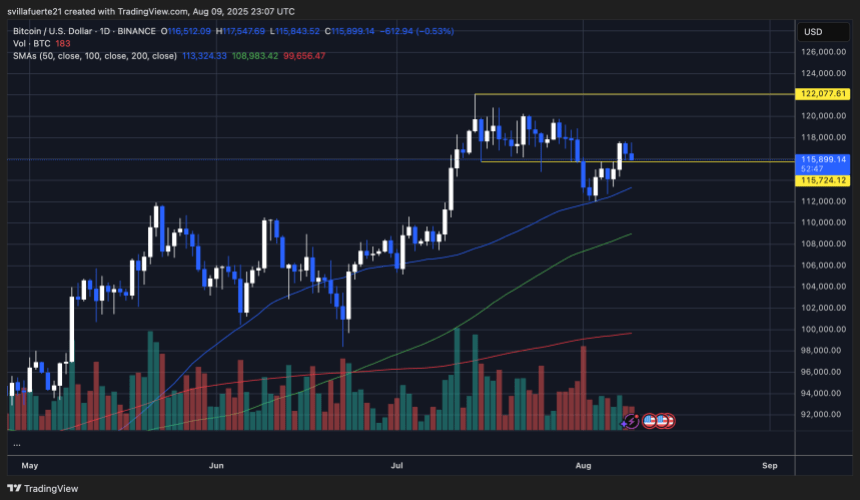

Bitcoin is consolidating above the $115,724 assist stage after a short dip beneath it earlier this month. The each day chart reveals worth stabilizing simply above the 50-day easy shifting common (SMA), presently close to $113,324, which has acted as a robust dynamic assist all through the latest uptrend. The short-term construction stays bullish, with BTC buying and selling inside a variety between $115,724 assist and the $122,077 resistance stage.

Quantity has tapered off barely for the reason that early August rebound, suggesting the market is in a wait-and-see mode earlier than a possible breakout. A decisive shut above $118,000 may invite one other take a look at of the $122,077 resistance, a key stage that has capped upside makes an attempt a number of occasions. If damaged, this might open the door towards new all-time highs.

Associated Studying

On the draw back, shedding $115,724 would shift focus to the 100-day SMA at $108,983 as the subsequent main assist. Till then, the higher-lows sample suggests patrons are defending the mid-$115K zone aggressively.

Featured picture from Dall-E, chart from TradingView