World crypto asset funding merchandise noticed a big rebound in investor curiosity final week, with inflows totaling $3.75 billion, based on CoinShares’ newest fund flows report. The determine marks the fourth-largest weekly influx on report, highlighting renewed exercise following a number of weeks of muted sentiment throughout the sector.

James Butterfill, head of analysis at CoinShares, famous that inflows have been closely concentrated: “Unusually, virtually all inflows have been directed right into a single supplier, iShares, and one particular funding product. Following current value good points, whole property underneath administration reached an all-time excessive of $244 billion on August 13.”

Whereas inflows have been widespread throughout a number of digital property, Ethereum stood out because the dominant contributor, far surpassing Bitcoin in each weekly and year-to-date (YTD) commitments.

Ethereum Leads with Report Inflows

Ethereum funding merchandise attracted $2.87 billion final week, accounting for roughly 77% of all inflows in the course of the interval. This efficiency introduced Ethereum’s YTD inflows to $11 billion, setting a report and underscoring its rising position in institutional portfolios.

The dimensions of capital transferring into Ethereum additionally meant that, relative to property underneath administration, inflows represented 29% of whole Ethereum AuM, in contrast with Bitcoin’s 11.6%.

By comparability, Bitcoin merchandise recorded $552 million in inflows in the course of the week. Though nonetheless a considerable determine, it lagged significantly behind Ethereum. Different altcoins additionally attracted investor consideration, with Solana seeing $176.5 million and XRP recording $125.9 million in inflows.

Conversely, some property skilled outflows: Litecoin misplaced $400,000, whereas Toncoin noticed $1 million withdrawn. The report emphasised that the surge in Ethereum inflows occurred towards a backdrop of elevated buying and selling volumes and value power, bringing ETH near its historic highs.

It’s steered that the focus of inflows into Ethereum might mirror rising confidence in its evolving position because the spine of decentralized finance (DeFi) and broader blockchain functions.

Regional Breakdown and Market Context

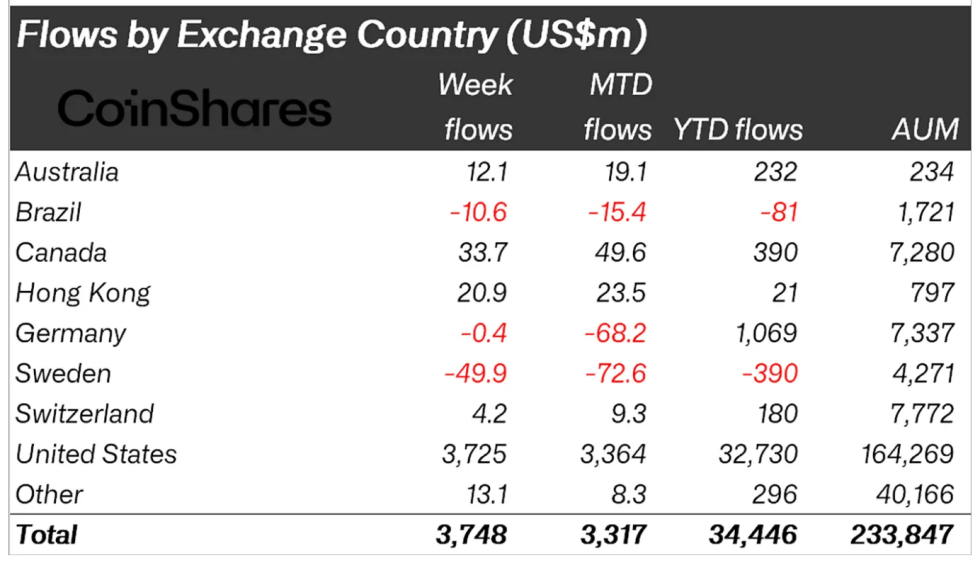

Geographically, the USA accounted for 99% of all inflows, totaling $3.73 billion. Different markets recorded modest figures: Canada registered $33.7 million, Hong Kong added $20.9 million, and Australia noticed $12.1 million. Then again, Brazil and Sweden bucked the development, recording outflows of $10.6 million and $49.9 million, respectively.

The heavy US focus highlights the continued dominance of North American establishments in driving digital asset fund flows. Butterfill as aforementioned already identified that whereas the sturdy influx numbers are encouraging, the weird focus right into a single supplier highlights the uneven distribution of institutional demand throughout the sector.

Wanting forward, it ought to be price monitoring whether or not Ethereum can maintain this momentum and whether or not Bitcoin inflows start to catch up. The report progress in whole property underneath administration throughout crypto funding merchandise means that regardless of current volatility, institutional curiosity in digital property continues to develop.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)