Crypto gasoline charges are the charge required to course of transactions or execute good contracts on blockchain networks like Ethereum, Polygon, and Binance Good Chain (BSC). It’s paid as an incentive to validators for offering the computational sources wanted to confirm transactions and safe the community.

On this article, we’ll decode gasoline charges, their significance, usability, calculation methodology, and impacts on the blockchain ecosystem. We’ll additionally run you thru the perfect instruments to trace gasoline costs and methods to attenuate transaction prices.

Understanding Crypto Gasoline Charges

Supply: Chainmyne

Blockchain transactions are sometimes promoted as a free or cheaper various to conventional banking companies. Nonetheless, these transactions are by no means actually costless or nominal. All blockchains, starting from Bitcoin and Ethereum to Solana and Cardano, cost transaction charges for each easy and complicated operations carried out on their networks.

Examples of easy transactions embody making funds for services and products or transferring cryptocurrencies to mates. Conversely, operating clever contracts, interacting with dApps, and minting tokens are examples of extra complicated transactions.

Gasoline Charges vs. Transaction Charges: What’s the Distinction?

Within the context of blockchains, Ethereum was the primary community to popularize the terminology “gasoline charges” to explain transaction prices.

Blockchains akin to Ethereum, Polygon, Arbitrum, and BSC generally refer to those prices as gasoline charges. In distinction, Bitcoin makes use of the time period “mining charges,” whereas others like Solana and Cardano merely deal with them as “community charges” or “transaction charges”.

In essence, the prices you incur to conduct transactions on Ethereum and Ethereum-compatible networks are generally known as gasoline charges. Contrarily, the fees you pay to course of transactions on different blockchains are referred to as mining prices or transaction charges.

Moreover, transaction or gasoline prices range throughout blockchains as a result of not all networks are created equal. For instance, Solana has a processing velocity of 65,000 transactions per second (TPS), whereas Ethereum is way slower with an common block time of round 12 seconds.

Moreover, these prices fluctuate ceaselessly. They rely upon the dimensions and complexity of the transaction and the demand and provide situations of the community. Sometimes, gasoline costs are impacted by numerous components. These embody consensus mechanism, nature of operations, community capability, validator availability, and demand for block house at transaction time.

Why Crypto Networks Cost Gasoline Charges?

Transaction verification requires computing energy and sources like giant digital computer systems and electrical energy. These sources incur prices, that are borne by validators.

In crypto networks like Ethereum that observe the proof-of-stake mannequin, validators should stake at the very least 32 Ether (ETH). This permits them to take part within the consensus course of and confirm transactions. The upper the quantity they stake, the larger their possibilities of being chosen as a validator for creating new blocks.

Furthermore, networks are susceptible to unauthorized entry or hacks with out validators. Consequently, scammers might steal person property or tamper with blockchain information.

Due to this fact, validators are an indispensable a part of the blockchain ecosystem. They have to be adequately compensated to stay motivated in verifying transactions and actively contributing to the community’s safety.

Thus, blockchains cost gasoline charges to incentivize and compensate miners and validators for his or her work in sustaining the community. These charges additionally protect a blockchain from Sybil assaults by making it costly for malicious actors to manage the community.

How Do Gasoline Charges Work on Blockchain Networks?

Gasoline is a unit for measuring the computational energy required to carry out transactions on blockchains. All on-chain transactions, together with interacting with dApps, executing clever contracts, or deploying NFTs, are topic to a gasoline charge.

Gasoline additionally serves as an incentive for validators. It rewards them for offering sources, authenticating transactions, staking tokens, including new blocks, and managing community safety.

Furthermore, gasoline prices additionally deter spam assaults. In its absence, a lot of unhealthy actors might set off an enormous variety of transactions, clogging the community and jeopardizing its sustainability.

Who Pays Gasoline Charges?

Customers pay gasoline charges after they submit their transactions for verification. Additionally it is the charges customers should incur when bidding for a block house to report their transactions on blockchains.

Sometimes, easy transactions, akin to making funds for on-line purchases, devour much less vitality and require decrease charges. Conversely, complicated operations like launching decentralized finance (DeFi) protocols or minting NFTs make the most of extra gasoline and incur greater prices.

Who Receives Gasoline Charges?

A decentralized community of computer systems, particularly the validator nodes, receives a portion of the gasoline charges as a reward. Since these validators devour vitality to confirm transactions, they have to be compensated for his or her computational energy.

In proof-of-work (PoW) blockchains akin to Ethereum Traditional and Bitcoin, gasoline prices are paid to miners, who resolve complicated mathematical puzzles utilizing intensive computational sources. In proof-of-stake (PoS) chains, the gasoline charge is rewarded to validators who stake their cryptocurrencies to safe the community.

Ethereum Gasoline Charges Defined

Gasoline is an integral a part of the Ethereum blockchain and represents the prices of executing Ethereum transactions. Ethereum gasoline charges are priced in small fractions of Ether (ETH), the community’s native cryptocurrency, and denominated in Gwei (10-9 ETH). The Ethereum community distributes a portion of those charges to validators as a reward for staking their ETH and validating transactions.

As Ethereum is essentially the most most well-liked platform for deploying good contract-enabled non-fungible tokens (NFTs) and dApps, it attracts quite a few customers. This ends in community congestion and excessive demand for computing energy. Thus, Ethereum gasoline charges are greater, although the community has transitioned to a PoS consensus system from the PoW mannequin.

How Gasoline Works on the Ethereum Digital Machine?

The Ethereum ecosystem is designed to allow people, companies, and builders to create novel use instances of cryptocurrencies and blockchains. Thus, it’s sometimes called the Ethereum Digital Machine (EVM) as a result of you possibly can construct and deploy functions on it.

The EVM is a decentralized digital setting akin to a cloud app that permits different blockchain-based functions to run inside it. It additionally executes good contract codes throughout all Ethereum nodes in a safe method. Because the Ethereum blockchain is part of the EVM, the crypto property, cash, NFTs, and dApps developed on EVM-compatible networks require gasoline charges.

For instance, the Pepe meme coin and Cryptopunks NFT assortment had been minted on Ethereum. Equally, AAVE, the native crypto of the Aave protocol, can also be Ethereum-based. So, once you wish to purchase, promote, commerce, or switch AAVE, PEPE, or Cryptopunks, you could pay gasoline prices for utilizing the Ethereum blockchain.

Gasoline Payment Denominations Defined: Gwei, Wei, and Ether

Wei: It denotes the smallest fraction of gasoline charges and is called after Wei Dai, a well known pc scientist acknowledged for his beneficial contributions to the fields of cryptography and cryptocurrencies. Gwei: It’s an acronym for “gigawei” and the unit of measurement for gasoline charges on platforms like Ethereum, BNB Chain, Polygon, and so on. The time period combines “giga”, which implies a billion, with “wei” to suggest billions of tiny fractions. One gwei equals 0.000000001 or 10-9 ETH. Ether: Ether or ETH is the native cryptocurrency of the Ethereum blockchain. As of June 2025, Ethereum is the second-largest digital foreign money after Bitcoin, as per market capitalization. One ETH is equal to 109 Gwei.

When Are ETH Gasoline Charges Lowest?

Often, ETH gasoline charges are low when community visitors is much less on the Ethereum blockchain. They lower additional throughout post-market or off-peak hours, like after midnight or early mornings. Gasoline costs are additionally nominal on weekends or public holidays, as a consequence of lowered market exercise and transaction volumes. Nonetheless, Ethereum gasoline charges are extremely risky. Even throughout off-peak hours, transaction processing could also be delayed as a consequence of restricted community capability.

Why Are Ethereum Gasoline Charges So Excessive?

Ethereum gasoline charges had been comparatively low earlier than 2020. However as adoption surged—pushed by DeFi, NFTs, and play-to-earn video games—community congestion elevated, inflicting charges to spike, typically exceeding $20–$30 per transaction.

Earlier than the London Onerous Fork in 2021, gasoline charges had been mounted, no matter transaction complexity or community load. The improve launched a two-part mannequin:

Base charge: Adjusts dynamically and is burned to scale back ETH provide.Precedence charge: An elective tip to incentivize validators for quicker processing.

In late 2021, Ethereum transitioned to Proof of Stake through The Merge, decreasing vitality use by over 99%. Nonetheless, it didn’t totally deal with gasoline charges spikes throughout peak exercise.

Main charge spikes had been triggered by:

ICO Growth (2017–2018): Large inflow of customers overwhelmed community capability.DeFi Summer season (2020–2022): Advanced transactions like lending and liquidity provision elevated demand.NFT Craze (2021): Heavy exercise on NFT marketplaces like OpenSea clogged the community, pushing charges over $100.

Whereas Ethereum continues evolving, scalability upgrades like sharding and Layer 2 options are anticipated to scale back gasoline charges sooner or later.

How Are Gasoline Charges Calculated?

Supply: Obiex

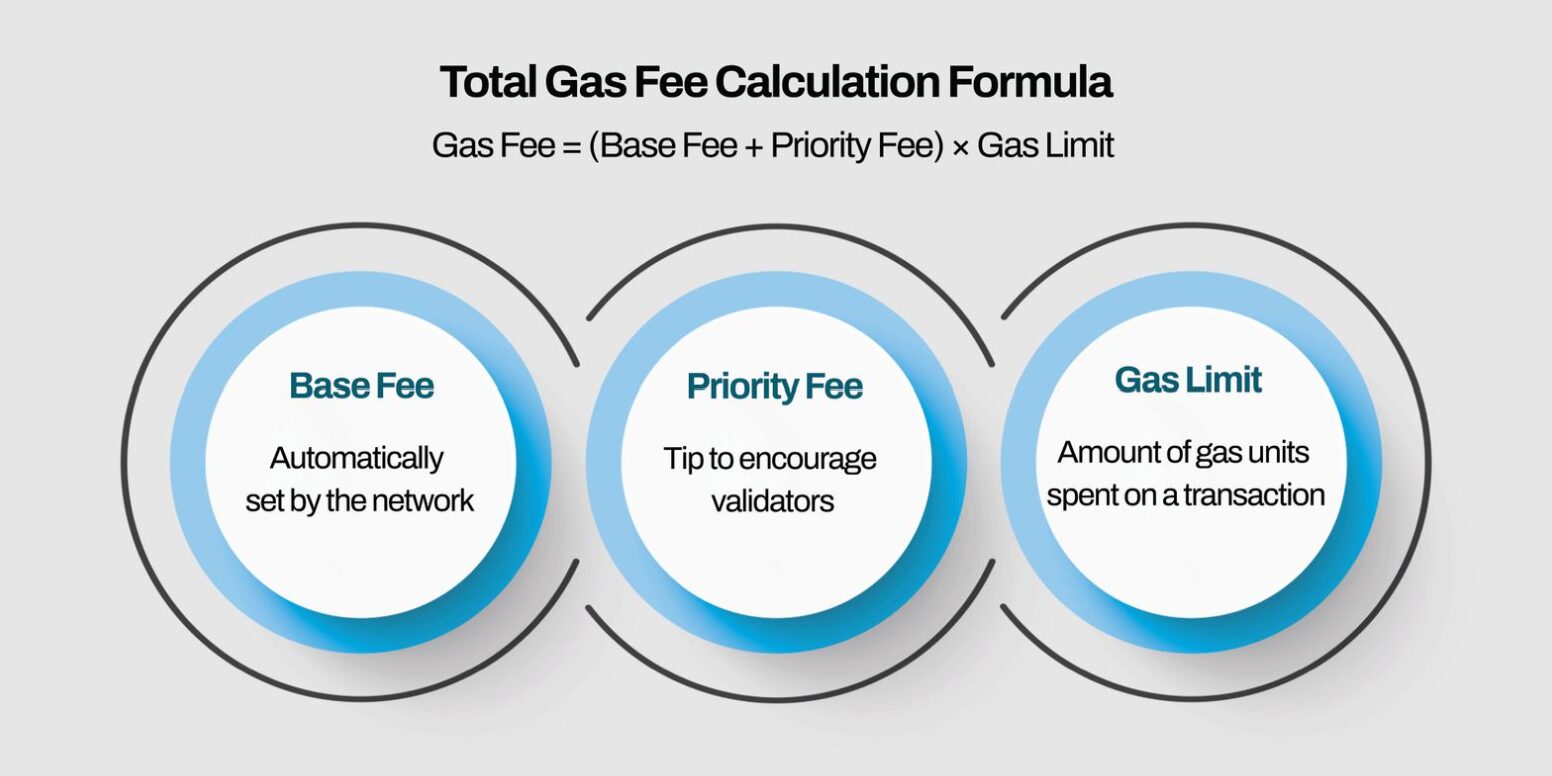

Initially, gasoline charges had been computed as a product of gasoline value per unit and gasoline limits. In August 2021, Ethereum modified the calculation technique to incorporate base charges, whole gasoline models required, and precedence prices. Base charges are the mounted prices set by the community for a transaction.

As an illustration, think about you wish to switch 5 ETH to a good friend and also you imagine it’ll want 3 models of gasoline. The bottom cost is 15 gwei, and also you provide a tip of 5 gwei. On this case, gasoline charges are calculated utilizing the next system: Items of gasoline required X (Base charge + precedence charge). After substituting values within the above system, the price of gasoline comes out to 60 gwei [3 X (15 + 5)] or 0.00000006 ETH. So, you could provoke a switch of 5.00000006 Ether.

What’s a Gasoline Restrict?

The gasoline restrict refers back to the most value a person is prepared to pay when sending transactions for verification or operating token contracts. It’s denominated in gasoline models and caps the utmost worth a transaction or operate can acquire from a person. It additionally acts as a defence mechanism by stopping excessive charges from being wrongly charged as a consequence of bugs in underlying contracts.

You possibly can outline gasoline limits as the utmost quantity of computational effort customers are prepared to expend for executing transactions. Whether it is too low, the set gasoline will likely be consumed, however the transaction will fail. On this manner, gasoline limits limit useful resource and vitality consumption.

Complete transaction prices = Gasoline limits X (Base charge + Precedence charge).

For instance, assume the bottom cost of a transaction is 50 gwei, and you’re prepared to spend an additional 10 gwei for quicker processing. With the gasoline restrict set at 20,000, your transaction charges will likely be 120,000 [20,000 X (50 + 10)] gwei.

How you can Use Gasoline in Ethereum Transactions?

Each motion on Ethereum requires gasoline or computational work. Since gasoline isn’t free, customers should pay for it utilizing Ether(ETH), the blockchain’s native cryptocurrency and governance token.

Conducting a transaction on Ethereum entails three essential steps:

Setting a gasoline restrict: Customers should specify the utmost computational effort they’re prepared to expend earlier than submitting their transactions for processing. The extra complicated the transaction, the larger would be the limits. Transaction failures can happen when you set limits decrease than the stipulated minimal.Selecting the gasoline value: Relying on the community’s demand and provide situations, customers can repair decrease costs to save lots of prices, or pay greater charges to incentivize validators to prioritize the processing of their transactions. Confirming and sending: As soon as validators course of transactions, the ultimate gasoline charges are deducted from the customers’ wallets.

Wallets like Metamask and Belief Pockets present stay gasoline predictions and charge adjustment choices, making the method easier and extra handy. Furthermore, the Ethereum community itself updates periodically to enhance transaction processing speeds. As an illustration, the Ethereum Enchancment Proposal (EIP) 1559 applied computerized base charge changes based mostly on community congestion.

How you can Set Gasoline Costs?

You possibly can resolve how a lot gasoline charges you want to pay. When you can not modify the bottom prices, as they’re robotically set by the community, you possibly can quote an elective tip to incentivize validators to course of your transactions quicker. The upper the precedence charges you provide, the extra seemingly your transaction will likely be validated and appended to the blockchain forward of others.

Ethereum wallets akin to Metamask can help you customise gasoline settings. Relying in your circumstances, you possibly can specify gasoline limits and the utmost international quantity (Base + precedence prices) you’re prepared to pay to your EVM operations.

To set gasoline speeds, Metamask permits you to select any of the choices talked about beneath:

Low – Pay much less gasoline and wait longer to your transaction to course of.Market – Set the gasoline to replicate the present market charges.Aggressive – Pay extra to get your transactions processed within the shortest potential time.

Moreover, Metamask lets you customise different parameters, get pleasure from a customized expertise throughout a number of blockchains, and save and reuse configured settings.

Typically, setting very low gasoline costs or limits shouldn’t be really useful, as your transaction could also be ignored or dropped by validators. It could even fail, and you’ll lose the gasoline spent as it’s non-refundable. In case you are unable to set costs your self, select the dynamic gasoline charge estimates your pockets recommends based mostly on community load.

Ethereum vs. Bitcoin Gasoline Charges

Bitcoin gasoline feesEthereum gasoline chargesBitcoin (BTC) is the biggest cryptocurrency by way of market capitalization (over $2,141 billion as of June 16, 2025)Ethereum (ETH) is the second-largest cryptocurrency as per market capitalization (over $318 billion as of June 16, 2025)Follows the proof-of-work (PoW) consensus mechanism.Follows the proof-of-stake (PoS) consensus system.Transaction prices are referred to as community or mining charges. Transaction prices are referred to as gasoline charges.Beneath PoW, new blocks are added to blockchains by way of mining, a course of that requires miners to unravel complicated math equations.Beneath PoS, transactions are verified and authorized by validators. They’re chosen based mostly on the quantity of ETH they’ve staked to safe the community.Mining charges are excessive, as miners require specialised software program, costly {hardware}, and electrical energy to decode the mathematical puzzles.Although Ethereum has lowered vitality consumption by 99.95% after transitioning to PoS, it prices excessive gasoline charges. The prime causes for the exorbitant prices are heavy community visitors, good contract capabilities, and quite a few transaction verification requests.The primary ones to unravel the complicated puzzles get a share of the mining charges as a reward for his or her exhausting work and computational energy.Those that have staked giant quantities of ETH stand the next probability of being chosen as a validator. As soon as chosen, they obtain a portion of the gasoline charge as a reward for verifying transactions, defending the community, and incurring useful resource prices (e.g, computer systems, electrical energy, and so on.)

How you can Scale back Gasoline Charges?

Every blockchain is completely different by way of velocity, effectivity, affordability, recognition, scalability, vitality utilization, safety, and different traits. Whereas some networks get congested quicker as a consequence of a big person base and excessive demand, many others course of 1000’s of transactions per second (TPS) at a a lot decrease price.

When you purchase, promote, commerce, or switch crypto property usually, selecting an energy-efficient blockchain with the next TPS and decrease charges, like Solana, is crucial.

You must also monitor gasoline value actions utilizing instruments like Etherscan earlier than submitting your transactions on blockchains like Ethereum, that are extremely susceptible to congestion. As gasoline charges rise throughout peak demand durations, buying and selling in off-peak hours, like early mornings or holidays, helps you reduce transaction prices.

It’s also possible to discover layer-2 (L2) options akin to Arbitrum, Polygon, Starknet, and Base to keep away from paying excessive gasoline prices. These networks cost solely a fraction of Ethereum’s gasoline charges as a result of they carry out computational processes off-chain, that means exterior the Ethereum mainnet. By offloading this work, L2 chains considerably scale back computational calls for, making transactions as much as 99% cheaper. It’s also possible to think about investing in crypto indices, a basket of property with computerized rebalancing performance, to decrease your transaction charges.

Finest Instruments to Monitor and Estimate Gasoline Charges

Blocknative gasoline estimator: It exhibits real-time updates on each element of the legacy in addition to the EIP-1559 gasoline charges. It lets you monitor and forecast gasoline costs for 40+ blockchains and analyze common transaction price heatmaps and traits. It’s also possible to obtain its Chrome extension or use the dashboard widgets to check superior visualizations of transactions awaiting verification.Crypto Wallets: Many blockchain wallets, akin to Metamask or Belief Pockets, have built-in calculators to auto-calculate gasoline charges in actual time. Etherscan: It’s a blockchain explorer and analytics platform for Ethereum that lets you monitor stay gasoline costs, view pockets balances, observe transactions, and entry on-chain knowledge. It is likely one of the key instruments for forecasting gasoline charges and verifying community exercise.

Conclusion

With out gasoline charges, validators don’t have any incentive to validate transactions or stake their digital tokens to safe a blockchain. A scarcity of validators poses important dangers to the community’s safety, transparency, effectivity, and long-term sustainability. Thus, gasoline is a crucial element that ensures the sleek functioning of blockchain networks, particularly Ethereum.

Nonetheless, when you commerce throughout a number of blockchains concurrently, hefty gasoline prices might decrease your income significantly. Selecting low-cost blockchains or layer 2 options, transacting throughout non-peak hours, and leveraging instruments like Etherescan to foretell gasoline value actions are some methods to scale back transaction prices.

Excessive gasoline charges may even work in your favour in case you are prepared to lock up your crypto holdings to assist a community. Staking bigger quantities will increase the probability of being chosen as a validator. As a portion of the transaction charges paid by customers is allotted to validators, the next gasoline charge will increase your earnings.

FAQs

How do I keep away from gasoline charges on crypto?

Gasoline charges rise and fall based mostly on a blockchain’s demand and provide situations on the time of the transaction. If the community is congested, gasoline prices enhance, and vice versa. Although it’s unimaginable to keep away from gasoline charges altogether, you possibly can reduce your outgo by buying and selling throughout non-peak hours.

Monitoring instruments like Etherscan that show the day’s highest, lowest, common, and stay gasoline costs will help you determine an opportune time to transact. It’s also possible to decrease your gasoline bills by using L2 chains or dApps for transactions, as a substitute of the Ethereum mainnet.

What’s the gasoline restrict in Ethereum?

Gasoline restrict is the utmost value a person is prepared to pay when submitting transactions for validation on Ethereum. Not too long ago, Ethereum elevated the boundaries to roughly 32 million models for the primary time since 2021.

Are gasoline charges refundable if the transaction fails?

Because of the elementary structure of blockchains, it’s unimaginable to refund gasoline charges, even when the transaction fails. These charges are paid on to the validators on the Ethereum community. Therefore, they’re non-refundable, whether or not your transaction is profitable or unsuccessful.

Do all crypto transactions require gasoline?

No. Solely transactions carried out on Ethereum and EVM-compatible chains require gasoline. Different blockchains like Bitcoin, Solana, and Polkadot additionally cost transaction charges, however they observe distinct charge constructions and are essentially completely different from Ethereum.

How a lot does gasoline price to ETH?

Gwei is a subunit of ETH, and 1 gwei is equal to 0.000000001 or 10-9 ETH. Thus, if the estimated gasoline charge to your transaction is 2,500,000 gwei, you could shell out 0.0025 ETH.

Are gasoline costs predictable?

With Ethereum’s L2 improve, gasoline charges have change into pretty predictable. Nonetheless, community demand is a important determinant of the gasoline prices. Whereas easy fund transfers incur nominal prices, interactions with token contracts and DeFi protocols command greater prices. For instance, Uniswap is the highest gasoline guzzler that consumes appreciable quantities of computational energy as a result of complexity of its version-3(V3) contracts and extra processes concerned. Due to this fact, you’ll want to incur a steep gasoline charge whereas partaking with Uniswap.