The crypto market has been rocked by a wave of liquidations totaling practically $808 million prior to now 24 hours, with Bitcoin (BTC) dipping beneath the vital $110,000 threshold.

Associated Studying

This mass sell-off erased practically all positive aspects sparked by Federal Reserve Chair Jerome Powell’s dovish feedback at Jackson Gap simply days earlier, leaving traders questioning whether or not the dip alerts alternative, or hazard.

Bitcoin Flash Crash Triggers Huge Liquidations

Knowledge from CoinGlass exhibits that lengthy positions accounted for $696 million of the $112 million liquidated, underscoring how overleveraged bullish merchants have been caught off guard.

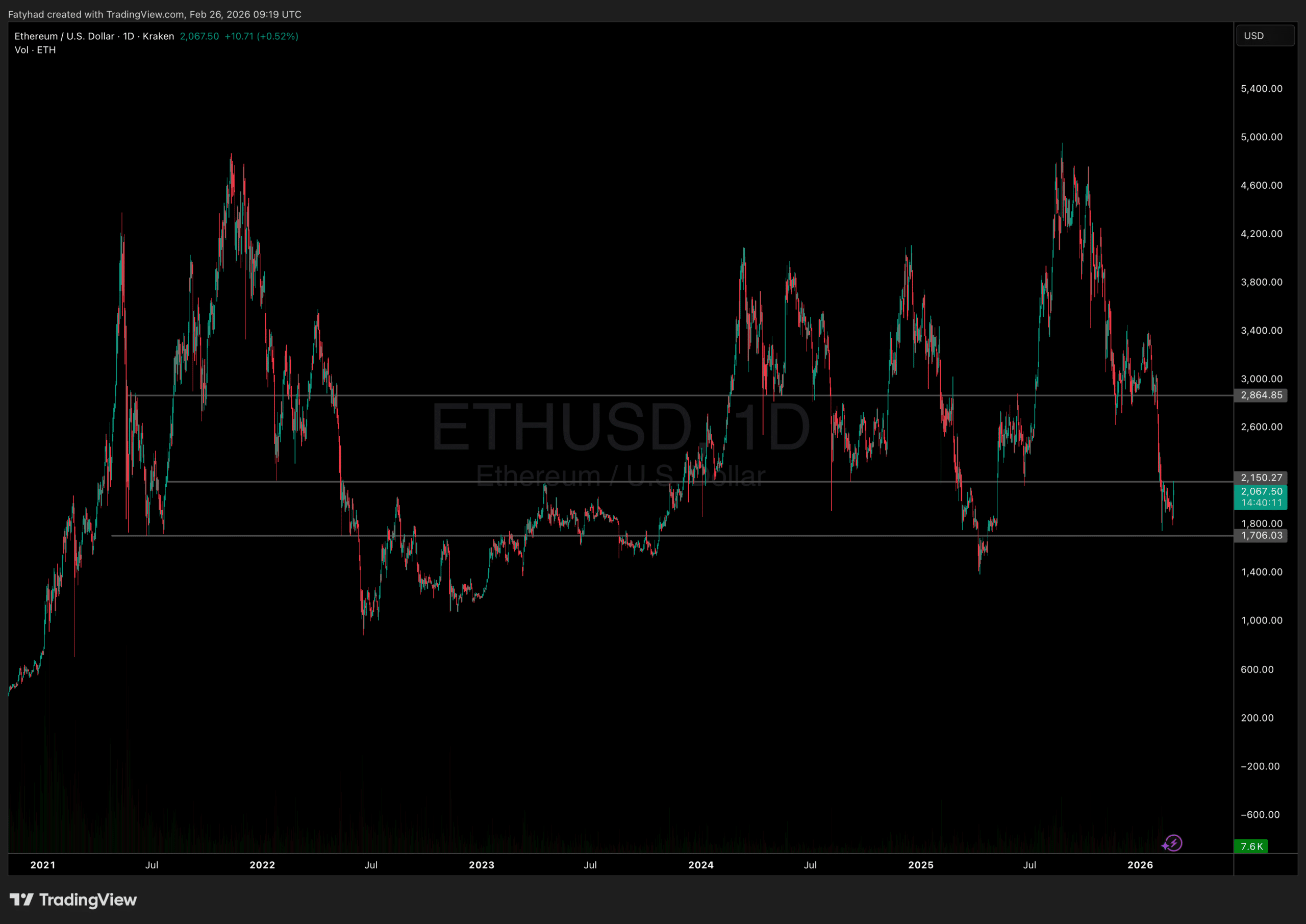

Bitcoin alone noticed $272 million liquidated, whereas Ethereum (ETH) adopted the checklist at $262 million. Altcoins together with Solana, XRP, and Dogecoin additionally suffered double-digit losses, dragging the worldwide market cap down by practically $200 billion to $3.8 trillion.

The sudden downturn was intensified by a Bitcoin whale unloading 24,000 BTC price $2.7 billion, triggering a flash crash that despatched shockwaves throughout exchanges. Greater than 200,000 merchants have been liquidated, with the one largest liquidation coming from a $39 million BTC commerce on HTX.

BTC’s value tendencies to the draw back on the each day chart. Supply: BTCUSD on Tradingview

Are Whales Shopping for the Dip?

Regardless of the sell-off, blockchain information reveals that a number of massive holders have been scooping up BTC and ETH in the course of the downturn.

One whale reportedly acquired 455 BTC ($50M), whereas one other spent practically $100M USDC to build up each Bitcoin and Ethereum. BitMine Immersion, one of many largest ETH holders, additionally added practically 5,000 ETH to its reserves, signaling confidence in long-term development regardless of short-term volatility.

This “purchase the dip” habits suggests whales may even see the correction as an entry level, boosting the idea amongst some analysts that the market is experiencing a wholesome reset after weeks of overleveraging.

What Comes Subsequent for Bitcoin and Crypto?

Whereas Bitcoin trades precariously round $110,000, analysts warn that the subsequent vital help lies at $105,000. A breakdown beneath this degree might speed up a fall towards the $92,000–$100,000 vary. September has additionally traditionally been a weak month for crypto, including additional draw back danger.

Associated Studying

Nonetheless, record-high futures open curiosity and institutional flows into ETH sign that sentiment hasn’t turned totally bearish. Whether or not that is the beginning of a deeper correction or only a shakeout earlier than the subsequent leg up, one factor is obvious: whales are quietly betting on a rebound.

Cowl picture from ChatGPT, BTCUSD chart from Tradingview