Within the set of AI initiatives constructing on Base (or energetic round Base), the three names with the most important market values are Virtuals Protocol (VIRTUAL), Venice AI (VVV), and AWE Community (AWE). Within the tooling layer for AI brokers, Warden Agent Equipment doesn’t have its personal token (the mother or father protocol has the WARP token). A number of small initiatives like A0x, Ratio1, and OXAI do have tokens, however their market values are nonetheless tiny. The information under is a snapshot on the time of writing; costs and market caps transfer on a regular basis.

The Base AI Initiatives

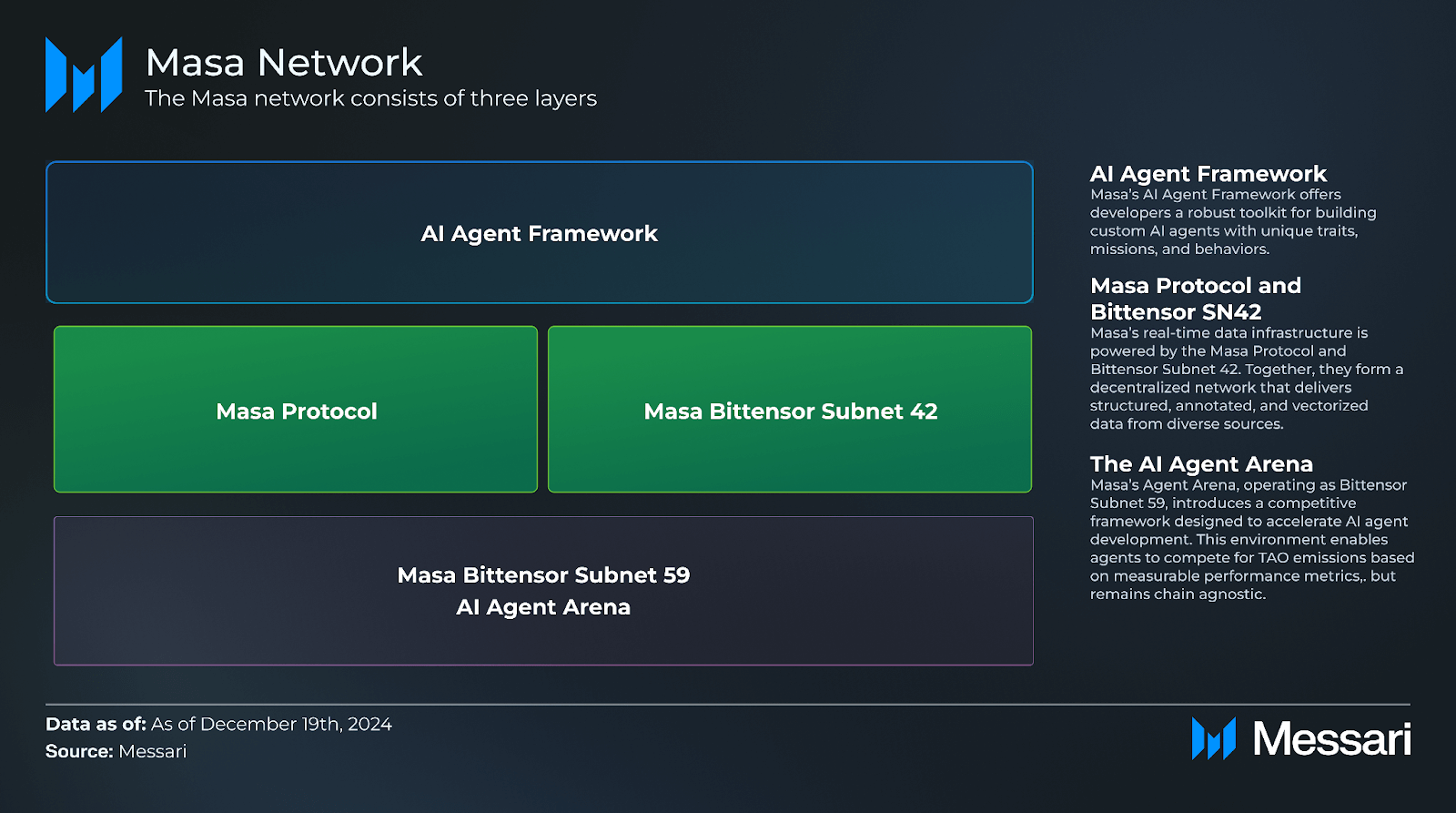

Trying on the Base AI map, we will break up initiatives into two easy buckets. The primary is AI infrastructure: instruments and rails that give knowledge, indexing, storage, and processing for AI brokers. Examples embody Masa, OpenCoin AI, Mozaic Finance, Virtuals Protocol, and Ratio1.

The second is AI brokers and apps (DApps): groups that construct good brokers or end-user apps powered by AI. Examples embody Rivalz Community, Yield Seeker, AITV, and Innovation Sport.

For extra: A Deep Dive into the Base Ecosystem

Base AI Ecosystem

Prime Token Initiatives and Market Dimension

The highest three take many of the “AI cap” on Base: VIRTUAL ~$744M > VVV ~$104M ≈ AWE ~$96M. The “future provide weight” just isn’t the identical throughout them: AWE is already totally circulating (market cap ≈ FDV), VIRTUAL nonetheless has about 34% not unlocked but (Mcap/FDV ~0.66), whereas GIZA has solely about 13% in circulation (Mcap/FDV ~0.13). Which means dilution threat is greater for GIZA if unlocks are heavy. The numbers come from every token’s web page on CMC.

Undertaking

Token

Market cap (est.)

FDV

Mcap/FDV

Fast be aware

Virtuals Protocol

VIRTUAL

~$744.3M

~$1.13B

~0.66

655.5M/1B in circulation; ~$41M 24h quantity

Venice AI

VVV

~$103.6M

~$219.0M

~0.47

35.3M/74.6M in circulation; “450k+ customers”

AWE Community (STP rebrand)

AWE

~$95.9M

~$95.9M

~1.00

100% circulating; tagged “Base” on CMC

Giza

GIZA

~$37.9M

~$282.6M

~0.13

134.3M/1B self-reported; “autonomous markets” infra

Masa

MASA

~$8.1M

~$22.9M

~0.74

1.5B circulating; real-time AI knowledge community

Ratio1

R1

~$1.6M

$7.2M

~0.21

Value and cap proven on Coinbase

A0x

A0X

~$4.59M

~$4.59M

~1.00

Listed on CoinGecko; fundamental liquidity on Aerodrome/Uni v3 (Base)

Rivalz Community

RIZ

~$1.91M

~$8.29M

~0.23

Cross-chain; small cap, large swings

Swan Chain

SWAN

~$1.2M

~$4.58M

~0.26

Calls itself an “AI SuperChain”; very small cap

Mozaic Finance

MOZ

~$31.2K

~$155.7K

~0.20

DeFAI yield

OXAI

OXAI

~€20.3K

~€22.9K

~0.89

Microcap; contracts on Base and app listings

AITV (AgentCoin TV)

AITV

$22.5M

~90M FDV

~0.25

Reveals Base community; whole provide 1B

Base AI Initiatives Have Tokens, and Which Do Not

Within the group that already has a token and a public itemizing, apart from the highest three, we’ve MASA, GIZA, A0X, R1, RIZ, SWAN, MOZ, OXAI, AITV. Every has its personal knowledge web page on CMC/CoinGecko/Coinbase.

Within the group that doesn’t have its token (or no CMC/CG itemizing seen presently), a key identify is Warden Agent Equipment. It’s an SDK/CLI to construct on-chain AI brokers. It’s a instrument, not a token. If you happen to observe the “Warden” ecosystem, the token you will see is WARP for Warden Protocol (listed on MEXC/Uniswap). That’s not a token for Agent Equipment. You’ll be able to learn extra in docs and GitHub, plus a number of Messari notes.

Some logos within the map (for instance, OpenCoin AI/COINAI, Innovation Sport/TIG, Brian, Elsa, Good CryptoX, MoonLight Pixels, Senpi, Rivo, BlockAI, Bitte Protocol, and OXAI) are very early, meme-like, experimental, or cross-chain. Listings can change quick. If a reputation doesn’t have a dependable CMC/CG web page but, deal with it as not publicly listed or micro-cap.

Neighborhood Buzz Based mostly on Followers and Utilization Indicators

If we rank by neighborhood pull (followers, public consumer claims), Virtuals and Rivalz have very massive social attain, whereas Venice stands out for actual consumer numbers.

Virtuals Protocol has about 278K followers on X.Rivalz Community has about 380K followers on X.Venice AI has about 51.6K followers on X and 450,000+ customers within the CMC “About” part.Masa highlights its knowledge community measurement: 1.4M+ distinctive customers and 48K node operators (proven in its CMC profile).

These figures are usually not the identical metric (followers ≠ energetic customers), however they assist us see share of voice. In media and neighborhood chatter, Masa pops up typically due to staking, knowledge farming, and airdrop occasions. Virtuals get consideration for the quick soar in worth and robust FOMO when the token launches. House and Time wins belief with traders due to its tech and help from Microsoft. The Graph is older however nonetheless a core knowledge layer many Base AI initiatives depend on.

For extra: The Base SocialFi – From Buddy.tech to Farcaster

Diversifying from Product Teams

Infrastructure/Engine/Koord AI-Brokers

AWE and Warden (Agent Equipment) lead the tech aspect. AWE sits at round a $95.9M market cap and is 100% circulating, so short-term unlock threat is low. Upside will rely on demand for “autonomous worlds.” Warden Agent Equipment has no token; in the event you make investments by ecosystem, you’d take a look at WARP for the Warden chain and watch actual adoption of the equipment (repos, hackathons, integrations).

We simply launched the AWEsome Ambassador Program at AWE Community.

If you happen to’re into AI brokers, digital worlds, or constructing onchain tradition, that is your invite to affix the motion.

Form the way forward for Autonomous Worlds.

Learn Extra → https://t.co/n3uqxM3RyIApply now →… pic.twitter.com/pSSfXlpijf

— AWE (@awenetwork_ai) Could 23, 2025

dApps/Brokers & Shopper AI

Virtuals lead by market worth (~$744M) and liquidity (about $41M 24h quantity). This reveals sturdy neighborhood pricing plus the AI-agent story. Venice (VVV) sits across the $100M vary with the thought of personal AI inference and a mannequin the place you stake VVV to get inference capability. This ties the token to compute entry.

For extra: Finest Base Community Gaming and NFT Ecosystem

Information/Privateness & DeFAI

Masa (knowledge + LLM community) is close to a $17M cap, with Mcap/FDV ~0.74, so the remaining issuance overhang just isn’t large. The story “real-time knowledge for AI brokers” suits the Base-AI theme and the undertaking reveals large consumer numbers (1.4M+). Giza goals at self-running market infrastructure with excessive FDV ($283M) however low market cap ($38M) as a result of solely about 13% is circulating, so unlock timing issues.

Supply: Messari

Conclusion

The Base AI Ecosystem is shaping up with sturdy infrastructure and fast-moving agent apps. Masa, Virtuals, AWE, and Warden appear to be anchors due to clear token designs, bigger caps, and strong tech. Many different groups within the map haven’t launched tokens but however are watched carefully by the neighborhood and will spark new waves after they checklist.

The long-term view is constructive. Base is backed by Coinbase, has low charges, and scales nicely. As AI and blockchain come collectively, the Base AI Ecosystem is a promising place for builders and traders to discover by means of 2025–2026.