Ethereum has confronted heightened volatility after setting new all-time highs, with the worth retracing to decrease ranges in current periods. The sharp swings have examined investor sentiment, however beneath the floor, institutional demand and whale accumulation proceed to inform a special story. Regardless of the pullbacks, huge gamers are shopping for Ethereum aggressively, signaling confidence in its long-term trajectory.

Knowledge from Lookonchain confirms this pattern, revealing that whales and establishments have been steadily including ETH to their holdings at a fast tempo. This wave of accumulation stands in sharp distinction to the short-term value fluctuations, suggesting that well-capitalized buyers view the present surroundings as a possibility moderately than a threat. Their exercise supplies a powerful basis for market stability and units the stage for potential upside.

Analysts argue that this institutional participation is barely the start of a broader pattern. With Ethereum cementing its function because the spine of decentralized finance and institutional-grade infrastructure, many consider its rally is way from over. Some forecasts now level to ETH climbing above $5,000 within the close to future, fueled by persistent demand and increasing adoption. For buyers, Ethereum’s story is more and more about accumulation and positioning for what might come subsequent.

Establishments Preserve Accumulating Ethereum

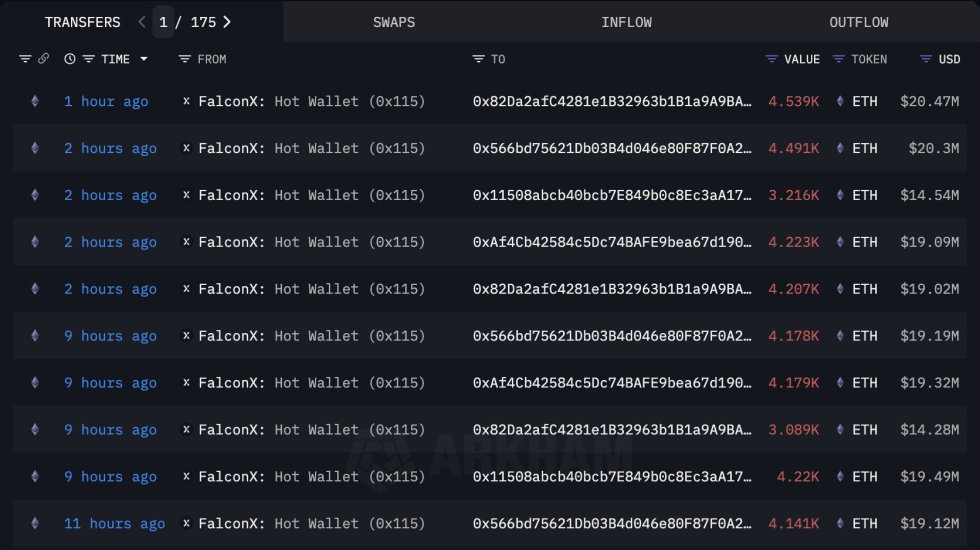

In line with Lookonchain, recent onchain information from Arkham Intelligence highlights a significant wave of Ethereum accumulation that underscores the boldness of huge gamers. Over the previous 30 hours, 4 newly created wallets — probably linked to BitMine — obtained a complete of 78,891 ETH, price roughly $358.16 million, immediately from FalconX. These inflows mark yet one more signal that whales and establishments are positioning aggressively, whilst volatility continues to check short-term sentiment.

This shopping for pattern shouldn’t be new, however its scale and consistency strengthen Ethereum’s bullish case. Analysts notice that persistent institutional demand supplies a agency basis for ETH’s value construction, serving to the asset soak up market swings whereas setting the stage for potential upside. With the sort of accumulation underway, many market watchers argue that it’s only a matter of time earlier than Ethereum breaks decisively above the $5,000 stage.

Such a transfer might carry broader implications past Ethereum itself. For years, merchants have speculated {that a} clear breakout in ETH might act because the catalyst for the long-awaited “altseason,” the place capital rotates into the broader altcoin market. With Ethereum already main the way in which — surging greater than 250% since April — the stage seems set for an additional cycle-defining second.

Worth Motion Particulars: Bullish Consolidation

Ethereum is buying and selling round $4,600 after bouncing from current lows close to $4,400, exhibiting resilience regardless of heightened volatility. The 4-hour chart highlights a constructive construction, with ETH now holding above the 50-day ($4,533) and 100-day ($4,493) transferring averages. This protection means that consumers are sustaining management of key ranges, conserving the broader uptrend intact even after sharp retracements.

The value motion additionally exhibits ETH consolidating slightly below resistance close to $4,800, the extent that capped its final rally. A decisive breakout above this zone could be essential for momentum, probably opening the door for a retest of the $5,000 psychological barrier. Analysts see this stage because the set off that would spark renewed bullish sentiment and prolong Ethereum’s rally into value discovery.

If ETH loses help at $4,500, the market might see one other dip towards $4,300, the place the final sturdy demand emerged. Under that, the 200-day transferring common at $4,146 serves as the final word safeguard for the present pattern.

Ethereum’s consolidation displays steadiness: bulls are defending larger lows, whereas resistance at $4,800 stays the important thing ceiling to interrupt. The subsequent transfer above or beneath these ranges will seemingly outline ETH’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.