The Day by day Breakdown seems to be on the S&P 500 as we wrap up Q2 earnings season. Elsewhere, Palantir bulls search for assist.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our every day insights, all it’s worthwhile to do is log in to your eToro account.

What’s Occurring?

Roughly 97% of S&P 500 companies have reported Q2 earnings, and up to now it’s been much better than anticipated. We already know what most of the companies have been saying on Wall Avenue — first from the banks and bank card firms, then with retailers.

Now listed below are among the key stats from the quarter, with Q2’s earnings report card for the businesses which have reported up to now:

81.4% of S&P 500 companies have beat analysts’ expectations, placing the S&P 500 on tempo to ascertain its greatest “beat fee” since Q3 2021.

Conversely, the speed of earnings misses — the “miss fee” — stands at simply 14.5% proper now. That’s the bottom miss fee in nearly 4 years (Q3 2021).

Analysts got here into the quarter anticipating about 2.8% earnings development. Exiting the quarter, S&P 500 companies are clocking a development fee nearer to 10.7% proper now. That unfold — 7.9 proportion factors — is likely one of the widest spreads in a number of years.

Corporations that beat Q2 earnings estimates posted a rally that was roughly in-line with the common (going again to 2020). Nonetheless, firms who missed expectations have seen the worst response up to now this decade, down a median of 5.3% — nearly double the common decline of two.9% within the prior quarters since 2020. Particularly, tech and healthcare shares have been punished most for lacking.

On the income entrance, 68.8% of companies are beating estimates, the best beat fee since This autumn 2021. For context, final quarter that determine stood at simply 51.1% and hasn’t topped 60% since Q1 2023.

In case you are questioning what among the longer-term implications from this quarter could also be, look no additional than the S&P 500’s anticipated earnings per share over the following 12 months, because it hits a brand new all-time excessive.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Palantir

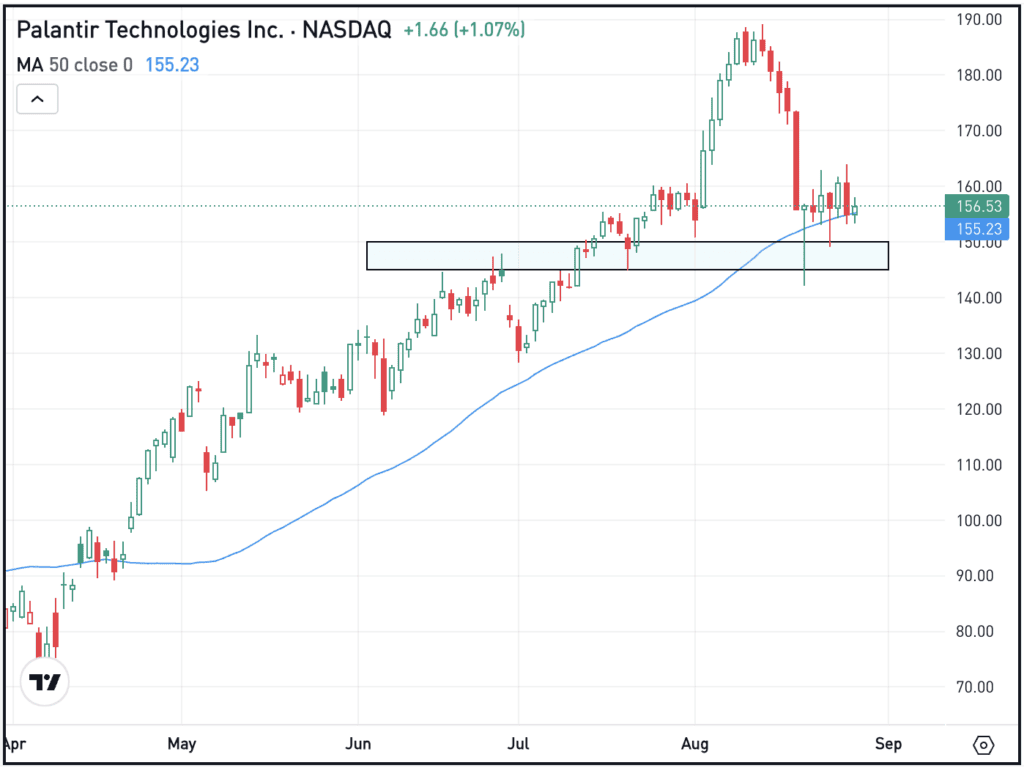

Palantir has been on a tremendous run up to now this 12 months. Regardless of the inventory’s present pullback, shares are nonetheless up 109% up to now in 2025 and are up 421% over the previous 12 months. Bulls are searching for a bounce amid the present pullback, and at the least for now, shares are discovering assist close to the $150 space, in addition to the 50-day transferring common.

If this space stays assist, bulls will need to ultimately see a rally over the $165 stage — which has been current resistance over the previous week — opening the door to probably increased costs. Nonetheless, if present assist breaks, bearish momentum may ensue.

Choices

Shopping for calls or name spreads could also be one solution to reap the benefits of a attainable rally. For name consumers, it could be advantageous to have satisfactory time till the choice’s expiration.

Those who aren’t feeling so bullish or who’re searching for a deeper pullback, places or put spreads might be one solution to take benefit.

For these seeking to study extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please notice that because of market volatility, among the costs might have already been reached and eventualities performed out.