Binance spot buying and selling is the method of exchanging cryptocurrencies immediately at present market costs. You absolutely personal the property, and there’s no leverage or borrowing concerned. The highest options of Binance embody 1,500+ spot pairs, low 0.1% charges with BNB reductions, superior order varieties, international entry with Binance’s SAFU insurance coverage fund, and full integration with its incomes ecosystem.

CriteriaRatingScore4.8/5 ⭐Safety9.5/10Out there Cryptocurrencies9/10Buyer Service9.5/10Consumer Expertise8.5/10Is Binance Spot Buying and selling Protected?Sure

On this Binance spot buying and selling evaluation, you’ll be taught precisely how the platform works, together with its primary benefits and disadvantages. We will even cowl order varieties, supported areas, key options, charges, step-by-step buying and selling guides, and confirmed suggestions for protected and worthwhile buying and selling.

Binance Spot Buying and selling Evaluate – What Is It and How Does It Work?

Binance spot buying and selling is a service that permits you to purchase and promote digital property at present market costs on one of many world’s greatest cryptocurrency exchanges. There isn’t a leverage or borrowing concerned. Binance additionally helps automated methods equivalent to Spot Grid Buying and selling Bots.

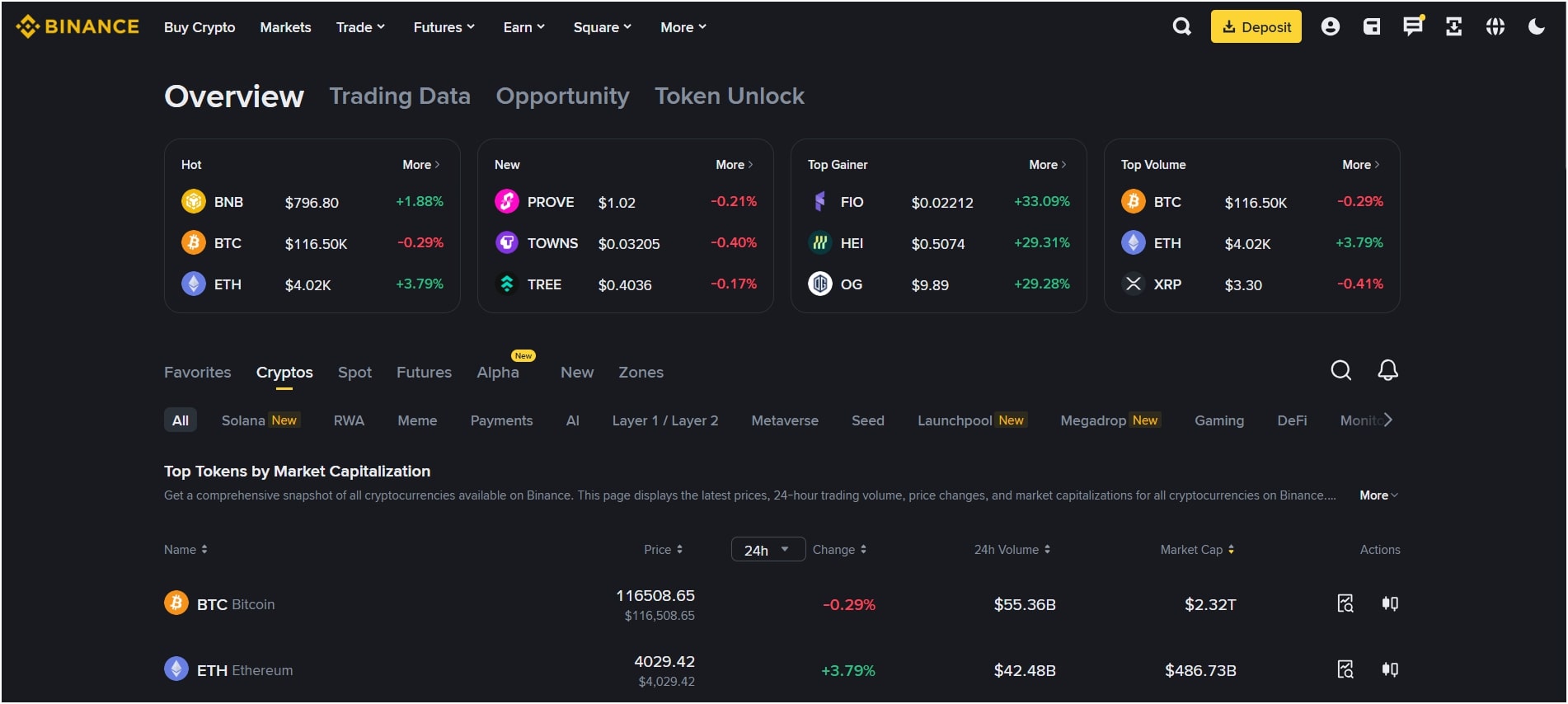

In the present day, Binance has turn into the world’s largest crypto alternate with over 280 million customers in additional than 100 international locations, and you may select from 500+ cryptocurrencies and over 1,500 buying and selling pairs. Liquidity is deep as a result of hundreds of thousands of merchants are shopping for and promoting across the clock, so trades usually execute shortly with minimal slippage.

Spot buying and selling works primarily based on an order e-book. It is advisable deposit fiat foreign money or one other crypto asset into your Binance pockets and choose a buying and selling pair, equivalent to BTC/USDT. The order e-book reveals bids (patrons) and asks (sellers). You must determine what number of tokens you need and select the worth, or use a market order to simply accept the most effective obtainable value. When your order matches with an reverse order from one other consumer, the alternate executes the commerce and updates your stability instantly. Binance expenses a small price for executing the order, which begins at 0.1% for each makers and takers.

After the commerce, the platform credit your new asset stability and debits the one you bought. You’ll be able to withdraw tokens to your individual pockets or maintain them on the alternate. The platform additionally provides further instruments equivalent to charts, technical indicators, and buying and selling bots.

What Are the Execs and Cons of Spot Buying and selling on Binance?

Execs of Spot Buying and selling on Binance

The professionals of spot buying and selling on Binance are deep liquidity, aggressive buying and selling charges, a big selection of property, a big built-in ecosystem, spot buying and selling bots, and superior buying and selling options.

Deep liquidity: The alternate has billions of {dollars} of spot buying and selling quantity each day. With a lot exercise on every buying and selling pair, your orders are more likely to be crammed shortly, and value slippage stays low even for bigger trades. Tight spreads imply you may enter and exit positions effectively.Low and versatile charges: Spot buying and selling charges begin at 0.1% for makers and takers. You’ll be able to scale back your prices by paying charges with BNB tokens, which supplies a 25% low cost, or by climbing by way of the VIP tiers primarily based in your 30‑day buying and selling quantity. Some well-liked pairs, equivalent to BTC/FDUSD, commerce with zero maker and taker charges.Huge choice of property: There are greater than 500 cryptocurrencies and 1,500 spot buying and selling pairs, supplying you with publicity to main cash like Bitcoin and Ethereum, plus a protracted record of altcoins. The alternate lists new cash often, so you may entry trending tokens with out opening accounts on a number of exchanges.Built-in ecosystem: Binance provides extra than simply spot buying and selling. You’ll be able to stake tokens by way of Binance Earn, pay retailers by way of Binance Pay, be taught by way of Binance Academy, and take part in neighborhood discussions on Binance Sq..Superior instruments: The platform supplies charting instruments, API entry, and completely different order varieties (market, restrict, cease‑restrict, trailing cease, and OCO). Additionally, extra skilled merchants can combine bots or algorithms, whereas newbies can use the straightforward purchase/promote interface.Binance Buying and selling Bots: Binance’s automated buying and selling bots can simplify methods. You’ll be able to set them to comply with dollar-cost averaging or different presets for regular market entry or use different preset methods for getting and promoting.

Cons of Spot Buying and selling on Binance

The cons of spot buying and selling on Binance embody an absence of full decentralization, potential regulatory restrictions, and a fancy interface for newbies.

Not Totally Decentralized: You don’t personal your personal keys when buying and selling on Binance. Your funds are saved on the alternate, which carries custody threat, and if the platform faces points, withdrawals may be delayed.Potential regulatory restrictions: Binance spot buying and selling entry is restricted in sure areas. Binance’s phrases of use limit clients in the USA, Canada (Ontario), Iran, Cuba, Crimea, and North Korea. Residents of those jurisdictions should search for alternate options or use native variations of the platform, equivalent to Binance.US, which provides fewer cash.Complicated Interface for Freshmen: The platform’s superior options can really feel overwhelming for brand new merchants. Charts, a number of order varieties, and settings might trigger confusion. So, newbies may take time to adapt.

Binance Spot Buying and selling Order Varieties

Binance spot buying and selling order varieties are market order, restrict order, OCO order, trailing-stop order, and stop-limit order.

Binance Market Order

A market order buys or sells immediately at the most effective obtainable value on the order e-book. So, while you place one, the alternate matches your order with present bids. Since you settle for the present market value, there is no such thing as a assure on the precise fill value, and taker charges apply. Market orders are helpful when speedy execution is extra vital than the worth.

Binance Restrict Order

A restrict order permits you to set a particular value at which you need to purchase or promote. The order stays within the e-book till the market reaches your chosen value, and if the worth by no means reaches your restrict, the order stays unfilled. Restrict orders offer you management over entry and exit costs, usually at decrease maker charges, they usually present liquidity to different merchants.

Binance One-Cancels-the-Different (OCO) Order

An OCO order combines a restrict order and a cease‑restrict order. When one a part of the pair executes, the opposite cancels routinely. Therefore, this setup primarily permits you to place a take‑revenue restrict order and a cease‑loss order concurrently.

Binance Trailing-Cease Order

A trailing‑cease order follows the market value at a hard and fast share or quantity. So, if the worth strikes in your favor, the cease stage strikes with it, locking in potential income. And when the worth reverses by the required path quantity, the order triggers and sells (or buys) at market, defending good points. Trailing stops are worthwhile in trending markets the place you need to let income run whereas limiting potential losses.

Binance Cease Restrict Order

A cease‑restrict order makes use of two costs: a cease value that triggers the order and a restrict value that defines the worst value you’re prepared to simply accept. When the market hits the cease value, the system locations a restrict order at your restrict value. Primarily, this order kind is useful for setting exact cease‑losses or set off‑primarily based entries the place you don’t need slippage past your restrict.

Is Spot Buying and selling on Binance Protected to Use in 2025?

Sure, Binance spot buying and selling is protected to make use of as a result of the alternate invests closely in protecting measures and supplies transparency round its reserves. The corporate publishes Proof‑of‑Reserves experiences displaying that consumer property are absolutely backed 1:1 with further reserves. They’ve additionally constructed a Merkle Tree system, so you may confirm that your property are included of their legal responsibility experiences.

The alternate additionally operates with zero debt in its capital construction and maintains an emergency Safe Asset Fund for Customers (SAFU) to cowl excessive instances. Two‑issue authentication, deal with whitelisting, and chilly‑storage wallets present additional safeguards towards hacks. Whereas no platform is threat‑free, Binance’s mixture of transparency, insurance coverage, and technical safety clearly makes it a comparatively protected alternative for spot buying and selling when used responsibly.

What Are Binance Spot Buying and selling Supported and Restricted Nations?

The Binance spot buying and selling supported international locations are unfold throughout Asia, Europe, Africa, Oceania, and elements of Latin America. Thousands and thousands of individuals from India, the Philippines, Australia, Germany, France, Nigeria, Turkey, Brazil, Argentina, and plenty of different jurisdictions commerce on the platform each day. Therefore, customers from these international locations can open accounts, full verification, deposit fiat or crypto, and entry the total vary of spot pairs.

Binance spot buying and selling entry is restricted in some jurisdictions because of authorized and regulatory issues. Binance’s phrases of use explicitly prohibit clients from the USA, Canada (Ontario), Iran, Cuba, the Crimea area, and North Korea. You may additionally face limitations if native regulators don’t license Binance or if sanctions apply. Individuals within the U.S. can solely use the separate Binance.US platform, which lists fewer cash and has completely different price constructions.

Is Binance Spot Buying and selling Out there within the U.S.?

No, Binance.com spot buying and selling just isn’t obtainable to clients residing in the USA due to regulatory restrictions. Therefore, U.S. residents can not open accounts on the worldwide alternate or commerce its full set of spot pairs.

As a substitute, they have to use Binance.US, an impartial entity operated underneath U.S. regulatory frameworks. The American platform provides a smaller choice of cash and options in contrast with Binance.com, and costs and VIP tiers differ. It nonetheless supplies market and restrict orders, however some superior merchandise and promotions usually are not obtainable. So, in the event you reside in the USA, be sure to register with Binance.US and comply with native Know‑Your‑Buyer (KYC) and tax reporting guidelines.

What Are the Distinctive Key Options of Binance Spot Buying and selling?

The distinctive options of Binance spot buying and selling are unmatched liquidity throughout 1,500+ pairs, tiered price reductions & BNB integration, seamless ecosystem with built-in earnings, and main safety with SAFU insurance coverage.

Unmatched Liquidity Throughout 1,500+ Pairs

The depth of Binance’s order books is one in every of its standout strengths. You achieve entry to 500+ digital currencies and greater than 1,500 spot buying and selling pairs. This implies you may commerce every little thing from properly‑identified cash like BTC, ETH, and BNB to newer tokens in DeFi, gaming, and layer 2 ecosystems.

Liquidity stays strong even on mid‑cap pairs, and each day spot quantity is over $10 billion, in accordance with CMC information, which interprets to tight bid‑ask spreads and speedy execution. Excessive liquidity additionally permits you to enter or exit positions at virtually any time. In contrast to smaller exchanges, the place a single commerce may transfer the market, Binance’s depth absorbs orders easily.

Tiered Price Reductions & BNB Integration

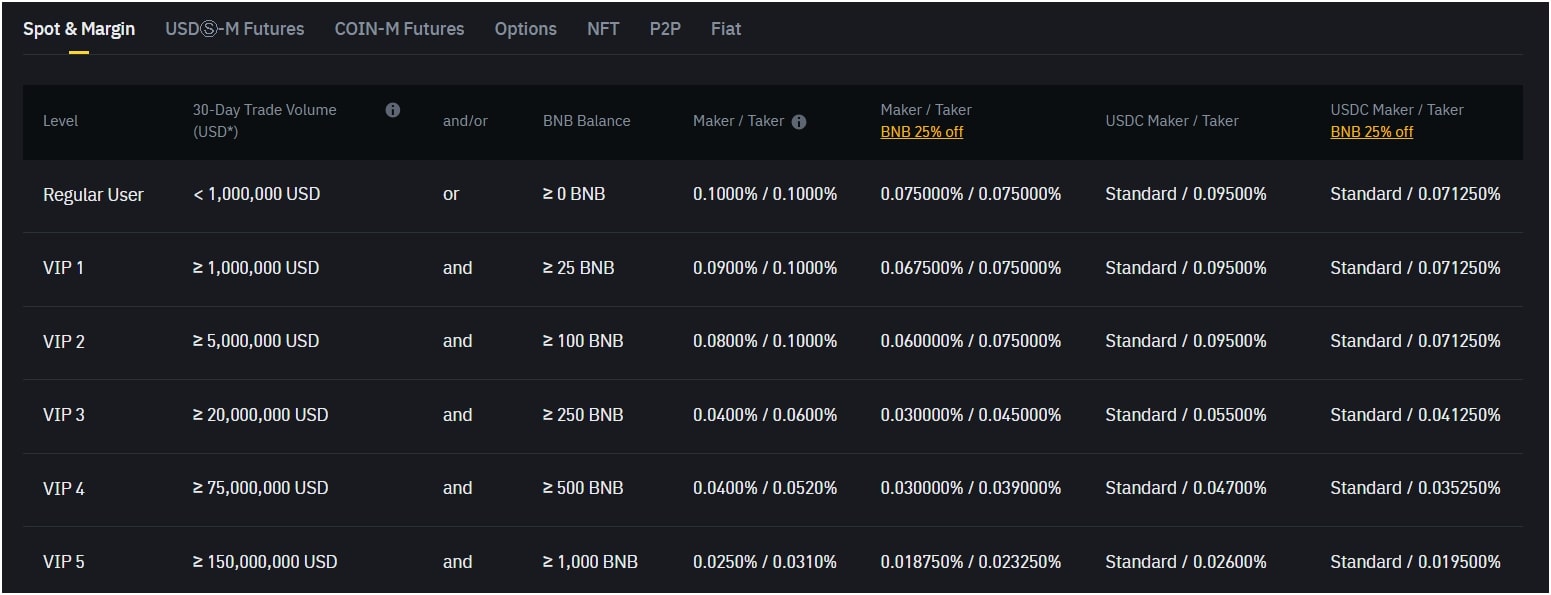

The Binance normal maker and taker price is 0.1%. By holding BNB, the alternate’s native token, you may pay charges with BNB and obtain a 25% low cost. This reduces your efficient charge to 0.075%, which beats many different centralized exchanges. Binance additionally supplies 9 VIP ranges. As your 30‑day buying and selling quantity will increase and your BNB stability grows, you’ll qualify for decrease charges. VIP 1 lowers maker charges to 0.09% and taker charges to 0.10%, whereas VIP 9 can convey maker charges all the way down to 0.011% and taker charges to 0.023%.

The platform runs periodic promotions providing zero maker and taker charges on particular buying and selling pairs. For instance, BTC/FDUSD and ETH/FDUSD have seen zero‑price intervals. Past spot charges, Binance provides rebates for market makers, referral commissions in the event you convey pals to the platform, and extra financial savings by way of buying and selling challenges.

Seamless Ecosystem & Constructed-In Incomes

Spot buying and selling on Binance is an element of a bigger ecosystem designed to make cryptocurrency helpful in each day life. After you purchase tokens, you may stake them on Binance Earn and earn curiosity by way of financial savings merchandise, launchpools, or on-chain staking. You’ll be able to earn APY as excessive as 20% on a few of your prime altcoins like DOT, ATOM, and extra.

The alternate additionally operates Binance Pay, a cost community that permits you to spend crypto at supported retailers or ship funds to pals with out charges. It’s also possible to order a Binance Card in some international locations, which converts crypto to fiat while you pay, letting you spend digital property like a debit card. All these options join underneath one login, so that you don’t want a number of accounts to commerce, be taught, and earn.

Main Safety & SAFU Insurance coverage

Binance is a extremely safe crypto alternate. The Proof‑of‑Reserves web page reveals that consumer property are absolutely backed at the very least 1:1, with further reserves. Additionally, company holdings are saved on a separate ledger, so consumer property usually are not combined. The proof‑of‑reserves system employs Merkle Tree and zk‑SNARK applied sciences, permitting you to confirm that your balances are included within the report with out revealing private data.

The corporate has zero debt and an emergency Safe Asset Fund for Customers (SAFU), an insurance coverage pool funded by buying and selling charges, that may cowl losses in excessive instances. The alternate makes use of multi‑layer chilly storage for almost all of funds and retains solely a small portion in sizzling wallets for withdrawals. Different options, like two‑issue authentication, deal with whitelisting, and cooldown intervals for withdrawals, assist stop unauthorized entry.

What Are the Binance Spot Buying and selling Charges in 2025?

Binance expenses spot merchants a base price of 0.1% for each makers and takers. Utilizing BNB to pay charges lowers this charge to 0.075%, and as your buying and selling quantity will increase, you may qualify for VIP tiers with decreased charges.

Binance spot buying and selling platform additionally has promotional zero‑price buying and selling on chosen pairs like BTC/FDUSD. Crypto deposits are free, although community transaction charges apply when withdrawing tokens. Fiat deposits and withdrawals might contain financial institution or cost processor expenses relying in your area.

To know how the charges work, contemplate an instance. Think about you place a market order to purchase 1,000 USDT value of BTC. As an everyday consumer with no VIP standing and with out utilizing BNB, your taker price could be 0.1%, so that you pay 1 USDT in charges. For those who maintain sufficient BNB and select to pay charges with it, the speed drops to 0.075%, so that you pay 0.75 USDT as an alternative.

The way to Do Spot Commerce on Binance: A Step-by-Step Information

To identify commerce on the Binance web site, you want to log in, deposit funds, open the spot buying and selling web page, select a pair, place your order, and make sure. To identify commerce on the Binance app, you want to obtain the app, log in and full KYC, deposit funds, entry the market, choose your buying and selling pair, place a commerce, and make sure.

The way to Do Spot Commerce on the Binance Web site?

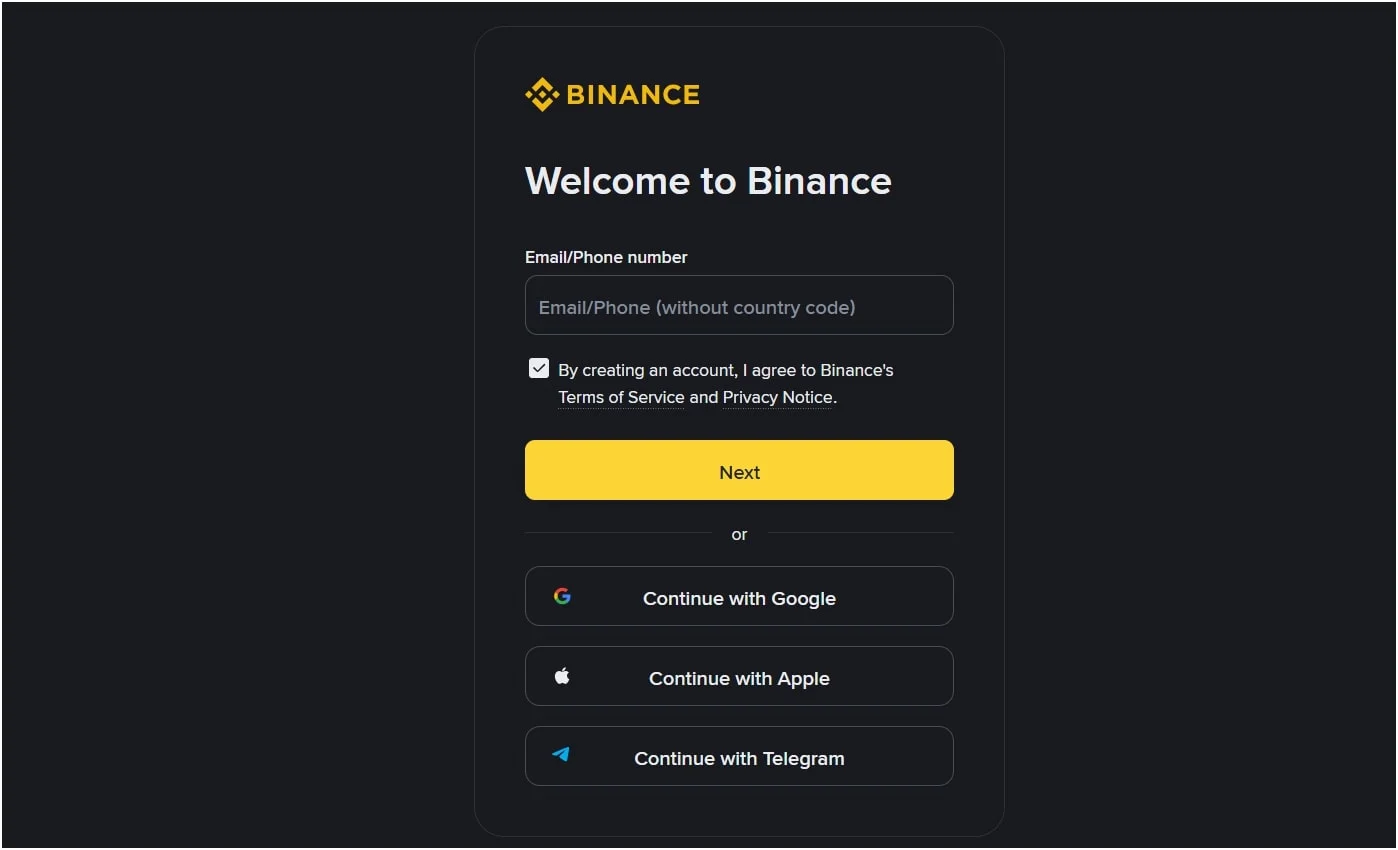

Step 1: Log In to Binance

It is advisable begin by navigating to binance.com and logging in to your account together with your electronic mail and password. Be sure you have accomplished the required id verification as a result of Binance requires KYC earlier than enabling full buying and selling. Additionally, in the event you don’t have a Binance account, you should use our Binance referral code throughout registration and get a $100 free crypto sign-up bonus.

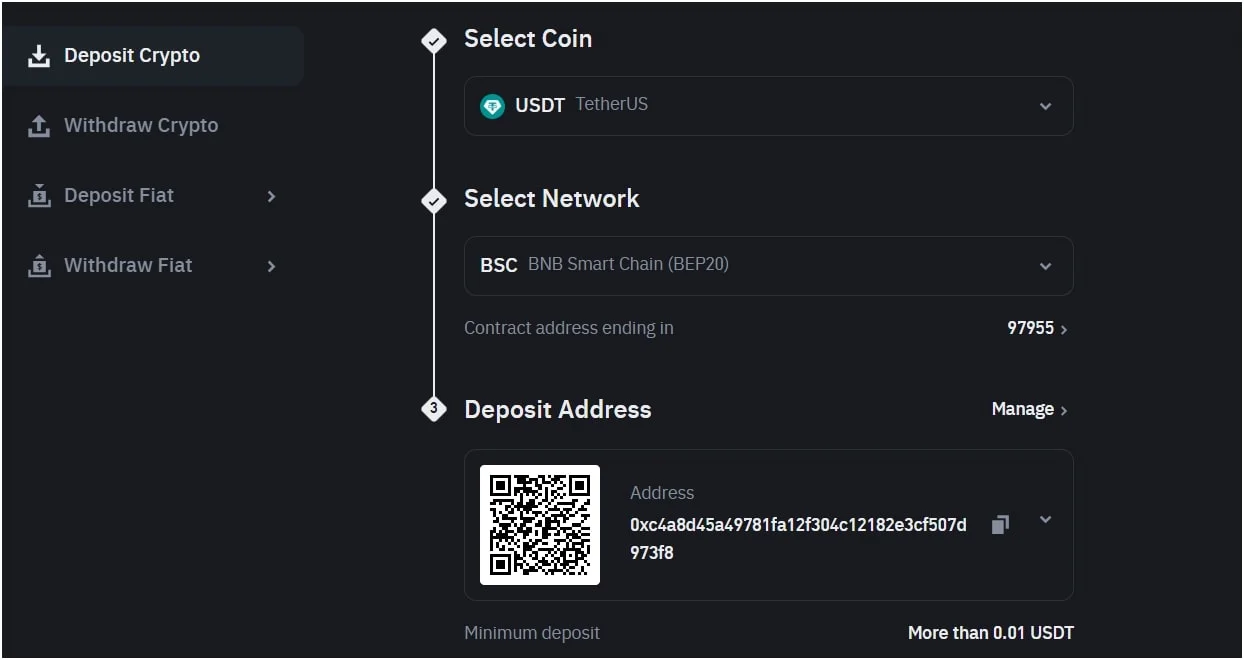

Step 2: Deposit Funds

As soon as logged in, you must find the “Pockets” tab on the highest menu and select to deposit funds. You’ll be able to both switch crypto from one other pockets or deposit fiat foreign money by way of a financial institution switch or every other supported cost methodology.

Step 3: Open the Spot Buying and selling Interface

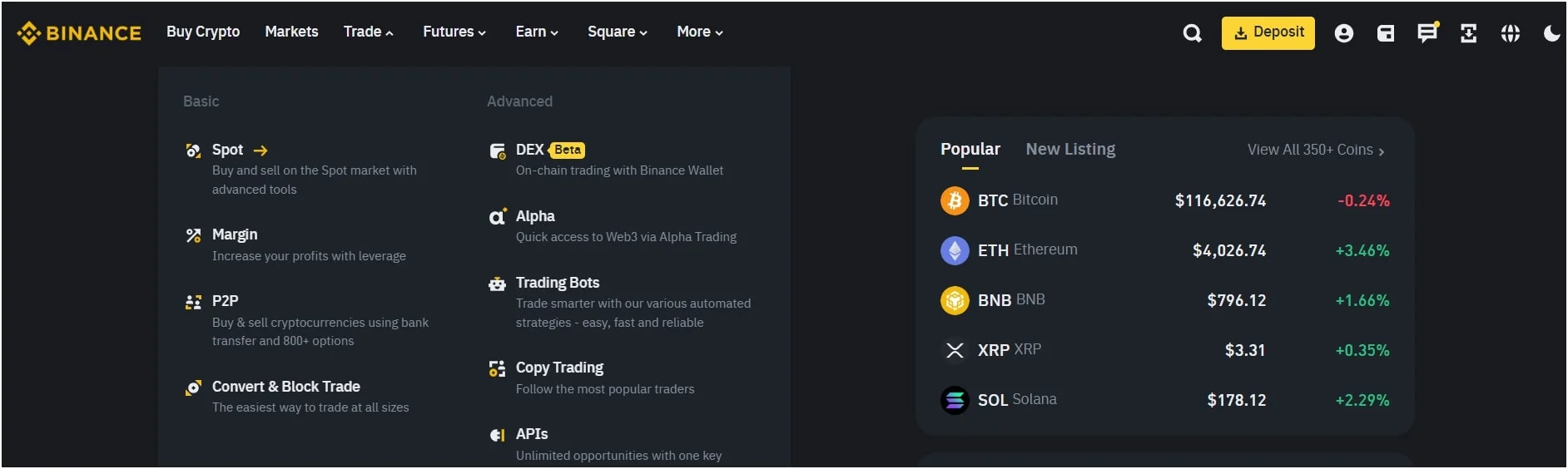

Subsequent, click on “Commerce” within the prime menu and choose Spot. Right here, you will notice the worth chart, order e-book, and purchase/promote kind. It is advisable choose your required buying and selling pair from the highest left, equivalent to BTC/USDT for buying and selling Bitcoin towards Tether.

Step 4: Place Your Commerce

You must determine which kind of order fits your technique. A Market order buys or sells immediately at the most effective obtainable value, whereas a Restrict order permits you to set an actual entry or exit value. It is advisable enter the quantity of the cryptocurrency in your purchase and promote orders within the order kind.

Subsequent, if you’re shopping for, choose the share of your USDT stability to spend; if you’re promoting, enter the quantity of BTC to promote. When you click on Purchase BTC or Promote BTC, the system processes your order and updates your stability. You’ll be able to then view your accomplished orders and commerce historical past within the Orders tab.

The way to Do Spot Commerce on the Binance App?

Step 1. Obtain the App and Log In

First, obtain the Binance app from the Google Play Retailer or Apple App Retailer and log in utilizing your credentials. After finishing KYC, faucet Wallets on the backside of the display screen and select to deposit funds. You’ll be able to scan a QR code to switch crypto, or use a financial institution card or cost service for fiat.

Step 2. Entry the Market

As soon as funded, faucet Trades on the house display screen to entry the market. Select the pair you need by tapping the search bar and coming into a logo like “ETH/USDT.”

Step 3. Place and Verify Your Commerce

Choose Purchase or Promote and choose your order kind – market, restrict, or stop-limit. Enter the worth and amount, verify the main points, and slide to submit. The app reveals a affirmation as soon as the commerce executes. You’ll be able to examine your positions and order historical past by navigating to Orders throughout the app. For more information in regards to the alternate, you may take a look at our in-depth Binance evaluation.

Ideas for Protected and Profitable Spot Buying and selling on Binance

The ideas for protected and profitable spot buying and selling on Binance are utilizing robust safety, doing analysis, setting threat limits, utilizing price reductions, and withdrawing to non-public wallets for long-term storage.

Use robust safety practices: Allow two‑issue authentication in your account, create a novel password, and use deal with whitelisting, so withdrawals solely go to accepted wallets. Additionally, attempt to keep away from logging in on shared gadgets and replace your credentials often.Do your analysis: Spend time understanding the tasks you commerce. Learn whitepapers, comply with the information, and analyze value charts. By studying about market traits and fundamentals, you make higher entry and exit selections slightly than performing on hype.Set clear threat limits: Resolve how a lot capital you’re prepared to threat on every commerce and cling to that restrict. Use cease‑restrict or OCO orders to chop losses if the market strikes towards you. Diversify throughout a number of property as an alternative of concentrating all funds in a single coin.Benefit from price reductions: Maintain BNB in your account to pay buying and selling charges at a reduction, and goal to progress by way of VIP tiers in the event you commerce massive volumes. Look ahead to promotional zero‑price pairs and use them after they align together with your technique.Withdraw to non-public wallets: Whereas Binance is safe, holding lengthy‑time period holdings in a non-public pockets reduces custodial threat. Solely retailer the quantity you want for lively trades on the alternate. Often examine that your withdrawals undergo and confirm pockets addresses fastidiously earlier than confirming transactions.