In recent times, the speedy development of stablecoins, digital property pegged to conventional currencies, has prompted U.S. lawmakers to think about regulatory measures to make sure monetary stability and shopper safety. The bipartisan Guiding and Establishing Nationwide Innovation for U.S. Stablecoins (GENIUS) Act, launched by Senators Kirsten Gillibrand, Invoice Hagerty, Tim Scott, and Cynthia Lummis, goals to create a transparent regulatory framework for fee stablecoins.

Equally, Congresswoman Maxine Waters unveiled bipartisan laws within the Home Monetary Companies Committee to determine complete oversight for each depository and nonbank stablecoin issuers. These legislative efforts replicate a rising focus in Congress on regulating stablecoins to deal with issues over shopper safety, monetary system integrity, and the potential dangers posed by the unregulated enlargement of digital currencies.

What Every Invoice Seeks to Accomplish

Each the GENIUS Act and the Home Monetary Companies Committee’s stablecoin invoice purpose to determine a transparent regulatory framework for stablecoins, although they take barely completely different approaches of their oversight mechanisms and implementation methods.

The GENIUS Act (Senate Invoice)

The Guiding and Establishing Nationwide Innovation for U.S. Stablecoins (GENIUS) Act is a bipartisan legislative proposal launched on February 5, 2025, by U.S. Senators Kirsten Gillibrand (D-NY), Invoice Hagerty (R-TN), Tim Scott (R-SC), and Cynthia Lummis (R-WY). This invoice goals to create a transparent regulatory framework for fee stablecoins in the USA.

Acknowledged Objectives:

Shopper Safety: Making certain that stablecoin issuers preserve one-to-one reserves and adjust to U.S. anti-money-laundering and sanctions rules to safeguard customers.Selling Innovation: Encouraging accountable innovation within the digital asset area to keep up U.S. management in blockchain know-how and preserve associated jobs inside the nation.Monetary Inclusion and Effectivity: Leveraging dollar-pegged stablecoins to reinforce transaction effectivity, develop monetary inclusion, and bolster the U.S. greenback’s standing because the world’s reserve forex.

Key Provisions and Mechanisms:

Definition of Fee Stablecoin: Classifies a fee stablecoin as a digital asset used for fee or settlement, pegged to a hard and fast financial worth.Licensing Procedures: Establishes clear processes for establishments searching for licenses to challenge stablecoins, relevant to each banks and sure non-bank entities.Reserve Necessities and Regulatory Requirements: Implements reserve mandates and tailor-made regulatory requirements for stablecoin issuers to make sure monetary stability and shopper belief.Regulatory Oversight Primarily based on Market Capitalization:Issuers with Over $10 Billion: Topic to federal oversight, with depository establishments regulated by the Federal Reserve and non-bank issuers overseen by the Workplace of the Comptroller of the Forex (OCC).Issuers with $10 Billion or Much less: Permits state-level regulation, supplied the state’s regulatory framework aligns carefully with federal requirements.Prohibition of Algorithmic Stablecoins: Bans the issuance of algorithmic stablecoins to forestall potential monetary instability related to such property.Supervisory and Enforcement Framework: Establishes clear supervisory, examination, and enforcement regimes with outlined limitations to make sure compliance and shield customers.

The Water’s Invoice (U.S. Home Monetary Companies Committee’s Stablecoin Invoice)

On February 10, 2025, Congresswoman Maxine Waters (D-CA), the highest Democrat on the Home Monetary Companies Committee, launched new fee stablecoin laws. This invoice represents the end result of three years of bipartisan negotiations, initially crafted with former Committee Chair Patrick McHenry (R-NC) and in collaboration with the Treasury Division and the Federal Reserve.

Acknowledged Objectives:

Set up a Complete Federal Framework: Create clear and constant guidelines for stablecoin issuers, guaranteeing regulatory oversight at each federal and state ranges.Improve Shopper Protections: Prioritize safeguards to forestall fraud, scams, and monetary instability inside the crypto area.Strengthen Monetary System Integrity: Implement anti-money laundering (AML) measures, counter-terrorist financing legal guidelines, and different compliance requirements to forestall illicit actions.Preserve Banking and Commerce Separation: Stop giant tech companies from proudly owning or controlling stablecoin issuers to keep away from conflicts of curiosity.

Key Provisions and Mechanisms:

Regulatory Oversight for Issuers: Depository Establishments & Nonbank Issuers will probably be regulated, with the Federal Reserve enjoying a central supervisory position.Sturdy Reserve Necessities: It requires stablecoin issuers maintain ample reserves to again their tokens.Prohibition on Large Tech Involvement: Non-financial industrial firms (e.g., Fb, Google, X) are barred from proudly owning or controlling a stablecoin issuer.Enforcement of U.S. Legal guidelines & Sanctions Compliance: Stablecoin issuers should adjust to U.S. anti-money laundering (AML) and counter-terrorist financing (CTF) legal guidelines to prevents issuers from exploiting offshore loopholes to evade U.S. rules (e.g., focusing on issuers like Tether working abroad).Banning People with Prison Convictions: People convicted of economic crimes, akin to FTX’s Sam Bankman-Fried, are prohibited from serving as executives or holding greater than 5% possession in a stablecoin issuer.Shopper Protections for Digital Wallets: Requires sturdy threat administration practices and monetary useful resource necessities for pockets suppliers. The Federal Reserve granted examination and enforcement authority to supervise shopper protections.Preservation of Present Company Authority: Ensures Treasury, CFPB, SEC, and CFTC preserve their regulatory powers over entities coated by the Act. Applies to stablecoin issuers, pockets suppliers, exchanges, broker-dealers, and market-makers engaged in stablecoin buying and selling.

Key Variations Between the Two Stablecoin Payments

Whereas each the GENIUS Act and Waters’ stablecoin invoice purpose to manage stablecoins, they differ of their approaches to oversight, decentralization, and participation within the business.

Method to Regulation

GENIUS Act: Takes a lighter-touch strategy with a tiered regulatory construction. It assigns Federal Reserve oversight to issuers with over $10 billion in stablecoins, permitting state regulation for smaller issuers. The invoice emphasizes fostering innovation and competitors inside the business.Waters’ Invoice: Establishes a stricter federal framework, with the Federal Reserve overseeing all issuers, no matter market cap. It focuses on shopper safety, monetary stability, and anti-money laundering compliance.

Stance on Decentralization and Trade Participation

GENIUS Act: Permits larger decentralization, offering a versatile regulatory atmosphere that encourages fintech companies and decentralized platforms.Waters’ Invoice: Opposes business centralization by barring Large Tech companies from proudly owning stablecoin issuers. It additionally contains stronger AML and KYC measures, making it tougher for decentralized or pseudonymous entities to take part.

Which Invoice Presents Extra Advantages?

The GENIUS Act is extra beneficial to innovation because it permits smaller stablecoin issuers to function underneath state rules, lowering federal oversight and inspiring competitors. By avoiding computerized Federal Reserve management, it creates an atmosphere the place fintech companies and decentralized platforms can thrive.

In distinction, Waters’ invoice imposes stricter federal oversight, rising compliance prices and limiting new entrants, which can decelerate crypto-native developments.

For market stability, Waters’ invoice is the stronger choice. It enforces strict reserve backing, provides the Federal Reserve a central position in oversight, and implements shopper safety measures to reduce monetary dangers. This prevents regulatory loopholes and enhances belief within the stablecoin market. The GENIUS Act, whereas nonetheless requiring reserves and AML compliance, leaves gaps that would permit regulatory arbitrage, probably resulting in the rise of under-collateralized stablecoins.

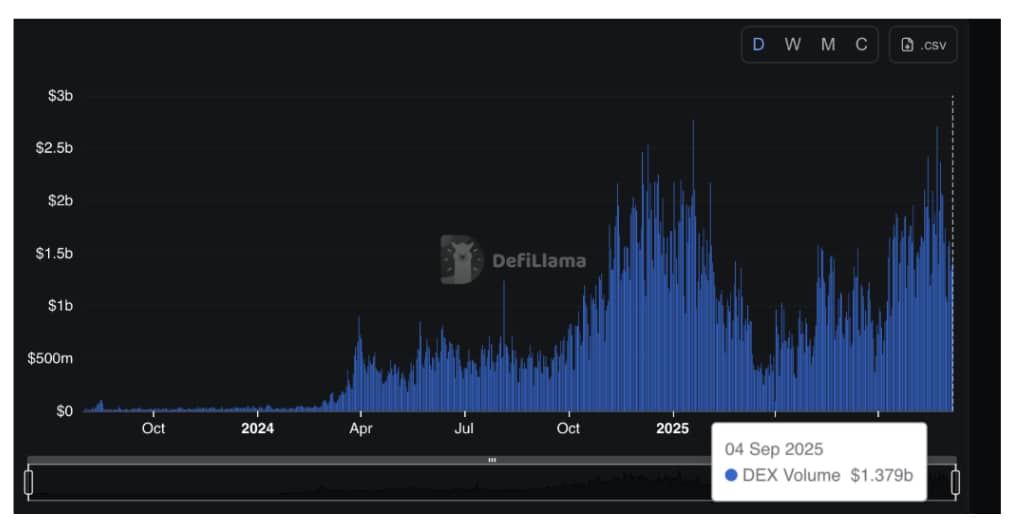

The influence of those payments varies throughout completely different gamers within the crypto ecosystem. The GENIUS Act advantages smaller stablecoin issuers, decentralized exchanges, and DeFi platforms by lowering boundaries to entry and fostering innovation. Nevertheless, bigger issuers exceeding the $10 billion cap might face stricter oversight.

Waters’ invoice, however, favors well-established, well-funded stablecoin issuers and controlled exchanges, guaranteeing safety and stability however creating challenges for smaller companies scuffling with compliance prices.

Probability of Passage

The destiny of the GENIUS Act and Waters’ Stablecoin Invoice will largely rely upon political alignment and business help. The GENIUS Act has a stronger enchantment amongst lawmakers who favour free-market insurance policies and monetary innovation.

Nevertheless, its reliance on state-level oversight and its extra permissive stance towards stablecoin issuers might increase issues amongst policymakers who prioritize monetary stability and robust federal oversight.

In distinction, Waters’ invoice has help from Democrats and regulators who view stablecoins as a systemic monetary threat that requires strict federal oversight. It aligns with issues raised by the Treasury Division and the Federal Reserve about stopping monetary instability and illicit finance dangers.

Conventional monetary establishments and compliance-focused crypto companies usually tend to help this invoice, because it reduces regulatory uncertainty and prevents competitors from unregulated gamers. Nevertheless, its strict provisions might alienate crypto-native companies and DeFi platforms, limiting broader business help.

Remaining Ideas

The GENIUS Act leans towards fostering innovation by permitting a mixture of federal and state-level oversight, whereas Waters’ invoice prioritizes stricter federal management to mitigate monetary dangers and stop company dominance within the sector.

If the GENIUS Act passes, it might appeal to extra crypto companies to the U.S., encouraging fintech innovation whereas sustaining sure shopper protections. Nevertheless, critics fear that its lighter regulatory strategy may not be sufficient to forestall monetary instability or dangerous actors from exploiting gaps in state oversight.

Alternatively, if Waters’ invoice turns into legislation, stablecoin issuers will face a extra inflexible federal framework with stronger shopper protections and monetary safeguards. Whereas this might strengthen market stability and stop illicit actions, it might additionally drive crypto companies offshore, stifling the U.S.’s aggressive edge in digital finance.

Transferring ahead, the broader implications for U.S. crypto regulation hinge on whether or not lawmakers can strike a steadiness between monetary safety and technological innovation. A compromise between the 2 payments might create a framework that protects customers with out stifling development, however political divisions and business resistance might delay progress.

Whatever the final result, stablecoin regulation will set the stage for broader crypto insurance policies, shaping the U.S.’s position within the evolving digital economic system.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”