The Central Financial institution of Brazil (BCB) is making main reforms to the nation’s international alternate (foreign exchange) system, as described in Regulation No. 14,286/2021. Though the adjustments primarily deal with digital foreign exchange (eFX) platforms, they might even have a major influence on crypto operations.

Underneath the proposals, solely licensed establishments will be capable of provide eFX companies. This implies crypto exchanges dealing with worldwide funds might quickly must get hold of particular licenses, meet stricter compliance requirements, and disclose full transaction prices to clients.

The brand new guidelines require all operators to show the Complete Efficient Worth (VET) of every transaction, a measure geared toward boosting transparency and shopper safety.

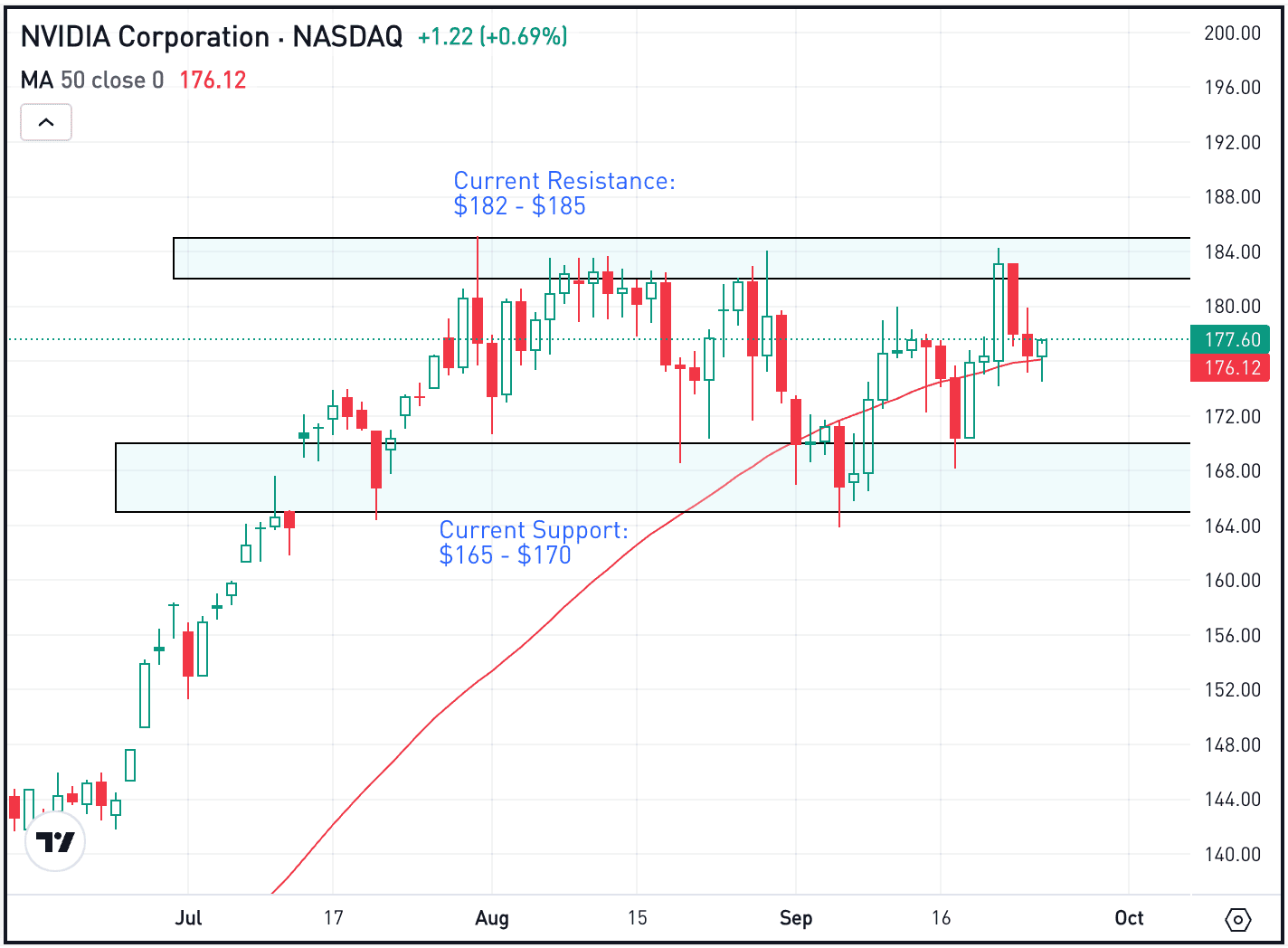

ETH’s worth holds essential degree on the every day chart. Supply: ETHUSD on Tradingview

Stablecoins and Worldwide Transfers Affected by New Brazilian Foreign exchange Guidelines

Broadly utilized in Brazil to hedge towards inflation and facilitate cross-border funds, stablecoins are prone to face elevated regulatory oversight underneath the brand new framework. Regulators are contemplating measures that will restrict worldwide transfers through crypto to $10,000 per transaction.

Such restrictions may scale back the utility of dollar-pegged stablecoins like USDT for bigger traders looking for to switch capital overseas. Officers argue that these measures are needed to cut back the dangers of cash laundering and capital flight, however critics warn that they could drive some exercise towards unregulated platforms.

Will the New Guidelines Enhance Crypto Safety

Though the reforms purpose to streamline foreign exchange processes and incorporate crypto into Brazil’s regulated monetary system, in addition they improve reporting necessities.

Exchanges and brokers shall be required to submit detailed shopper and transaction information to the central financial institution. Integration with techniques like Pix, Brazil’s immediate cost community, signifies regulators need crypto to be extra intently linked to conventional finance.

For merchants who beforehand seen crypto as a strategy to bypass foreign exchange controls, these adjustments might imply much less privateness and tighter regulation. Nevertheless, analysts recommend the BCB is strolling a fragile line, looking for to draw funding and enhance market integrity with out stifling innovation.

How the ultimate guidelines are carried out will decide whether or not Brazil units a typical for balanced crypto regulation and adoption in Latin America or dangers pushing companies towards extra permissive markets.

Cowl picture from ChatGPT, BTCUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.