The crypto market confronted in latest months, as each Bitcoin and Ethereum broke under necessary help ranges. Bitcoin broke under $110,000, whereas Ethereum additionally slipped underneath $4,000. This downturn triggered billions in liquidations and pushed the Concern and Greed Index into concern territory.

Nevertheless, knowledge from on-chain analytics platform Sentora (previously IntoTheBlock) reveals that accumulation is quietly underway. Regardless of the worth declines, trade outflows for each belongings have remained strongly detrimental.

Associated Studying

Key Weekly Metrics

An prolonged decline carried over from the earlier week noticed the Bitcoin value falling under $110,000 with rising promoting strain and liquidations of leveraged positions. Nevertheless, regardless of this sharp transfer to the draw back, on-chain knowledge illustrates an attention-grabbing totally different pattern occurring beneath the floor of the volatility. In accordance to figures supplied by the on-chain analytics platform Sentora, greater than $5.75 billion value of BTC flowed out of centralized exchanges over the course of the week.

This outflow, though small in comparison with durations of robust bullish motion, exhibits a lingering investor conviction, particularly amongst some buyers that could be taking benefit and shopping for the dip.

Ethereum’s value motion over the identical interval was much more pronounced than that of Bitcoin. The worth crash noticed the main altcoin break down beneath the psychologically vital $4,000 help degree and proceed to briefly take a look at decrease zones round $3,850. Nonetheless, regardless of the depth of this decline, the trade move knowledge makes it clear that the bearish value motion didn’t handle to discourage accumulation exercise throughout the community.

Over $3.08 billion value of ETH exited exchanges through the week, which serves as proof of a continued willingness amongst buyers to steadily accumulate Ethereum, even within the face of short-term losses and market strain.

Regardless of detrimental value efficiency, trade outflows remained robust for each ETH and BTC, indicating accumulation throughout the market pic.twitter.com/eAqZTk6Vof

— Sentora (beforehand IntoTheBlock) (@SentoraHQ) September 26, 2025

Outflows Drive Change Balances To Multi-Yr Lows

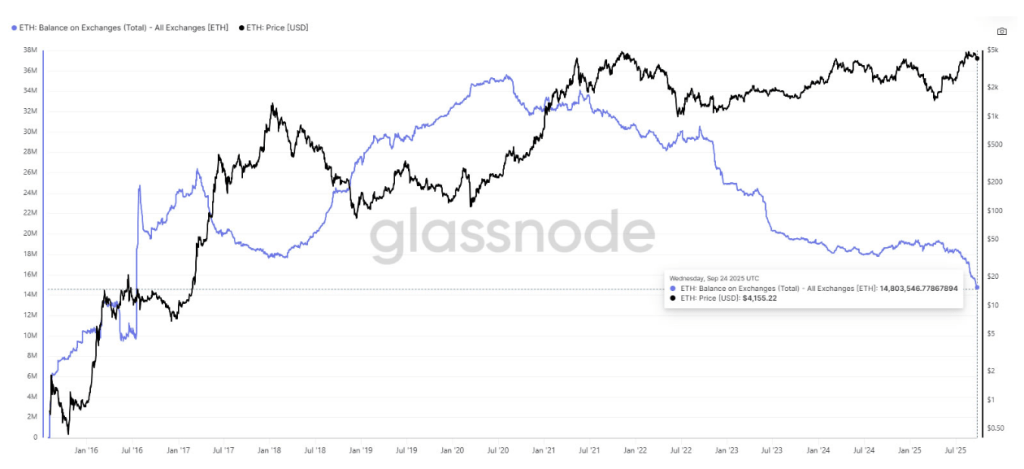

Curiously, Ethereum final week’s outflows ties right into a notable pattern that has been growing in latest months. Knowledge exhibits that Ethereum’s whole provide on exchanges has dropped to only 14.8 million ETH, its lowest degree since 2016. A lot of this provide has been redirected into staking, long-term chilly storage, and DeFi protocols, which have all led to a drastic decline within the ETH on buying and selling platforms.

ETH stability on exchanges. Supply: Glassnode

Knowledge from a CryptoQuant Quicktake publish by contributor CryptoOnchain provides additional weight to this pattern of heavy outflows. Between August and September 2025, Ethereum’s 50-day Easy Shifting Common (SMA) netflow dropped under -40,000 ETH per day, the bottom degree seen since February 2023. This persistent detrimental netflow exhibits that buyers have been steadily shifting their ETH away from exchanges and putting it into staking, chilly storage, or different long-term holding choices. “Decrease trade balances equals diminished short-term provide,” the analyst stated.

Ethereum Change Netflow

Associated Studying

On the time of writing, Bitcoin was buying and selling at $109,585, whereas Ethereum traded at $4,011.

Featured picture from Unsplash, chart from TradingView