On-chain analytics agency Glassnode has revealed in a report that Bitcoin long-term holder have slowed down distribution after months of promoting.

Bitcoin Lengthy-Time period Holder Internet Place Change Is Now Impartial

In its newest weekly report, Glassnode has talked about how the habits of the Bitcoin long-term holders has modified not too long ago. The “long-term holders” (LTHs) confer with the BTC buyers who’ve been holding onto their cash since greater than 155 days in the past.

Statistically, the longer a holder retains their cash dormant on the blockchain, the much less doubtless they turn into to promote them at any level. As such, the LTHs with their comparatively lengthy holding time are thought of to be the diamond fingers of the community.

This could make the habits of this cohort price maintaining a tally of, as shifts in it may have penalties for the cryptocurrency as a complete, contemplating their standing.

There are numerous methods to maintain observe of LTH habits, with one methodology being via the Internet Place Change metric. This indicator measures, as its identify implies, the month-to-month web change within the Bitcoin provide held by the LTHs as a complete.

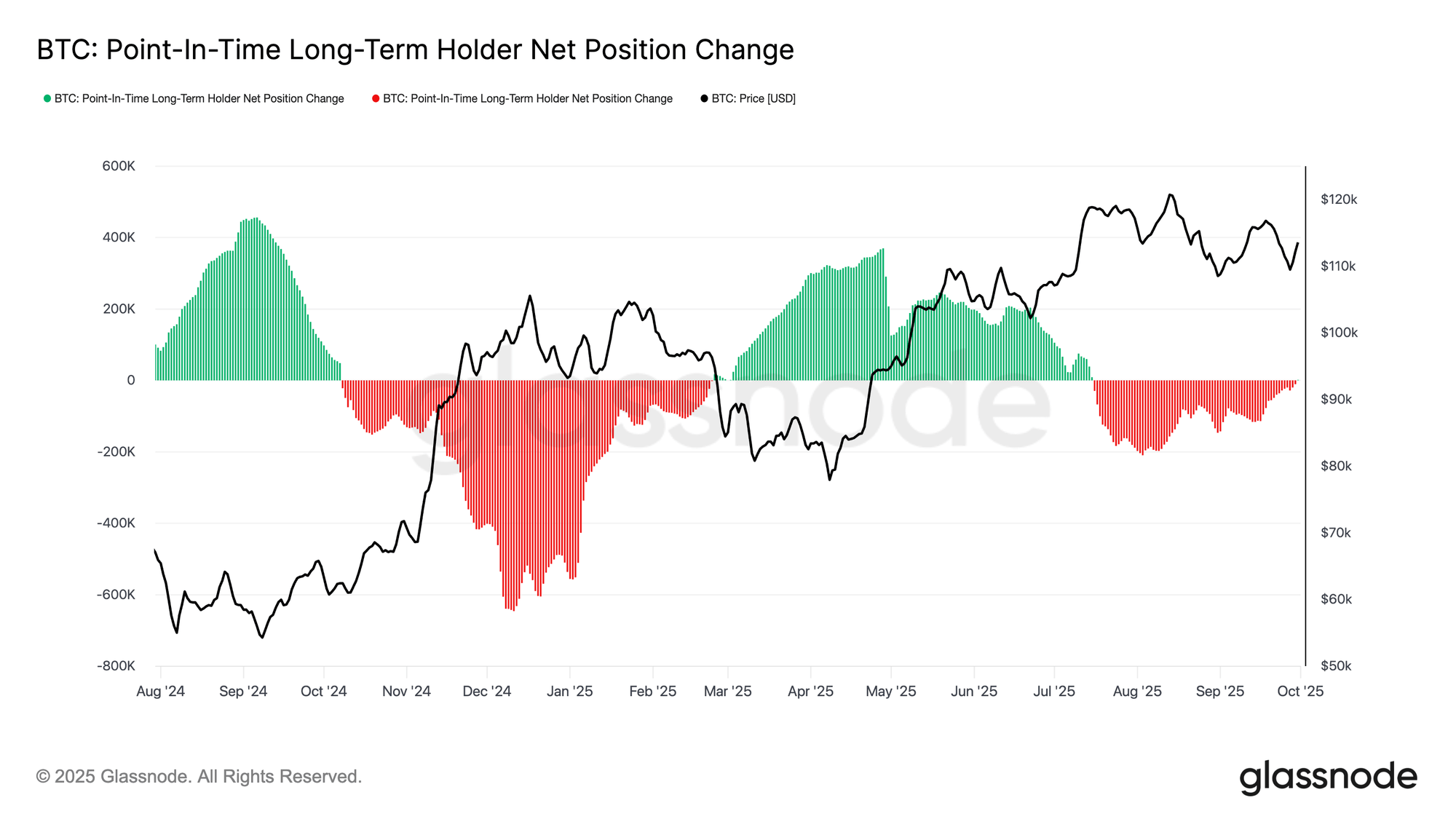

Under is the chart for the metric shared by Glassnode that reveals the pattern in its worth over the previous 12 months.

Appears to be like like the worth of the metric has been unfavourable in latest months | Supply: Glassnode’s The Week Onchain – Week 39, 2025

From the graph, it’s seen that the Bitcoin LTH Internet Place Change was optimistic in the course of the first half of 2025, however a shift occurred in July because the indicator flipped into the unfavourable. This suggests provide began exiting the cohort.

One thing to remember is that whereas promoting from the group can immediately register on the chart, the identical isn’t true for getting. When LTH provide rises, it doesn’t imply accumulation is going on within the current, however reasonably that some shopping for occurred 155 days in the past and people cash have now been held for lengthy sufficient to turn into part of the group.

The LTH distribution continued via August and September, however with the beginning of October, the Internet Place Change has returned again to a impartial worth, indicating cash being bought by the group are actually being balanced out by tokens maturing previous the 155-day cutoff. In different phrases, their web profit-taking has calmed down.

Because the report explains:

This cooling provide stress means that the latest section of long-term holder profit-taking could also be easing, doubtlessly leaving ETFs and new inflows as extra decisive drivers of market route.

The spot exchange-traded funds (ETFs) have additionally seen a shift not too long ago, as one other chart cited by Glassnode reveals.

How the netflow associated to the US BTC spot ETFs has modified over the past twelve months | Supply: Glassnode’s The Week Onchain – Week 39, 2025

As displayed within the graph, the US Bitcoin spot ETFs switched to outflows in late September, however the netflow has as soon as once more turned inexperienced for these funding autos. The analytics agency notes:

Ought to this renewed demand align with diminished LTH promoting, ETFs may present a stabilizing pressure, providing a extra constructive basis for value resilience and supporting the situations wanted for a sustainable advance.

BTC Value

On the time of writing, Bitcoin is floating round $119,700, up nearly 8% over the past seven days.

The pattern within the value of the coin over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.