Information from Glassnode has revealed how the big Bitcoin merchants confirmed skilled timing within the derivatives market throughout the market reversal.

Bitcoin Massive Merchants Have Shifted To A Web Quick Bias

In a brand new submit on X, on-chain analytics agency Glassnode has talked about how the big Bitcoin merchants behaved throughout the newest pullback within the cryptocurrency’s worth.

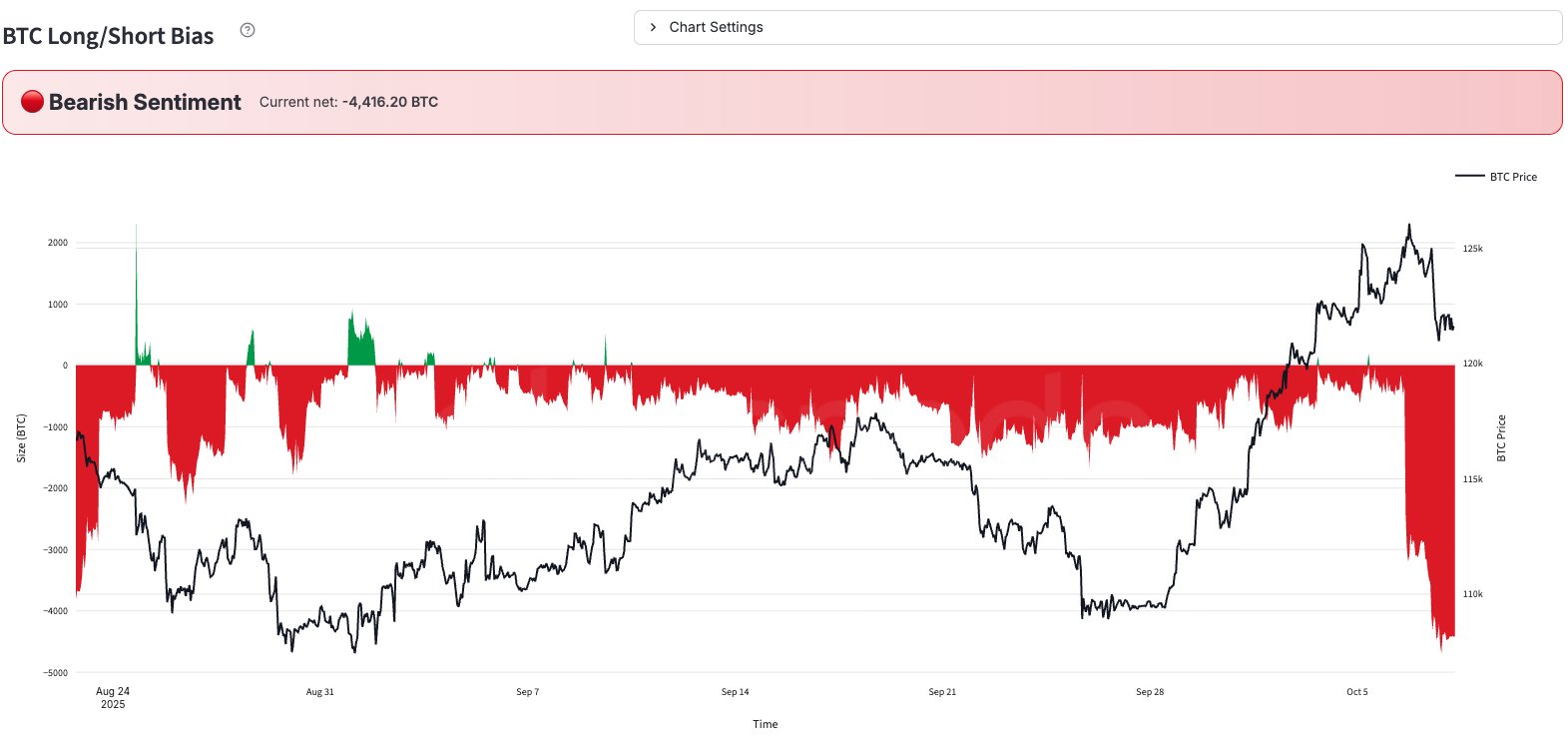

Beneath is the chart shared by Glassnode that reveals the pattern within the BTC Lengthy/Quick Bias, a metric monitoring the distinction between lengthy and quick positions opened by the big buyers on derivatives exchanges, over the previous couple of months.

Seems like the worth of the metric has plummeted in current days | Supply: Glassnode on X

From the graph, it’s seen that the Lengthy/Quick Bias has principally been at a slight damaging stage for Bitcoin throughout the previous few weeks, indicating that the big merchants have simply leaned towards quick positioning. When BTC set its preliminary all-time excessive (ATH) above $125,000 on Saturday, nonetheless, the indicator assumed a small constructive worth, implying there was a slight bias towards a bullish sentiment amongst derivatives customers.

Apparently, this identical habits wasn’t seen throughout the second ATH break above $126,000 on Monday. Actually, the whales behaved within the fully reverse method: the Lengthy/Quick Bias noticed a plunge deep into the damaging territory. “The shift to a internet quick bias suggests profit-taking on longs alongside new quick positioning,” notes the analytics agency. Thus, it could appear that the big merchants had been anticipating a worth pullback after the value prime, in order that they began transferring upfront.

The Lengthy/Quick Bias solely noticed an extra decline when Tuesday’s quick crash beneath $121,000 happened. Now, the metric is sitting at a price of -4,416.20 BTC, which implies bearish bets outweigh bullish ones by greater than 4,400 tokens.

It now stays to be seen how sentiment among the many Bitcoin whales will develop within the coming days. One other shift from good cash might probably foreshadow one other shift for the asset’s worth as properly, given the newest sample.

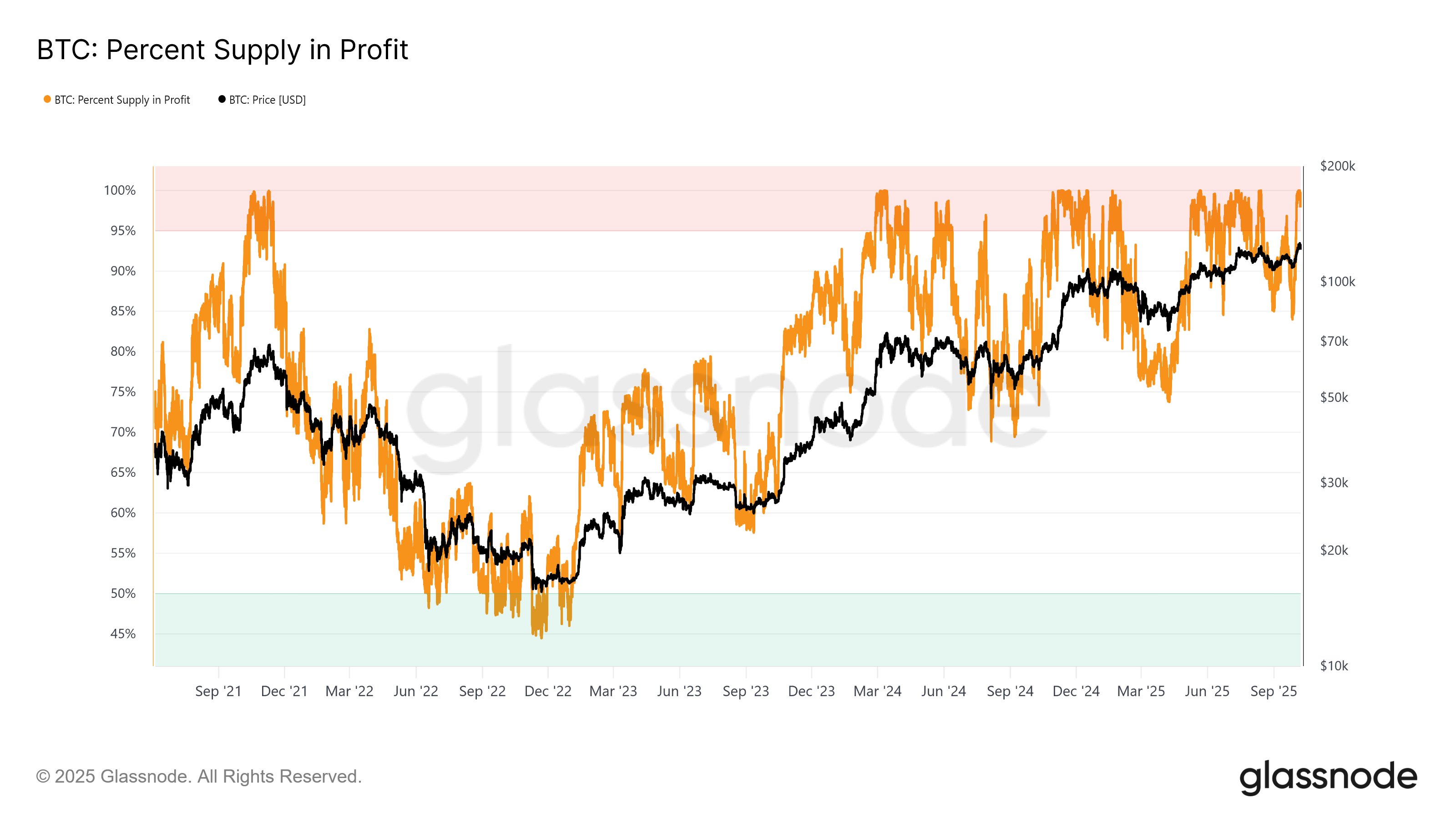

In another information, the current Bitcoin worth surge has meant that % Provide in Revenue has damaged into an excessive territory, as Glassnode has identified in one other X submit.

The pattern within the proportion of the BTC provide carrying an unrealized acquire over the previous few years | Supply: Glassnode on X

As displayed within the above chart, the Bitcoin % Provide in Revenue broke above 95% when it crossed the $117,000 stage throughout the rally. Naturally, the metric later went on to achieve 100% as BTC set a brand new ATH, since everyone seems to be within the inexperienced each time the cryptocurrency explores new worth ranges.

Traditionally, the metric being above 95% has typically indicated overheated situations for BTC. Because the analytics agency explains, such a excessive worth is “a trademark of Euphoria phases, the place widespread profitability typically fuels accelerated profit-taking and rising market threat.”

BTC Value

Bitcoin has proven some restoration throughout the previous day as its worth has returned to the $123,000 mark.

The value of the coin appears to have general moved sideways over the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.