Publicly traded agency BitMine Immersion Applied sciences purchased the crypto market dip over the weekend, because it bolstered its Ethereum (ETH) reserves by 202,037 ETH, propelling its complete ETH holdings to past 3 million ETH.

BitMine’s Complete Ethereum Holdings Surpass 3 Million

NYSE-listed Bitcoin (BTC) and Ethereum community firm BitMine right this moment disclosed that it had purchased a further 202,037 ETH through the crypto market crash over the weekend. Notably, the market crash led to an enormous $19 billion in liquidations.

In keeping with the announcement, BitMines’ complete crypto holdings now comprise of three,032,188 ETH, purchased at a median value of $4,154. As well as, the agency holds 192 BTC, a stake in Eightco Holdings price $135 million, and unencumbered money price $104 million.

BitMine continues to reign as the most important publicly-traded Ethereum treasury on the earth, and the second-largest general international crypto treasury, trailing Michael Saylor’s Technique, which holds digital property price a complete of greater than $73 billion on its stability sheet. BitMine Chairman, Tom Lee, mentioned:

The crypto liquidation over the previous few days created a value decline in ETH, which BitMine took benefit of. We acquired 202,037 ETH tokens over the previous few days pushing our ETH holdings to over 3 million, or 2.5% of the provision of ETH. We at the moment are greater than midway in the direction of our preliminary pursuit of the ‘alchemy of 5%’ of ETH.

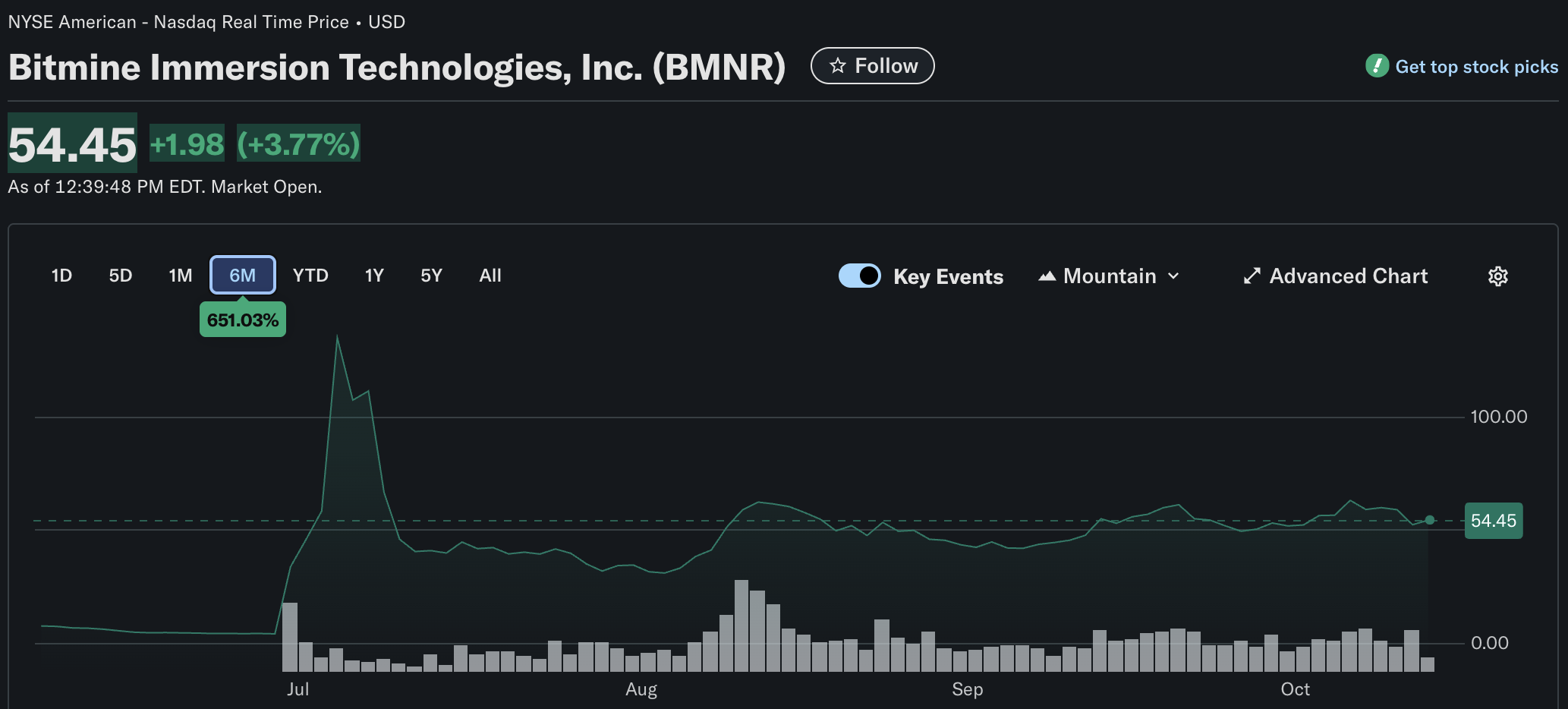

BitMine’s share can also be experiencing renewed curiosity as its ETH guess continues to get larger. Right now, the corporate’s inventory, BMNR, is up 3.4%, buying and selling at $54.45 on the time of writing.

Current information from BitMine means that, based mostly on its common five-day buying and selling quantity, BMNR was the twenty second most traded inventory on US-based exchanges, witnessing a buying and selling quantity of $3.5 billion on Friday.

Opinion Nonetheless Cut up On ETH Utility

Whereas 2025 is seeing unprecedented curiosity in Ethereum as a viable company treasury asset, some business consultants are nonetheless on the fence. The strongest opposition comes from staunch Bitcoin advocates.

For example, not too long ago Bitcoin maximalist Nick Szabo warned that Ethereum has a “elementary drawback,” including that the majority of its use-cases are largely exterior to ETH’s market worth.

Equally, crypto entrepreneur Samson Mow famous that ETH’s value is being “propped up” by $6 billion in Korean retail cash. He added that Ethereum’s latest bullish value motion will not be solely attributable to its market demand.

That mentioned, some ETH bulls are firmly behind the digital asset. SharpLink CEO Joseph Chalom not too long ago remarked that Ethereum is a superior treasury asset in comparison with BTC. At press time, BTC trades at $4,165, up 1% up to now 24 hours.

Featured picture from Unsplash.com, charts from Yahoo! Finance and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.