The Each day Breakdown takes a more in-depth have a look at the week forward, which incorporates earnings studies from Tesla, GM, GE, and Netflix.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all it is advisable to do is log in to your eToro account.

Weekly Outlook

Since Friday October tenth, markets have been bumpy. The S&P 500 has had a mean buying and selling vary of about 114 factors during the last six periods. That’s a large buying and selling vary, as volatility has clearly woken up a bit.

Extra earnings will proceed this week (extra on that in a second) and hey! We’ll lastly get some financial knowledge this week.

Earnings on Deck

Firms like Netflix (which studies on Tuesday night) and Tesla (Wednesday night) headline the motion, however there will likely be loads of others to observe this week. They embody Coca-Cola, Normal Motors, and Normal Electrical on Tuesday, and AT&T and IBM on Wednesday.

On Thursday, firms like Ford, T-Cell, and Intel will report, adopted by Procter & Gamble on Friday.

Get Prepared for the Inflation Report

The Bureau of Labor Statistics (BLS) is liable for a handful of the important thing month-to-month financial studies, considered one of which is the CPI launch, which tracks client inflation.

Whereas many studies have been delayed because of the authorities shutdown, the BLS will transfer ahead with a launch of the CPI report, which is now scheduled for launch on Friday. Given the current lack of financial knowledge mixed with subsequent week’s Fed assembly, further emphasis will probably be placed on this report.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — GLD

Gold has been the speak of Wall Avenue these days, because the steel has soared greater than 60% in 2025. That’s despatched the GLD ETF to new heights as effectively.

The GLD broke out over the important thing $316 space in September and has rapidly rallied greater than 20% since. Massive strikes like this gasoline optimism for the bulls, however can even result in sudden pullbacks. Whereas the development stays intact, do not forget that pullbacks can and do occur. Within the quick time period, bulls need to see the 21-day transferring common act as help.

Choices

As of Friday October seventeenth, the choices with the best open curiosity for GLD — that means the contracts with the biggest open positions within the choices market — had been the October twenty fourth $395 calls, adopted by the $405 calls.

For choices merchants, calls or bull name spreads may very well be one method to speculate on help holding on a pullback. On this state of affairs, patrons of calls or name spreads restrict their threat to the value paid for the calls or name spreads, whereas attempting to capitalize on a bounce within the ETF. Conversely, buyers who count on help to fail might speculate with places or put spreads.

For these seeking to be taught extra about choices, contemplate visiting the eToro Academy.

What Wall Avenue’s Watching

AXP

Shares of AXP rallied 7.3% on Friday after the corporate reported earnings. In a promising signal for the well being of shoppers, Amex reported $421 billion in bank card transaction quantity, above analysts’ expectations of $415.2 billion. Additional, earnings grew 19% whereas income grew 11%, with each measures beating expectations. The response additionally gave a lift to Visa and MasterCard. Dig into the basics for AXP.

ORCL

Oracle inventory practically tripled from its April low to its September excessive, however there’s been some volatility lately. On Friday, shares slid regardless of administration’s long-term steering calling for a mean of 31% annual income progress over its subsequent 5 years. Additional, they mentioned income might attain $225 billion in 2030, whereas earnings might hit $21 a share.

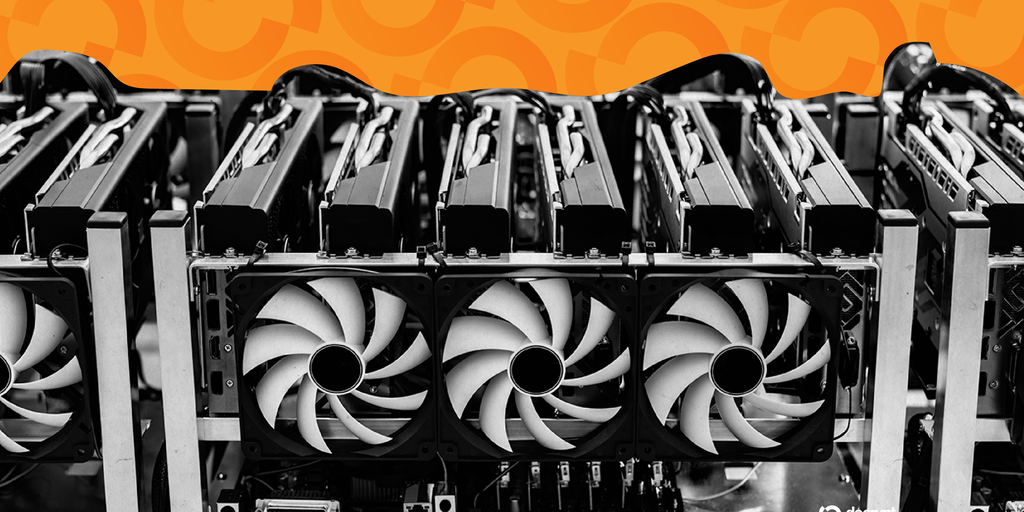

BTC

Bitcoin costs took a tumble on Friday, dipping all the way down to about $103,500 — its lowest value since June twenty third. Nonetheless, BTC was capable of finding its footing over the weekend, logging positive aspects on Saturday and Sunday whereas holding the 200-day transferring common. At the moment, Bitcoin is again above $110K. Try the chart for BTC.

Disclaimer:

Please notice that on account of market volatility, among the costs might have already been reached and situations performed out.