Anybody searching for a good cryptocurrency trade is spoilt for alternative since there are a lot of choices for merchants to pick out from. Nevertheless, with so many decisions, selecting the best one turns into a tough affair. On this HTX trade assessment, we take you thru an all-inclusive tour of the trade, beforehand traded as Huobi.

By the point you end studying our information, you’ll have had an ideal image of HTX trade, its historical past, and key options. We additionally reveal its advantages, payment construction, and disadvantages. Since an knowledgeable resolution is vital, please learn our assessment to find out whether or not HTX is a secure possibility for you.

HTX Trade Assessment: At a Look

Crypto ExchangeHTX, previously HuobiLaunch year2013 as Huobi, turned HTX in 2023FounderLeon Li, a former Oracle engineer and graduate of Tsinghua College.HeadquartersVictoria, SeychellesTrading optionsSpot buying and selling

Margin buying and selling (5x)

Futures buying and selling (200x)

Copy buying and selling

Buying and selling bots

Supported cryptocurrencies700+International presence160+ countriesSecurity measuresCold storage, Safety Reserve Fund, Proof of Reserves (PoR), Common safety audits, Superior encryption, DDoS safety, Two-Issue Authentication (2FA), Know Your Buyer (KYC) and Dynamic permission validation:Accepted Fee MethodsCredit/debit playing cards, Financial institution transfers, native cost techniques like iDeal, SEPA, PIX, UPI and Fee gateways like Alchemy Pay, Banxa, Mercuryo, and Simplex.Native TokenHTX tokenFiat currencies supported100+ fiat currencies, together with USD, EUR, and CAD amongst othersTrading feesSpot: 0.2% maker/takerFutures:- USDT-Margined Contracts: 0.02% maker, 0.06% taker– Coin-Margined Contracts: 0.02% makers, 0.05% takersRestricted International locationsUnited States, Mainland China, North Korea, Singapore, Iran, Cuba, Syria, Venezuela and different nations.Cellular App Scores4.0 ★ on Google play3.7 ★ on Apple Retailer

What’s HTX (Huobi Rebrand)?

HTX is a centralized international cryptocurrency trade platform, initially based mostly in China, the place it was based in 2013 by Leon Li, a former Oracle pc engineer. It started as a Bitcoin buying and selling hub underneath the title Huobi and rapidly turned one of many prime exchanges within the Chinese language crypto market. Nevertheless, following China’s 2017 ICO ban, the platform moved its operations abroad. In 2023, Huobi formally rebranded to HTX and is now registered in Seychelles. Whereas it beforehand had its headquarters in Singapore and expanded throughout numerous Asian and international markets, HTX is at present blocked in a number of nations, together with america, North Korea and mainland China.

HTX at present helps over 700 cryptocurrencies and affords aggressive charges and buying and selling instruments excellent for each newbies and knowledgeable merchants. From copy buying and selling to staking and API integration, HTX offers a variety of superior buying and selling methods. Merchants can use the desktop browser model designed for lively merchants in want of superior social buying and selling instruments and bots. Alternatively, the HTX cell App is providing a easy, user-friendly interface for customers serious about buying and selling on the transfer. The platform’s inexpensive payment construction has made it a well-liked possibility amongst day merchants trying to maximize their good points.

Professionals of HTX

Huge Collection of Supported Belongings: Helps over 700 cryptocurrencies and no less than 800+ buying and selling pairs.Superior Buying and selling Instruments: Presents superior instruments like futures, margin, copy buying and selling, and automatic buying and selling bots.Excessive Liquidity: The platform’s each day buying and selling volumes exceed $4 billion.Safety Options: Presents strong safety features corresponding to chilly storage, 2FA, PoR, and withdrawal whitelists.Cellular App: HTX has an intuitive, user-friendly, and feature-rich cell App for on-the-go buying and selling.HT Token Advantages: Customers of the native HT token get pleasure from payment reductions and staking rewards.

Cons of HTX

Combined Consumer Opinions: Web sites like Trustpilot have given low scores, citing withdrawal points and poor buyer help.Restrictions: Companies are usually not obtainable in China and the US resulting from regulatory constraints.Previous Safety Incidents: Whereas they’ve been addressed, previous safety breaches could concern cautious customers.Excessive Withdrawal Charges: Comparatively excessive withdrawal charges, particularly for BTC and ETH.

HTX Assessment: Buying and selling Options

HTX customers can get pleasure from a variety of buying and selling options, together with spot and futures buying and selling, margin and duplicate buying and selling, and quite a few automated instruments. Among the many hottest options are the next:

1. Spot buying and selling

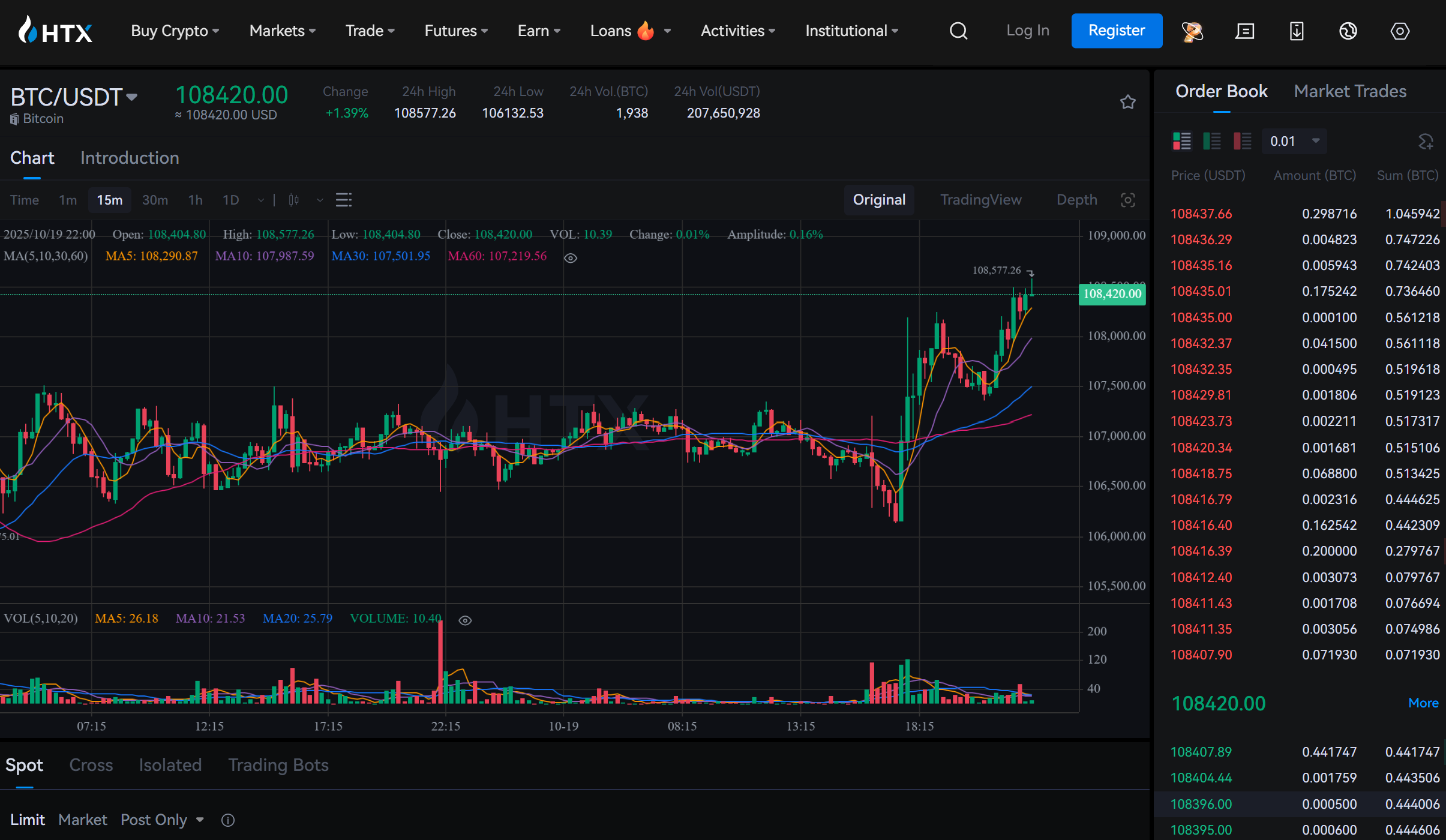

HTX spot buying and selling includes the fast shopping for and promoting of crypto on the present market worth on the trade. Spot buying and selling differs from derivatives buying and selling because the dealer owns the underlying asset instantly. The characteristic works through the “spot worth”, often known as the present market worth pushed by real-time provide and demand between patrons and sellers.

2. Margin Buying and selling

The Margin buying and selling characteristic allows customers to spice up their buying and selling energy by borrowing funds from the trade to commerce bigger quantities. This multiplies the revenue and loss potential and helps no less than 80 crypto belongings with as much as 5x on spot markets. Customers can select between Cross Margin – utilizing all obtainable funds to cowl losses, or Remoted Margin – borrowing restricted to a single commerce.

3. Futures Buying and selling

HTX affords by-product buying and selling with merchandise starting from Conventional Futures to Perpetual Swaps, Coin-Margined Futures, and USDT-Margined Futures. Some derivatives merchandise provide as much as 200x leverage with margins largely obtainable through a tiered construction based mostly on buying and selling volumes. The Futures contract buying and selling characteristic is out there 24/7, permitting customers to categorize their buying and selling varieties as opening or closing positions and additional divide them into longs and shorts.

4. Leveraged buying and selling

HTX Leveraged buying and selling includes utilizing funds borrowed from the trade to spice up your buying and selling place, revenue, and potential. It’s a high-risk technique because it additionally amplifies the magnitude of potential losses. The product obtainable via futures contracts and margin buying and selling works by requiring the dealer to place up the preliminary capital, referred to as margin. For instance, with 10x leverage on a $1,000 margin, the trade lends you further funds to open a $10,000 place.

5. Automated & superior instruments

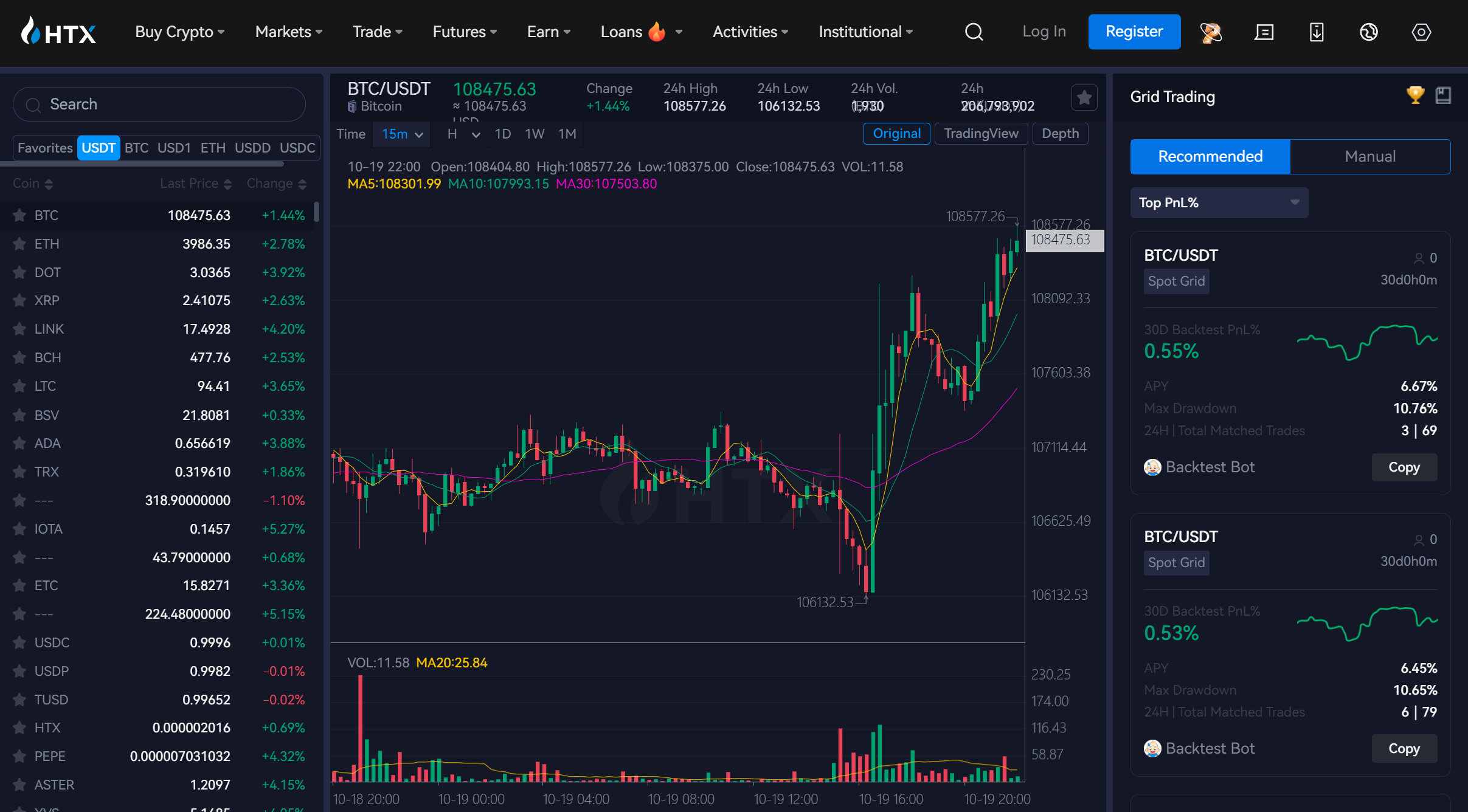

Futures Grid 2.0: The automated technique lets you place purchase and promote orders on a perpetual contract to revenue from market volatility, doubtlessly

Copy Buying and selling: HTX copy buying and selling permits customers to routinely replicate the commerce methods of skilled merchants by mirroring their accounts.Good Buying and selling: The platform affords strong superior companies for institutional purchasers looking for to automate their trades and entry high-volume choices. These embody constructing and integrating customized methods with HTX’s API, which offers real-time market information streaming and WebSocket help.

6. Buying and selling Bot

Merchants can use HTX buying and selling bots to automate their buying and selling methods, facilitating 24/7 shopping for and promoting based mostly on pre-set guidelines. The characteristic helps the “Grid Buying and selling Bot,” permitting customers to set costs and place purchase and promote orders inside their most popular ranges. You don’t have to observe the market on a regular basis as a result of the bot repeatedly buys low and sells excessive.

HTX Options and Companies

The HTX buying and selling platform affords a wide-ranging suite of economic and buying and selling companies for cryptocurrencies, which embody the next:

1. HTX Token

The Huobi Token (HTX) is the native token of the Huobi Token firm and is designed to gas your complete platform’s ecosystem. The ERC-20 token, obtainable on fashionable networks like BEP-20 and TRC-20, affords utility by way of rewards, charges, and entry to airdrops. Holders are inspired to repeatedly go to the HTX zone for information on duties and airdrops related to utilizing the HTX token. Furthermore, the trade affords HTX token holders buying and selling payment reductions, governance rights, and different rewards.

2. Crypto Loans

HTX affords a crypto loans product with a superb incomes potential for customers throughout the cryptocurrency house. Customers can take out loans to put money into alternatives they imagine will yield excessive ROIs. Every day pursuits start at 0.02% of the borrowed quantity, and debtors can select between 30 and 90 reimbursement days. This selection permits customers to leverage their belongings to boost their buying and selling technique.

3. HTX Earn

HTX Earn refers to a collection of economic companies and merchandise via which customers can earn passive revenue from their crypto belongings. Among the many obtainable monetary merchandise are versatile and fixed-term deposits, staking, and structured funding choices, together with:

Auto-Earn: This automated characteristic locations a dealer’s idle spot account into associated Versatile Earn merchandise hourly to maximise incomes potential.Diversified merchandise: HTX affords a spread of merchandise via this characteristic to satisfy merchants’ various funding methods and danger appetites.Versatile Earn: Merchants can subscribe and redeem belongings at will, incomes compound curiosity with the merchandise’ Annual Share Yield (APY) fluctuating with market circumstances.Mounted Earn: Requires customers to lock their belongings for a selected interval in trade for the next and glued APY. No early redemption is feasible with these merchandise.

Different Options

Structured merchandise: HTX affords a number of different superior funding alternatives, together with the next:Shark Fin: Gives a assured primary return with out a principal loss and potential for greater market-based ROIs.Staking: Customers can earn rewards from proof-of-stake (PoS) cryptocurrencies by staking their holdings.HTX Prime pool: Presents short-term staking alternatives with the potential for even greater returns.

HTX App Assessment: Consumer Expertise

HTX affords a cell app for Android and iOS, permitting customers to commerce and handle belongings on the go. It’s beginner-friendly, quick, and filled with superior instruments. Key options embody:

Intensive Buying and selling Choices: The HTX cell App helps quite a few buying and selling pairs, together with spot, futures, margin, and by-product buying and selling, protecting over 700 cryptocurrencies.Consumer-friendly interface: The App’s structure options an intuitive and responsive interface that’s simple for each newbie and knowledgeable merchants to navigate. The trade launched an up to date v11.0 model in July 2025 with refined aesthetics for a smoother expertise.Superior buying and selling instruments: The App options customizable buying and selling charts and technical indicators for various order varieties, together with grid buying and selling bots and duplicate buying and selling.Safe account administration: The cell App integrates high-tech safety features corresponding to fingerprint and Face ID logins and two-factor authentication.Portfolio and market insights: The App’s customers can simply monitor their asset portfolios in actual time, entry academic content material, and set customizable worth alerts.Seamless cross-platform syncing: The App’s account info and buying and selling layouts are simply synced between the cell and internet platforms for smoother working.

HTX Safety Measures

HTX trade takes issues of person information and person funds critically and employs a strong system to make sure nothing is compromised or misplaced. Among the many measures the trade employs are the next:

Two-factor authentication (2FA): HTX encourages customers to implement two-factor authentication as a further safety layer alongside a powerful password.Chilly Storage: The platform holds over 98% of its crypto holdings in chilly wallets. The offline storage ensures the vast majority of the funds are safe from the opportunity of on-line assaults.Multi-Signature Wallets: HTX makes use of multi-signature expertise, that means a couple of key will likely be used to switch any funds. This measure helps stop anybody particular person or hacker from stealing funds with ease.Investor Safety Fund: Since January 2018, the trade has been investing no less than 20% of its quarterly earnings in a fund as a reserve for emergencies. The fund can be useful if one thing went fallacious, corresponding to throughout a hacking incident.SSL Encryption: HTX trade makes use of SSL encryption to safe all information, together with person login info, transmitted to the web site, stopping entry by hackers.Anti-DDOS Safety: The platform has methods to forestall Distributed Denial of Service (DDOS) assaults, whereby fraudsters bombard an internet site to deliver it down.KYC Verification: All customers should bear necessary Know Your Buyer (KYC) laws and supply ID and deal with proof when signing up. The measure goals to forestall fraud and illicit use on the positioning.Anti-phishing Code: The platform makes use of an anti-phishing code that helps customers determine any phishing makes an attempt.

Is HTX Secure Trade?

Sure, HTX is usually thought of a secure trade as we speak, regardless of previous safety incidents. It now makes use of sturdy safety measures corresponding to 2FA, chilly pockets storage, multi-signature entry, anti-phishing codes, and a reserve fund to guard customers and their belongings.

HTX Charges Assessment

Buying and selling Charges

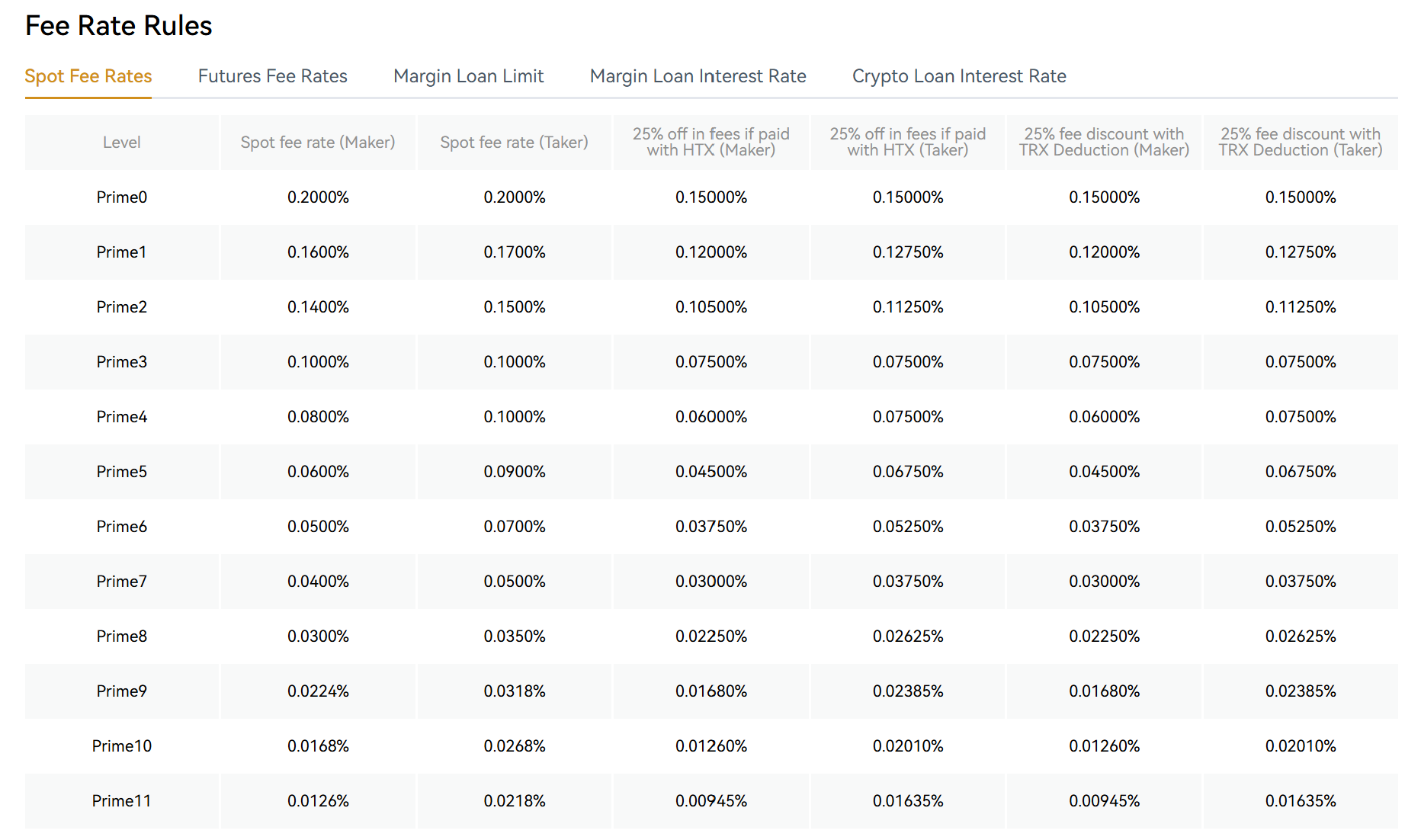

HTX makes use of a dynamic tiered “Prime” system to find out buying and selling charges, providing decreased charges to customers with greater buying and selling quantity or bigger token holdings. As customers transfer up the Prime ranges based mostly on 30-day buying and selling quantity, complete asset worth, or HTX token stability, they acquire entry to progressively decrease charges for each spot and futures buying and selling.

Spot Buying and selling Charges (Prime 0)

Maker Charges: 0.20%Taker Charges: 0.20%

As merchants transfer up the VIP ranges (Prime 1 via 11), charges lower, with the best tier receiving the bottom charges.

Futures Buying and selling Charges (Prime 0)

USDT-Margined ContractsCoin-Margined Contracts

Prime-tier futures merchants can obtain even decrease charges, together with maker rebates.

Deposits and Withdrawal Charges

Customers depositing cryptocurrencies to the HTX accounts don’t incur any charges. Consequently, you may switch BTC, ETH, or another crypto asset to your account or HTX pockets with out paying a dime.

Nevertheless, withdrawing cryptocurrency out of your HTX account to a special trade or pockets will entice a payment. The precise quantity to be charged will fluctuate based mostly on the actual cryptocurrency withdrawn and the situation of the blockchain community. For instance, withdrawal charges for Bitcoin are 0.00025 BTC, whereas ETH is charged 0.0021 ETH.

Word that the figures talked about listed here are pointers, as they could change over time and will improve resulting from community congestion. You need to get the proper withdrawal charges figures by visiting the “Withdrawal” part of the HTX web site.

The best way to Use HTX Trade?

To make use of HTX, it’s essential open an account via the official HTX web site or cell App and full KYC verification. The next is the step-by-step course of:

The best way to Open an HTX Account?

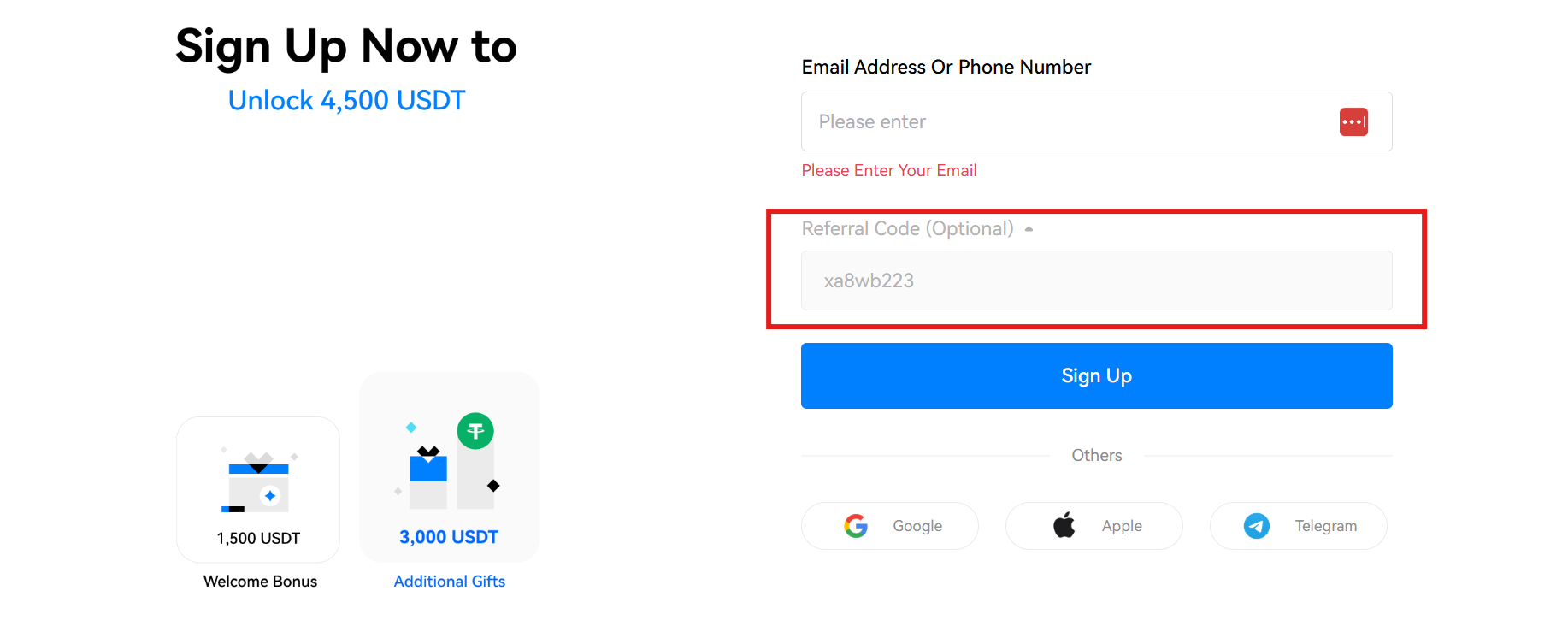

Join an account: Navigate to the HTX web site and click on “Signal Up.” Enter your e-mail or cell quantity and ensure to make use of the referral code “xa8wb223” throughout registration to unlock bonus rewards.Full id verification (KYC): To get full entry to all options like fiat deposit and withdrawal, full the KYC verification course of. Three verification ranges require completely different paperwork and provide various transaction limits.Deposit funds: When you’re verified, fund your account with crypto or fiat foreign money to start buying and selling.

The best way to Commerce on the HTX Platform?

Navigate the web site or App to the “Commerce” or “Spot” part.Choose that buying and selling pair you need to commerce, for instance, BTC/USD.Select an order sort: Market Order to purchase or promote on the present market worth, or Restrict Order to set a selected purchase or promote worth to your Order.Enter the specified crypto quantity and make sure your Order to finish the transaction.

The best way to Deposit & Withdraw at HTX?

Crypto Deposit

Log in to your account and navigate to the “Balances” or “Pockets” part.Choose “Deposit” and select the asset you need to switch.Select an acceptable community, e.g., ERC20 or TRC20.Copy the generated HTX pockets deal with.Navigate to your trade or exterior pockets, paste the deal with, and ship crypto to your account.

Fiat deposit

Navigate to the “Purchase Crypto” part and select “Fiat deposit.”Choose your foreign money and cost methodology.Enter the specified deposit quantity and comply with the prompts to finish the transaction.

Withdraw funds

Navigate to “Pockets” or “Stability” and choose “Withdraw.”Choose the asset you need to withdraw, and enter the proper blockchain community.Enter the pockets deal with to ship funds.Double-check to substantiate correctness and full the transaction.To withdraw fiat foreign money, comply with the identical process and choose the specified foreign money and checking account.

HTX Regulatory Compliance

HTX implements a number of measures designed to meet completely different regulatory necessities. The platform additionally repeatedly educates customers on adjustments associated to current and rising regulatory measures.

Along with observing stringent safety and custody necessities, KYC ensures its stablecoin reserves are safe. The corporate can also be actively engaged with dynamic international laws, such because the EU’s MiCAR, to align innovation with market sustainability. This requires implementing onchain compliance measures and creating safe techniques to safeguard person belongings and forestall illicit commerce actions.

HTX Buyer Assist & Consumer Suggestions

HTX offers a strong buyer help system to assist customers navigate the platform and resolve points effectively. Assist is out there via a number of channels:

24/7 Dwell Chat: HTX help through reside chat contains a number of languages and is out there from the cell App of the HTX web site.Assist Ticket System: Addresses advanced points that require detailed investigation and contains sharing account-specific info for as much as 24 hours.E-mail Assist: Out there for customers preferring e-mail communication. It might be used for extra detailed correspondence and follow-ups.Social Media Assist: The platform has an lively presence and communities on platforms like X (Previously Twitter) and Telegram.Instructional Assets: The platform disseminates info through HTX Study, that includes repeatedly up to date articles and Buying and selling Guides that provide step-by-step tutorials. The trade offers extra info via video tutorials and the HTX weblog, which affords buying and selling ideas and platform updates.

The platform’s Assist Heart additionally features a detailed FAQ part addressing widespread questions.

Whereas many customers recognize the vary of help and academic instruments, some have reported delayed withdrawals or frozen funds linked to flagged exercise. Trustpilot evaluations spotlight occasional sluggish responses and automatic replies, pointing to areas the place HTX might enhance its service high quality.

Finest Alternate options to HTX for Crypto Buying and selling

ExchangeEstablishedSupported

Cryptos

24 Hrs.

Quantity

Key FeaturesSupported

Fiat Currencies

KYC RequiredAccepted Fee MethodsHTX2013700+$2.51B+Established since 2013

Grid & DCA bots

100+YesCredit/debit playing cards

P2P buying and selling

Third-party retailers

MEXC20183100+$2.51B+Most cryptos

Lowest charges

Deep liquidity

50+YesCredit/debit playing cards (Visa, Mastercard)Financial institution transfers

Third-party companies

Bybit2018729+$2.53B+Highest buying and selling quantity

Superior options

A number of buying and selling bots

25+YesBank transfers

Card funds

Money

Blofin2019564+$379.32M+No KYC required

A number of fiat choices

85+NoCredit/debit playing cards

Financial institution transfers (like SEPA and PIX)

E-wallets

Kraken2011450+$2.47B+Main safety

Deep liquidity

Wide selection of buying and selling choices

10+YesApple Pay or Google Pay

Debit or Credit score Card

Account Stability

Binance2017350+$43.62B+Binance Earn

Staking

Financial savings accounts

100+Yescredit/debit playing cards,

Financial institution transfers (native and worldwide)

Peer-to-peer (P2P)

Conclusion: Is HTX a Good Trade?

HTX stands out as one of many largest cryptocurrency exchanges, patronized by tens of millions of merchants globally, particularly within the Asian market. The platform helps an honest variety of tradable cryptocurrencies utilizing a professional-grade, user-friendly interface. The trade additionally has a superb cell app that’s excellent for each newbies and consultants to commerce on the go. Whereas there’s nonetheless room for enchancment, HTX is usually ranked among the many prime ten most distinguished and most trusted buying and selling platforms.

With no less than 10 million customers worldwide and a each day commerce quantity exceeding $2 billion, the platform affords deep liquidity. The wide selection of sturdy buying and selling services makes HTX a well-liked alternative amongst merchants, particularly these serious about day buying and selling. Moreover, the trade allows customers to earn passive revenue via staking, copy buying and selling, and speed up good points via HTX Earn. With a broad international attain of over 160 nations, no matter your thought of an trade is, HTX gives you peace of thoughts and meet your cryptocurrency buying and selling wants.

FAQs

Is HTX obtainable in america?

No, current regulatory restrictions have made US-based crypto merchants unable entry the HTX trade. Consequently, the platform particularly mentions america jurisdiction as one of many areas the place its companies are prohibited.

Is HTX higher than Binance?

Binance trade is listed as the largest cryptocurrency trade globally by way of commerce quantity and handles no less than 1.4 million orders per second. Additionally it is acknowledged because the quickest crypto buying and selling platform worldwide. HTX, however, affords spot buying and selling with as much as 5x leverage and is fashionable particularly within the Asian market. Evaluating the 2, Binance could also be forward of HTX because the former fees decrease charges and is regulated in lots of extra jurisdictions. Binance additionally affords extra Earn merchandise and has many extra options.

Is OKX higher than HTX?

In response to many customers, OKX is extra fashionable and broadly adopted than HTX. Among the many causes OKX could also be superior to HTX are providing extra tradable cryptos and markets, in addition to deeper liquidity. HTX offers extra options and merchandise past simply crypto buying and selling.

Does HTX provide staking or rewards?

Sure, HTX cryptocurrency trade affords staking companies and numerous associated reward applications that allow customers to earn passive revenue on their crypto holdings. The trade offers quite a few versatile and glued staking merchandise that embody rewards for holding the platform’s native token. On the subject of staking, customers can earn from “quite a few different yield-generating merchandise. Merchants can earn staking rewards from a number of fashionable crypto belongings whereas sustaining their belongings’ liquidity, relying on the precise product.

Does HTX Require KYC?

Sure, customers should full KYC verification, particularly in the event that they need to deposit and commerce crypto. Customers will likely be requested to submit authorities ID paperwork, corresponding to a driver’s license or a passport, along with proof of deal with.