Nasdaq-listed Solana treasury agency Upexi (UPXI) stated its Solana reserves rose +4.4% to 2,106,989 SOL as of Oct. 31, a rise of 88,750 SOL since its final replace on Sept. 10.

At Solana’s month-end value of $188.56, Upexi’s holdings had been valued at about $397M.

In line with the press launch, the corporate stated it acquired the tokens for $325M in complete, at a median value of $157.66 per SOL.

That positioned unrealized features close to $72M, reflecting value features, staking rewards, and a reduction from locked tokens.

After the broader market decline on Monday, Solana fell roughly 15% to about $160.94.

7d

30d

1y

All Time

The worth of Upexi’s holdings now sits close to $340M, trimming the paper revenue to roughly $15M.

The replace comes as digital-asset treasury corporations face sharp share-price declines from highs earlier this 12 months. Upexi’s inventory is down about -75% from its peak.

(Supply: UPXI USDT, TradingView)

In consequence, market-cap-to-net-asset-value ratios have tightened, with Upexi’s modified NAV now round 0.7.

Upexi additionally reported an adjusted SOL per share of 0.0187 ($3.52), representing a +47% acquire in SOL and 82% in greenback phrases because the firm launched its treasury effort in April by a $100M personal placement led by GSR.

EXPLORE: Prime 20 Crypto to Purchase in 2025

Solana Value Prediction: Might SOL Value Drop 30-40% If Help Breaks?

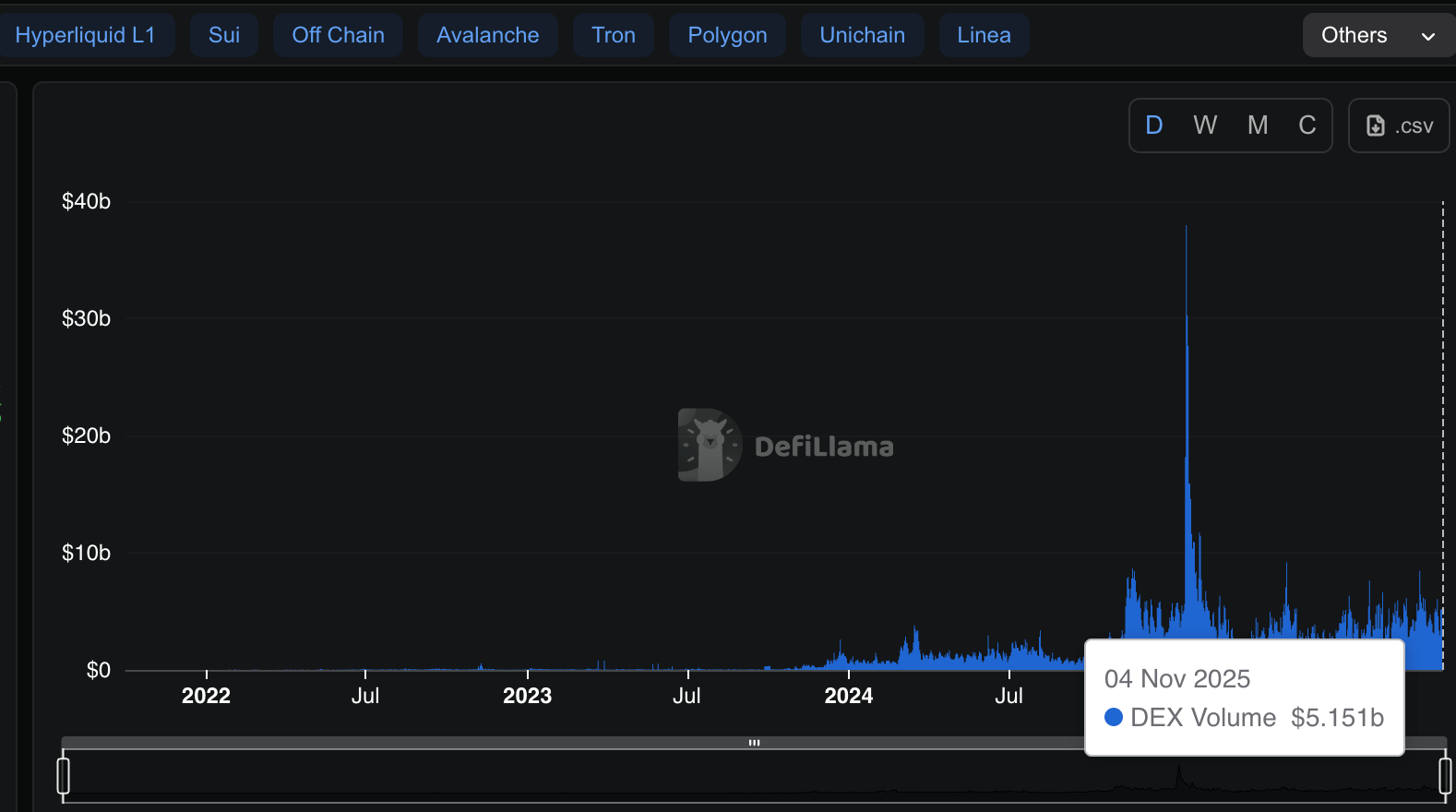

On Solana, recent figures from DeFiLlama present about $10.30Bn locked throughout DeFi platforms.

(Supply: DefiLlama)

Stablecoins on the community complete roughly $14.26Bn in market worth, and USDC makes up about 65% of that share.

Buying and selling exercise is powerful. Solana-based DEXs processed round $5.15Bn in quantity over the previous day.

Value motion, nevertheless, seems fragile. SOL is now retesting a long-running weekly trendline that has supported its rise since 2023.

The chart nonetheless reveals a clear stretch of upper lows over the previous 12 months, however current candles level to fading energy as value drifts towards the $150–$160 zone.

You may actually see story on that $SOL

Months of unpolluted greater lows, now hanging proper on fringe of the trendline that’s held since 2023.

If this breaks, belief me there’s no magic it’s a 30–40% slide straight into subsequent liquidity zone.And but, persons are nonetheless making an attempt to purchase the… pic.twitter.com/JkZoPxrvZH

— Henry (@LordOfAlts) November 4, 2025

If this assist provides approach, the transfer may flip quick. The analyst warns {that a} breakdown might result in a 30–40% drop, lining up with a liquidity pocket close to $100–$120.

One chart notice marks the draw back nearer to 36%, underscoring how uncovered the market may turn into if consumers fail to defend.

SOL has additionally failed a number of occasions to push previous resistance round $225, forming decrease highs since mid-2025.

That sample reveals sellers are nonetheless in management. From right here, the trendline is the important thing marker: maintain and bounce, or lose it and slide deeper. For now, the temper leans cautious.

EXPLORE: The 12+ Hottest Crypto Presales to Purchase Proper Now

The put up TradFi Solana Value Prediction is BULLISH? Solana Treasuries Maintain Stacking SOL appeared first on 99Bitcoins.