Tom Lee acknowledged that latest drops in crypto costs could also be linked to monetary issues confronted by buying and selling companies.

The chairman of BitMine spoke with CNBC and mentioned that some market makers are dealing with huge monetary gaps.

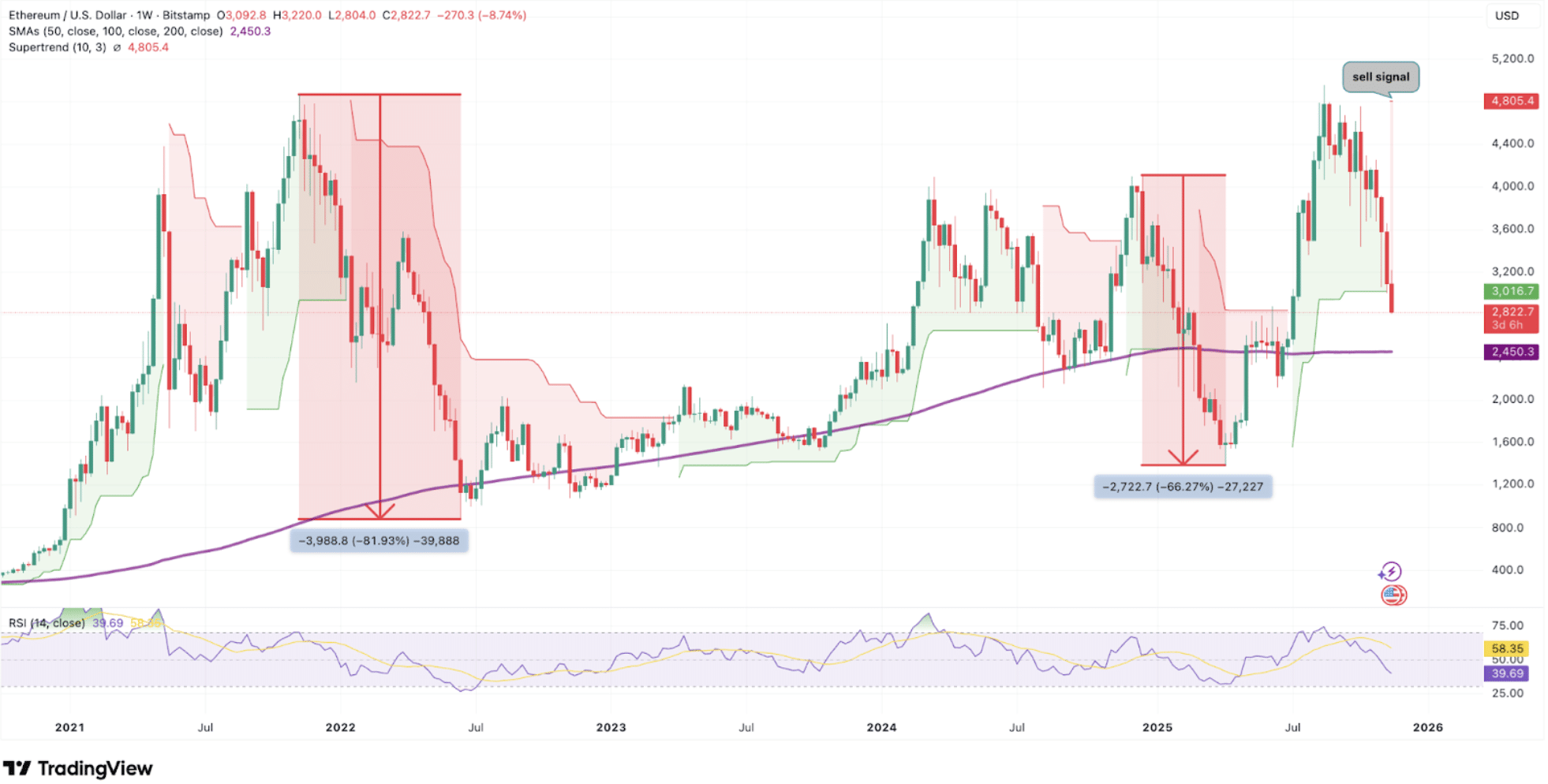

Lee referred to the October 10 fall, when round $20 billion was worn out of the crypto market in a single day. He mentioned the crash caught some market makers abruptly and left them with much less cash to commerce.

Do you know?

Subscribe – We publish new crypto explainer movies each week!

What’s a Crypto Pockets? (Defined With Animation)

Consequently, they needed to in the reduction of their exercise and promote extra belongings, which added to the downward stress on costs.

He defined that these firms depend on buying and selling exercise for his or her revenue. When buying and selling volumes dropped after the crash, their income and accessible funds each fell. Subsequently, they lowered their buying and selling dimension and took fewer dangers to guard what capital that they had left.

Lee mentioned the state of affairs creates a troublesome cycle. As losses enhance, market makers are compelled to promote much more belongings to boost money, which then pushes costs decrease once more. He described the gradual decline in crypto costs over latest weeks because of this ongoing stress.

He additionally in contrast market makers within the crypto trade to “central banks”. He acknowledged that they play a job in sustaining market stability and liquidity. Once they face monetary hassle, the complete system can turn into fragile.

Just lately, Arthur Hayes, former BitMEX

$624.37K

CEO, shared his ideas on Bitcoin’s

$84,434.67

newest value decline. What did he say? Learn the total story.