Bitcoin is struggling to seek out help as promoting strain accelerates and uncertainty spreads throughout the crypto market. After hitting its all-time excessive close to $126,000 in early October, BTC has now misplaced greater than 35% of its worth, shaking investor confidence and fueling rising calls that the present bull cycle has ended. Market sentiment has shifted quickly, with merchants, analysts, and long-term contributors reassessing expectations as value volatility intensifies and liquidity thins throughout main exchanges.

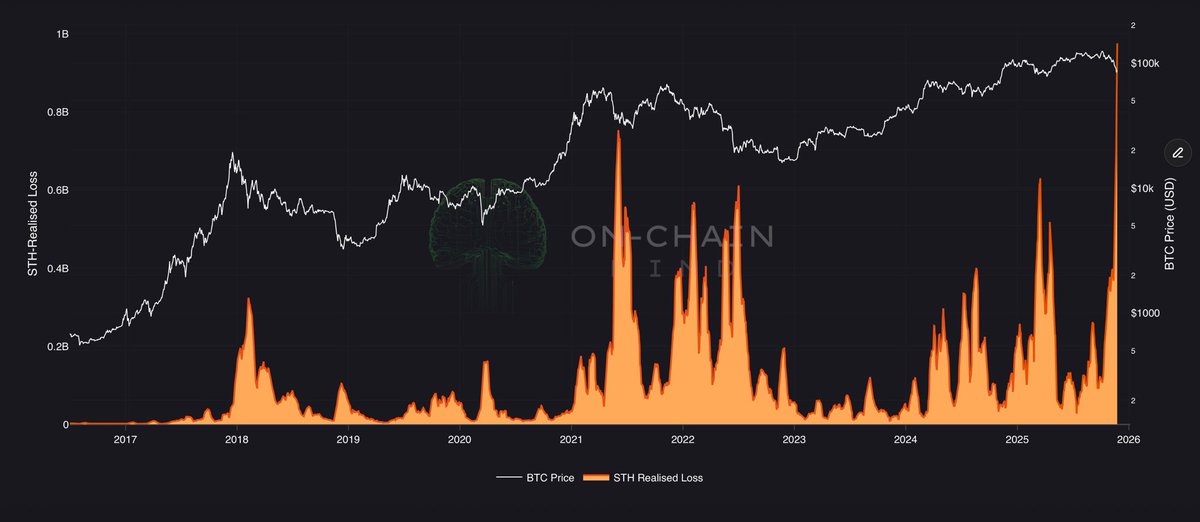

What makes the present part much more regarding is the conduct of short-term holders, who traditionally act as probably the most reactive phase of the market. In keeping with key information shared by On-Chain Thoughts, short-term holders are actually locking within the greatest realized losses in Bitcoin’s total historical past. This stage of loss realization surpasses the capitulation seen in the course of the China mining ban, the FTX collapse, and even the COVID crash, marking an excessive part of market misery.

This unprecedented stage of capitulation means that panic has taken management, with newer entrants exiting positions at steep losses. Whereas some analysts argue that such occasions have traditionally preceded main reversals, others imagine it indicators the start of a protracted downtrend. The approaching days might decide which narrative takes maintain.

Brief-Time period Holders Face File Losses as Market Capitulates

On-Chain Thoughts studies that short-term holders are locking in additional than $900 million in losses per day. This excessive stage of loss realization displays a part of true capitulation.

Brief-term holders are traditionally probably the most delicate to sharp value swings, and after they start exiting at such magnitude, it usually indicators a breaking level in market sentiment. The info means that panic promoting has reached ranges by no means seen earlier than, even when in comparison with main historic shock occasions.

Through the COVID crash, the China mining ban, and the FTX implosion, realized losses spiked sharply, but none of these occasions reached the present scale. This locations the current correction in a class of its personal and raises questions in regards to the structural stability of the market over the approaching weeks. Some analysts argue that this marks the definitive starting of a bear cycle, the place confidence erodes and capital rotates out of danger belongings.

Nonetheless, there stays a smaller group of optimistic voices who observe that excessive capitulation has usually preceded highly effective recoveries. If Bitcoin stabilizes and consumers return, this might type a significant macro backside. The following transfer will doubtless outline the market’s trajectory.

BTC Checks Weekly Assist After Sharp Reversal

Bitcoin’s weekly chart reveals a steep reversal from the all-time excessive close to $126,000, with value now buying and selling round $86,900 after a fast decline. The drawdown has positioned BTC again towards the important thing 100-week transferring common, which is presently sitting simply above $83,000 and performing as an vital structural help stage.

Traditionally, this transferring common has outlined the boundary between bull-phase retracements and full macro pattern breakdowns. A clear weekly shut beneath it could strengthen the bear-market narrative that many analysts are actually starting to advertise.

Regardless of the severity of the decline, value is starting to stabilize, forming a small response wick suggesting early makes an attempt at demand absorption across the $80,000–$85,000 zone. This area coincides with prior consolidation from early within the cycle, making it a logical space for consumers to defend.

Nonetheless, momentum indicators stay pointed downward, and the space from the 50-week transferring common highlights the lack of pattern energy.

For the bullish case to re-emerge, Bitcoin would want to reclaim the $95,000–$100,000 band, the place damaged help now acts as resistance. Till then, uncertainty stays elevated, and the weekly construction leans cautiously bearish.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.