Bitcoin has lastly damaged above the $90,000 mark after days of struggling to reclaim this key psychological degree. The transfer comes throughout a interval of sharp volatility and protracted promoting strain that continues to dominate market sentiment.

Analysts stay divided, however a rising quantity are calling for the official begin of a bear market as BTC trades practically 30% under its all-time excessive and fails to determine a convincing restoration construction. Worry stays elevated, and confidence amongst each retail and institutional buyers is weakening.

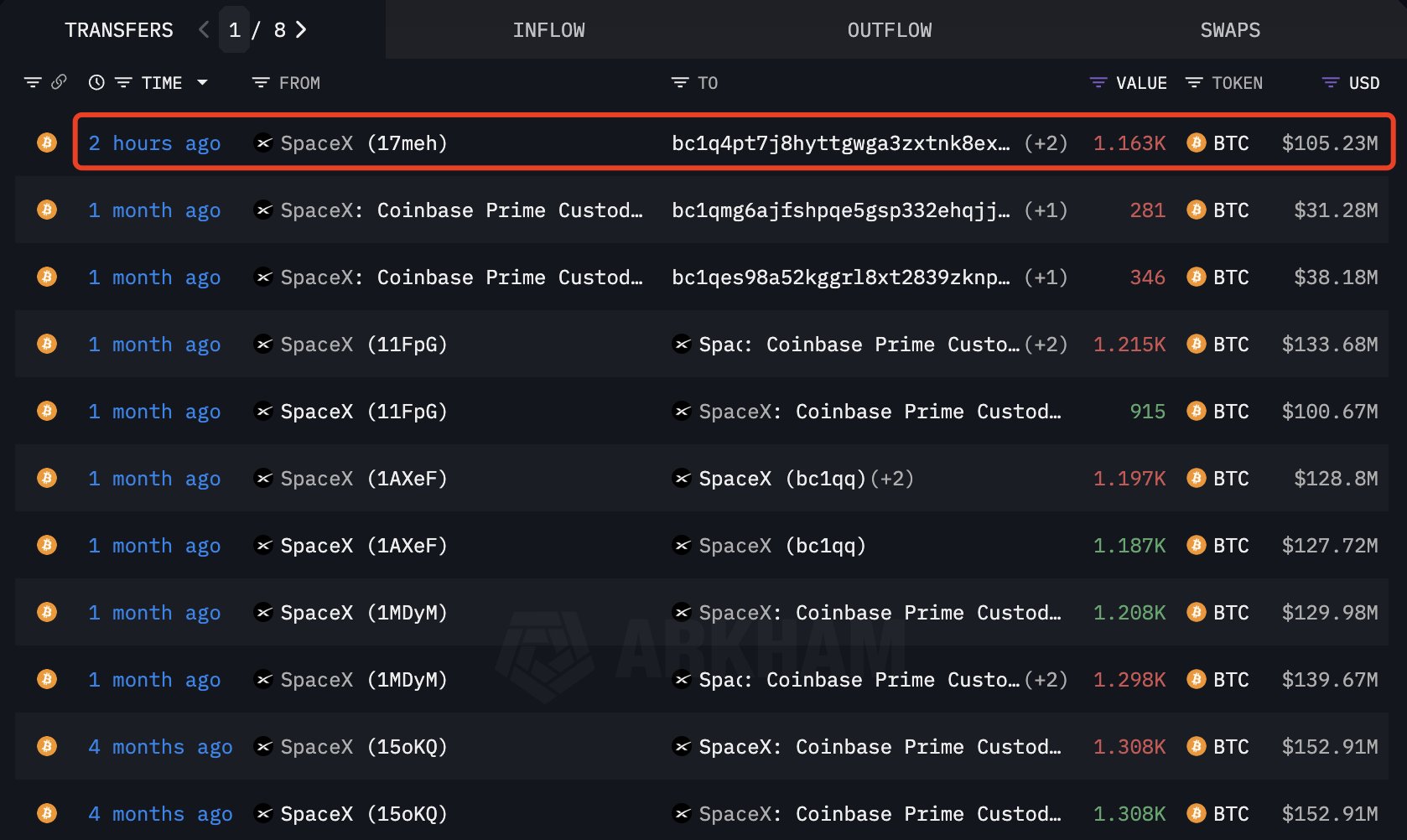

Including to the uncertainty, new information from Arkham reveals that SpaceX transferred out one other 1,163 BTC—value roughly $105.23 million—only a few hours in the past. The switch seems to have been routed to Coinbase Prime, suggesting a possible custody shift by the corporate. Such giant actions usually spark concern available in the market, as they might sign repositioning, promoting preparation, or treasury changes by main company holders.

Whereas Bitcoin’s push above $90K supplies momentary aid, it does little to vary the broader narrative: the market stays below strain, liquidity is thinning, and macro-driven uncertainty continues to form worth motion. The approaching periods will decide whether or not BTC can construct momentum or slip again into deeper correction territory.

SpaceX’s Bitcoin Actions Add New Layer of Market Uncertainty

In accordance with information from Arkham, SpaceX at the moment holds 6,095.45 BTC, valued at roughly $550 million at as we speak’s costs. This substantial treasury place locations the corporate among the many bigger company Bitcoin holders, and its current on-chain exercise has rapidly drawn consideration throughout the market.

The newest switch—1,163 BTC moved simply hours in the past—marks a significant shift in exercise for SpaceX, particularly contemplating the corporate has been largely inactive by way of BTC actions for months.

Arkham experiences that that is SpaceX’s first notable transaction since October 29, when the corporate transferred 281 BTC to a brand new pockets handle. Whereas the motives behind these transfers stay unknown, merchants usually monitor such strikes intently, as giant company holders can affect market sentiment.

Transfers to Coinbase Prime—as suspected within the newest motion—usually recommend custody changes, treasury restructuring, or preparations for strategic repositioning.

For now, there isn’t any clear indication that SpaceX is decreasing its Bitcoin publicity. Nevertheless, the renewed on-chain exercise comes at a delicate second for the market, which is scuffling with promoting strain, concern, and broad hypothesis about an rising bear section.

So long as main smart-money entities stay energetic, Bitcoin’s short-term route could proceed to expertise heightened volatility.

Tried Restoration however Nonetheless Below Stress

Bitcoin is displaying indicators of restoration after plunging to new native lows final week, with the value now pushing again above $91,000. The chart reveals a pointy bounce from the sub-$82,000 zone, which acted as a brief help throughout the capitulation section. Nevertheless, regardless of this rebound, BTC stays under all main transferring averages—the 50-day, 100-day, and 200-day—which reinforces the broader bearish construction.

The current upswing displays short-term aid somewhat than a confirmed development reversal. Quantity spiked closely throughout the sell-off, indicating compelled liquidations and panic promoting. However the present bounce is occurring on lighter quantity, suggesting that patrons are cautious and never but committing with robust conviction.

Structurally, Bitcoin should reclaim the $95,000–$98,000 zone, the place the 50-day and 100-day transferring averages converge.

This space represents the primary main resistance cluster and can decide whether or not the market is transitioning right into a restoration or just forming a decrease excessive earlier than one other leg down. Failure to interrupt above this band might invite renewed promoting strain.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.