.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

colour: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px stable #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px stable #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavorable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavorable {

border: 1px stable #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable {

colour: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable::earlier than {

border-top: 4px stable #A90C0C !necessary;

}

0.89%

Bitcoin

BTC

Worth

$86,638.22

0.89% /24h

Quantity in 24h

$48.83B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(operate($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

has climbed from its dip to $84,000 and is now buying and selling near $87,000, drawing consideration once more from massive traders and smaller merchants searching for the following 100x crypto. Right now’s rebound displays fast stabilization after Bitcoin briefly fell beneath $84,000 as a consequence of skinny liquidity and practically $1 billion in compelled liquidations throughout leveraged positions.

By noon, BTC returned to the $86,500–$87,200 zone, roughly 3% above its intraday low. The transfer follows a tricky November through which Bitcoin shed over $18,000 as ETFs noticed file month-to-month redemptions of $3.47 billion, the worst since February.

But on-chain exercise reveals massive holders quietly accumulating, whereas technical knowledge highlights agency assist close to $86,000. Analysts imagine Bitcoin may try a run towards $100,000 if December inflows reappear, particularly with historic averages pointing to a 9.7% acquire for the month.

Grayscale Analysis expects Bitcoin to set new all-time highs in 2026, pushing again in opposition to the broadly held “four-year cycle” narrative. The agency stated this cycle has not seen the same old parabolic surge pushed by retail merchants, with institutional inflows, potential price cuts, and…

— Wu Blockchain (@WuBlockchain) December 2, 2025

EXPLORE: 10+ Subsequent 100x Crypto to Purchase

Merchants Discover the Subsequent 100x Crypto As Vanguard’s New Coverage Alerts a Main Shift for Conventional Finance

One of many fundamental catalysts behind right this moment’s restoration is Vanguard’s sweeping coverage change. The $11 trillion asset supervisor introduced that, beginning December 2, it would permit shoppers to commerce crypto ETFs and mutual funds, reversing years of exclusion. This contains merchandise monitoring Bitcoin, Ether, XRP, and Solana, opening entry to greater than 50 million prospects. Vanguard cited improved administrative frameworks and shifts in investor conduct, even because the crypto market has declined by $1 trillion since October. The change may introduce new capital into Bitcoin ETFs, which collectively maintain $113 billion, providing potential reduction from current outflows and supporting worth stability.

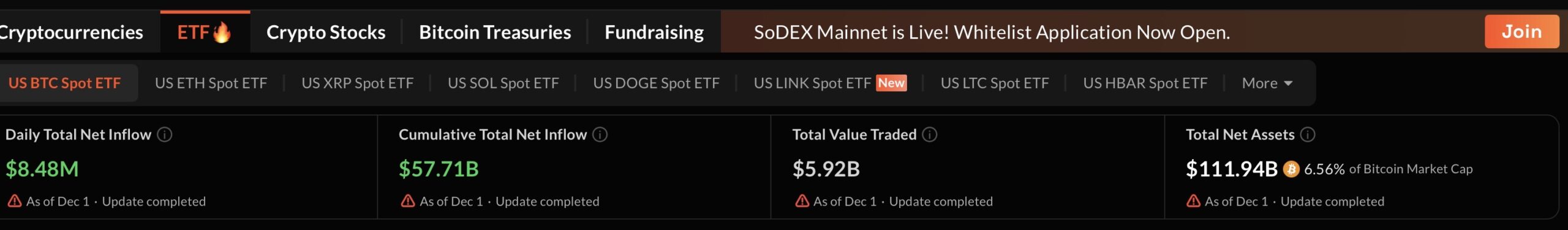

ETF exercise stays essential, with spot Bitcoin funds experiencing heavy withdrawals in November however now displaying early indicators of levelling off.

BlackRock’s IBIT, at present the biggest with $70 billion in property, not too long ago elevated its inner allocations, contributing to right this moment’s rebound. In the meantime, the Federal Reserve’s choice to finish quantitative tightening, pausing its $2.2 trillion discount in balance-sheet property, eases liquidity constraints: situations that usually profit property like Bitcoin.

Further actions embrace Coinbase’s This fall index replace, including HBAR, MANTLE, VET, FLR, SEI, and IMX to trace high-liquidity performers. Franklin Templeton additionally expanded its Crypto Index ETF to incorporate Bitcoin, Ether, Solana, XRP, and several other others, widening publicity for traders.

Altogether, Bitcoin’s rebound, Vanguard’s sudden coverage reversal, and the Fed’s liquidity shift create a constructive setup for the market. With merchants monitoring each established property and attainable subsequent 100x crypto alternatives, December may open the door to significant market progress.

DISCOVER: Vanguard Crypto ETF Greenlight Might Finish The Crypto Crash Right now

Japan Crypto Strikes Towards Flat 20% Crypto Tax as Authorities Backs Main Reform

Japan is making ready to overtake its crypto tax system after greater than a decade of investor complaints and business lobbying. In keeping with new reporting from Nikkei Asia, the federal government and ruling coalition have formally endorsed a plan to chop the nation’s most crypto tax price to a flat 20%, aligning digital property with equities and funding trusts.

The Monetary Companies Company (FSA) is anticipated to introduce the crypto invoice in the course of the common Weight loss program session in early 2026.

The choice marks some of the consequential shifts in Japan’s digital-asset coverage since the collapse of Mt. Gox in 2014. It additionally displays a rising political will to revitalize Japan’s stagnant cryptocurrency sector, which has been hindered for years by punitive tax guidelines.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Learn the Full Article Right here

The publish [LIVE] Crypto Information Right now, December 2 – Bitcoin Rebounds to $87K, Vanguard Opens to Crypto ETFs, Fed Ends QT: Subsequent 100x Crypto? appeared first on 99Bitcoins.