Fraud is rising extra refined and has grow to be supercharged by generative AI, deepfakes, and more and more organized social-engineering networks. The altering dynamics have pressured each banks and fintechs to rethink their defenses as criminals adapt quicker, extra steadily, and with extra personalised assaults. Throughout fintech, it’s clear that conventional fraud controls are not sufficient to guard clients.

However whereas all the business is dealing with the identical escalating threats, fintechs have been particularly artistic in rolling out new layers of safety. Over the previous 12 months, a handful of standout options have emerged that fight fraud by proactively shaping buyer habits, interrupting social-engineering techniques, and shutting gaps that legacy techniques can’t attain. Listed below are three distinctive new improvements value watching (and borrowing).

Revolut’s geolocation restrictions

Revolut launched a security characteristic yesterday that enables customers to limit cash transfers to particular, user-approved geographic areas. If a switch request is made out of the shopper’s gadget, however takes place at a location that the shopper has not listed, the app blocks the transaction mechanically, even when the fraudster has the consumer’s credentials. The characteristic makes use of each gadget GPS and Revolut’s inner threat engine to cut back account takeover losses.

Why banks ought to care:Geolocation locking provides a low-friction layer to fraud protection, particularly for decreasing licensed push fee fraud (APP) and account takeovers. By having the consumer decide their restricted, “protected” places, banks might provide customers extra granular management over how and the place their cash can transfer.

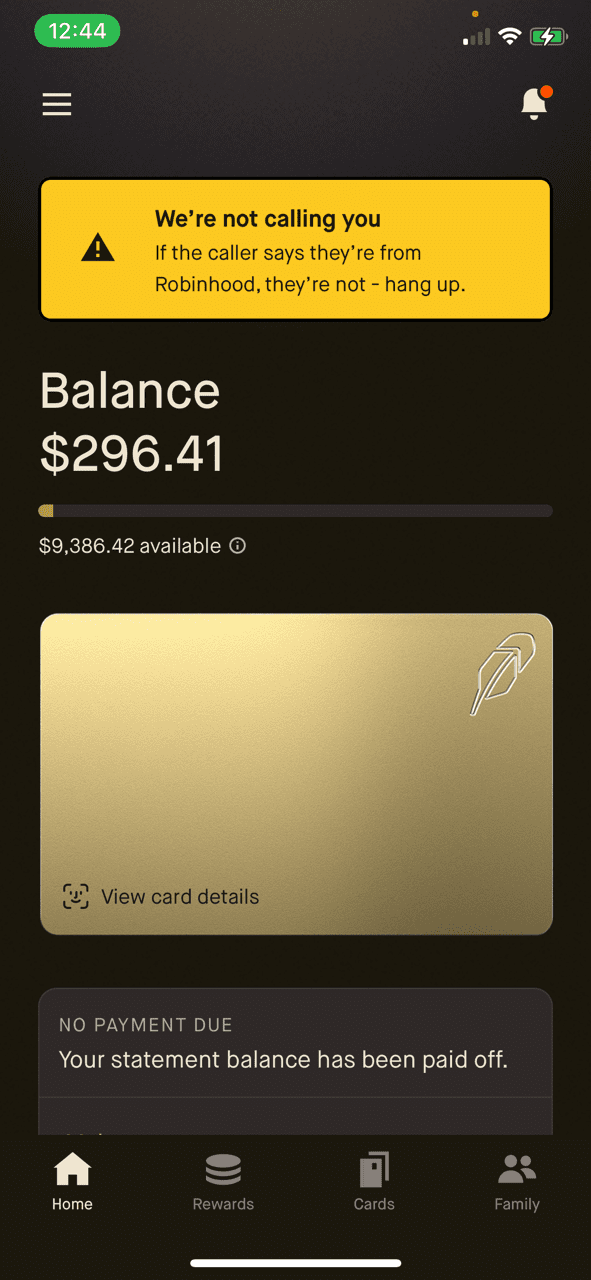

Monzo’s and Robinhood’s in-app rip-off warnings

Each Monzo and Robinhood assist customers decide whether or not an inbound name claiming to be from the financial institution is legit. When a buyer is on a name and opens their cellular app, the app shows a banner that clearly communicates that the decision they’re on isn’t with the financial institution. In Robinhood’s case, the message states, “We’re not at present making an attempt to name you. If the caller says they’re from Robinhood, they aren’t. Hold up.”

Why banks ought to care:Impersonation scams are one of the costly types of APP fraud. Including an in-app, real-time verification banner is an very simple however efficient approach to interrupt fraudsters.

iProov’s deepfake-resistant biometric verification

iProov is combating deepfakes with biometric verification that detects AI-generated faces and artificial video spoofing. The corporate analyzes pixel-level mild reflections, which it calls “liveness assurance,” and makes use of deepfake-detection fashions to establish whether or not a stay consumer is current. That is changing into important for distant KYC, account restoration, and high-risk authentication.

Why banks ought to care:Banks more and more depend on distant onboarding and passwordless authentication, however deepfakes at the moment are capable of defeat lots of the legacy selfie-verification techniques launched previously decade. Deploying deepfake-resistant biometrics is changing into important to stop fraudulent account opening and social-engineering-driven account resets.

Every of those options has one factor in widespread: they put friction in precisely the appropriate place. The friction isn’t utilized to each transaction, and so they gained’t deter trustworthy clients, however they’ll assist cease fraud in widespread locations. By utilizing smarter triggers, real-time context, and design decisions, fintechs are capable of interrupt fraudsters. And whereas every resolution gained’t cease all fraud, they deal with a few of the heavy lifting whereas minimizing the burden of friction on finish customers.

Picture by Pixabay

Views: 79