Financial institution of America is the newest conventional establishment to heat as much as Bitcoin, with its funding strategists set to cowl 4 ETFs beginning in January.

Financial institution of America To Start Endorsing Crypto Publicity

As reported by Yahoo Finance, Financial institution of America will begin recommending its shoppers a 1% to 4% portfolio allocation to digital property. Till now, the financial institution’s wealth advisors couldn’t endorse crypto publicity and shoppers needed to request entry to digital asset merchandise in the event that they needed them of their portfolio.

With this transfer, Financial institution of America advisors can start recommending digital asset publicity to shoppers throughout the financial institution’s Merrill, Financial institution of America Personal Financial institution, and Merrill Edge Platforms. “Our steering emphasizes regulated automobiles, considerate allocation, and a transparent understanding of each the alternatives and dangers,” stated Chris Hyzy, chief funding officer at Financial institution of America Personal Financial institution.

Funding strategists will initially cowl 4 Bitcoin exchange-traded funds (ETFs) beginning January 5. ETFs are funding automobiles that enable merchants to speculate into an underlying asset with out having to straight personal it. Since they commerce on conventional platforms and are regulated, institutional entities desire to speculate by way of them.

The 4 spot Bitcoin ETFs Financial institution of America will probably be specializing in embrace Bitwise’s BITB, BlackRock’s IBIT, Constancy’s FBTC, and Grayscale’s BTC.

Financial institution of America is among the largest monetary establishments on this planet, rating solely second behind JPMorgan Chase in market cap and inserting sixth largest by way of complete property. It’s designated as a worldwide systemically necessary financial institution (G-SIB) by the Monetary Stability Board (FSB), that means it’s so entrenched in world financial system that instability associated to it might have widespread penalties.

Even an establishment of its dimension not having the ability to ignore Bitcoin showcases simply how far digital asset adoption in conventional finance has come. “This replace displays rising shopper demand for entry to digital property,” famous Nancy Fahmy, head of Financial institution of America’s funding options group.

The information arrives only a day after Vanguard Group, one of many largest asset managers on this planet, opened its doorways to crypto ETFs and mutual funds.

Morgan Stanley, one other G-SIB, broadened entry to crypto publicity for its shoppers again in October. The monetary providers establishment’s world funding committee advised 2% to 4% allocation in digital property.

Financial institution of America’s suggestion of 1% to 4% is kind of related. “The decrease finish of this vary could also be extra acceptable for these with a conservative danger profile, whereas the upper finish might swimsuit traders with larger tolerance for total portfolio danger,” added Hyzy.

Bitcoin Worth

Bitcoin has already recovered from its Monday blow as its value has returned to $92,100.

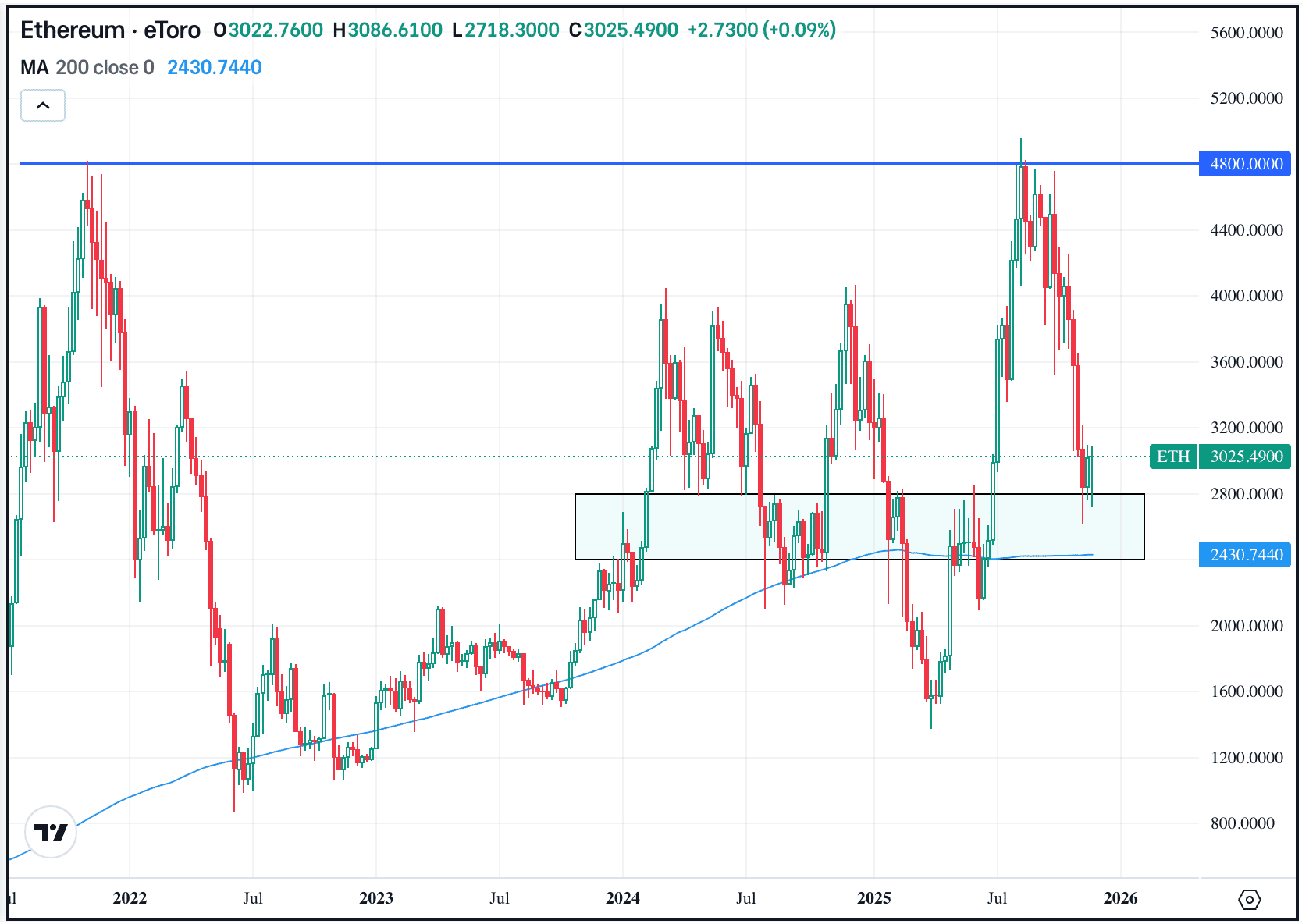

The worth of the coin seems to have shot up over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.