Bitcoin (BTC) clawed again from $86,286 on Dec. 2 to $93,324 as of press time, up by 8%, whereas the Trump household’s American Bitcoin (ABTC) shares tumbled.

The BTC value enhance will be attributed to improved macro situations and Vanguard’s opening of crypto ETF entry to tens of thousands and thousands of purchasers.

On the identical time, American Bitcoin, the Trump-linked mining inventory pitched as a Bitcoin proxy, cratered as a lot as 50% intraday on quantity about ten instances regular, triggering repeated buying and selling halts earlier than settling round 35% decrease.

The inventory now sits about 80% under its September peak of $9.40, even because the asset it’s supposed to trace staged a textbook reduction rally.

The strikes ran in reverse instructions as a result of they responded to thoroughly completely different catalysts.

Bitcoin bounced as a result of the macro tide turned again in its favor, with the Fed’s quantitative tightening ending, rate-cut odds rising, and ETF distribution channels widening. ABTC dumped as a result of a wall of recent inventory hit a tiny, hype-driven float suddenly as the primary main lock-up expiry freed pre-merger and private-placement shares.

The “proxy commerce” broke as a result of these two tales have nearly nothing to do with one another over a 24-hour window.

The divergence exposes what occurs when a levered, politically branded fairness wrapper stops behaving just like the factor it’s supposed to trace. For months, ABTC traded as if it had been an artificial Bitcoin wager with a Trump-family premium baked in.

Then the lock-up expired, early traders dumped, and the proxy commerce proved to be precisely that: a commerce, not an artificial ETF.

How Bitcoin clawed again towards $93,000

Bitcoin rebound will be tied to the Fed formally ending quantitative tightening and futures markets now pricing an nearly 90% likelihood of one other fee reduce on the Dec. 10 FOMC assembly.

That shift eased the “macro shock” that had simply knocked BTC under $90k. On the identical time, a second narrative tailwind arrived from the ETF channel. Vanguard, which was an enormous anti-crypto holdout, reversed course and opened entry to Bitcoin and different crypto ETFs for its tens of thousands and thousands of purchasers.

Regardless of these developments not altering Bitcoin’s float or capital construction, they alter how a lot individuals are prepared to pay for a similar 21 million-cap asset.

The value moved as a result of the macro backdrop improved and distribution channels widened, not as a result of something elementary shifted within the community itself.

Why ABTC slumped anyway

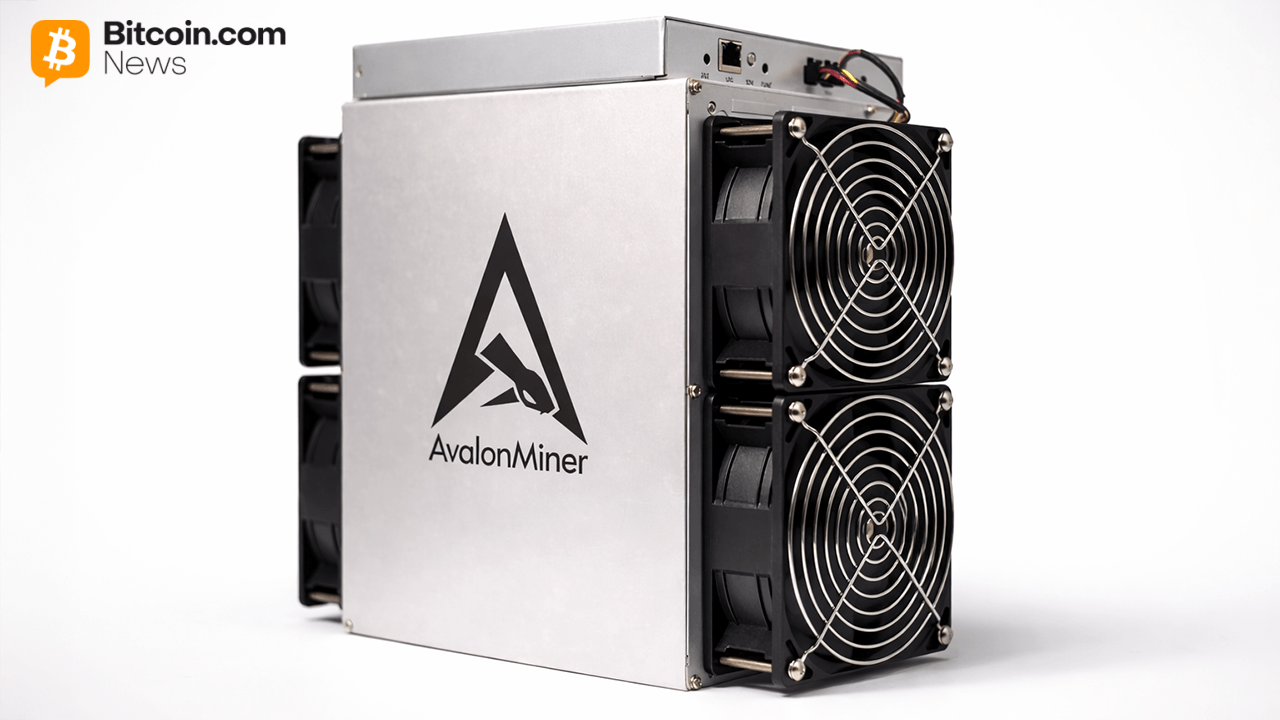

American Bitcoin is structurally completely different. It’s a majority-owned Hut 8 subsidiary that mines BTC and runs a “Bitcoin accumulation” balance-sheet technique, with a number of thousand BTC on its books and a mandate to construct a US-centric mining and treasury platform.

That setup inspired merchants and a few commentators to pitch ABTC as a “Bitcoin proxy” or perhaps a sort of Trump-branded mini-Technique.

As a part of going public, the corporate bought privately issued inventory to lift about $220 million, with insiders explicitly stating they anticipated it to commerce as a Bitcoin proxy.

The crash, although, was concerning the provide of shares, not the hashpower or the BTC value. The Dec. 2 plunge coincided with the primary main lock-up expiry for pre-merger and private-placement shares.

As these beforehand restricted blocks turned freely tradable, early traders dumped inventory into the open market, sending ABTC down roughly 35% to 50% intraday, on quantity about 10 instances regular, and triggering repeated buying and selling halts.

Administration is overtly framing it as a technical occasion. American Bitcoin president Matt Prusak informed traders on X that the group “anticipated the following few days to be uneven as these shares discover new houses.”

In the meantime, Reuters reported that Hut 8, Eric Trump, and Donald Trump Jr. say they didn’t promote into the unlock and proceed to carry. However whether or not or not insiders bought is sort of inappropriate: tens or a whole lot of thousands and thousands of {dollars}’ price of beforehand caged inventory simply hit a skinny float in a single shot. That’s why ABTC sank whilst BTC was bouncing.

Why the “proxy commerce” cracked

Three structural forces broke the ABTC/BTC hyperlink on this transfer, and none of them resolved shortly.

First, the float modified, however Bitcoin’s didn’t. BTC’s circulating provide is predictable and adjustments slowly. ABTC’s free float simply jumped with the unlocking of pre-merger and personal placement inventory.

That floods the order ebook with sellers who paid a lot decrease costs months in the past and are completely satisfied to take income or de-risk, no matter what BTC does on a given day.

The result’s precisely what the market noticed: Bitcoin up within the mid-single digits, the proxy down by nearly half.

Second, ABTC carries equity-specific and Trump-specific danger that Bitcoin itself doesn’t. Trump-linked crypto ventures, equivalent to memecoins like TRUMP and MELANIA, are down greater than 90% from their peaks.

Moreover, Trump Media & Expertise Group has misplaced over 60% of its worth this yr, and ALT5 Sigma, which holds tokens in one other Trump crypto enterprise, is down by the same margin and underneath SEC scrutiny.

When the “Trump crypto advanced” is in free fall, ABTC stops buying and selling as a pure macro Bitcoin wager and turns into a political and governance story.

Third, miners are levered, idiosyncratic wrappers even in regular instances. ABTC’s enterprise is a leveraged play on hash value, energy prices, execution, and financing phrases, wrapped in a small-cap inventory that simply got here public by way of a reverse merger.

A lock-up expiry in that context magnifies each different concern: traders fear about dilution, overhang, insider incentives, and the chance that early backers know one thing they don’t.

On one facet of the chart, BTC has simply staged a textbook macro reduction rally: Fed QT is over, rate-cut odds are rising, Vanguard lastly opened its doorways to crypto ETFs, and flows into spot merchandise have turned constructive once more.

On the opposite facet, ABTC is digesting a completely completely different shock: the primary wave of locked-up Trump-linked miner inventory hitting a skinny float suddenly, in a sector the place sentiment towards crypto equities and Trump-brand tokens is already brittle.

That offers a transparent clarification for the divergence: the proxy broke as a result of it was by no means actually Bitcoin within the first place.