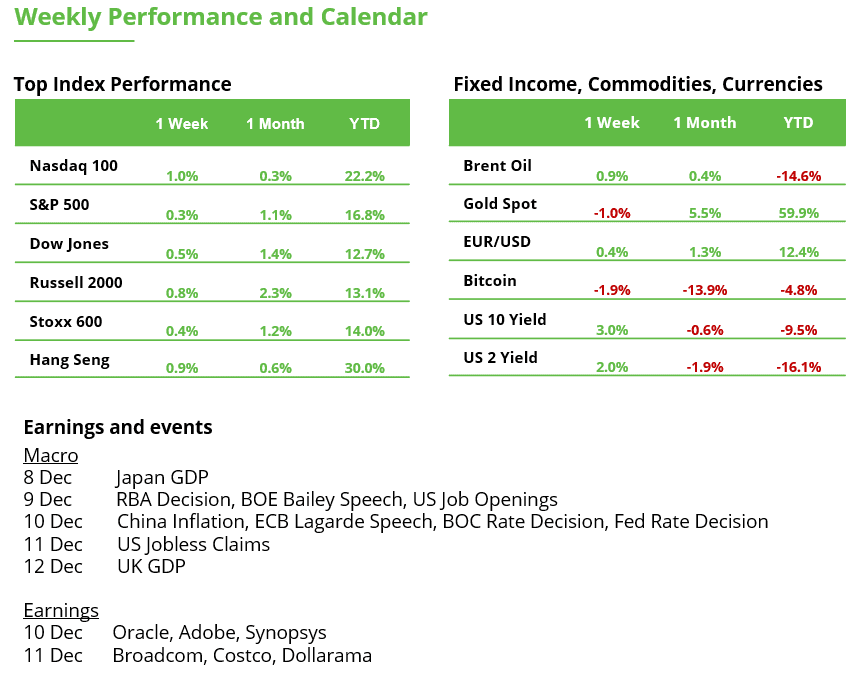

Analyst Weekly, December 8, 2025

A BOJ climbing cycle could possibly be 2026’s greatest macro plot twist.

After years of snoozing close to zero, Japan’s 10-year authorities bond yield (JGB) is ripping increased into year-end, inching towards 2% & increased. For a rustic that’s lived with ultra-low charges for a era, this can be a seismic shift.

What’s driving the surge? Sticky inflation + a fiscal hangover

Japan lastly has inflation, the type it really wished for years, however now it gained’t go away. The CPI has averaged round 3% since 2022, properly above the Financial institution of Japan’s goal, whereas coverage charges have barely budged.

Add in Japan’s eye-watering 237% debt-to-GDP ratio and a BOJ steadiness sheet full of long-dated bonds (with increased rate of interest sensitivity), and the market is dropping persistence. The BOJ at present is going through the identical downside the Federal Reserve bumped into in the course of the 2022-2023 climbing cycle: giant, unavoidable mark-to-market losses on the huge bond portfolio it amassed throughout years of QE.

Buyers need compensation for rising dangers, and yields are transferring as much as ship it.

Why world traders care: Japan’s strikes don’t keep in Japan

Japan is without doubt one of the world’s greatest consumers of US Treasuries and world sovereign bonds. When JGB yields spike:

Carry trades unwind, including volatility to equities.

World long-end yields rise as Japanese traders convey cash residence.

The US Treasury curve steepens, pressuring mortgage spreads (MBS) and long-duration property.

Briefly, if JGB yields hold climbing, the “protected” a part of world portfolios may get shaken up.

US: When the Actual Economic system Shares Begin Speaking, Buyers Hear

Market temper is shifting: as a substitute of a handful of mega-caps steering the ship, a wider mixture of economically delicate sectors is beginning to take part.

It’s the sort of broadening that tends to get traders’ consideration, and we predict that markets are pricing in an accelerating macro exercise in 2026, particularly as power exhibits up throughout banks, transports, power (early phases), and even world FX.

REITs stay the clear laggard, although healthcare-focused names are quietly gaining share. Total, markets are sending a broader, and a extra economically grounded message, whilst lagging indicators (comparable to unemployment knowledge) proceed to stay weak in This fall (and presumably into Q1 2026).

The Large Image

1) Cyclicals are displaying indicators of life

Equal-weight indices, small caps, banks, and industrials have all pushed increased, a tone that usually exhibits up when market confidence within the financial backdrop corporations.

Investor Takeaway: Some traders view broader participation as a more healthy market sample, notably when small caps and cyclical teams be part of the transfer.

2) Housing and Vitality add some spark

Homebuilders noticed one in every of their strongest 10-day surges in years, whereas equal-weight Vitality reached an eight-month excessive.

Investor Takeaway: Momentum in these pockets typically displays shifting expectations round development and charges, themes that many market contributors carry on their radar when positioning.

3) World indicators lean constructive

Japan’s main indices held up whilst native yields climbed, and EM currencies touched a 52-week excessive with assist from MXN, BRL, and ZAR. In the meantime, the US greenback misplaced some steam close to its 200-day common.

Investor Takeaway: Stronger EM FX can point out enhancing sentiment outdoors the US, a development world allocators have a tendency to look at intently.

Beneath the Hood

Giant banks broke increased after a multi-month pause, and regionals pushed towards current highs because the yield curve re-steepened.

Investor Takeaway: The group typically responds to shifting charge expectations, making it a spot the place some traders gauge broader threat urge for food.

Industrial shares noticed their first significant enlargement in 20-day highs since early summer season.

Investor Takeaway: When transports perk up, some see it as a read-through on underlying financial exercise.

Semis rebounded from an oversold backdrop. Breakouts in ADI, AMAT, and power in ASML recommend momentum is broadening past headline names.

Investor Takeaway: Comply with-through in semi tools generally aligns with more healthy trade cycles.

REITs stay underneath stress, regardless of shifting charge expectations. Healthcare REITs, nonetheless, have quietly climbed the sector rankings.

Investor Takeaway: The divergence contained in the REIT area highlights how uneven efficiency has develop into throughout rate-sensitive pockets.

Broadcom Earnings: Can the AI Story Face up to Valuation Stress?

Broadcom will launch its quarterly outcomes on Wednesday after the market shut. Its core enterprise, semiconductors and {hardware}, operates in extremely aggressive markets. On the similar time, corporations like Alphabet and Broadcom itself are making noticeable progress within the AI chip phase. Competitors is intensifying, and the market construction may shift over the long run.

Buyers have not too long ago turned extra cautious, and the inventory fell 3% final week. With a ahead P/E of 46.3, Broadcom is very valued. To justify this degree, both the share value should come down or earnings expectations should rise. Operationally, nonetheless, the corporate stays sturdy, as mirrored by its LTM EBIT margin of 39.6%.

From a technical perspective, a number of help zones lie shut collectively: the truthful worth hole between $310.47 and $332.83, the current short-term low at $328.57, and the 20-week transferring common at $334.23. The RSI sits at 68, indicating that the market is just not overbought. So long as the decrease boundary of the hole holds, there’s little to recommend that the uptrend will finish. A break under that degree, nonetheless, would require reassessing the state of affairs.

Key questions for the earnings launch embrace whether or not Broadcom will elevate its outlook and whether or not strategic changes are deliberate—notably within the AI phase, pricing technique, or capability enlargement. It should even be essential to see how the market reacts to margins, order consumption, and the up to date steerage.

Broadcom, weekly chart. Supply: eToro

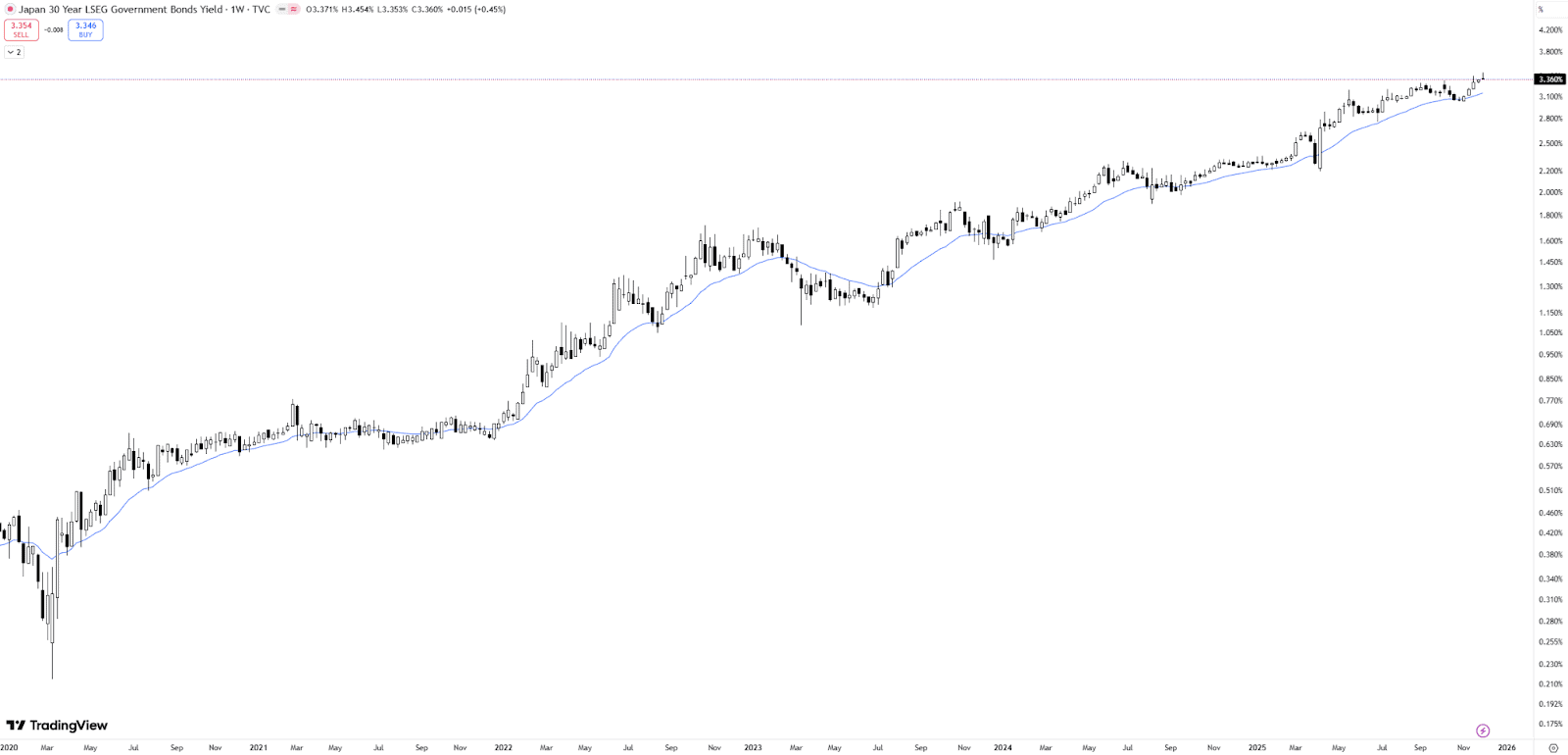

Japan’s Lengthy-Time period Yields Climb: Multi-12 months Uptrend Intact

The yield on 30-year Japanese authorities bonds has been in a secure uptrend for years. Final week, it rose once more barely, closing at 3.360% (+0.45%). In a world comparability, Japan now stands roughly on par with Germany (3.442%), whereas the US stays noticeably increased at about 4.793%.

A continuation of this development, that means additional rising yields, presently seems more than likely. For that to occur, the development construction should stay intact: increased highs and better lows are important.

The image would develop into regarding provided that the latest low at 3.026% had been to be damaged. Simply as necessary is whether or not the yield falls sustainably under the 20-week transferring common, which presently stands at 3.146%. Both growth would sign a possible development reversal or at the very least a weakening of the upward momentum.

Nevertheless, chart evaluation tells solely a part of the story. Elementary components stay the true drivers. Amongst them are the Financial institution of Japan’s coverage stance, home inflation tendencies, world capital flows, relative yield differentials, and the motion of the yen.

Yield on 30-year Japanese authorities bonds. Supply: TradingView

Bitcoin’s Large-Selections Week

Bitcoin’s heading right into a stretch the place the market might lastly decide a lane for the remainder of the yr. The bounce towards $90K has been strong, helped by a pickup in US demand, however the actual battle is at $100K–$103K. That zone has acted as the road between “bull run continues” and “correction incoming” in previous cycles.

Flows Say: Steady… however Not Sturdy

Regardless of loud headlines, flows paint a calmer image. New cash isn’t dashing in, however institutional holders additionally aren’t heading for the exits, holding value construction secure. That stated, with out recent inflows, upside strikes depend on thinner help. And subsequent week’s financial coverage calls may inject a dose of volatility and shift near-term liquidity.

A Breakout or a Breakdown?

Markets are approaching a fork within the highway:

A clear break above $100K: strengthens the case for a resumed uptrend.

A fail or no try in any respect: raises the percentages of an extended cooling-off section.

A drop under $88K: opens the door to deeper doubts.

The following a number of days of value motion will probably set the tone.

The Fragility Issue

The narrative is now not about value: it’s about liquidity. Buying and selling volumes in each BTC and ETH collapsed over 90% in 48 hours, displaying that consumers exist however exercise has thinned to the purpose the place even average orders can transfer markets dramatically. This value–exercise disconnect is now crypto’s stress level.

What to Watch

Quantity’s Comeback: After the collapse in exercise, a rebound in quantity is the highest sign for whether or not any transfer has legs.

Liquidity High quality: Tight spreads + shallow depth = a market that appears secure however can break rapidly on huge orders.

BTC vs. ETH Relative Power: ETH’s relative resilience is a learn on the place institutional curiosity is sticking, and the place it’s fading.

Danger-Asset Correlation: Equities nonetheless set the temper. A downturn in shares may spill into crypto instantly.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.