Oracles are the indispensable bridge connecting off-chain knowledge (like asset costs) to on-chain sensible contracts in Decentralized Finance (DeFi).

Nonetheless, as DeFi matures, present Oracle options wrestle to satisfy the demand for quicker, cheaper, and crucially, extra correct knowledge, which we name Excessive Constancy Information. Previous vulnerabilities have underscored the pressing want for a brand new customary.

Consequently, APRO is engineered to determine this customary. By optimizing for high-fidelity knowledge supply, APRO guarantees a brand new degree of security and effectivity for the following era of DeFi purposes.

What Is APRO?

APRO is just not merely an information supplier. As a substitute, it’s a decentralized oracle structure designed to deal with the oracle trilemma: the right way to concurrently obtain velocity, low price, and absolute constancy (accuracy).

If the primary era of Oracles targeted on creating fundamental knowledge bridges and the second era centered on growing decentralization, APRO, because the third era, is targeted on knowledge high quality on the degree of excessive constancy.

That is APRO’s core worth. Excessive-fidelity knowledge encompasses three essential parts:

Granularity: Extraordinarily excessive replace frequency (e.g., each second as a substitute of each minute).Timeliness: Close to-zero latency, making certain knowledge is transmitted immediately after aggregation.Manipulation Resistance: Information is aggregated from a big, verified variety of sources, eliminating the potential of worth assaults originating from a single change.

Finally, by offering knowledge with unprecedented accuracy and velocity, APRO unlocks the flexibility to create novel DeFi merchandise that have been beforehand too dangerous or technologically unfeasible (e.g., quick time period by-product contracts).

What Is APRO? Supply: APRO

Be taught extra: NFTevening High Choose: Every thing about OKX Alternate

APRO’s Core Expertise and Innovation

APRO’s structure is a complicated layered system designed to course of complicated, unstructured knowledge and guarantee knowledge integrity throughout transmission:

The Layered System Structure

APRO separates the duties of knowledge acquisition/processing and consensus/auditing to maximise efficiency and safety.

Layer 1: AI Ingestion (Information Acquisition and Processing)

This primary layer (L1) serves because the acquisition and uncooked knowledge transformation layer.

Artifact Acquisition: L1 Nodes purchase uncooked knowledge (artifacts) equivalent to PDF paperwork, audio recordings, or cryptographically signed net pages (TLS fingerprints) by way of safe crawlers.

Multi-modal AI Pipeline: The Node runs a posh AI processing chain: L1 makes use of OCR/ASR to transform unstructured knowledge and NLP/LLMs to construction the textual content into schema compliant fields.

PoR Report Era: The output is a signed PoR Report, containing proof hashes, structured payloads, and per discipline confidence ranges, which is prepared for submission to L2.

Layer 2: Audit & Consensus (Auditing and Finalization)

In the meantime, Layer 2 (L2) is the validation and dispute decision layer, which ensures the integrity of L1 knowledge.

Watchdogs and Impartial Auditing: Watchdog Nodes constantly pattern submitted experiences and independently recompute them utilizing totally different fashions or parameters.Dispute Decision and Proportional Slashing: The mechanism permits any staked participant to dispute an information discipline. If the dispute succeeds, the offending reporting Node is slashed proportional to the influence of the error, creating a strong, self correcting financial system.

Twin Information Transport Mannequin and Information Integrity Mechanisms

APRO combines its Layered Structure with a twin transport mannequin to optimize efficiency on EVM chains.

Information Push: Delivers finalized knowledge from Layer 2. Following PBFT consensus and dispute decision, Nodes execute a transaction to push the ultimate knowledge onto the sensible contract. Appropriate for dApps requiring foundational on chain knowledge availability.Information Pull: Exploits the extremely excessive frequency efficiency of Layer 1. L1 permits Nodes to signal excessive accuracy worth and PoR experiences off chain at extraordinarily excessive frequencies. Information Pull is the user-initiated means of fetching and verifying that signed proof on chain, successfully decoupling gasoline price from knowledge frequency.

Core Value Discovery and Anti-Manipulation

Information high quality is ensured by strong algorithms and consensus mechanisms:

TVWAP Pricing: APRO makes use of the TVWAP (Time Quantity Weighted Common Value) to calculate costs weighted by each quantity and time, thereby actively mitigating small-scale worth manipulation makes an attempt.

PBFT Consensus and Status System: Moreover, the quick PBFT consensus mechanism is mixed with the Validator Status Scoring System to make sure Nodes are topic to financial penalties (slashing) if they supply stale or malicious knowledge. Consequently, this strategy maintains a robust financial barrier to entry for dishonest actors.

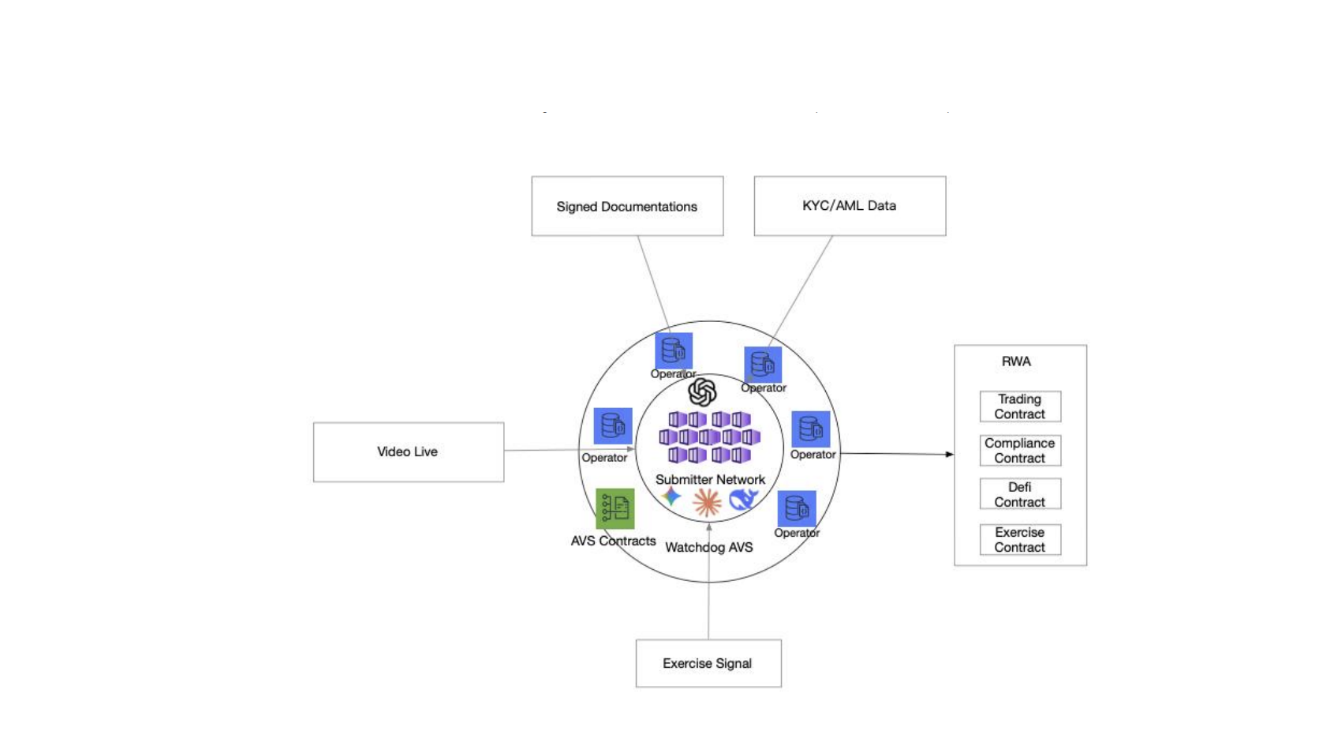

APRO’s Core Expertise and Innovation – Supply: APRO

Non Commonplace Oracle Capabilities

APRO’s analytical capabilities prolong far past typical crypto Value Feeds, specializing in complicated RWA/PoR verticals:

Proof of Reserve (PoR) and Automated Auditing

APRO elevates PoR to an automated auditing operate:

Multi modal Supply Processing: The L1 AI Pipeline analyzes complicated proof like financial institution letters or regulatory filings by way of OCR/LLM.

Authorized Consistency: Consequently, L2 performs Reconciliation Guidelines to make sure totals throughout paperwork match (e.g., verifying asset legal responsibility summaries), thereby drastically lowering human error and manipulation dangers in reserve reporting.

RWA and Area of interest Eventualities

APRO supplies an in depth Oracle Functionality Matrix for complicated RWA fields, reworking the Oracle into a complicated verification device:

Pre IPO Shares: L2 performs cap desk reconciliation, making certain share counts align with the overall approved shares. Outputs embody final spherical valuation and a provenance index.Authorized/Agreements: The Oracle analyzes contracts, extracting obligations and enforceability indicators. L2 verifies digital signatures and cross references public courtroom dockets, permitting sensible contracts to implement complicated authorized phrases.Actual Property: APRO processes paperwork like land registry PDFs and appraisal experiences, extracting title/encumbrance details. L2 can mirror registry snapshots for verification, addressing a core downside of actual property tokenization.

The convergence of the Layered Structure and the Multi modal AI Pipeline allows APRO to not solely ship quicker worth knowledge but in addition to make sure contextual accuracy and institutional grade auditability for probably the most complicated belongings.

APRO Tokenomics

APRO’s native utility token is $AT, with a Most Provide of 1,000,000,000 tokens.

The $AT token features because the financial core, driving community safety by staking and facilitating knowledge service funds, in the end selling platform sustainability.

Be taught extra: APRO (AT) Will Be Listed on Binance HODLer Airdrops!

Token Allocation

The $AT token allocation construction is designed to stability ecosystem growth, safety, and preliminary capital distribution:

Token Allocation – Supply: APRO

Ecosystem: 25percentStaking: 20% Investor: 20percentPublic Distribution: 15percentTeam: 10percentFoundation: 5percentLiquidity: 3percentOperation Occasion: 2%

The mixed allocation of 45% to Ecosystem and Staking underscores APRO’s highest precedence: enhancing community safety and constructing a strong group of Validator Nodes, which is a prerequisite for a profitable subsequent era Oracle platform.

FAQ

What’s APRO?

APRO is a 3rd era Decentralized Oracle Structure designed to ship Excessive Constancy Information (excessive accuracy and timeliness). It solves the Oracle Trilemma. Its core innovation is a Layered System. This technique makes use of an AI Pipeline (OCR/LLM) in Layer 1 to remodel complicated, unstructured knowledge into auditable data. Crucially, APRO makes a speciality of non customary verticals like RWA and Proof of Reserve (PoR).

What’s the major distinction between APRO and established Oracle platforms?

The elemental distinction lies within the Layered Structure and Information Pull. APRO focuses on Excessive Constancy Information by way of the L1 AI Pipeline and makes use of Information Pull to ship extremely excessive frequency knowledge affordably on EVM chains.

How does APRO guarantee RWA knowledge reliability?

RWA knowledge is processed by the Multi modal AI Pipeline in L1. RWA knowledge is processed by the Multi modal AI Pipeline in L1. Nonetheless, it should move L2’s rigorous auditing course of. Particularly, this course of contains outlier filtering and attaining PBFT consensus from the varied Node community. Moreover, L2 additionally performs Reconciliation Guidelines for complicated monetary paperwork.

What mechanisms defend APRO from worth manipulation assaults?

APRO makes use of a mixture of defenses: TVWAP and outlier rejection algorithms for technical knowledge cleansing, together with the proportional slashing system primarily based on status scores to implement financial honesty.

How does Information Pull stay price environment friendly regardless of frequent updates?

Information Pull shifts the continual replace burden from the Nodes to the end-user. Nodes signal contemporary worth proofs off chain (gasoline free). The person solely pays a single gasoline charge for his or her transaction, after they pull the signed proof onto the sensible contract for verification.