Ethereum has reclaimed the $3,150 stage after a risky stretch, providing a uncommon signal of power in an in any other case unsure market. The broader crypto panorama stays sharply divided: some analysts argue that ETH and the remainder of the market nonetheless face downward continuation, probably setting new native lows, whereas others imagine this correction is just a reset earlier than a a lot bigger bull cycle—probably extending into 2026.

Associated Studying

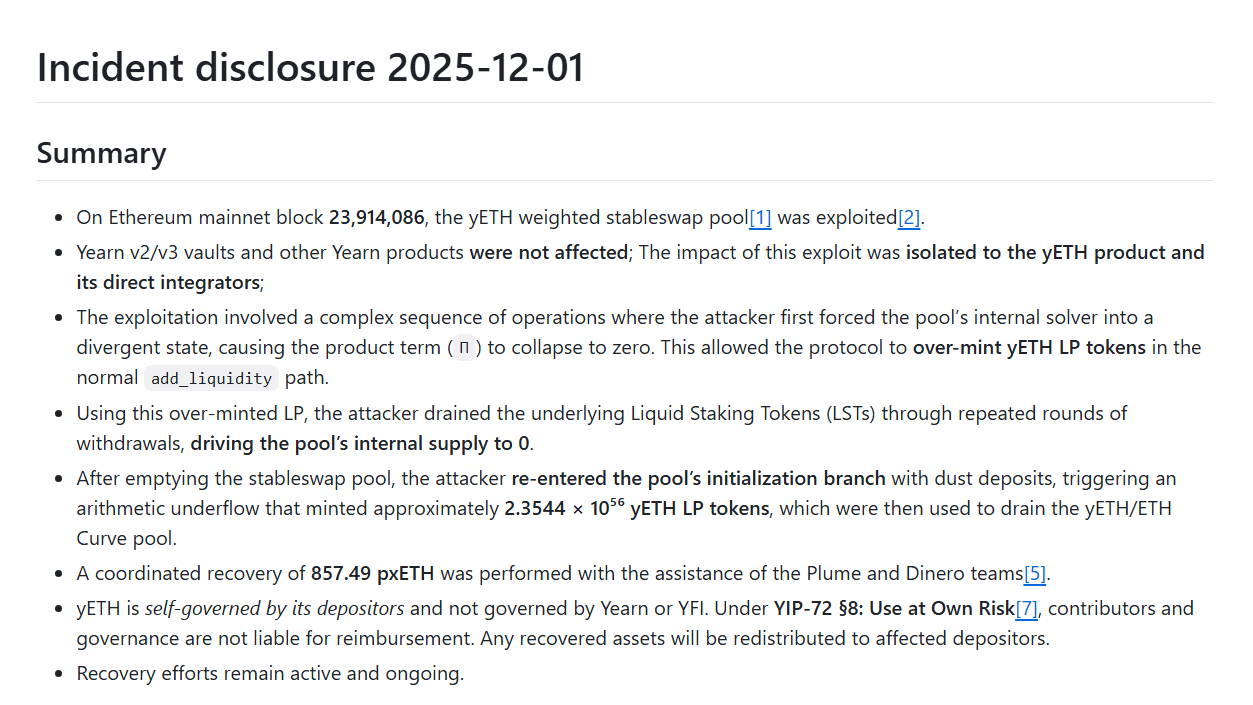

But one sign stands out clearly amid the noise: sensible whales are unanimously going lengthy on ETH. On-chain knowledge exhibits that a number of of probably the most worthwhile and constant whale merchants—every with tens of tens of millions in realized positive factors—have opened substantial lengthy positions, collectively exceeding tons of of tens of millions of {dollars}. Their coordinated conduct signifies confidence that Ethereum’s latest lows symbolize alternative somewhat than hazard.

This alignment amongst top-performing whales introduces a compelling counterpoint to bearish narratives. Whereas retail sentiment stays fragile, probably the most refined market individuals seem like positioning for a bigger transfer forward. As Ethereum stabilizes above $3,150, the query now turns into whether or not whale conviction will show to be early—or appropriate.

Prime Performers Load Up on Ethereum

In accordance with Hyperdash knowledge shared by Lookonchain, among the most profitable and influential whales out there are aggressively accumulating Ethereum—sending a robust sign that high-conviction gamers count on upside forward.

Probably the most notable is BitcoinOG, the dealer well known for shorting the market in the course of the violent 10/10 crash, a transfer that earned him vital credibility. With a complete realized PNL of $105 million, BitcoinOG is now positioned firmly on the bullish facet, holding 54,277 ETH price roughly $169.48 million.

One other main participant is the well-known Anti-CZ whale, named for his historic sample of taking the other facet of positions favored by Binance founder Changpeng Zhao. With a formidable $58.8 million in whole PNL, this whale is at the moment lengthy 62,156 ETH—an enormous $194 million place. His trades have typically been early indicators of broad market route, including weight to this shift towards bullish publicity.

Lastly, pension-usdt.eth, a persistently worthwhile whale tackle with $16.3 million in realized positive factors, is lengthy 20,000 ETH valued at $62.5 million.

Taken collectively, these positions mirror a unified stance amongst top-performing whales: regardless of market uncertainty, they’re positioning for Ethereum power.

Associated Studying

Weekly Construction Reveals Early Indicators of Stabilization

Ethereum’s weekly chart reveals a market trying to regain its footing after a pointy multi-week decline from the $4,500 area. The latest reclaim of $3,150 is a significant growth, as this stage aligns carefully with prior weekly assist from mid-2024 and sits simply above the 50-week shifting common—an space that always acts as a trend-defining zone. ETH briefly dipped beneath this area in the course of the November selloff, however patrons stepped in aggressively, producing a robust weekly wick that indicators demand at decrease ranges.

Regardless of this restoration try, ETH stays beneath key resistance ranges. The 20-week and 100-week shifting averages are positioned above the present worth and converging, making a zone of potential rejection except momentum strengthens. For now, ETH is buying and selling in a transitional construction: now not trending downward aggressively, however not but exhibiting a confirmed bullish reversal on excessive timeframes.

Associated Studying

Quantity patterns additionally assist this interpretation. Promoting quantity has diminished in comparison with the capitulation section, whereas latest inexperienced candles present average however regular shopping for curiosity—suggesting accumulation somewhat than full risk-on conduct.

If ETH can set up consecutive weekly closes above $3,200–$3,300, the chart opens the door for a retest of the $3,600–$3,800 vary. Failure to carry $3,150, nevertheless, dangers one other transfer towards $2,800 assist.

Featured picture from ChatGPT, chart from TradingView.com