Ethereum has pushed above the $3,350 stage, injecting recent momentum into the market after weeks of uncertainty. But regardless of this breakout, total sentiment stays clouded by concern, with many analysts nonetheless warning that the broader construction factors towards a growing bear market. Merchants now discover themselves at a pivotal juncture: is that this the start of a sustained restoration, or merely a short lived rally earlier than additional draw back?

Associated Studying

In response to a brand new CryptoQuant report, one of the revealing indicators proper now’s Ethereum’s funding price habits throughout main exchanges. Not like the explosive funding spikes seen in the course of the two main rallies earlier this yr, the present transfer exhibits a remarkably restrained funding setting. Throughout these earlier surges, funding charges climbed aggressively into overheated territory, signaling euphoric lengthy leverage and speculative extra — circumstances that intently preceded short-term market tops.

This time, nevertheless, funding stays way more subdued. The absence of aggressive lengthy positioning means that the present rally will not be being pushed by extreme leverage, which supplies the transfer a unique character in comparison with earlier spikes. Whether or not this alerts more healthy accumulation or just an absence of conviction stays the core query as Ethereum approaches the subsequent decisive section.

Muted Funding Charges Spotlight a Cautious However Probably Constructive Rally

The CryptoQuant report highlights that, not like earlier explosive rallies, Ethereum’s present funding charges stay unusually low, even after its sharp restoration from the $2.8K area. This subdued funding setting alerts that the derivatives market will not be but saturated with speculative lengthy positions.

Consumers are stepping in, however modest leverage drives this transfer in comparison with previous phases dominated by aggressive merchants. Consequently, spot accumulation drives the present advance greater than overheated futures exercise.

This distinction carries vital implications. And not using a surge in speculative demand, Ethereum might wrestle to ignite the type of full bullish continuation leg seen in earlier breakout cycles. Traditionally, robust uptrends have required funding charges to broaden meaningfully as merchants chase value, forcing shorts to cowl and fueling upward momentum. That habits has not but emerged within the present construction.

Nevertheless, this muted panorama will not be inherently bearish. As an alternative, it displays a recovering market, not an overextended one. This leaves Ethereum with room to climb additional — if demand strengthens. On the similar time, the dearth of leverage means the rally stays susceptible; robust resistance rejections may rapidly weaken momentum until recent patrons step in.

Associated Studying

Testing Key Resistance as Momentum Builds

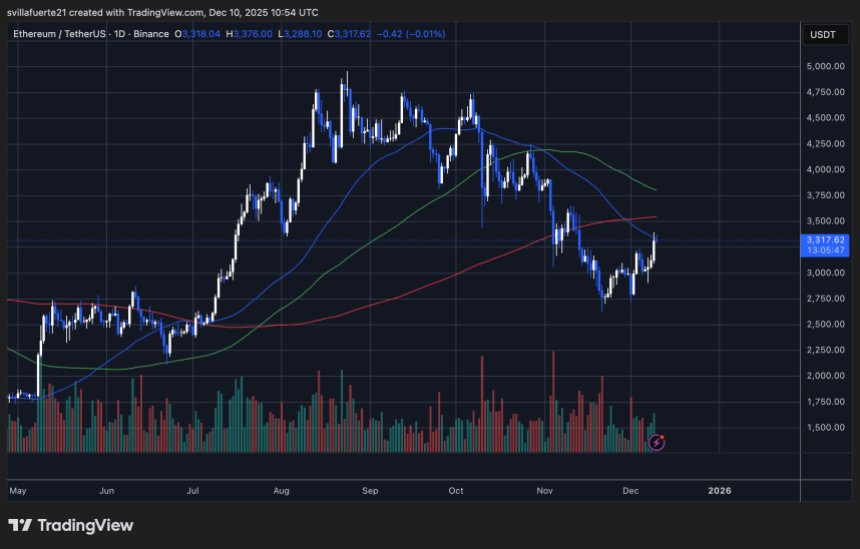

Ethereum’s day by day chart exhibits a notable shift in momentum as the worth pushes towards $3,320, extending its rebound from the sub-$2,800 lows. This restoration section has been regular relatively than explosive, reflecting a market that’s stabilizing however nonetheless dealing with key overhead challenges.

The primary main take a look at is the 200-day shifting common (pink line), which ETH is now approaching after a number of weeks of buying and selling under it. Traditionally, reclaiming this stage has marked the transition from corrective phases into renewed bullish cycles, however a clear breakout is way from assured.

Associated Studying

The construction of the latest transfer highlights bettering purchaser confidence: ETH has shaped a collection of upper lows, indicating accumulation after the capitulation-like November drop. Though patrons are lively, the comparatively subdued quantity profile suggests they lack broad-based conviction. A stronger inflow of quantity should flip the development decisively bullish.

The 50-day and 100-day shifting averages stay above the present value and are each aligned downward, reinforcing that ETH remains to be technically in a broader downtrend. For momentum to increase, Ethereum should break above the $3,350–$3,400 resistance zone, the place prior assist became resistance.

Featured picture from ChatGPT, chart from TradingView.com