Bitcoin worth jumped above $95,000 on Wednesday after contemporary US inflation knowledge got here in decrease than anticipated. BTC climbed over 4% in 24 hours, whereas Ethereum, Solana, and Cardano posted positive aspects close to 8%. The transfer suits a well-recognized sample: when inflation cools and rate of interest stress eases, traders rush again into threat property like crypto.

7d

30d

1y

All Time

DISCOVER: High Ethereum Meme Cash to Purchase in 2026

Why Did Bitcoin Immediately Leap Above $95K?

Inflation is the velocity at which costs rise. When it slows, borrowing cash will get cheaper, and traders really feel extra comfy taking dangers. That’s precisely what occurred after the most recent US inflation report.

Bond yields fell, the greenback weakened, and money began searching for a brand new dwelling. Bitcoin typically advantages on this setup as a result of many traders see it as a hedge towards central financial institution uncertainty. Softer inflation and world tensions have repeatedly pushed demand towards Bitcoin as a non-government asset.

Core CPI at 2.6% marks the bottom US inflation studying since March 2021

Trump pressures Fed Chair Jerome Powell to chop charges, markets bets no till June

December report eats expectations as headline inflation holds regular at 2.7%

95% odds the Fed holds charges this month pic.twitter.com/IbXhwF1huk

— Boi Agent One (@boiagentone) January 13, 2026

Altcoins adopted quick. Ether pushed towards $3,300, whereas Solana and Cardano jumped near 9%. This indicators renewed urge for food for threat, not only a one-coin spike.

What Does This Rally Imply for New Crypto Buyers?

Mainly, momentum is again, however so is hazard. When costs transfer this quick, merchants utilizing borrowed cash get worn out first.

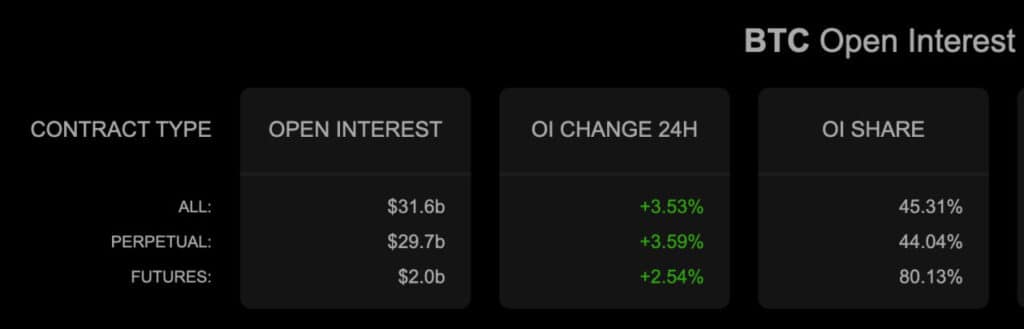

(Supply: Bitcoin Open Curiosity / Coinalyze)

Over $688 million in crypto futures positions vanished in in the future as costs surged. About $603 million got here from merchants betting towards the market. Futures are contracts that permit merchants use leverage, that means they borrow cash to amplify positive aspects. When worth strikes the fallacious means, losses hit exhausting and quick.

For newbies, this issues as a result of sharp rallies typically entice emotional shopping for. Chasing inexperienced candles normally ends badly. In case you are new, deal with spot shopping for solely. Meaning shopping for actual cash with out leverage.

DISCOVER: High 20 Crypto to Purchase in 2026

Rising Volatility Is the Hidden Value of Quick Features

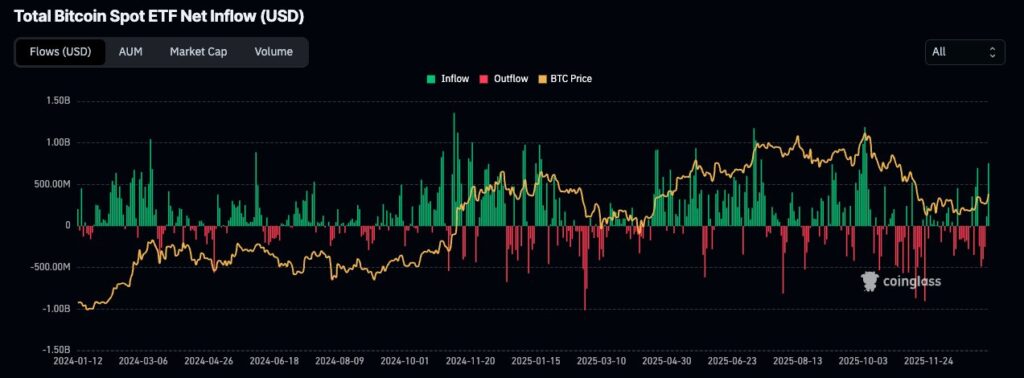

(Supply: Bitcoin ETFs had $753.8M in web inflows yesterday, essentially the most since 10 October / Coinglass)

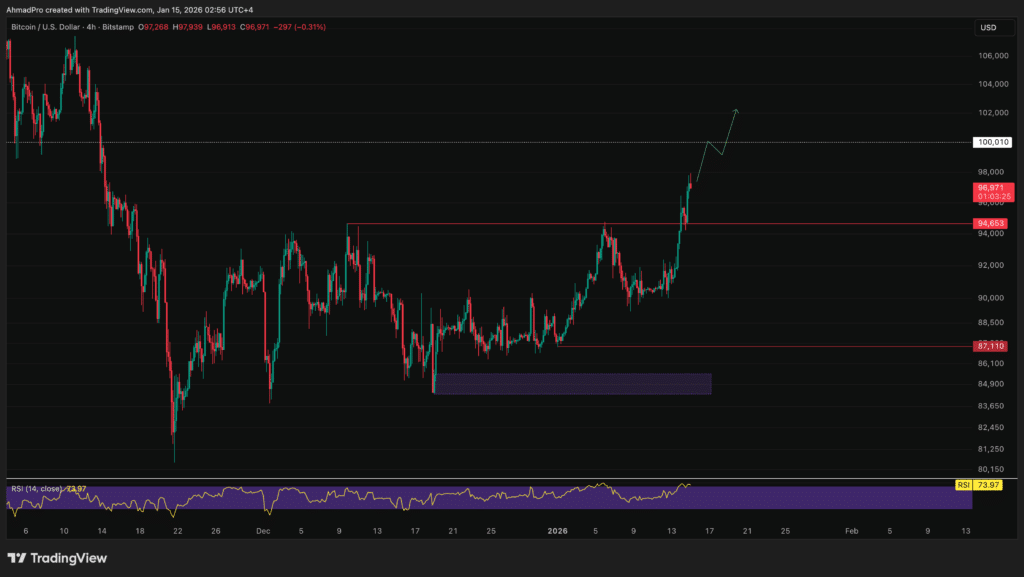

Bitcoin is now approaching worth ranges that triggered heavy promoting earlier in January. On the identical time, derivatives knowledge reveals leverage rebuilding shortly. This combo normally results in wild worth swings.

Consider leverage like stacking dominoes. It appears to be like secure till one small push knocks every thing over. If Bitcoin stalls close to $95K, liquidations can flip path simply as quick.

Conventional markets verify the risk-on temper. Asian shares hit file highs, and gold hovered close to its peak. That alignment issues as a result of Bitcoin now trades extra like a macro asset. Bitcoin’s correlation with conventional markets continues to rise, significantly throughout macroeconomic-driven strikes.

(Supply: BTCUSD / TradingView)

Security Verify: The way to Strategy This Rally With out Getting Burned

If this rally has your consideration, chances are you’ll decelerate. Quick strikes reward endurance, not impulse.

If contemplating shopping for close to market highs, preserve your place sizes small, keep away from utilizing leverage except you’re extremely skilled, and ensure you have a transparent plan in place earlier than coming into a commerce, together with the place you’ll exit and the way a lot threat you’re prepared to take.

Ethereum’s surge towards $3,300 reveals how shortly sentiment can flip. We lined this setup in our breakdown of the latest Ethereum worth rally and why resistance issues.

If inflation stays calm and fee cuts stay on observe, crypto momentum can maintain. Simply bear in mind: when threat urge for food snaps again, volatility at all times follows.

DISCOVER: High Solana Meme Cash to Purchase in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Skilled Market Evaluation

The publish Bitcoin Breaks $95K as Inflation Knowledge Sparks Danger-On Rally appeared first on 99Bitcoins.