Hyperliquid is gaining consideration within the decentralized buying and selling house for combining a number of the finest options of centralized exchanges with decentralization. As extra merchants search clear, non-custodial buying and selling, Hyperliquid meets this want by utilizing an on-chain order guide and a custom-built blockchain designed for high-speed buying and selling.

This permits customers to commerce perpetual contracts and spot belongings whereas maintaining possession of their funds. On this article, we’ll clarify how Hyperliquid works, its key options, and the way it compares with different decentralized exchanges (DEXs).

What Is Hyperliquid?

Hyperliquid is a decentralized buying and selling platform designed to supply quick, environment friendly, and clear crypto buying and selling. Not like many main decentralized alternate platforms that depend on automated market makers, Hyperliquid makes use of an on-chain order guide, enabling merchants to position restrict and market orders and implement superior buying and selling methods.

Hyperliquid runs by itself {custom} blockchain constructed particularly for buying and selling purposes. This blockchain is optimized for high-speed transactions, low latency, and real-time settlement, permitting customers to execute trades rapidly whereas maintaining their belongings safe in their very own wallets. Hyperliquid helps each spot and perpetual futures buying and selling, giving customers a number of methods to take part available in the market.

Who Created Hyperliquid?

Hyperliquid was based by Jeff Yan, a former Wall Road dealer and key determine from Chameleon Buying and selling, along with a workforce of skilled derivatives merchants from prime monetary corporations. Their mixed experience in high-frequency buying and selling highlighted main gaps in present decentralized exchanges, together with gradual execution and restricted instruments for critical customers.

Utilizing this expertise, the Hyperliquid workforce designed a purpose-built Layer-1 blockchain with a decentralized alternate that prioritizes pace, precision, and effectivity. Options reminiscent of sub-millisecond order matching, superior order sorts, and Hyperliquidity Supplier (HLP) vaults mirror a give attention to derivatives buying and selling, as seen in main world crypto buying and selling platforms and market-making automation.

How Does Hyperliquid Work?

The Hyperliquid ecosystem combines a {custom} Layer-1 blockchain, HyperCore, with an off-chain matching engine, delivering centralized-exchange pace whereas maintaining settlement totally on-chain. Consumer orders go to the present validator chief through HyperBFT, who bundles transactions into blocks, broadcasts them for validator votes, and achieves finality after a number of rounds with quorum from two-thirds of staked validators.

This course of ensures that trades are confirmed rapidly and securely. The system follows a leader-based design impressed by HotStuff and makes use of optimistic execution, permitting blocks to be processed as rapidly as community circumstances allow, typically in below 0.07 seconds.

HyperCore handles the core state for margin accounts, order matching, and liquidations with out counting on exterior order books. In the meantime, HyperEVM supplies EVM compatibility for basic decentralized purposes, however all buying and selling operations stay optimized inside HyperCore to reduce latency.

After matching, all trades settle transparently on-chain, decreasing dangers reminiscent of front-running or manipulation that may happen in purely off-chain techniques. The structure helps as much as 200,000 orders per second, making Hyperliquid appropriate for each skilled and high-frequency buying and selling methods.

Hyperliquid Ecosystem and Tokens

Hyperliquid has a local token known as HYPE, which varieties the core of its ecosystem. The HYPE token powers governance, permitting customers to take part in choices that form the platform’s growth, and likewise helps rewards, staking, and different incentives that encourage energetic participation.

By integrating HYPE into buying and selling, liquidity provision, and platform governance, Hyperliquid ensures that every one customers have a job in sustaining community safety, contributing to liquidity, and benefiting from the platform’s progress.

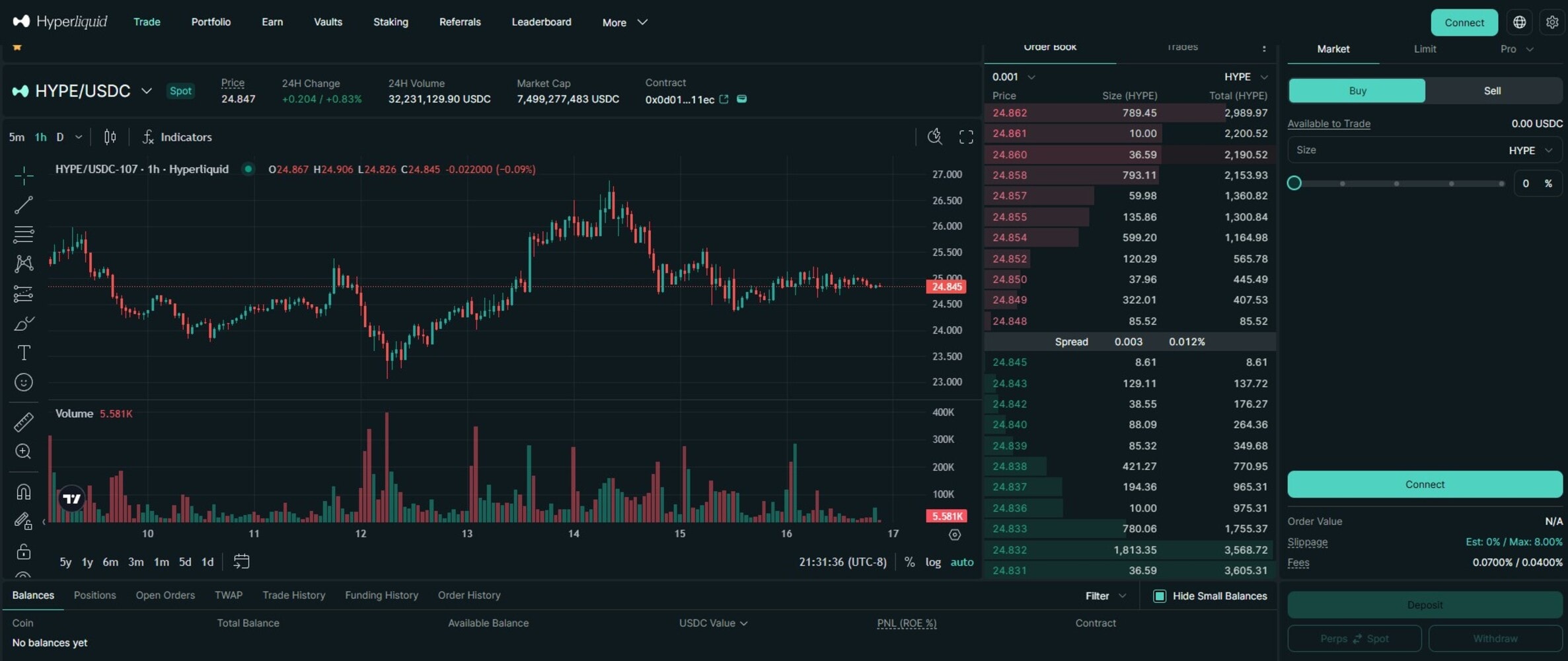

What’s the HYPE token?

HYPE is the native utility and governance token of the Hyperliquid Layer-1 blockchain. It was launched by a neighborhood airdrop in late 2024, rewarding early merchants and customers. The token has a set provide of 1 billion, and a portion of buying and selling charges is used to repurchase and burn HYPE, creating shortage and supporting its long-term worth.

HYPE serves a number of vital capabilities. It acts as a gasoline token for HyperEVM transactions and buying and selling charges, and affords staking to safe the HyperBFT consensus. It’s also used as a reward for validators and allows governance by on-chain voting on upgrades, listings, and treasury choices.

Stakers and Hyperliquidity Supplier vault customers can earn yields typically exceeding 20–50% APY, whereas HYPE additionally supplies entry to premium copy-trading vaults and capabilities as collateral in spot and perpetual markets.

Token Utility and Governance

The HYPE token powers a number of capabilities throughout the Hyperliquid ecosystem whereas giving customers a voice in governance. It acts because the gasoline token for HyperCore and HyperEVM transactions, typically below $0.01 per commerce. HYPE additionally serves as collateral for spot and perpetual positions, enabling leveraged buying and selling with out bridging exterior belongings.

Governance is managed by on-chain voting on Hyperliquid Enchancment Proposals, or HIPs, permitting staked token holders to approve updates, new buying and selling pairs, vault methods, and treasury choices. Moreover, quadratic voting prevents dominance by massive holders, and accredited modifications, reminiscent of HyperBFT or HyperEVM upgrades, are applied quickly.

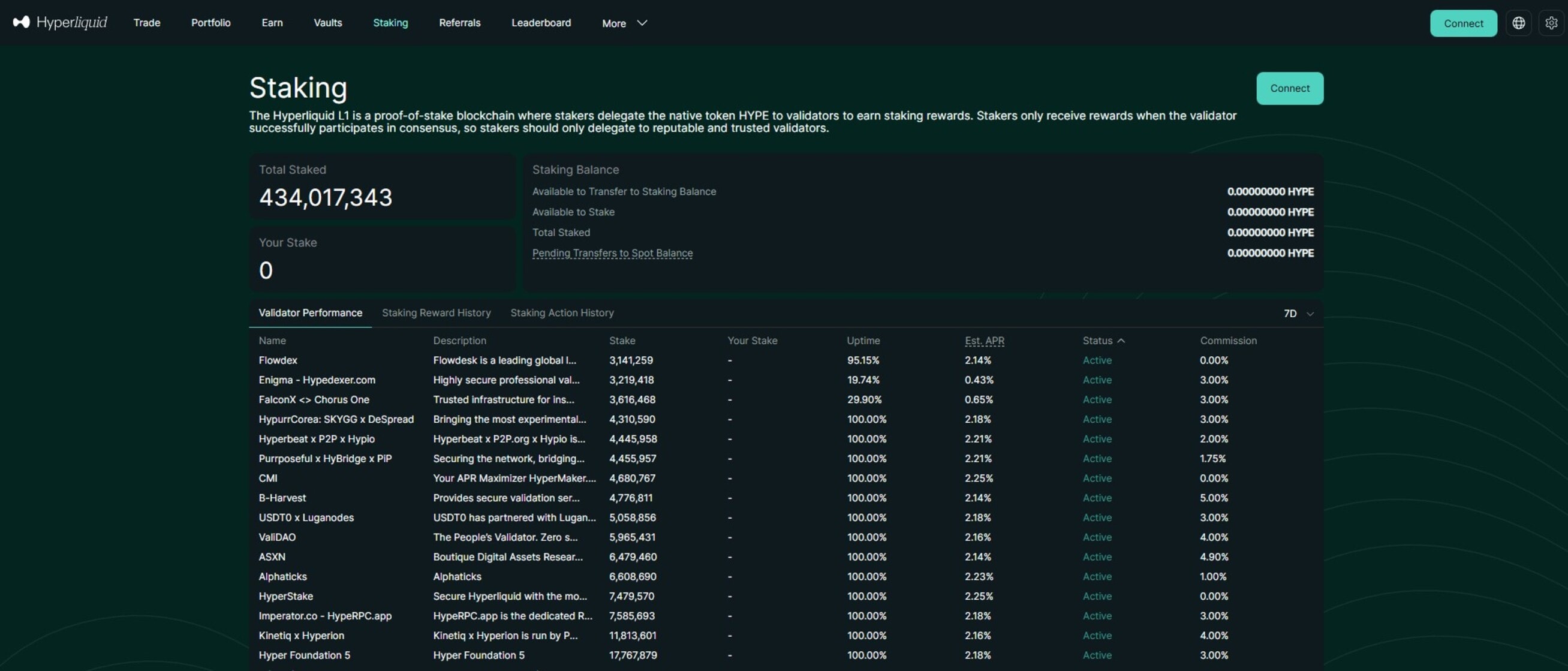

Staking and Rewards

Staking HYPE tokens on Hyperliquid secures the HyperBFT consensus whereas offering passive revenue. Customers delegate HYPE to energetic validators from a devoted account, with a minimal self-delegation of 10,000 HYPE.

Rewards come from the long run emissions reserve fairly than inflation and accrue each minute throughout 100k-round epochs, with every day distribution and computerized compounding, permitting stakes to develop with out handbook claiming. The dynamic reward system adjusts based mostly on complete staked HYPE. For instance, 400M HYPE staked yields round 2.37% APY, whereas 142–144M HYPE staked produces 2.27 – 2.29%.

Validators earn block rewards and share proportional returns with delegators, after a 5–10% fee. Stakers additionally acquire buying and selling payment reductions from 5% as much as 40% and eligibility for airdrops and vault bonuses. To study extra about how staking works and its advantages, learn our detailed information on what staking is in crypto.

Key Options of Hyperliquid

1. Hyperliquid Alternate

Hyperliquid Alternate affords merchants a quick, dependable, and versatile platform for managing their crypto positions. It’s designed to deal with high-frequency trades with out delays, guaranteeing that each order is executed precisely and transparently. Each inexperienced persons {and professional} merchants can use the platform, whether or not they wish to commerce casually or implement superior methods.

The alternate additionally contains instruments and options that give customers extra management over timing, pricing, and execution. Under are the three fundamental options of the platform, that are perpetual futures, the spot market, and superior order sorts.

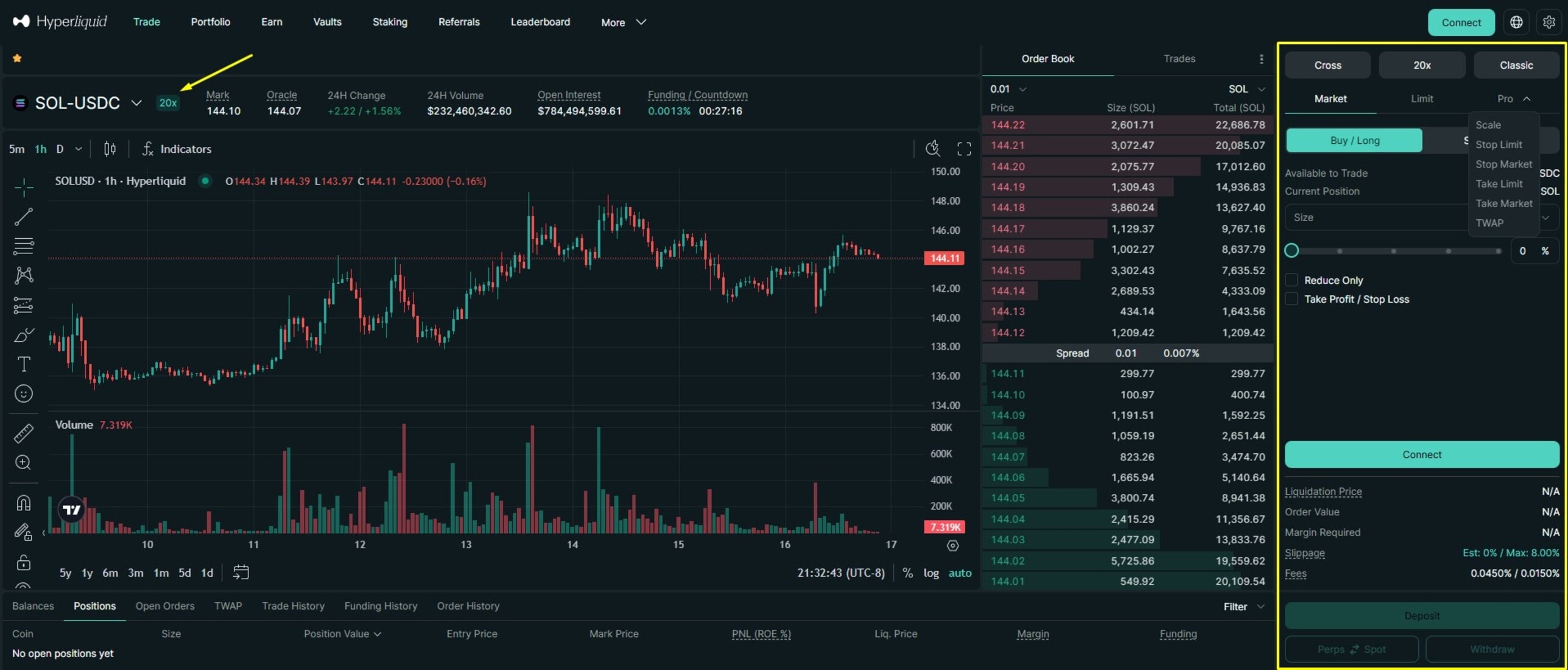

Perpetual Futures

Perpetual futures buying and selling enable merchants to take lengthy or quick positions on digital belongings with out worrying about expiration dates. This characteristic supplies steady publicity to the market, letting customers handle positions over time in accordance with their technique. Merchants can use leverage to amplify potential returns whereas maintaining danger controls in place. The system is optimized for pace and accuracy, guaranteeing trades are executed rapidly even throughout excessive volatility.

Spot buying and selling

Spot buying and selling permits customers to purchase and promote crypto belongings instantly at present market costs. It’s appropriate for inexperienced persons who need simple transactions in addition to skilled merchants preferring rapid settlement. Orders are processed rapidly, guaranteeing dependable execution and minimal value slippage throughout energetic market circumstances.

Superior Order Varieties

Superior order sorts give merchants extra management over how and when trades are executed. Options reminiscent of restrict orders, TWAP, and iceberg orders assist handle massive positions with out inflicting sudden value actions. These instruments enable customers to automate elements of their buying and selling technique and scale back emotional decision-making.

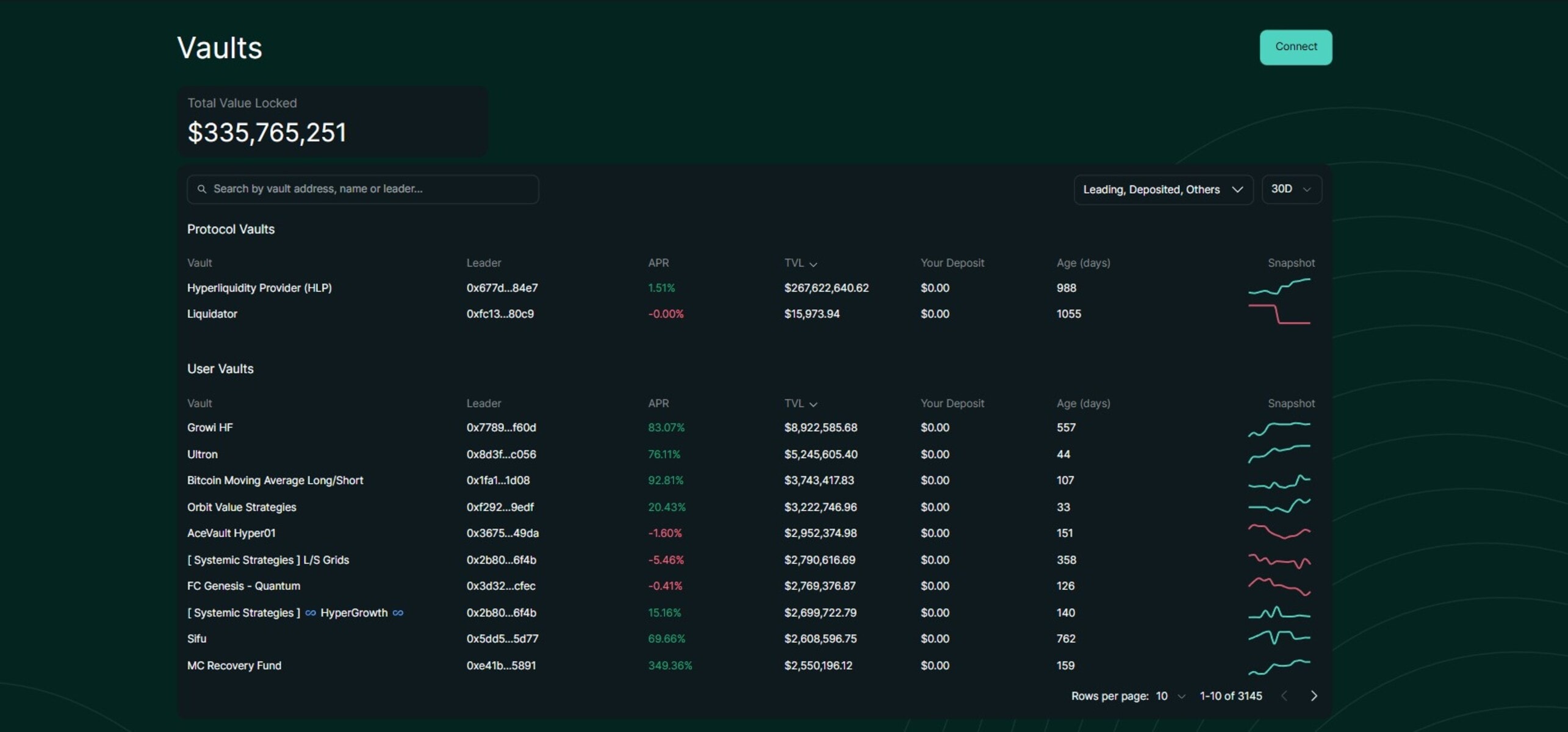

2. Vaults and The Hyperliquidity Supplier (HLP)

Vaults on Hyperliquid enable customers to pool funds into automated methods reminiscent of copy buying and selling and liquidity provision. The Hyperliquidity Supplier vault capabilities because the platform’s fundamental market maker and liquidation engine, accepting USDC deposits with out supervisor charges.

Funds are used to position bids and asks throughout perpetual markets and deal with liquidations, with earnings shared proportionally amongst depositors. With a whole bunch of hundreds of thousands in complete worth locked, HLP helps keep deep liquidity and secure execution. Though withdrawals require a 4-day lockup, yields typically attain 20-60% APY throughout risky market circumstances.

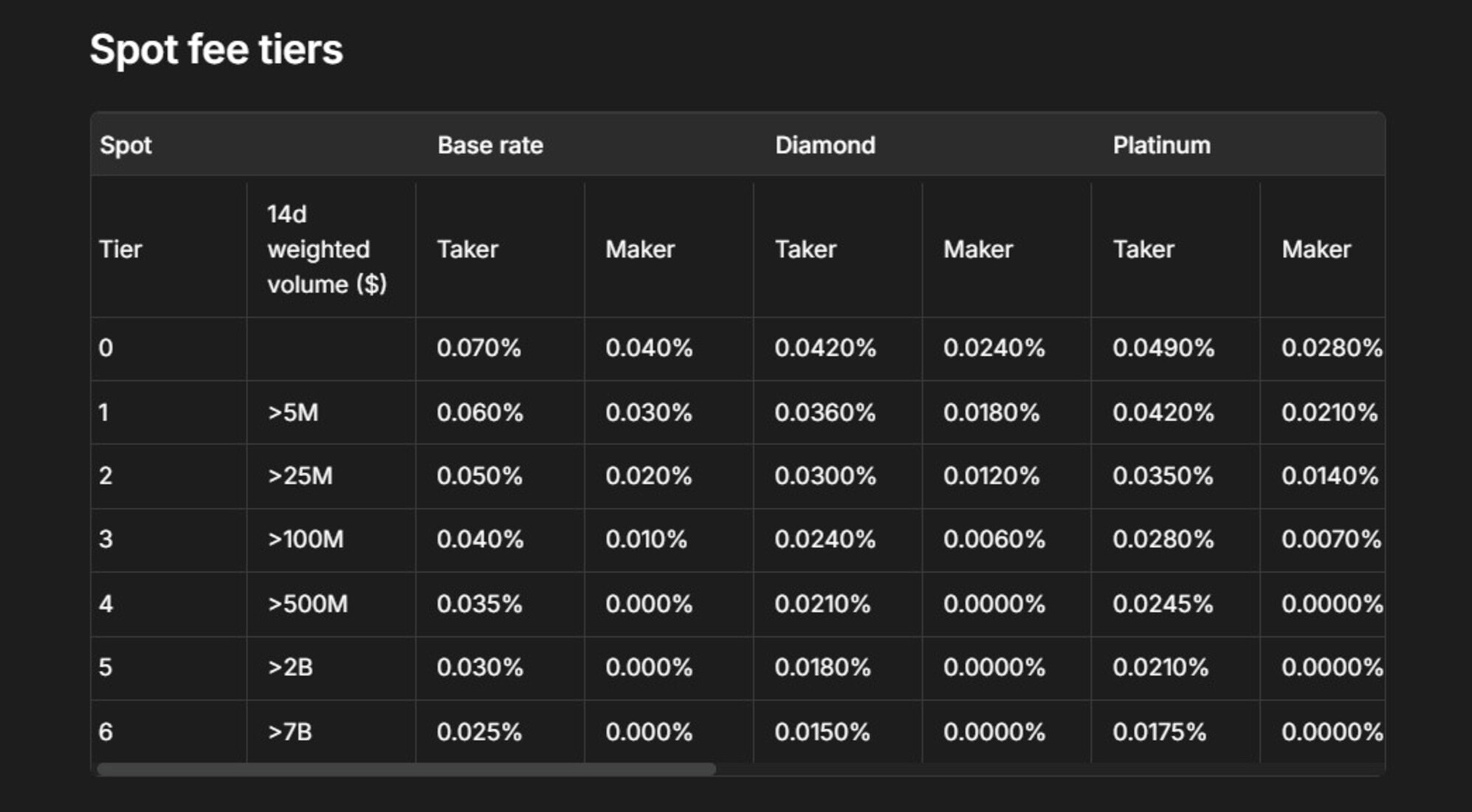

3. Hyperliquid DEX Payment Construction

Hyperliquid removes gasoline charges on all trades by its Layer-1 design and as an alternative applies low maker and taker buying and selling charges. It additionally runs a tiered payment construction with 0.070% for takers and 0.040% for makers, which is decrease than many main decentralized exchanges.

Excessive-volume merchants can additional scale back prices by HYPE staking tiers, which provide payment reductions of as much as 40% or 50%, whereas HLP depositors earn a share of taker charges.

Income distribution helps long-term sustainability by directing funds towards HYPE buybacks and burns, the Help Fund for platform safety, and rewards for stakers and liquidity suppliers. This permits the protocol to develop with out exterior enterprise capital funding.

4. The Hyperliquid Blockchain

Hyperliquid operates on a dual-chain structure made up of HyperCore and HyperEVM, every designed for particular community capabilities. HyperCore handles high-speed buying and selling actions reminiscent of margin administration, liquidations, and order execution, whereas HyperEVM helps decentralized purposes and sensible contracts.

To know the underlying know-how powering these chains, you possibly can study extra about what a blockchain is. The community makes use of the HyperBFT consensus mechanism to realize block instances as little as 0.07 seconds and excessive transaction throughput.

Greater than 50 validators safe the community by HYPE staking, enabling quick finality and defending transaction integrity. Since validators may very well be malicious or offline, Hyperliquid integrates Byzantine Fault Tolerance (BFT) through its {custom} HyperBFT consensus algorithm, which secures your complete Layer 1 blockchain in opposition to malicious or failed validators.

How Does Hyperliquid Provide Such Quick Speeds?

Hyperliquid achieves high-speed efficiency by combining a purpose-built Layer-1 blockchain with an optimized buying and selling engine. The HyperBFT consensus mechanism allows transactions to succeed in finality inside seconds by a leader-based validation course of and fast block affirmation rounds. Buying and selling operations are dealt with instantly on HyperCore, eliminating exterior dependencies and decreasing community congestion.

What Are the Drawbacks of Hyperliquid?

Whereas Hyperliquid affords pace and superior options, it additionally comes with sure limitations.

The platform’s complexity could also be difficult for inexperienced persons, particularly these unfamiliar with perpetual futures buying and selling or superior order sorts.Liquidity is excessive for well-liked pairs, however smaller or area of interest belongings might expertise increased spreads or slippage.The validator-based HyperBFT system depends on staked HYPE, so downtime or misbehavior by validators, though uncommon, might influence efficiency.Staking and vault methods carry dangers, together with impermanent loss and decreased flexibility throughout lock-up intervals. Customers should fastidiously perceive these components earlier than collaborating totally within the ecosystem.

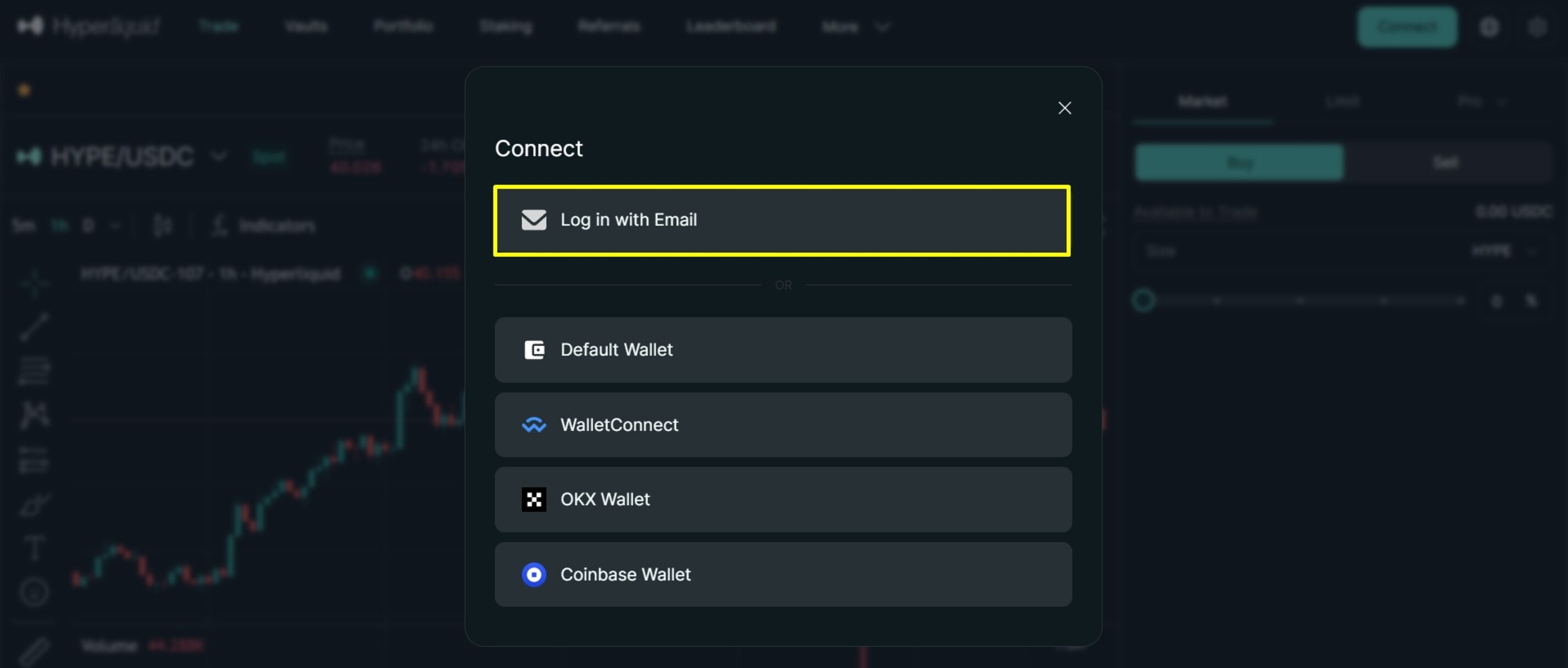

How one can Use Hyperliquid Alternate (Step-by-Step)

Step 1: Join Pockets: Go to the official Hyperliquid web site and join a supported pockets, reminiscent of OKX Pockets, Coinbase Pockets, or log in with an e mail deal with. Make sure the pockets is funded with HYPE or USDC for buying and selling.

Step 2: Deposit Funds: Switch HYPE, USDC, or different supported belongings into your Hyperliquid account. Deposits are totally on-chain, enabling rapid buying and selling or staking.

Step 3: Begin Buying and selling or Staking: Select between spot, perpetual futures, or depositing into vaults like HLP. Every possibility affords totally different danger and reward profiles.

Step 4: Handle Positions: Monitor trades, staking rewards, or vault efficiency utilizing the dashboard. Withdrawals are topic to the platform’s guidelines, together with the HLP four-day lockup.

Hyperliquid vs Different Perpetual DEXs

FeatureHyperliquid GMX dYdX Aevo LayerL1 (HyperCore Orderbook)L2 (Arbitrum/Avalanche AMM)L1 (Cosmos Orderbook)L2 (Optimism Orderbook)Order VarietiesPerps and spotPerps and SpotPerps, Superior ProfessionalPerps, Choices, SuperiorCharges (Maker/Taker)0.04% / 0.070% (zero gasoline payment)0.05% / 0.07% + gasoline0.02% / 0.05% + gasoline0.02% / 0.05% + gasolineSupported Cryptocurrencies130+40+ majors200+100+Liquidity MannequinHLP Vaults (on-chain)GLP Swimming poolsOrderbook/CustodialPre-Market LiquidityTVL/30d Quantity$2.5B / $150B+$500M / $5B$400M / $12B$300M / $3BStaking Rewards2–60% APY (HYPE/HLP)GLP ~10–30%Not obtainable 15%Why it stands outCEX-speed, no MEV, sub-second executionZero value influenceDeep orderbookChoices integration

The Way forward for Hyperliquid

The Hyperliquid Crypto Alternate goals to grow to be a number one decentralized finance (DeFi) derivatives platform in 2026. Some vital developments and milestones embody the total integration of HyperCore and HyperEVM, enabling dApps to run at exchange-level speeds whereas remaining EVM-compatible.

The platform plans to deploy a $1B treasury fund to purchase and stake HYPE, aligning protocol reserves with token demand to stabilize the market and counteract volatility. Massive-scale buybacks might tighten provide, particularly provided that 97% of protocol charges have already been allotted to HYPE repurchases.

Looking forward to 2026–2027, HyperEVM is anticipated to develop with new tasks, together with liquid staking through kinetiq xyz and cash markets by hyperlendx. Permissionless perpetuals launched below HIP-3 in October 2025 will additional decentralize listings, increasing use instances for staking, lending, and derivatives buying and selling.

Conclusion

Not like conventional DeFi platforms, Hyperliquid combines pace, superior buying and selling instruments, and a singular token ecosystem to create a professional-grade decentralized alternate. Its dual-chain design, HyperBFT consensus, and modern vault system provide each retail and institutional merchants methods to maximise returns whereas sustaining safety.

Whereas some dangers exist, together with validator downtime and lockup intervals, HYPE staking and HLP vaults present sturdy incentives for participation. However that’s not all. We reviewed the platform and compiled a complete Hyperliquid overview to offer perception into its options, safety, and structure.

FAQs

Is Hyperliquid protected to make use of?

Sure. Hyperliquid is designed with a validator-based HyperBFT consensus and staked HYPE as financial safety, offering sturdy safety in opposition to malicious exercise. Nevertheless, dangers exist, reminiscent of validator downtime or vault impermanent loss, however these are uncommon and mitigated by community design.

What blockchain is Hyperliquid constructed on?

Hyperliquid runs on HyperCore, a trading-optimized Layer-1, and HyperEVM, an EVM-compatible Layer-1 for decentralized apps. This twin structure ensures quick, low-latency buying and selling and full on-chain transparency.

Can I commerce with out KYC?

Sure. Hyperliquid permits customers to commerce with out KYC.

How briskly is Hyperliquid?

The platform achieves sub-second commerce execution and finality, with block instances as little as 0.07 seconds and throughput of over 200,000 transactions per second.

What’s a perpetual alternate?

A perpetual alternate lets customers commerce futures contracts that by no means expire, providing leverage and the power to go lengthy or quick on belongings with out settlement deadlines.