Analyst Weekly, January 19, 2026

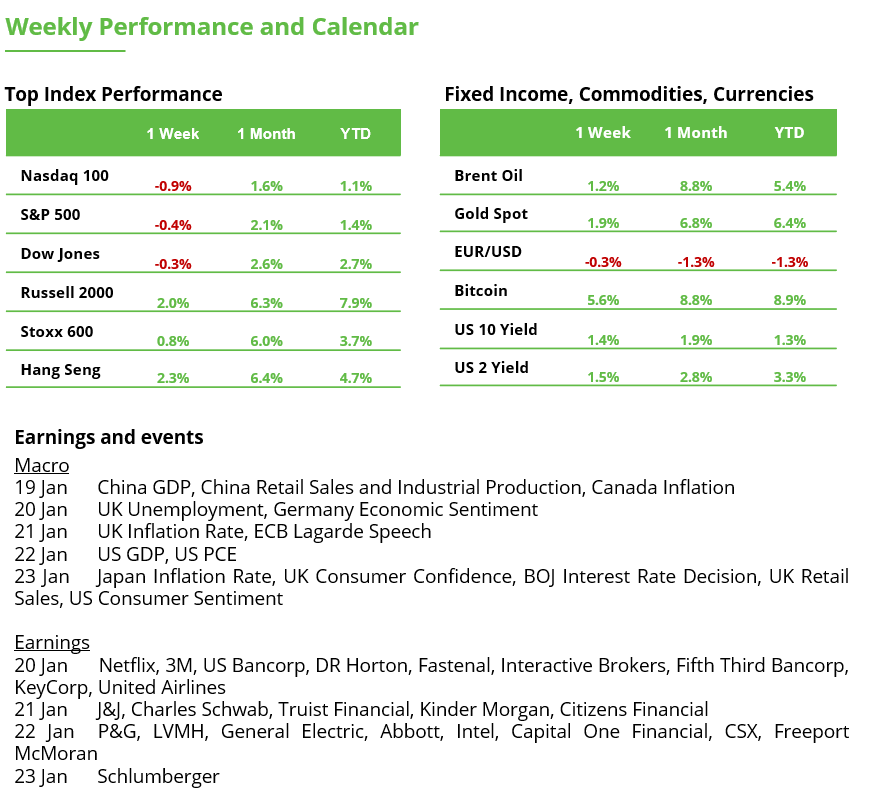

The week forward places earnings firmly in focus, with outcomes spanning streaming, semiconductors, healthcare, client staples, industrials, vitality, and UK-listed cyclicals. Traders shall be watching not simply headline numbers, however what these experiences reveal about pricing energy, demand resilience, margins, and 2026 steerage throughout sectors.

Netflix (NFLX). Focus: Promoting progress, pricing energy, and person engagement are within the highlight greater than subscriber additions. Traders shall be watching if Netflix’s new ad-supported tier and up to date value hikes maintain income rising ~17% YoY as anticipated, and whether or not administration guides for continued subscriber momentum. Market Response Drivers: Robust advert income traction (versus forecasts) might carry the inventory, whereas any slowdown in engagement or cautious ahead steerage might weigh on sentiment.

Intel (INTC). Focus: The chipmaker’s report shall be scrutinized for indicators of a turnaround in its PC and server companies in addition to progress in its AI and foundry initiatives. A powerful This autumn is predicted due to bettering PC demand and data-center developments, together with extra optimism round its foundry enterprise. Market Response Drivers: Traders will search for gross margin stabilization and upbeat 2026 steerage. Any optimistic shock in chip demand (or cost-cutting advantages) might increase shares, whereas weak outlook or additional market-share losses to rivals might stress the inventory.

Johnson & Johnson (JNJ). Focus: J&J’s efficiency in key drug franchises and medical units shall be pivotal. The corporate has been delivering mid-single-digit income progress (Q3 gross sales +6.8% YoY) throughout its Revolutionary Drugs and MedTech segments, so traders will give attention to whether or not that momentum continued and on any updates to 2026 revenue steerage. Market Response Drivers: Strong progress in pharmaceutical gross sales (particularly new therapies) or expanded system margins, coupled with a assured outlook for 2026, might help the inventory. Conversely, any indicators of slowing demand or cautious steerage would possibly mood enthusiasm within the defensive healthcare area.

Procter & Gamble (PG). Focus: The buyer staples big’s report will heart on natural gross sales developments and revenue margins. P&G has maintained a modest full-year progress outlook (FY2026 gross sales +1% to five%, with flat to +4% natural gross sales), so traders will parse This autumn for the combo of pricing vs. quantity modifications throughout its product classes. Price pressures have eased, so an uptick in gross margin is predicted. Market Response Drivers: If P&G reveals it will possibly maintain elevating costs with out dropping quantity, or if it indicators larger earnings steerage on easing enter prices, the inventory might see a optimistic response. Nevertheless, any weak spot in client demand or margin compression would elevate concern for the staples sector and will weigh on the shares.

Common Electrical (GE). Focus: Now targeted on aerospace after spinning off different models, GE’s earnings will spotlight jet engine orders, service revenues, and supply-chain standing. The report will take a look at GE Aerospace’s execution amid booming air journey demand, with consideration on whether or not provide constraints have eased and high-margin aftermarket providers proceed to develop. Market Response Drivers: A powerful quarter pushed by strong plane engine deliveries and upbeat 2026 steerage (e.g. double-digit aerospace income progress) would underscore GE’s transformation and sure bolster the inventory. Any indicators of manufacturing bottlenecks or a slower-than-expected ramp in aviation markets, alternatively, might give traders pause after GE’s current run-up.

Schlumberger (SLB). Focus: Outcomes will make clear international drilling exercise and vitality capex developments. Final yr, SLB beat expectations however cautioned that an “extra oil provide” was making clients cautious, projecting flat income into 2025. This This autumn, traders will give attention to worldwide challenge power (SLB’s specialty) versus any North America softness, and pay attention for administration’s outlook on 2026 spending by oil & gasoline producers. Market Response Drivers: If SLB indicators that upstream funding is ready to rebound (or if it experiences better-than-feared income regardless of $59 oil), its inventory might rally, particularly given SLB’s current dividend hike and buybacks. Nevertheless, a subdued outlook (continued buyer warning or flat exercise ranges) would possibly mood the inventory and weigh on the broader vitality sector.

Burberry Group (BRBY). Focus: Burberry’s buying and selling replace shall be eyed for the influence of its model revamp. Analysts anticipate solely low-single-digit progress in key markets, ~3% in China and ~2% within the Americas, so traders will search for any upside shock from the essential Chinese language market rebound or new product strains below Burberry’s refreshed artistic route. Market Response Drivers: Assembly or beating these modest gross sales forecasts (for instance, delivering a optimistic ~2% like-for-like gross sales uptick) could be effectively acquired, probably sparking a re-rating of the inventory. Conversely, if luxurious demand in China or the US disappoints, or if administration sounds cautious on present buying and selling, it might weigh on Burberry and different luxurious names given excessive market expectations for a China-led restoration.

Rio Tinto (RIO). Focus: The mining big’s operational replace will spotlight iron ore manufacturing and Chinese language demand developments. Rio indicated after Q3 that it wanted a “sturdy This autumn efficiency” to hit its iron ore cargo targets, noting Chinese language infrastructure stimulus has pushed iron ore costs to yearly highs. Traders will give attention to whether or not Rio met its quantity steerage and on commentary about commodity demand in China and past (for iron ore, copper, and so forth.). Market Response Drivers: If Rio reveals strong year-end output, and particularly if it strikes an optimistic tone on China’s metals urge for food, it might increase mining shares and sign power within the international economic system. On the flip facet, any manufacturing shortfall or cautious outlook (citing prices or weaker demand shifting into 2026) would possibly stress Rio’s inventory and the broader supplies sector.

Related British Meals (Primark). Focus: AB Meals’ replace will revolve round its Primark retail arm’s essential vacation efficiency amid a tricky client local weather. The corporate has already warned that Primark’s like-for-like gross sales fell ~2.7% over the 16 weeks to Jan 3, as “heavy discounting” was wanted to clear inventory, squeezing margins. Past Primark, ABF’s grocery and substances models confronted weaker US demand late in 2025. Market Response Drivers: Traders will look ahead to any enchancment in Primark’s buying and selling developments or stock ranges and any methods to revive European gross sales and US footfall. If ABF can reassure that the revenue hit was one-off and that measures are in place to carry Primark’s efficiency, the inventory might stabilize. Nevertheless, affirmation of continued powerful buying and selling or a subdued client outlook might additional stress ABF shares and spill over to sentiment on UK retail friends.

What US’s Greenland Tariffs Could Imply for Markets

Trump’s risk to slap tariffs on eight European nations over Greenland has reopened a well-recognized threat for markets: coverage unpredictability. Even when the levies by no means materialise, the message is obvious: commerce offers below a second Trump presidency will not be sturdy, and headline threat is again.

Within the close to time period, this factors to larger volatility slightly than a clear directional transfer. Europe isn’t just a serious US buying and selling accomplice; it is usually the most important international holder of US monetary belongings, which limits how far escalation can go with out spilling into capital markets.

The larger threat sits one layer deeper. If the EU prompts its anti-coercion instrument, the battle shifts from tariffs to monetary, regulatory or funding leverage, which might be much more disruptive for FX, charges and threat belongings. Mockingly, repeated tariff brinkmanship might undermine the greenback by encouraging reserve and portfolio rebalancing away from US belongings.

For traders, that is a few rising geopolitical threat premium being repriced throughout currencies, equities and cross-border capital flows.

Netflix and Intel Forward of Earnings

Netflix inventory heads towards a key help stage

Netflix shares fell by round 30% within the second half of 2025 and prolonged losses by one other 6% in January 2026. The inventory is at the moment buying and selling at its lowest stage since April, closing 1.6% decrease final week at $88.

A powerful help zone round $83 is subsequently coming into focus. This space marked a backside in April, from which the rally started that later pushed Netflix to new file highs. A sustained break under $83 might threaten the long-term uptrend.

The important thing resistance is positioned at $110, the interim excessive of the multi-month downtrend. The latest sell-off began exactly at this stage. A bullish response close to or at help would stabilize the short-term chart image and assist protect the long-term uptrend.

Netflix weekly chart, earnings on Tuesday after the shut. Supply: eToro

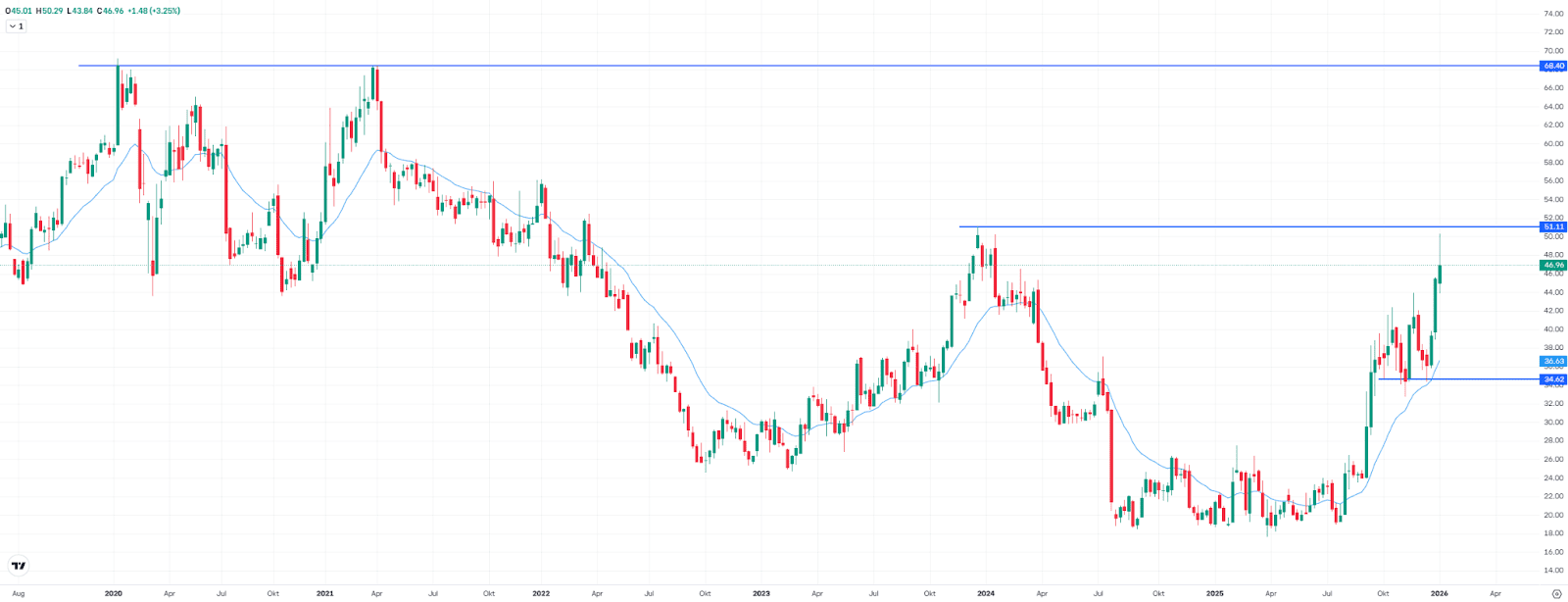

Intel: Will earnings set off a technical breakout?

Intel shares are up 27% yr to this point. Final week’s shut was round $47, the best stage in a yr. The important thing resistance sits at round $51, the 2023 excessive.

A sustained breakout above $51 would open up additional upside, with a possible goal zone round $68. A double prime shaped in 2021 close to this stage, making it the subsequent main resistance space.

After the sturdy short-term rally, a pullback could be attainable and technically wholesome. In that case, Intel might try to interrupt the resistance on a second run. Any declines would initially be categorized as a correction inside the medium-term uptrend.

Robust help is positioned round $34, the place buying and selling exercise was elevated within the fourth quarter. The 20-week shifting common is at the moment close to $37.

Intel weekly chart, earnings on Thursday after the shut. Supply: eToro

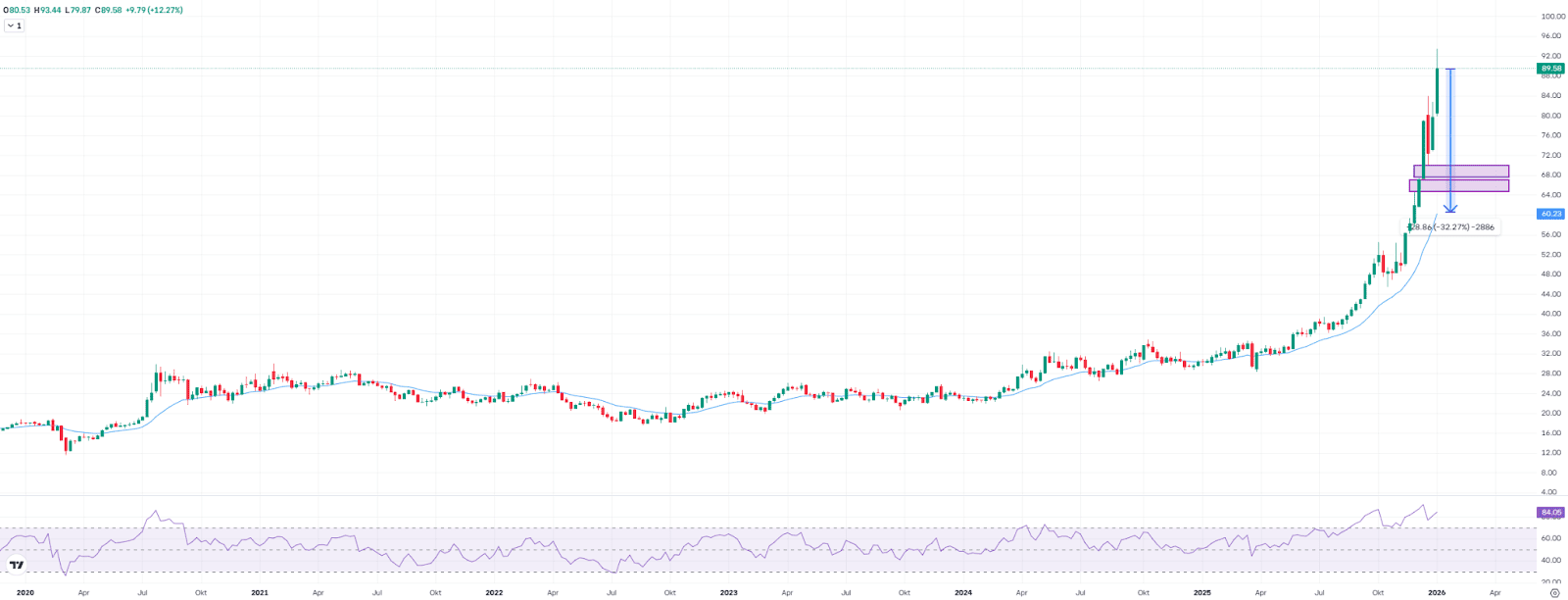

Silver Rally Intact, However Brief-Time period Warning Indicators Are Rising

Silver crossed the $90 mark for the primary time final week however failed to carry above it sustainably. Since Thursday, preliminary profit-taking has set in.

Whereas the broader uptrend stays intact, the rally is already effectively superior, growing the danger of a correction. An RSI studying of 84 indicators a short-term overbought market, whereas a bearish RSI divergence, rising costs alongside a falling RSI, provides to the warning.

The space to the 20-week shifting common is greater than 30%, final examined in Could. Two key help zones, often known as honest worth gaps, are positioned between $67.40 and $70.00, and $63.60 to $67.30.

Within the brief time period, the risk-reward profile seems unattractive. A pullback could be wholesome and will create way more enticing entry ranges.

Silver weekly chart. Supply: eToro

Bitcoin: What Worth Exhibits is Solely the Floor

Bitcoin ended the week larger by greater than 5%, however this transfer seems very totally different from previous rallies.

The most important inform? ETFs pulled in over $1.4bn of web inflows in the course of the week, a pointy reversal from the earlier week’s outflows. That means demand didn’t disappear, and when sentiment stabilized, capital got here again rapidly.

What’s lacking is simply as vital. Leverage is muted. CME futures foundation and perpetual funding charges stay effectively under ranges usually related to speculative extra. Costs are rising, however with out the gasoline that normally precedes sharp reversals.

On the identical time, spot volumes are falling. Bitcoin and Ethereum buying and selling exercise has cooled, reinforcing a sample that’s been in place since final yr: this cycle is being pushed by establishments and ETFs, not retail. Altcoins proceed to lag, as excesses from prior cycles unwind.

There are exceptions. XRP has proven relative power, supported by regulatory progress in Europe and its positioning as a compliant settlement asset. Solana stays on institutional watchlists, however its value continues to be extra delicate to exercise cycles than Bitcoin’s structurally pushed flows.

Regulatory noise hasn’t helped. The blockage of the CLARITY Act has weighed on sentiment, particularly round stablecoins and tokenization. However the pushback itself highlights the place the actual friction lies and the place long-term change is most definitely.

What to look at subsequent week:

Do ETF inflows persist regardless of softer spot volumes?

Can costs rise with out leverage returning?

Does US regulation make clear, or additional expose, structural tensions?

How markets steadiness institutional adoption with long-term warning.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.