Bitcoin’s value is fluctuating under the $90,000 mark as volatility will increase throughout all the cryptocurrency market. Through the bearish value motion, consideration is now being shifted to the cautious sign from the Bitcoin Open Curiosity in BTC phrases, which has remained under previous all-time excessive in years.

Open Curiosity Tells A Completely different Story When Measured In BTC

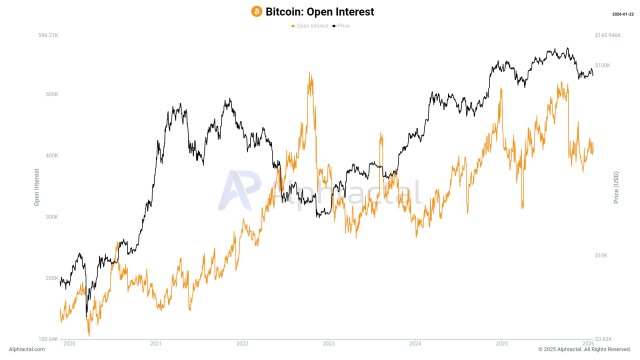

Amid the continued unstable motion of the crypto market, the derivatives marketplace for Bitcoin is offering a extra subdued message. This message is unfolding on the Bitcoin Open Curiosity (OI) in BTC phrases as outlined in a latest analysis by Joao Wedson, a market knowledgeable and founding father of the Alphractal analytics platform.

Within the report shared on the X platform, the market knowledgeable highlighted that the open curiosity measured in BTC phrases has failed to succeed in new all-time highs since 2022. The BTC-based perspective reveals a extra restricted utilization of leverage over cycles, whereas dollar-denominated measures ceaselessly climb in tandem with value.

On Thursday, the metric skilled a bounce, however Wedson acknowledged that the upward transfer was primarily in USD-dominated open curiosity. This sample means that merchants have gotten extra cautious available in the market by allocating capital extra fastidiously versus placing all of it into dangerous positions.

In response to the knowledgeable, the pattern merely means that hypothesis is current available in the market and it’s at the moment increasing. Nonetheless, the chart reveals that the broader market remains to be removed from any type of excessive or irrational euphoria.

Not Sufficient Revenue To Set off A Bullish Restoration

BTC’s incapability to supply one other main rally is linked to the extent of buyers in revenue. Darkfost acknowledged that there are nonetheless not sufficient buyers in revenue to hope for a sustainable bullish restoration. Thus, it’s essential to know that latent income will not be dangerous to a market; it’s fairly the other.

When buyers are most in revenue, the state of affairs is far more comfy, which motivates them to carry. Nonetheless, this solely holds as much as a sure level. Additionally, when the availability in revenue surpasses 95% and even 100%, newest income start to impression the market and will set off important corrective phases.

The continuing correction remained reasonable with a drawdown to round 31%, however it was in a position to sharply cut back the share of provide in revenue, suggesting very late entry by many buyers. At the moment, over 71% of BTC is in revenue after dropping as little as 64%, a really regarding degree that has sometimes been noticed solely when Bitcoin was coming into a bear market.

Nonetheless, in Darkfost’s view, the market should reclaim above 75% provide in revenue to regain a extra steady construction. So long as it stays above this degree, the availability in revenue has traditionally been related to constructive intervals, as proven within the chart.

With the latest value rebound, the availability in revenue noticed a short climb again to 75% earlier than getting rejected. In the meantime, many BTC buyers presumably used this chance to exit at break-even or to chop their losses.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.