Bitcoin, Ethereum, and XRP, and most main crypto cash are dropping in value because the USD is taking a success with rumors of Japanese Yen intervention and one other US Authorities shutdown by the top of the month. Bitcoin dumped much more from final week to the 88,000 space, whereas Ethereum dumped by 1,4% and XRP fell additional to the two USD mark.

Individuals are speculating that the Fed may quietly comply with Japan’s playbook and assist the yen by promoting {dollars}; the USD weakens by implication. What comes subsequent normally follows with property priced in {dollars}, these embody Bitcoin, Ethereum, XRP, and most massive crypto cash like Solana.

BREAKING:

As reported by the Monetary Occasions, it seems that the NY Federal Reserve desk carried out fee verify(s) on Friday in an effort to weaken the greenback/strengthen the Yen

That is extremely uncommon, and indicators {that a} LOT extra greenback weak point could be forward of us https://t.co/OgVz6B1bto pic.twitter.com/jeJOgl4o2H

— Milo (@milocredit) January 24, 2026

Bitcoin Value Falls as USD Weakens?

Bitcoin USD value is pinned below $88,000, testing assist after a tough stretch of ETF outflows. US spot Bitcoin ETFs noticed a wholesome sum of outflows by the top of final week, and leverage liquidation hit $1.8 billion in liquidations over the previous 2 days. As regular, institutional cash doesn’t tiptoe when it leaves.

7d

30d

1y

All Time

Unexpectedly, GameStop transferred 4,710 Bitcoin, or about 422 million USD, to Coinbase Prime. Whether or not this may result in a sale or a treasury reshuffle remains to be unclear, nevertheless it simply doesn’t look good in any respect.

GameStop Moved 4.7K BTC to Coinbase Prime at $76M Loss • GameStop, the world’s largest online game retailer, is seeing big losses on its Bitcoin holdings because the main asset struggles under $90,000.• In Might 2025, GameStop amassed 4,710 BTC for roughly $504 million,… pic.twitter.com/R1yI24T6zy

— D (@DateeD1) January 24, 2026

Value-wise, Bitcoin USD continues to echo older patterns seen in opposition to gold and even the NASDAQ. Gold simply tagged $5,000 per ounce for the primary time, silver crossed $100, and copper pushed to $5.92. In the meantime, the whole crypto market cap slid to a vital level of $3.04 trillion, erasing 150 billion in a short while span. Nonetheless, traditionally, Bitcoin’s bear phases versus gold final round 14 months; the present drawdown sits close to 51 p.c over 350 days. For the reason that 2022 low, Bitcoin has tended to fall, go quiet for seven or eight weeks, then climb once more. It’s annoying, however time will inform.

DISCOVER: 10+ Subsequent Crypto to 100X In 2026

Ethereum Value Slides, as ETH Basis Spends 2 Million USD for Insurance coverage

7d

30d

1y

All Time

Ethereum value is holding assist between 2,700 and a couple of,800 USD, with RSI hovering close to oversold ranges round 37. Bitcoin dominance stays excessive at below 60%, holding altcoins on a brief leash. Even so, Ethereum on-chain exercise hasn’t cracked, as its value skilled a ten% dump this week.

Technically, ETH is consolidating under its 50-day EMA at $3,150 vary, which caps upside for now. Nonetheless, oversold situations usually precede bounces towards 3,000, particularly if Bitcoin USD stabilizes.

On the event facet, the Ethereum Basis launched a post-quantum safety workforce with 2 million in funding, specializing in insurance coverage and fondation, which is nice for the years to comes.

At present marks an inflection within the Ethereum Basis's long-term quantum technique.

We've shaped a brand new Submit Quantum (PQ) workforce, led by the good Thomas Coratger (@tcoratger). Becoming a member of him is Emile, one of many world-class skills behind leanVM. leanVM is the cryptographic…

— Justin Drake (@drakefjustin) January 23, 2026

XRP USD Rangebound as We Look ahead to Value Catalyst

The XRP value continues to respect a variety that’s lasted practically 400 days. The XRP USD value has oscillated between $1.8 and $3.6, a really vast 2x complicated vary. Patrons who entered between $2 and $3 have endured drawdowns of 25 to 30 p.c, and a few suspect market makers may drive a deeper flush earlier than momentum backs, and are additionally very depending on Bitcoin.

7d

30d

1y

All Time

Macro forces loom giant right here, too. If the Fed does weaken the greenback by successfully creating {dollars} to purchase Yen, USD devaluation may inflate danger property throughout the board. In 2024, related volatility preceded sharp BTC rallies, dragging the Ethereum and XRP value alongside for the trip.

It could be scary, however Large 4 agency says crypto has crossed an irreversible level, and CZ Binance says the supercycle is coming this 12 months.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ This fall 2025 State of Crypto Market Report

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Knowledgeable Market Evaluation.

Ethereum Preps for Quantum Risk With $1M Safety Push

The quantum menace could be nearer than we predict, and Ethereum’s core builders simply made a long-term safety transfer that the majority traders by no means take into consideration till it’s too late. The Ethereum Basis has stood up a devoted Submit-Quantum (PQ) safety workforce, backed by vital funding, together with two $1 million analysis prizes.

One targeted on hardening the Poseidon hash operate (the “Poseidon Prize“), used closely in zero-knowledge proofs, and one other broader post-quantum effort was introduced beforehand.

The workforce is taking the quantum danger severely and upgrading the blockchain safety as Ethereum is pushing deeper into finance, apps, and tokenised property, whereas governments and establishments begin asking more durable questions on long-term security.

The Ethereum Basis is prioritizing post-quantum safety.

Good. Quantum-resistant tech is essential for ETH’s long-term survival.

— H2 finance (@H2_Finance) January 24, 2026

Learn extra right here.

Circle Briefly Flips BlackRock in Tokenized Treasuries Race

You probably have ever despatched or acquired USDC or USDT, then that, proper there, is interacting with tokenized merchandise. Stablecoins are a giant success, and the primary platforms to see this “future” at the moment are making massive cash. Tether alone makes double-digit billions in earnings whereas being very lean.

In early 2024, Larry Fink of BlackRock mentioned the longer term will likely be tokenized. And round that point, the asset supervisor started tokenizing US treasuries on Ethereum. In the meanwhile, billions value of treasuries haven’t solely been tokenized however are getting used as collateral in DeFi protocols.

Given this trajectory, it’s no shock that the competitors to seize the tons of of thousands and thousands in Treasury property is cutthroat. Latest information reveals that Circle briefly flipped BlackRock as the most important Treasury tokenization automobile on the earth.

Learn extra about it right here.

Coinbase Survey Says Bitcoin Is Undervalued as Value Slips Beneath $90K

Over 70% of institutional traders say Bitcoin is undervalued, in keeping with a brand new Coinbase survey launched this week. The hole between value motion and big-money conviction is rising as international markets flip cautious on BTC USD and the broader crypto market.

This warning is evidenced by the Worry and Greed Index sitting at 20 (excessive concern), whereas this time final week it was at 44 (concern), simply on the cusp of shifting towards greed, however rising macroeconomic tensions proceed to rule the charts.

1/2 Buyers are bullish on bitcoin. And establishments are main the cost.

Whereas our December survey reveals broad-based optimism for BTC, there’s a clear sentiment hole: 71% of establishments imagine BTC is undervalued, in comparison with 60% of non-institutions.

Has crypto matured… pic.twitter.com/vL6N5IWznv

— Coinbase Institutional

(@CoinbaseInsto) January 22, 2026

This Coinbase survey relating to whether or not Bitcoin is overvalued, pretty valued, or undervalued comes because the mixed crypto market cap slipped an extra -0.9% in a single day, into Monday morning.

Proper now, the crypto market cap is sitting at $3.051 trillion, getting nearer to the important thing $3 trillion stage, which, if misplaced, may sign additional draw back on the charts. The Coinbase Bitcoin survey makes for optimistic studying, however hasn’t stopped BTC USD dropping $88,000 in a single day, the place it presently trades for $87,800.

7d

30d

1y

All Time

Learn our full protection right here.

Ethereum Spot ETFs Outflows Spike as ETH Value Slumps

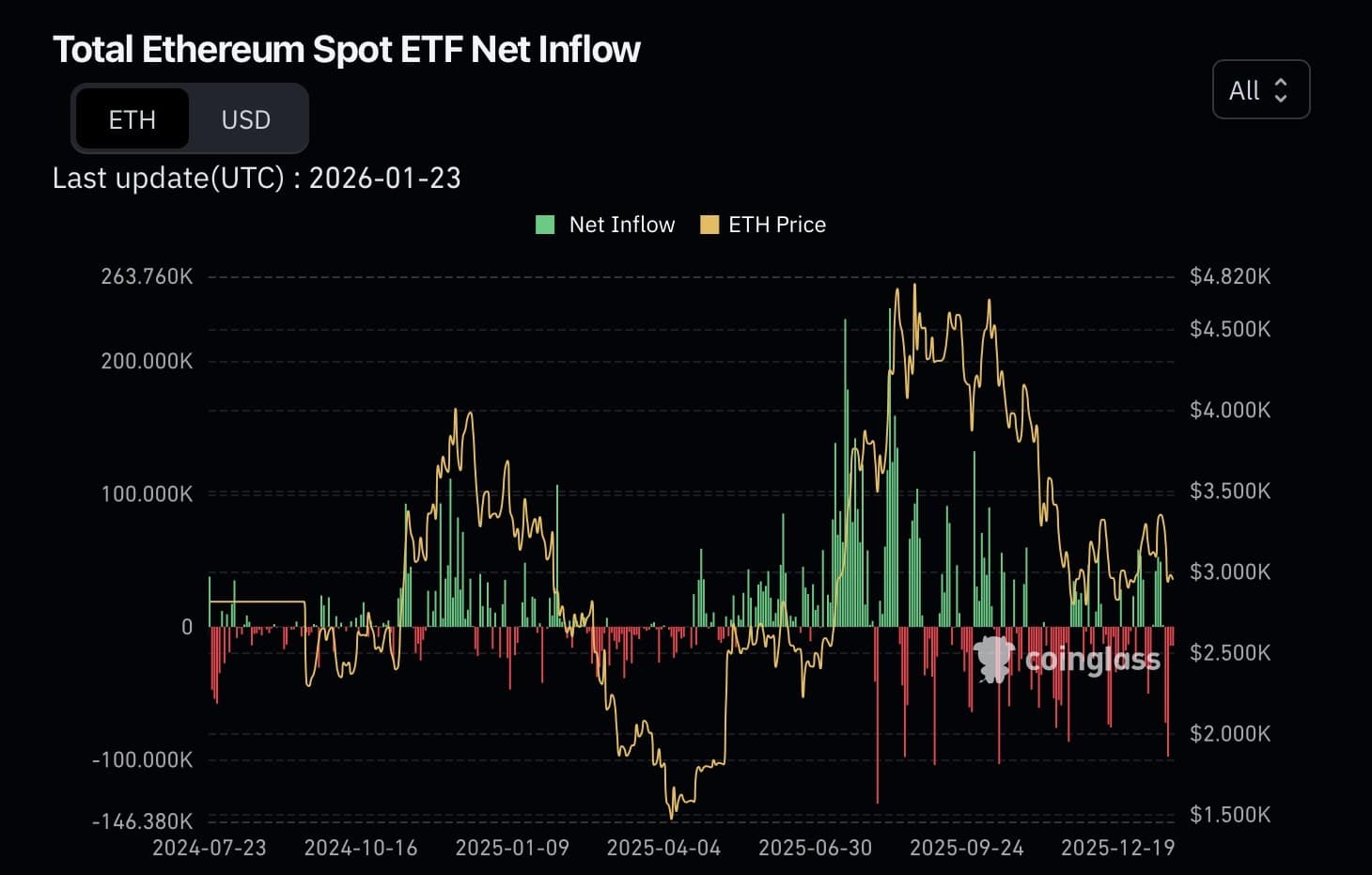

Ethereum spot ETFs are bleeding capital within the new 12 months, with web outflows stacking up week after week. Whole AUM (Property Underneath Administration) throughout the merchandise hovers round $16–17 billion, a transparent step down from end-of-2025 peaks as value motion and redemptions each chunk. The week of January 19–23 noticed roughly $611 million exit the doorways, one of many heavier prints just lately.

Each day flows have stayed adverse for a number of classes working, with single-day outflows ceaselessly touchdown within the $40–50 million vary and occasional greater hits topping $200–400 million from the most important issuers.

(Supply: Coinglass)

We noticed an analogous sample throughout current Bitcoin ETF outflows, which added additional promoting strain.

Learn the total story right here.

SEC Submitting Reveals Which Cryptos Wall Avenue Trusts Most

If crypto, at one cut-off date, attracts the billions usually funneled to TradFi devices like bonds, Bitcoin, Ethereum, and a number of the greatest cryptos will simply bounce to 10X spot charges. It might take months, years, and even many years earlier than that occurs.

The excellent news is that there’s concerted efforts to make sure there are safe bridges connecting TradFi and crypto. In any case, pound-to-pound, crypto property, together with prime Solana meme cash, are typically extra risky. If volatility is what’s wanted, then it may be tapped for enormous good points. Bonds, for instance, not often transfer and are thought-about method safer than Bitcoin and different liquid property.

https://twitter.com/MerlijnTrader/standing/1991823916680073403

Subsequently, the current SEC submitting displaying Cyber Hornet ETFs proposing an S&P-linked crypto ETF leaning closely on Bitcoin, Ethereum, and XRP is exactly what each crypto fanatic needs to look at. Even with this information, nonetheless, XRP and Ethereum stay below strain. The XRP USD value, for instance, remains to be under the $2 mark and below immense promoting strain. Within the final week of buying and selling, XRP crypto has misplaced practically -5%.

Learn the total story right here.

The submit Crypto Market Information At present, January 26: Bitcoin, Ethereum, XRP, and Crypto Value Gravitating as USD Falls appeared first on 99Bitcoins.