Tokenomics defines how a token is created, distributed, used, and sustained over time, and infrequently determines whether or not a challenge will thrive or fail. As crypto advances, tokenomics has develop into a essential framework for buyers to judge long-term worth, incentives, and real-world impression. On this information, you’ll be taught what tokenomics actually means, how its core elements work collectively, and why it issues for buyers, builders, and retail customers. Let’s dive in!

What’s Tokenomics?

Tokenomics is the financial framework that defines how a crypto token works inside a blockchain ecosystem. The idea combines token and economics to explain the principles governing a token’s creation, distribution, utility, incentives, long-term sustainability, and even removing from a community.

Tokenomics solutions the query of why a token exists, the function it performs within the ecosystem, how worth is created, who will get what share of the token equipped, and what’s preserved or burnt over time. In contrast to conventional monetary techniques, the place central authorities management cash provide and coverage, crypto tokenomics is embedded immediately into sensible contracts.

A number of cryptocurrency initiatives have collapsed, wiping out billions in digital belongings, primarily as a result of flawed tokenomics. Some distinguished examples embrace:

Terra (LUNA/UST): The algorithmic stablecoin UST relied on a mint/burn mechanism with LUNA however lacked enough collateral, resulting in a loss of life spiral in 2022 wherein UST misplaced its 1:1 peg to the US greenback and LUNA hyperinflated amid mass redemptions. This erased over $40 billion in market capitalization.OneCoin: Raised $4 billion via MLM with no useful blockchain, failing as a result of fraudulent tokenomics centered on hypothesis slightly than verifiable tech.Axie Infinity (SLP): Play-to-earn token SLP flooded the market by way of extreme gameplay rewards outpacing sinks like breeding, inflicting persistent inflation and value crashes as new participant inflow slowed.

These examples, together with others, present {that a} well-designed tokenomics mannequin ought to align incentives throughout all individuals within the community, together with customers, builders, and long-term holders.

Key Components of Tokenomics

1. Token Provide

Token provide defines the entire tokens in existence, what number of will ever exist, and what number of are at the moment obtainable to the market. It covers three key facets: most provide, whole provide, and circulating provide, and so they form shortage, inflation, and long-term worth.

Tasks sometimes start by defining a most provide for his or her token, setting a transparent higher restrict on the variety of tokens that may ever be created. When a max provide exists, it introduces shortage by design, signalling that new tokens will finally cease being issued.

From there, whole provide represents the variety of tokens which have already been minted. This contains allotted tokens for the staff, buyers, ecosystem funds, and future rewards, even when these tokens are locked or not but accessible. Whole provide helps buyers perceive the challenge’s full financial footprint, not simply what’s at the moment tradable.

Whereas max and whole provide matter in the long run, circulating provide issues most within the quick time period. Circulating provide focuses on the tokens actively obtainable in the marketplace and subsequently has essentially the most fast impression on the present market value and liquidity. Nevertheless, a low circulating provide relative to whole or most provide can initially create upward value stress, but it surely additionally raises questions on future dilution as locked tokens are step by step launched.

2. Token Distribution

Token distribution explains who receives tokens, once they obtain them, and below what situations. This immediately impacts decentralization, equity, and market stability. Distribution covers allocations to founders, early buyers, the group, ecosystem funds, and community individuals similar to validators or liquidity suppliers.

In the case of token distribution, vesting schedules and lock-up durations are essential. They stop early stakeholders from dumping giant quantities of tokens instantly after launch. A well-balanced distribution reduces centralization threat and aligns long-term incentives, whereas poor distribution can focus energy, possibly among the many staff and early buyers, and destabilize value motion.

3. Token Utility

Token utility defines how the token is used throughout the ecosystem. With out clear utility, a token dangers changing into purely speculative, like many crypto initiatives and meme cash available in the market. Utility can embrace paying transaction charges, accessing platform options, staking to safe the community, offering collateral in DeFi protocols, unlocking premium companies, and even improvements.

Some tokens serve a number of capabilities, whereas others are deliberately centered on a single core use case. Whichever one a specific challenge focuses on, the concept is to make sure the token has real-world use instances slightly than hype alone.

4. Demand and Incentives

Demand and incentives describe why customers would need to purchase and maintain the token, and what motivates them to take part within the community. Incentives could come within the type of staking rewards, yield farming, governance rights, airdrops, price reductions, or entry to unique options.

On the token demand facet, usage-driven demand is extra sustainable than incentives that rely solely on excessive emissions. Certainly, the best token fashions steadiness rewards with utility. This steadiness ensures incentives encourage long-term participation slightly than short-term extraction, the place early buyers unload their holdings after launch, leaving unsuspecting buyers with nugatory tokens.

5. Burn Mechanisms

Burn mechanisms completely take away digital belongings from circulation, decreasing provide over time. That is usually used as a counterbalance to inflation or ongoing token issuance. Burns will be triggered by transaction charges, protocol income, buyback applications, or particular consumer actions. When designed correctly, burn mechanisms can create deflationary stress and align token worth with ecosystem progress.

6. Governance

Governance determines how choices are made inside a protocol and the way a lot affect token holders have over its future. In governance tokens/techniques, holders can vote on proposals similar to protocol upgrades, parameter modifications, treasury utilization, or ecosystem funding. This shifts management away from centralized groups and towards the group.

Examples of Tokenomics: Actual-World Crypto Tasks

Let’s discover some real-world examples of token economics.

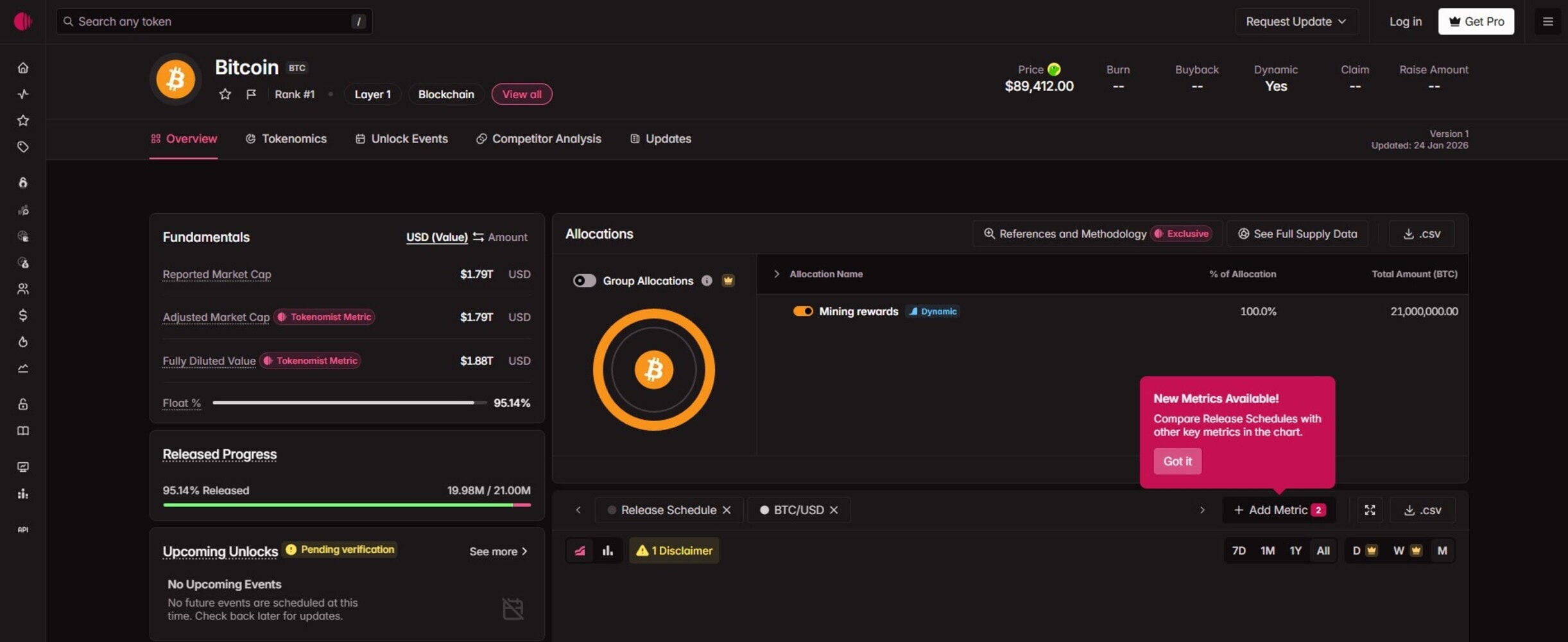

1. Bitcoin (BTC)

Bitcoin options one of many easiest and most strong tokenomics fashions in crypto, centered on absolute shortage and decentralized issuance. Its design prioritizes long-term worth storage over complicated utilities, distinguishing it from multi-function digital belongings.

Key options of Bitcoin’s Tokenomics

Fastened Provide Cap: Whole provide is hard-capped at 21 million BTC, with roughly 19.8 million in circulation as of early 2026. No extra cash can ever be created past this, imposing deflationary economics as cash are misplaced over time.Halving Mechanism: Mining rewards halve roughly each 4 years (final in 2024 at 3.125 BTC per block; subsequent in 2028), slowing new provide issuance till the ultimate block round 2140.Decentralized Distribution: BTC had a good launch with no pre-mine or staff allocation; early miners earned rewards organically. Transaction charges complement block rewards post-halvings, incentivizing community safety by way of Proof-of-Work with out centralized management.Core Utility Focus: BTC serves primarily as a retailer of worth and peer-to-peer medium of alternate, with no governance, staking, or secondary capabilities diluting its mannequin.

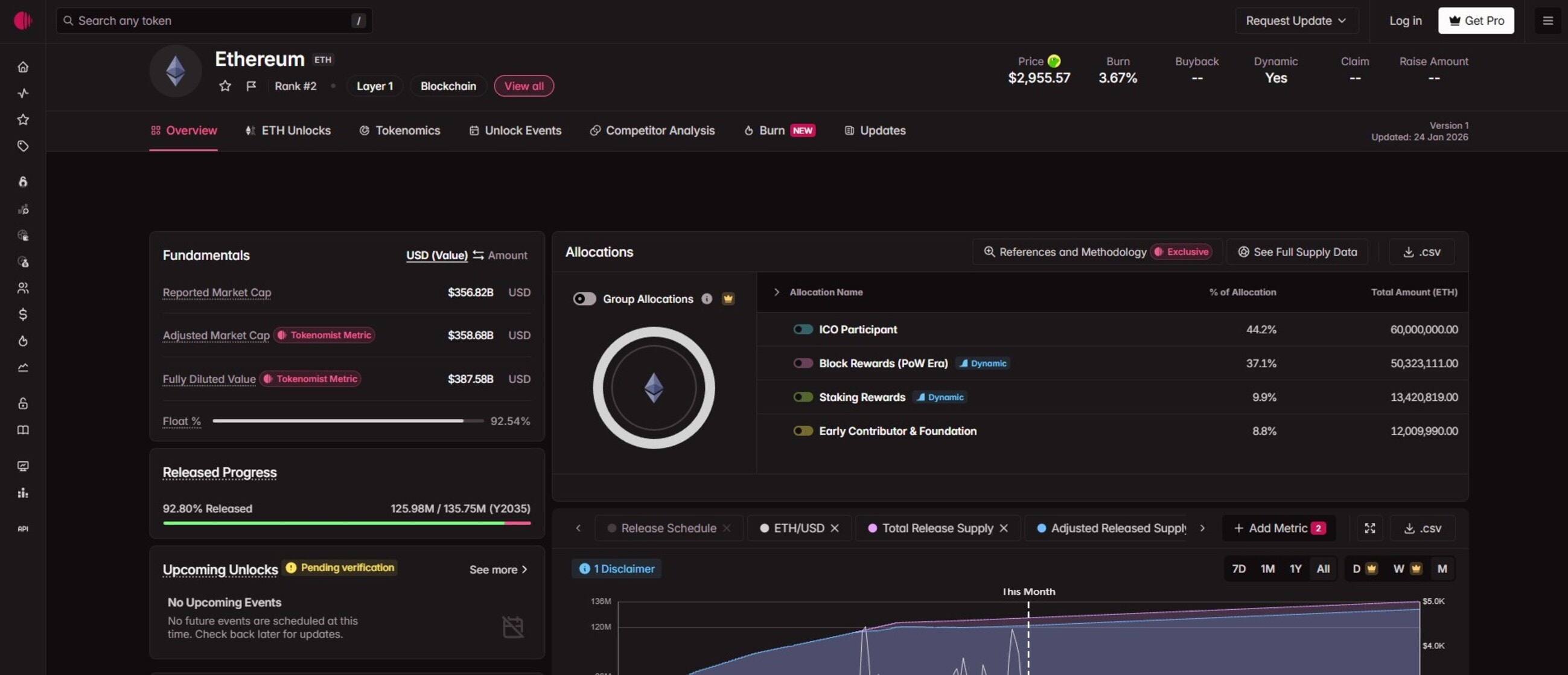

2. Ethereum (ETH)

Ethereum’s tokenomics has a dynamic provide mannequin formed by Proof-of-Stake issuance and EIP-1559 burns. In contrast to Bitcoin’s fastened cap, ETH’s worth is tied to community exercise throughout DeFi, NFTs, and Layer 2s. This dynamic method helps scalability upgrades, similar to these eyed for 2026.

Key options of Ethereum’s Tokenomics

No Provide Cap: Whole token provide exceeds 120 million ETH in early 2026, with no higher restrict. New Ether (ETH) tokens are issued by way of staking rewards to validators securing the Proof-of-Stake consensus.Burn Mechanism: EIP-1559 (2021) auto-burns a portion of transaction charges, eradicating over 12.5 million ETH since launch and countering issuance. Surge in actions like NFT mints or DeFi booms speed up deflation, making it completely different from Bitcoin’s predictable halving occasions.Staking Incentives: 30% of ETH is staked for 3-5% APY, locking provide and enhancing safety with out staff allocations. Liquid staking (e.g., stETH) boosts liquidity for buying and selling on main exchanges.Multi-Utility Focus: ETH pays fuel for sensible contracts, governs by way of proposals, and serves as collateral in dApps, driving token demand past store-of-value. 2026 upgrades like Glamsterdam promise 10k TPS by way of ZK proofs, amplifying utility with out diluting core economics.

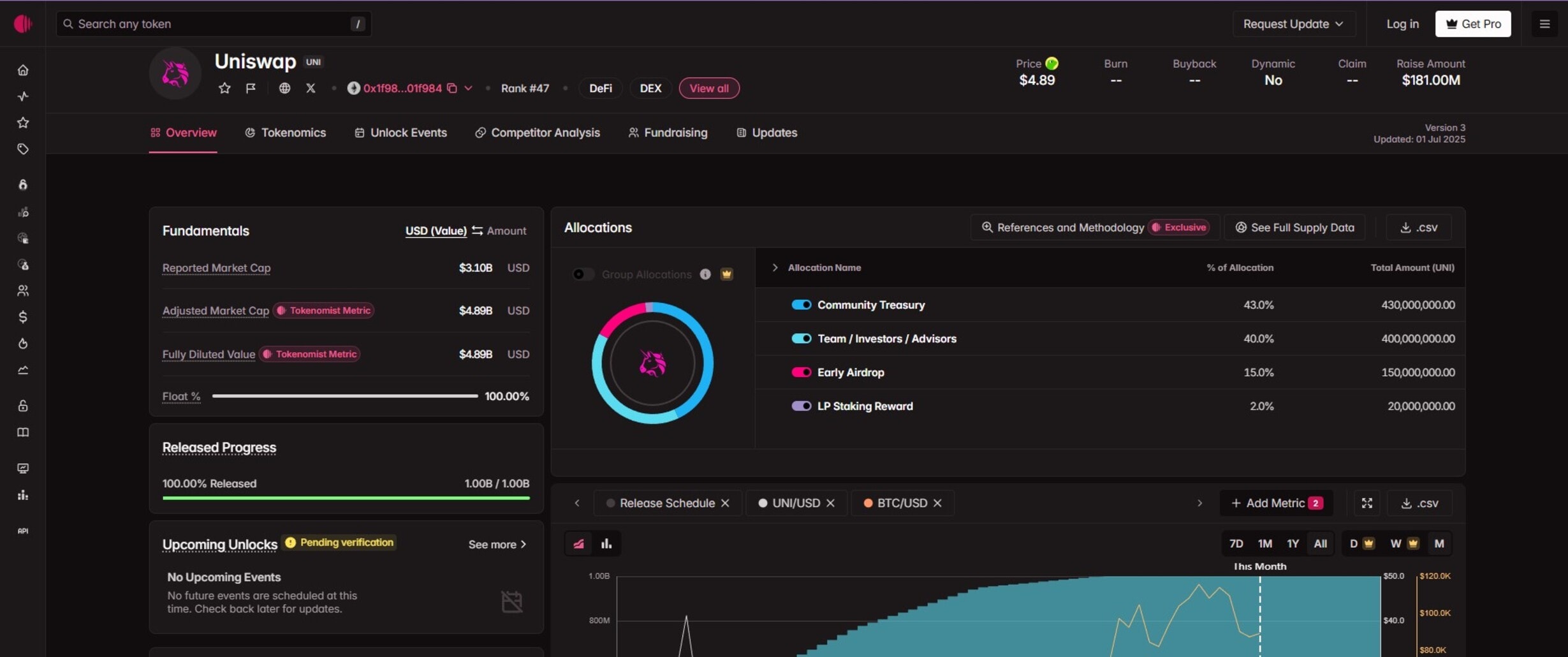

3. Uniswap (UNI)

Uniswap’s tokenomics emphasizes governance with current deflationary upgrades by way of the 2025 UNIfication proposal. This proposal will rework it from a pure governance token right into a value-accruing asset.

Key options of Uniswap’s Tokenomics

Fastened Provide with Burns: Whole provide is at 1 billion UNI, totally circulating since launch, however 100 million tokens ($596M worth) have been burned in late 2025 from treasury reserves as retroactive compensation for previous charges. Protocol charges from now move to TokenJar for automated UNI buybacks and burns by way of Firepit.Governance Incentives: UNI holders vote on upgrades, price switches, and treasury (20M UNI/12 months for grants beginning 2026), with no staking rewards or halvings like Bitcoin/Ethereum.UNI’s worth is tied to affect and long-term ecosystem alignment slightly than fast money move.

4. Binance Coin (BNB)

Binance Coin (BNB) tokenomics centres on utility throughout the Binance ecosystem and BNB Chain. This mannequin helps its function as a centralized alternate token powering low-fee buying and selling and blockchain operations.

Key options of Binance Coin’s Tokenomics

Quarterly Burns: Binance conducts computerized burns each quarter utilizing 20% of BNB Chain’s fuel charges. This burn mechanism destroys tokens to focus on a max provide of 100 million from an preliminary 200 million. The present circulating provide of BNB is about 136 million after a number of burns, creating deflationary stress tied to community utilization, in contrast to the Ethereum community’s dynamic burns.Multi-Utility Design: BNB reductions buying and selling charges (as much as 25% on Binance), pays fuel on BNB Sensible Chain for DeFi/NFTs, permits staking yields, and grants governance/launchpad entry.Market demand scales with platform utilization, making BNB’s worth carefully tied to ecosystem progress.

Why Tokenomics Issues in Cryptocurrencies?

Tokenomics issues as a result of it determines whether or not a crypto challenge can survive past hype. Whereas expertise defines what a blockchain can do, token economics units the principles for a way worth flows via a community, who earns rewards, who pays prices, and who holds decision-making energy.

Nicely-designed tokenomics, like Bitcoin’s 21 million cap or Ethereum’s burns, create shortage and counter inflation, stopping crashes seen in failures similar to Terra’s loss of life spiral. In the meantime, poor provide controls result in hyperinflation or dumps, eroding investor belief.

For builders, tokenomics acts as an incentive layer. It dictates how contributors are rewarded, how networks stay safe, and the way capital is allotted for future growth. A powerful token mannequin can entice builders, bootstrap liquidity, and fund innovation with out counting on centralized management.

Superior Tokenomics Ideas

1. Recreation Idea in Crypto Economics

Recreation concept in crypto is the strategic decision-making framework used to design blockchain techniques and incentives, making certain all individuals act truthfully for mutual profit. It performs a foundational function in how blockchain networks operate and the way rational gamers like miners, validators, or merchants work together in aggressive environments to attain outcomes that profit your complete community.

Crypto-economics blends recreation concept with incentives to align self-interest with community well being. For example, Proof-of-Stake slashes stakes for dangerous actors, making dishonest too costly, whereas miners cooperate on consensus to maximise beneficial properties.

One other instance of how that is carried out is in Bitcoin mining. Right here, egocentric mining fails in the long run as trustworthy chains develop sooner, devaluing rewards. In the meantime, in DeFi protocols, liquidity suppliers earn charges however face dangers similar to impermanent loss, that are balanced by yields.

2. GameFi and Twin-Token Economies

GameFi introduces complicated financial techniques the place tokens govern each participant incentives and long-term worth creation. In contrast to conventional gaming economies, that are centrally managed, GameFi depends on tokenomics to steadiness reward distribution, asset possession, and participant development in open markets.

Many GameFi initiatives undertake dual-token fashions to separate short-term utility from long-term governance or worth seize. One token is usually earned via gameplay and used for in-game actions similar to upgrades or crafting, whereas the second token is scarce and used for governance, staking, or ecosystem choices.

3. Decentralized Bodily Infrastructure Networks (DePIN)

Decentralized Bodily Infrastructure Networks lengthen tokenomics past purely digital ecosystems into real-world coordination. In DePIN fashions, tokens are used to incentivize people and companies to deploy, keep, and function bodily infrastructure similar to wi-fi networks, vitality techniques, sensors, or knowledge storage {hardware}.

Tokenomics in DePIN should account for real-world prices, geographic constraints, and long-term upkeep, making incentive design considerably extra complicated. Rewards have to mirror precise utility supplied, similar to uptime, protection, or knowledge high quality, slightly than easy participation.

Efficient DePIN tokenomics aligns financial incentives with measurable bodily output, enabling decentralized networks to scale with out centralized possession. Poorly designed fashions, nevertheless, threat overpaying for low-quality contributions or failing to maintain infrastructure as soon as early incentives decline.

Limitations and Challenges of Tokenomics

Tokenomics faces important limitations that may undermine the challenge’s token sustainability. These challenges usually stem from unpredictable markets, technical constraints, and exterior pressures, making flawless fashions uncommon.

Regulatory Uncertainty: Various world rules create compliance hurdles, elevating prices and limiting market entry for token initiatives. For that reason, smaller groups usually wrestle with authorized experience and ongoing monitoring, which may deter buyers.Safety Dangers: Sensible contract vulnerabilities invite hacks and exploits, eroding belief regardless of audits.Market Manipulation and Volatility: Whales and pump-and-dump schemes distort costs in nascent markets, whereas excessive volatility disrupts long-term planning. Balancing incentives with out enabling centralization proves tough.Scalability and Interoperability: Rising consumer bases pressure blockchain infrastructure, slowing transactions and elevating charges. Cross-chain compatibility points additional restrict token utility throughout networks.

Tips on how to Consider a Challenge’s Tokenomics Earlier than Investing

Listed below are some elements to think about earlier than investing in any crypto challenge:

Token Provide Construction: Look past the utmost token provide and give attention to how tokens enter circulation. A low circulating provide paired with giant future unlocks can create hidden dilution threat, particularly if early customers/buyers or groups maintain important allocations. Additionally, understanding vesting schedules and emission charges helps you anticipate when promoting stress could improve.Token Distribution and Possession Focus: Tokens closely managed by insiders or a small variety of wallets usually sign governance threat and value manipulation potential. A more healthy mannequin distributes tokens throughout customers, contributors, and ecosystem individuals in a method that encourages decentralization and long-term dedication slightly than short-term exits.Test Utility: Tokens with obligatory use instances, similar to paying charges, staking for safety, or accessing core options, are likely to have extra resilient demand than these added purely for governance or incentives.Incentive and Rewards: Excessive rewards could look good, however unsustainable emissions usually result in inflation and declining costs as soon as progress slows. Robust tokenomics balances incentives with actual financial exercise, making certain rewards are funded by utilization or worth creation slightly than fixed token issuance.Governance: Governance mechanics present perception into who controls the protocol’s future. Clear voting techniques, affordable quorum necessities, and safeguards towards whale dominance recommend a extra resilient governance construction.

Rising Development in Tokenomics

1. Integration of Actual-World Property (RWAs)

The mixing of real-world belongings into tokenized techniques is altering how worth is represented on-chain. RWAs convey historically illiquid belongings, similar to actual property, commodities, bonds, and personal credit score, into blockchain ecosystems. This enables them to be fractionalized, traded, and used as collateral.

RWAs introduce cash-flow-based demand and extra predictable financial conduct. Tokens backed by or linked to real-world belongings usually derive worth from yield era, income sharing, or rights to underlying digital tokens slightly than pure hypothesis.

2. GameFi and Twin-Token Economies

Early GameFi initiatives usually collapsed as a result of extreme emissions that rewarded extraction over engagement, highlighting the significance of sustainable token design. Fashionable dual-token economies separate in-game utility from long-term worth and governance.

One token sometimes helps gameplay mechanics and frequent transactions, whereas the second token governs ecosystem choices or captures long-term market worth. This construction permits builders to fine-tune incentives, cut back inflation, and create extra sturdy in-game economies.

3. Decentralized Bodily Infrastructure Networks (DePIN)

DePIN represents probably the most sensible evolutions of tokenomics, extending blockchain incentives into the bodily world. These networks use tokens to coordinate the deployment and operation of infrastructure similar to wi-fi connectivity, knowledge storage, vitality techniques, and sensor networks.

Tokenomics in DePIN fashions should immediately mirror real-world efficiency. Rewards are sometimes tied to metrics similar to uptime, protection, knowledge accuracy, or service demand, making certain tokens mirror precise utility slightly than passive participation.

Conclusion

In abstract, tokenomics is a essential issue that determines a crypto challenge’s sustainability, separating these with long-term potential from these doomed to fail. When investing, it is very important analysis the challenge’s tokenomics to grasp its provide construction, incentives, utility, and governance. This data will assist you make knowledgeable choices on the tokens you need to spend money on.

FAQs

What’s an instance of tokenomics?

Bitcoin is likely one of the clearest examples of tokenomics in observe. Its fastened max provide, predictable issuance schedule, and halving mechanism have been designed to create shortage and resist inflation. One other instance is Ethereum, the place tokenomics balances utility, community safety, and provide administration via fuel charges, staking, and token burning.

Why do some tokens have limitless provide?

Some tokens have a vast token provide to help ongoing community incentives and long-term sustainability. In networks that depend on validators or miners, steady issuance helps reward individuals for securing the system.

What is the distinction between circulating provide and whole provide?

Circulating provide refers back to the variety of tokens at the moment obtainable in the marketplace and freely tradable by customers. In the meantime, whole provide contains all tokens which were minted, even these which might be locked, vested, or reserved for future use.

What’s good tokenomics?

Good tokenomics aligns incentives throughout all individuals in a community. It encourages actual utilization, helps long-term safety, and distributes worth pretty with out extreme inflation or centralization. A powerful tokenomics mannequin is clear, predictable, and resilient throughout market cycles, permitting the ecosystem to develop with out counting on fixed hypothesis.

The place can I discover the tokenomic info for a crypto asset?

You will discover tokenomics particulars in a challenge’s whitepaper or official documentation. You may also verify platforms like CoinMarketCap or CoinGecko for provide knowledge, and use blockchain explorers to confirm distribution and token actions on-chain.

![Best Crypto Margin Trading Exchanges [Year]: Ranked & Reviewed](https://nftplazas.com/wp-content/uploads/2026/03/Best-Crypto-Margin-Trading-Exchanges.jpg)