Japan is reportedly prone to approve and checklist its first wave of crypto-based exchange-traded funds (ETFs) within the subsequent two years because the nation’s monetary authorities work on rule adjustments that enable the funding merchandise.

Japan To Be part of World Crypto ETF Race In Two Years

On Monday, information media outlet Nikkei Asia reported that Japan’s first crypto ETFs might be listed as early as 2028, providing retail traders simpler entry to Bitcoin (BTC) and different digital belongings.

This is able to mark a significant shift within the nation’s regulatory strategy to digital asset-based merchandise. Japanese regulators have been cautious about crypto funds, with the Monetary Companies Company (FSA) repeatedly expressing its reservations in regards to the funding merchandise.

The FSA plans to amend the Funding Belief Act’s enforcement order to incorporate cryptocurrencies within the checklist of specified belongings for ETFs. Moreover, the company will suggest stronger safeguards to guard traders, Nikkei added with out detailing its sources.

Forward of the regulatory adjustments, Japanese giants Nomura Holdings and SBI Holdings are getting ready to develop the nation’s first crypto ETFs. In August, SBI filed to launch an ETF linked to each BTC and XRP, in addition to a Digital Gold Crypto ETF, which might allocate 51% to gold and 49% to digital belongings to mitigate funding dangers.

As reported by Bitcoinist, Japan’s Minister of Finance Satsuki Katayama highlighted earlier this month that US crypto ETFs have expanded as “a way for residents to hedge in opposition to inflation.”

In her New Yr’s handle on the Tokyo Inventory Trade’s (TSE) Grand Opening Ceremony, Katayama supported a possible launch of crypto-based funding merchandise, suggesting that comparable initiatives to these of the US can be pursued in Japan.

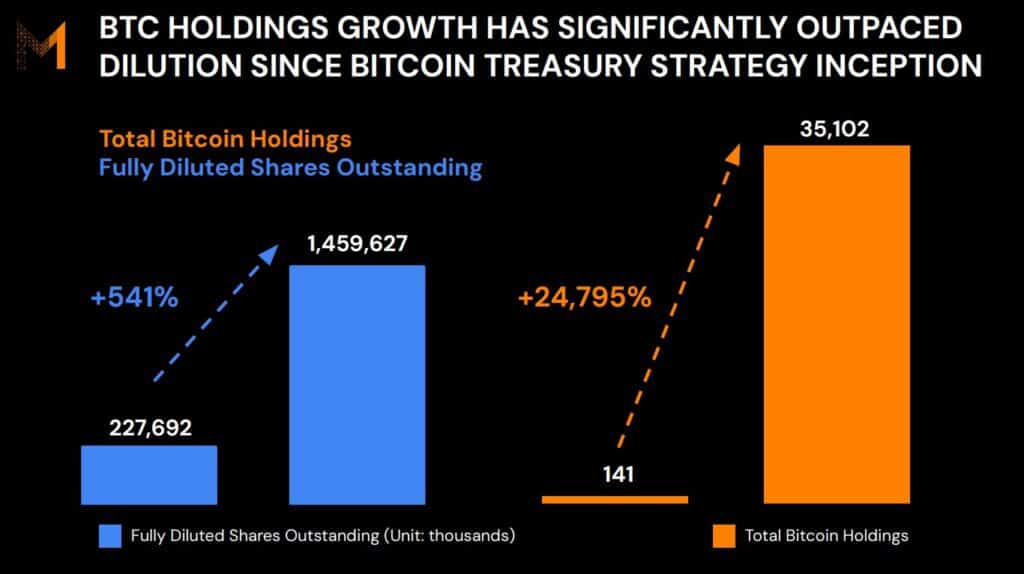

Notably, the US permitted the primary wave of spot crypto ETFs in 2024, primarily based on Bitcoin and Ethereum (ETH), main pension funds, endowment funds for main universities comparable to Harvard, and government-affiliated traders to incorporate them of their portfolios.

As of January 23, BTC funds’ whole web belongings quantity to roughly $115.8 billion, in line with SoSoValue knowledge. Nikkei famous that Japan’s asset administration business has estimated that Japanese crypto ETFs may finally attain 1 trillion yen, price round $6.4 billion.

Authorities Put together For Japan’s ‘Digital Yr’

Japanese authorities have been reviewing their regulatory system over the previous few years to develop buyer fund security insurance policies and permit innovation in a extra dependable surroundings.

Final yr, the Liberal Democratic Get together and the Japan Innovation Get together printed their upcoming FY2026 Tax Reform. The tax reform is about to introduce vital adjustments to the present taxation system, addressing the categorization and regulation of crypto belongings, and reclassifying them as monetary merchandise.

The reform indicators a shift from the regulators’ earlier remedy of digital belongings as speculative. Furthermore, authorities are additionally exploring introducing a separate taxation system for crypto earnings, with a flat 20% tax just like the inventory system.

Throughout her New Yr’s handle, Finance Minister Katayama additionally acknowledged the nation’s efforts to combine digital belongings and blockchain know-how into the native monetary markets. She expressed her help of Japan’s improvement as an asset administration nation, affirming that “there may be nonetheless room for development.”

Katayama declared that 2026 can be the “Digital Yr” for Japan, asserting that this yr “is a turning level” in overcoming deflation. Finally, she emphasised the significance of inventory exchanges in supporting the transition to a growth-oriented economic system that opens public entry to crypto belongings.

Bitcoin trades at $87,896 within the one-week chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.