Understandably, one have to be “strong-willed” to purchase Ethereum, XRP, or any top-10 altcoin taking a look at prevailing market circumstances. The previous few weeks have been brutal for promising tokens. And that is anticipated to proceed so long as Bitcoin struggles for momentum.

To place in numbers, Ethereum is down from December 2025 highs of close to $3,500. In the meantime, like Solana, Cardano, and different finest cryptos to purchase, XRP crypto, regardless of the XRP Military calling for a moonshot, slid under $2 and is but to reverse losses.

7d

30d

1y

All Time

Nonetheless, given this state of crypto market affairs, on-chain knowledge factors to a distinct story. On January 26, Santiment, an on-chain intelligence platform, mentioned XRP and Ethereum are sitting in an “undervalued” zone primarily based on market worth to realized worth (MVRV) ratio.

The decrease a coin's 30-day MVRV is, the much less threat there’s in opening or including on to your place.

A coin having a unfavorable share means common merchants you're competing with are down cash, and there is a chance to enter whereas earnings are under the conventional… pic.twitter.com/YH8y4IzkWc

— Santiment (@santimentfeed) January 26, 2026

DISCOVER: Greatest Meme Coin ICOs to Put money into 2026

XRP Crypto and Ethereum Holders In “Ache”

For novices, the MVRV ratio gauges the “well being” of the asset in query. On this case, it’s all about XRP and ETH crypto costs. What it does is straightforward: It compares the present market value, that’s, what it’s promoting for now, to the typical value everybody paid to get their cash.

When the ratio is excessive, it means holders are in revenue, and the other is true. Total, analysts use this metric to find out if a market is overheated (overvalued) or if everyone seems to be in “most ache” (undervalued).

The 30-day MVRV by Santiment appears solely at individuals who purchased within the final month. When that quantity turns unfavorable, it means current patrons are down cash on common. Santiment treats this zone as “undervalued” as a result of sellers really feel strain and fewer folks rush to take earnings.

Given this discovering, it seems that ETH and XRP crypto costs are presently buying and selling under the typical entry value, and holders are underneath strain and within the pink. When Santiment shared their findings, the Ethereum 20-day MVRV stood at almost -8%, whereas XRP crypto was at -6%.

Curiously, the identical metric for Bitcoin was barely constructive. This reveals that regardless of all eyes monitoring Bitcoin, patrons who scooped the digital gold throughout the final 30 days are at or above break-even. In the meantime, those that purchased ETH or XRP crypto at the moment are feeling the ache and would possibly promote and capitulate, heaping extra strain on the worth.

DISCOVER: 9+ Greatest Memecoin to Purchase in 2026

Reduction Incoming for XRP USD and Ethereum Crypto?

The excellent news is that the 30-day MVRV for Bitcoin is constructive. If it have been in unfavorable territory, any sell-off would threat dragging the entire market with it. When this occurs, as current value motion reveals, not solely will ETH USD and XRP crypto dump, however the affect spreads, influencing sentiment, and resulting in redemptions throughout spot XRP and Ethereum ETFs.

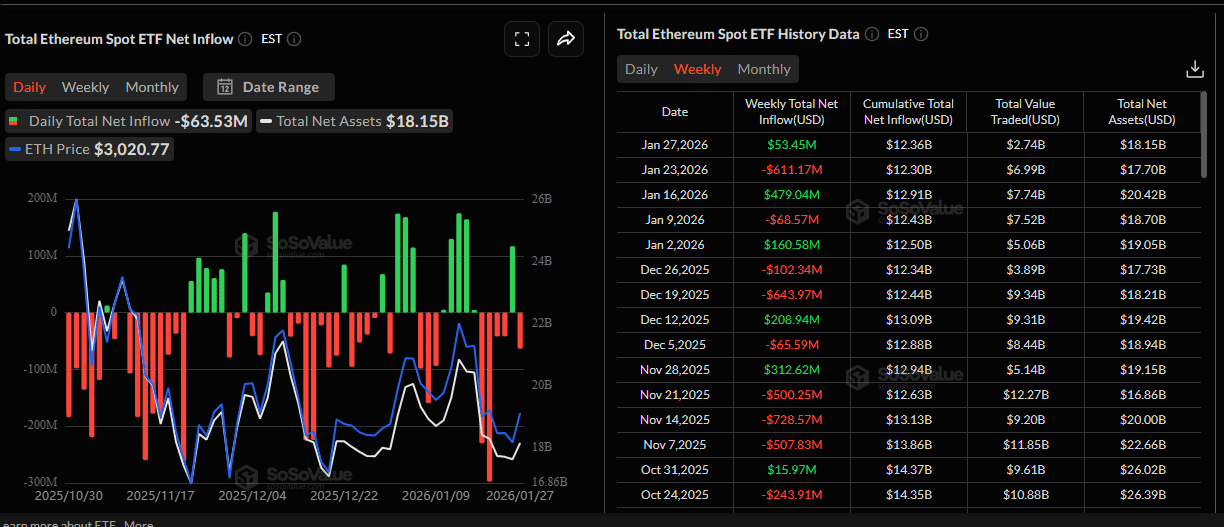

Ethereum crypto costs fell in the previous few weeks following large spot ETF outflows. Trackers present that over $611M of spot Ethereum ETF shares have been redeemed, weighing negatively on value.

(Supply: SosoValue)

In addition to ETFs, it stays to be seen whether or not the upcoming Glamsterdam improve in H1 2026 would entice institutional funding in Ethereum. By the top of the 12 months, builders may also implement the Hegota improve. Each of those updates will make the community lighter, extra performant, and dependable, permitting establishments to run nodes safely.

Whereas ETH USD posted losses, the sell-off in XRP crypto has been sharper. Particularly, the drop under $3 and later $2 was principally as a consequence of macro nerves. Threats of extra tariffs to eight European nations, coupled with a weaker Bitcoin, accelerated the dump.

7d

30d

1y

All Time

Nevertheless, there’s confidence that XRP crypto may flip the nook. With the authorized battle absolutely settled, the “regulatory threat” that suppressed XRP for years is gone. This readability has reopened doorways for US-based banks and controlled funds to make use of XRP for cross-border settlements with out authorized concern.

The combination of the RLUSD into the XRP Ledger is the much-needed “bridge” for TradFi. Whereas RLUSD offers stability, XRP stays the “fuel” and utility token that powers these high-speed transactions.

Ripple's Brad Garlinghouse solutions how prime brokers can carry establishments into DeFi.$XRP $RLUSD pic.twitter.com/SicNaiywl3

— ALLINCRYPTO (@RealAllinCrypto) January 28, 2026

The extra RLUSD finds adoption amongst establishments, the extra fuel is required for transaction affirmation. To date, RLUSD is among the many largest stablecoins, commanding a market cap of $1.4Bn.

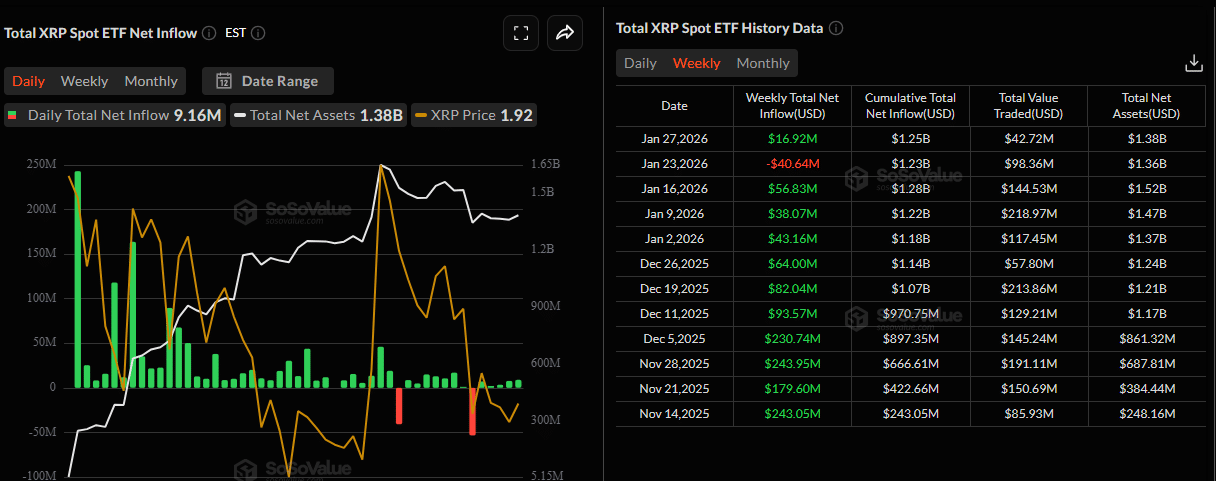

Establishments are additionally flocking to XRP. Information reveals regular inflows to identify XRP ETFs from November 2025 untill final week indicating that the large boys may very well be “accumulating” XRP as a structural asset.

(Supply: SosoValue)

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ This autumn 2025 State of Crypto Market Report

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation.

The submit Santiment Flags XRP and Ethereum as Undervalued After Pullback appeared first on 99Bitcoins.