Tether CEO Paolo Ardoino has revealed that the USDT issuer has elevated its gold purchases and plans to proceed doing so over the following few months. This has prompted hypothesis that the stablecoin issuer is abandoning Bitcoin for the dear steel, although that’s not the case.

Tether To Preserve Investing In Each Bitcoin and Gold

In line with a Reuters report, the Tether CEO mentioned his firm plans to proceed investing in Bitcoin and gold as its reserve property. He said that it was cheap to allocate roughly 10% of their portfolio to BTC and 10%-15% to gold. The stablecoin issuer notably makes use of gold as a part of the reserves for the USDT stablecoin and in addition to again its XAUT gold token, which has a market cap of $2.6 billion.

Bloomberg reported that the USDT issuer holds roughly 140 tons of gold, based on Ardoino. The stablecoin issuer’s holdings are valued at round $24 billion, representing the biggest identified hoard outdoors central banks, ETFs, and industrial banks. In a latest launch, Tether introduced that it now ranks among the many prime 30 world gold holders, surpassing nations similar to Greece, Qatar, and Australia.

The Tether CEO revealed that they’ve been shopping for at a fee of about one to 2 tons per week and plan to maintain doing so for at the least the following few months. At present costs, that equates to about $1 billion in month-to-month purchases. Regardless of the numerous curiosity in gold, the USDT issuer has not deserted its Bitcoin technique.

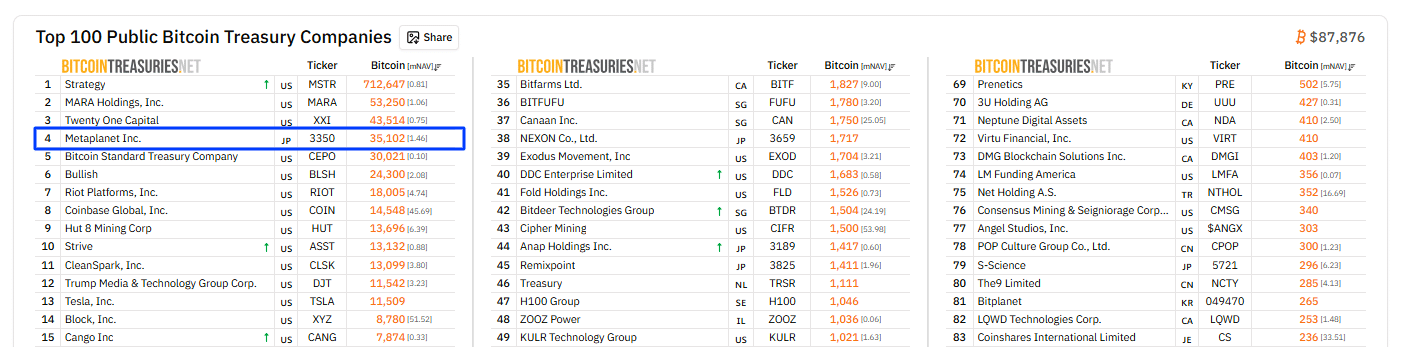

Tether bought 8,888 Bitcoin, valued at roughly $779 million, within the fourth quarter of final 12 months. The stablecoin issuer at the moment holds 96,370 $BTC($8.46 billion) in whole. Primarily based on these holdings, it ranks because the second-largest company Bitcoin holder, solely behind Michael Saylor’s Technique, which holds 712,647 BTC.

The Lengthy-Time period Aim For Tether

Throughout his interview with Bloomberg, Ardoino described Tether’s function within the gold market as just like a central financial institution. This got here as he mentioned the stablecoin issuer is successfully changing into one of many world’s largest gold central banks. Their bullish outlook for gold seems to partially stem from the assumption that America’s geopolitical rivals will launch a gold-backed various to problem the greenback’s standing because the reserve foreign money.

In the meantime, the Tether CEO revealed that they aren’t trying to solely maintain gold but in addition commerce it, competing with banks in buying and selling the dear steel. Ardoino said that they must be one of the best gold buying and selling flooring on the earth to proceed accumulating it over the long run. His feedback come at a time when gold is reaching new all-time highs (ATHs) above $5,300. In the meantime, Bitcoin continues to lag, buying and selling under $90,000.

Featured picture from Getty Photographs, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.