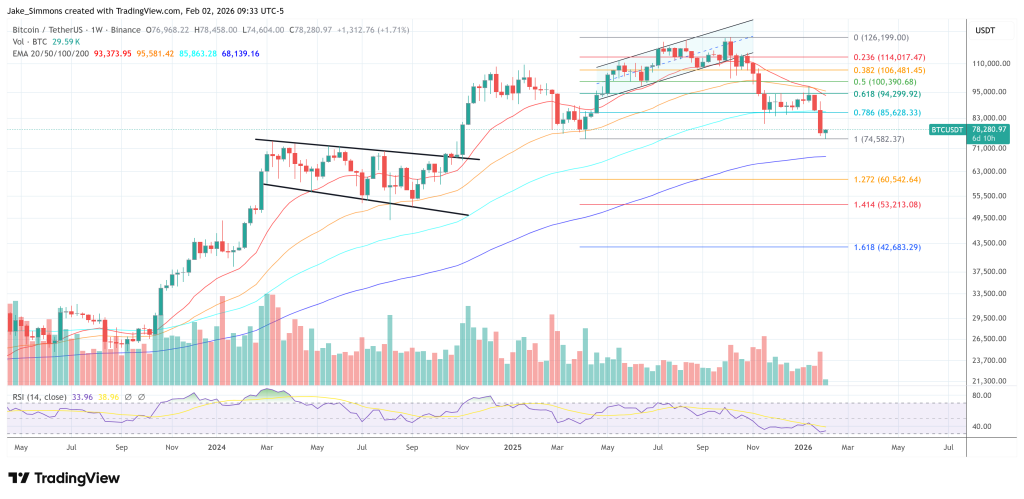

Bitcoin’s newest drawdown is being framed much less as a technical breakdown and extra as a liquidity downside, with Ki Younger Ju arguing that the important thing inputs that sustained the rally recent capital inflows have stalled. In that setup, he says, requires a full-cycle, -70% fashion capitulation hinge on a single variable: whether or not Technique turns from purchaser to significant vendor.

Will Bitcoin Expertise One other -70% Bear Market?

In a Feb. 1 publish, Ki mentioned “Bitcoin is dropping as promoting stress persists, with no recent capital coming in.” He pointed to a flatlining Realized Cap as proof that incremental cash is now not getting into the market, and tied that on to market construction. “Realized Cap” has flatlined, that means no recent capital. When market cap falls in that surroundings, it’s not a bull market.”

His learn is that the profit-taking has been there for some time, it was merely absorbed. Early holders, he wrote, have been “sitting on massive unrealized positive aspects due to ETFs and MSTR shopping for,” and “have been taking income since early final yr, however sturdy inflows saved Bitcoin close to 100K.” The change now, in his telling, is that the bid that mattered most has light: “Now these inflows have dried up.”

Associated Studying

That’s the place the crash math modifications. Ki described Technique (MSTR) as “a significant driver of this rally,” however argued the reflexive draw back seen in prior cycles is unlikely and not using a decisive reversal from the corporate’s stability sheet technique. “Until Saylor considerably dumps his stack, we received’t see a -70% crash like earlier cycles,” he wrote, carving out an express situation slightly than presenting the drawdown as inevitable.

Even so, he didn’t declare the market has discovered a ground. “Promoting stress remains to be ongoing, so the underside isn’t clear but,” Ki mentioned, including that the extra possible path is time, not a straight-line liquidation. His base case is “a wide-ranging sideways consolidation,” a regime the place volatility can persist however route turns into more durable to maintain with out new marginal consumers.

Stablecoin Liquidity Dries Up

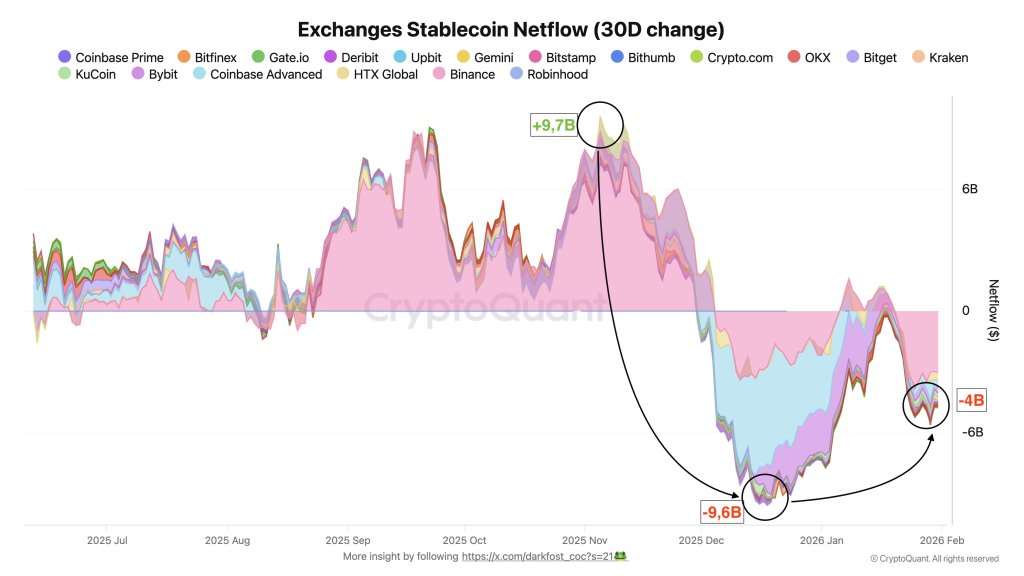

CryptoQuant contributor Darkfost added coloration on what “no recent capital” appears to be like like within the plumbing. He argued stablecoin exercise, typically handled as a near-term proxy for deployable crypto liquidity, has rolled over sharply as uncertainty stays elevated.

Associated Studying

“The crypto market is at present going by a fragile part, marked by a structural lack of liquidity in a context of persistently excessive uncertainty,” he wrote, calling it an surroundings “not conducive to threat taking,” particularly relative to property like treasured metals and equities which can be nonetheless drawing flows.

Darkfost mentioned the stablecoin market had expanded by greater than $140 billion since 2023, however that whole stablecoin market capitalization started declining in December, “placing an finish to this sustained development development.” The extra actionable sign, he argued, is alternate flows: “Robust inflows usually point out a willingness to realize publicity to the market, whereas outflows as a substitute counsel capital preservation and a discount in threat.”

He highlighted October because the final clear liquidity-heavy month, when “common month-to-month stablecoin netflows exceeded $9.7B,” with almost $8.8B focused on Binance alone—situations that “supported Bitcoin’s rally towards a brand new all time excessive.” Since November, he mentioned, these inflows have been “largely worn out,” with an preliminary $9.6 billion drop, then a short stabilization, adopted by renewed internet outflows of greater than $4 billion, together with $3.1 billion from Binance.

At press time, BTC traded at $78,280.

Featured picture created with DALL.E, chart from TradingView.com