Binance has returned to the middle of market consideration following the October 10 crash, an occasion that marked some of the violent deleveraging episodes of the present cycle. On that day, a pointy wave of liquidations swept via derivatives markets, erasing billions in open curiosity and exposing the extent of extreme leverage throughout a number of exchanges.

Binance stood out throughout the turmoil not as a result of it drove the sell-off, however as a result of its liquidation footprint was notably smaller relative to its market share, highlighting variations in leverage focus and danger administration in contrast with rival platforms.

Quick ahead to at the moment, and the broader market backdrop stays fragile. Bitcoin is buying and selling beneath the $80,000 degree, whereas Ethereum has slipped beneath $2,300, reinforcing the notion that the market has entered a corrective, if not outright bearish, section. Macro uncertainty, shrinking liquidity, and weakening spot demand have led many analysts to anticipate additional draw back earlier than any sturdy stabilization can happen.

In opposition to this backdrop, new knowledge from Arkham has added an sudden twist. Arkham stories that Binance’s SAFU fund has begun accumulating Bitcoin, buying 1,315 BTC—price roughly $100 million—inside the final hour. This transfer contrasts sharply with prevailing risk-off sentiment and means that, whilst costs pattern decrease, Binance could also be positioning defensively or opportunistically amid market stress.

Many analysts have been fast to level fingers at Binance and its founder, Changpeng Zhao, following the most recent wave of market weak point. The criticism largely stems from Binance’s dominant place in international derivatives buying and selling, its deep liquidity swimming pools, and its outsized affect on funding charges, open curiosity, and liquidation dynamics.

In durations of stress, any sharp transfer originating on Binance tends to ripple throughout the whole crypto ecosystem, reinforcing the notion that the alternate acts as a central transmission level for volatility.

Nonetheless, regardless of the depth of those claims, there’s at the moment no concrete on-chain or market proof exhibiting that the alternate or CZ actively triggered or engineered the current sell-off. Liquidation knowledge means that leverage was extensively distributed throughout a number of platforms, and in a number of cases, Binance recorded a smaller share of compelled liquidations relative to its market share. This weakens the argument that Binance was the first supply of systemic stress.

What seems extra probably is that Binance is being conflated with broader structural points: extreme leverage, thinning liquidity, and fragile investor sentiment. These situations can amplify strikes no matter the place they start. The approaching days will likely be vital. How worth reacts, how leverage resets, and whether or not spot demand returns will decide whether or not the market stabilizes—or confirms {that a} deeper bearish section is unfolding.

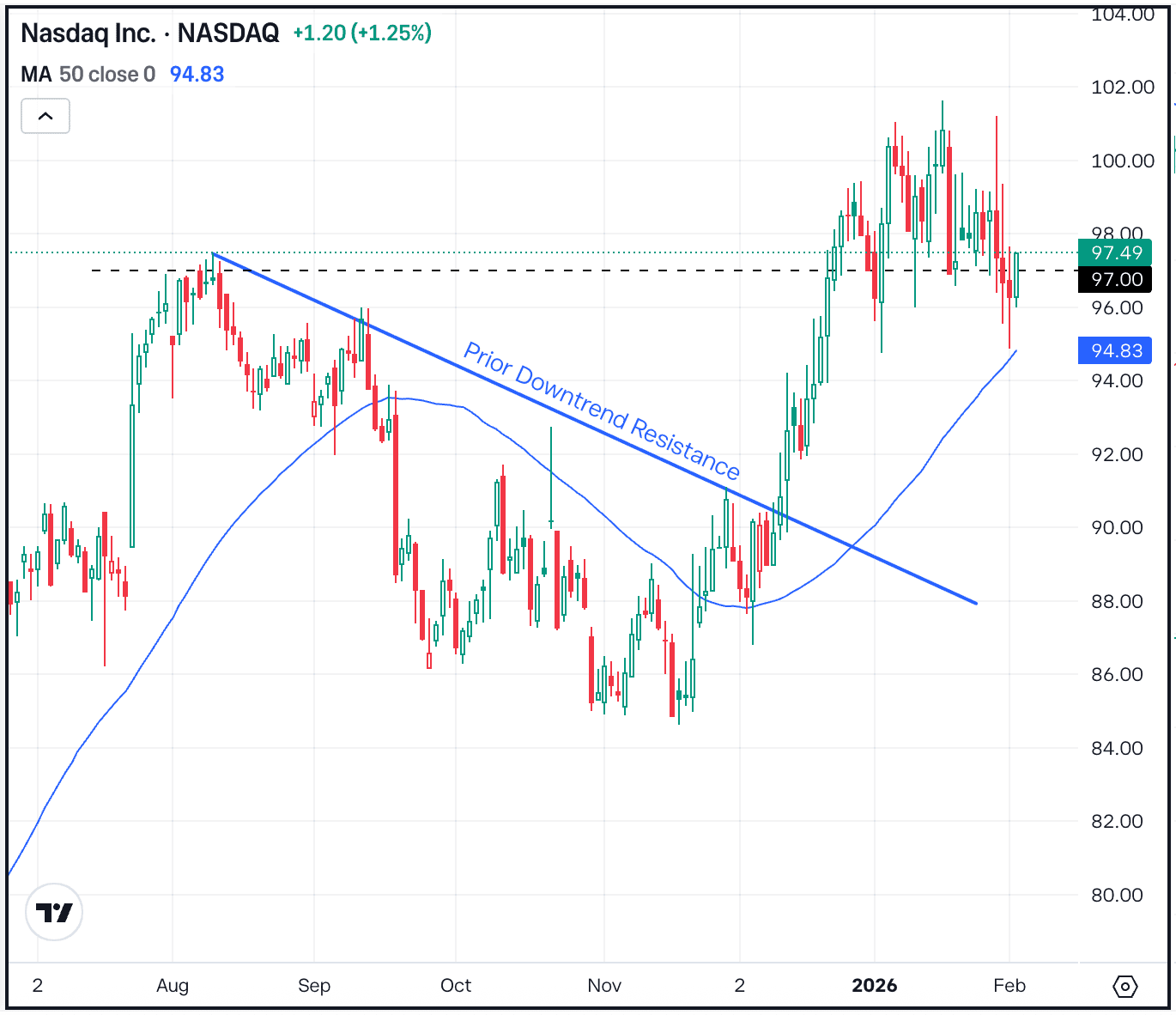

Bitcoin’s weekly chart displays a transparent shift in market construction following the lack of the $80,000 psychological degree. After failing to reclaim the 50-week shifting common (blue line), BTC has resumed its downward trajectory, confirming this zone as lively resistance quite than momentary consolidation. The rejection close to the mid-$90K space marked a decrease excessive relative to the 2025 peak, reinforcing a broader bearish pattern on greater timeframes.

Worth is now buying and selling beneath each the 50-week and 100-week shifting averages, whereas the 200-week shifting common (pink line) continues to rise properly beneath present ranges. This configuration traditionally alerts a transition section, the place momentum has turned unfavorable however long-term structural help has not but been examined. The current breakdown towards the $74,000–$78,000 vary locations Bitcoin again close to a former high-volume space from early 2025, which can provide short-term stabilization however doesn’t but qualify as a confirmed backside.

Quantity dynamics add to the cautionary outlook. Promoting stress has elevated on down weeks, whereas rebound makes an attempt have been accompanied by weaker quantity, suggesting restricted conviction from consumers. This sample aligns with distribution quite than accumulation.

Except Bitcoin can reclaim and maintain above the 50-week shifting common, the trail of least resistance stays to the draw back. On this context, the market seems to be getting into a corrective or early bear section, with additional draw back danger towards deeper demand zones nonetheless unresolved.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.