The Bitcoin value bounced emphatically off assist at $60,000 within the first sturdy sign of bottoming exercise, after giving up all of its Trump rally good points – however is it Trumpism in crypto that’s on the root of crypto’s ills?

There’s definitely extra hope within the air because the European session opens this morning, with Bitcoin buying and selling above $66,400.

However all of the elements that created the crash are nonetheless very a lot in play. Crypto leverage, crowded tech trades, high-risk asset correlation and Bitcoin narrative doubts are all within the bear market combine.

Fireplace up your Bloomberg terminal and create a chart to indicate the correlation between Bitcoin (XBT/USD), The Magnificent 7, tech shares (BM7T) and the Bloomberg AI Worth Chain Whole Return Index (BAIVT) and you will notice the next (because of Kathleen Brooks, analysis director at brokerage XTB):

Brooks explains what’s occurring right here: “The sell-off in bitcoin can also be attention-grabbing, as bitcoin and the Nasdaq have a tendency to maneuver collectively, and their constructive correlation is 40%. This can be a average constructive correlation, nevertheless, the correlation between bitcoin and Bloomberg’s basket of AI shares have a more in-depth constructive relationship, at 62%.

“This means that when Bitcoin strikes, it has an impression on AI shares. The rationale for that is liquidity. Lately, liquidity has flowed throughout digital property and superior tech shares on the identical time. Which means each asset lessons share a decent monetary hyperlink, which is impacted by shifts in liquidity patterns.

“So, when bitcoin gained power, this flowed into AI shares, and when the worth of bitcoin falls, this draw back strain can weigh on tech shares.”

However what concerning the Trump issue? I requested Brooks for her take: “I feel that the Trump household’s crypto pursuits are grubby, however I don’t assume that’s the fundamental motive for traders deserting crypto in current months.

Billionaire GOP Donor Ken Griffin Criticizes Trump Administration For ‘Enriching’ Household Membershttps://t.co/04YcnBglX5 pic.twitter.com/xbz9zrRJAR

— Forbes (@Forbes) February 4, 2026

“I feel Trump’s insurance policies, his threats to take Greenland by power, ditching his allies, and threatening Fed independence are literally hurting the surroundings for crypto.

“Crypto nonetheless has very restricted makes use of, so when the geopolitical outlook/order is upended by a US President with an America First agenda, this makes it even much less enticing to carry.”

Brook then turned to what she sees because the technical elements at play: “Prior to now few months, traders have been very cautious of property which have reached document highs, crypto was the primary asset the place valuations appeared stretched and traders offered their stakes, wth few consumers to select up the dip.

“That is taking place with silver now and to a lesser extent with gold. Thus, the sell-off in crypto is a part of a market-wide occasion with merchants and traders reassessing valuations and the way a lot danger they’re keen to carry in richly valued property.”

7d

30d

1y

All Time

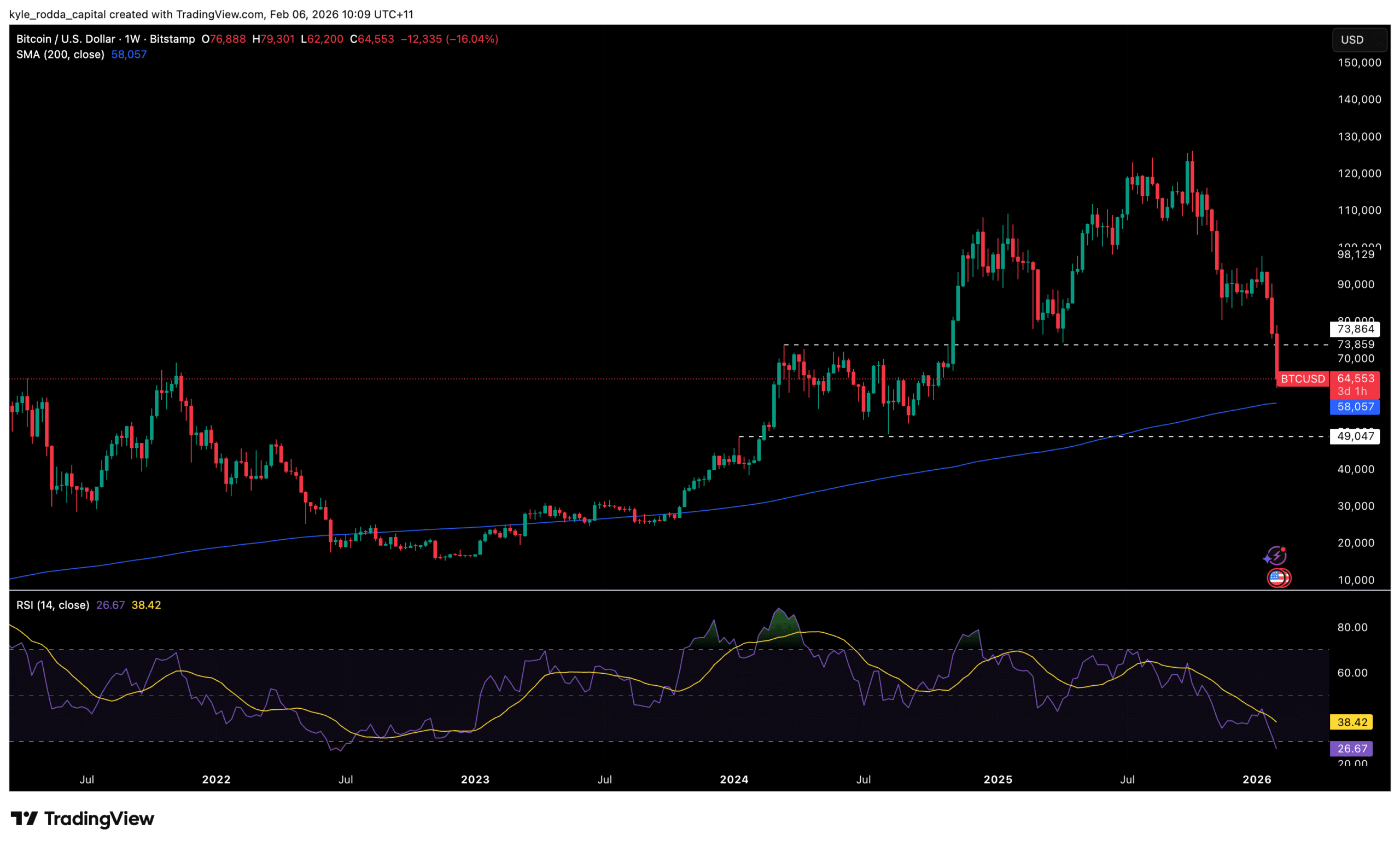

Bitcoin wants to carry above $58,000 and $60,000

On the finish of the Asia session, Allen Ding, head of analysis on the Hong Kong-licensed digital asset supervisor Bitfire, issued a be aware outlining the market’s precarious state heading into the weekend.

He thinks if Bitcoin doesn’t maintain $60,000 or $58,000, a deeper correction is on the playing cards.

“Technically, Bitcoin accelerated its decline after breaching the important thing $74,000 assist. Whereas oversold situations trace at a short-term bounce, focus shifts to the weekly EMA240 and the $60,000 degree as the subsequent vital assist,” Ding explains.

He concludes that we’re witnessing the unravelling of the supportive sentiment round high-risk property. He feedback, “A extreme shake-up in international danger property, with silver costs collapsing and Korean shares alongside the Nasdaq tumbling.

“Fed expectations shifted, prompting a broad retreat from danger property, whereas Bitcoin ETFs noticed sustained outflows, Coinbase’s destructive premium widened, and institutional bids weakened.

A wave of liquidation from leveraged Ethereum, amplified by programmed stop-losses, triggered a promoting cascade.”

Chart: Bitcoin/USD Feb fifth 200-day SMA – Due to Kyle Rodda, Senior Monetary Market Analyst at Capital.com.

DISCOVER: 20+ Subsequent Crypto to Explode in 2026

Fed worries shift, Citadal Securities breaks cowl on Trump

Let’s pull out the half Ding mentions concerning the Fed choose – ‘Fed expectations shifted’ could show to be the understatement of this quarter. Kevin Warsh was within the checklist of doubtless contenders, however his choice has nonetheless injected but extra uncertainty into the macro surroundings.

Warsh was beforehand seen as a hawk. So, if his “I’m a low charges man” ingratiation technique with President Trump proves to be paper-thin and he begins working down the Fed’s bloated steadiness sheet, that’s not accommodative of an expansionary situation. Trump’s plan is to throw cash on the voters within the lead-up to the November midterms.

And that brings us again to the Trump Midas contact in reverse that nobody desires to speak about, or not less than, not out loud.

One in every of my sources at Citadel Securities lately instructed me that egrets have been rising concerning the Trump administration. Citadel is likely one of the largest market-makers on Wall Road, and its boss, Ken Griffin, is a serious Republican donor.

His firm was behind the organising of EDX Markets in 2023 and later moved into crypto market-making in the beginning of final 12 months, taking its cue from the incoming administration’s avowed crypto-friendliness.

Though Griffin thinks Warsh will likely be a “stable” Fed choose that places to mattress worries about Fed independence, he’s not so certain about all the pieces else the Trump White Home is as much as. In accordance with Bloomberg, Griffin broke cowl at a current Wall Road Journal occasion:

Citadel’s Ken Griffin stated the Trump administration’s tendency to reward loyalists doesn’t play effectively with enterprise executives and criticized the president’s willingness to counterpoint his household whereas in workplace.

“Most CEOs don’t need to discover themselves within the enterprise of sucking as much as one administration,” Griffin stated in an interview Tuesday at a Wall Road Journal occasion. When the US authorities “tastes of favoritism,” executives fear they may win or lose primarily based on whether or not they publicly assist the administration, he added.

At a minimal, the Trump household’s ‘grubby’ pursuits aren’t serving to crypto

Though Brooks doesn’t purchase the road that it’s all Trump’s fault, she does agree that the administration’s actions and the Trump household’s “grubby” dealings aren’t serving to in opposition to the backdrop of extra consequential market-moving developments.

If there’s one description that, for a lot of, sums up the Trump model, it’s grifting, and the hazard is that it has rubbed off on crypto.

Companies want state constructions they will belief to be honest and even-handed when adjudicating between opponents available in the market. Crypto must rebuild religion in its narratives or set up use instances that obtain the identical outcomes. If crypto is seen as a approach for the Trump household to counterpoint itself on the expense primarily of retail traders, it is going to depart a bitter style within the mouth.

Delivering a CLARITY Act that actually works for crypto and all market contributors, and the emergence of killer apps, with Polymarket’s prediction market maybe the primary, may begin to change it up in a extra constructive route for crypto.

Within the meantime, the leverage must be expunged and the market construction repaired, which partially requires Trump to pipe down – in the beginning of the week, he remarked that he was “an enormous crypto particular person” – and for his crypto corporations to vanish. Brutal, however right here we’re. Sufficient already.

The put up Bitcoin Value Crash – Is it All Donald Trump’s Fault? appeared first on 99Bitcoins.