If cryptocurrency costs confuse you, you’re not lacking a secret method. There isn’t one. The crypto market runs on provide, demand, and human habits—identical to each different market. The distinction is depth. This text explains how crypto costs rise, fall, and stall, utilizing on a regular basis examples so you may learn worth motion with out guessing.

Desk of Contents

1How Any Market Decides PricesSupply, Demand, and Worth: The On a regular basis StoryWhy “Extra Patrons than Sellers” Pushes the Worth UpWhy “Extra Sellers than Patrons” Pushes the Worth DownWhat an Order Ebook Is in Plain LanguageMarket Orders and Restrict OrdersHow the “Final Traded Worth” Is DecidedLiquidity and Slippage: Why Skinny Markets Swing HarderSlippage: Why Massive Market Orders Transfer PriceWhy Small-Cap Cash with Low Buying and selling Quantity Are Additional JumpyVolatility: The Dimension and Pace of Worth MovesWhat Makes Crypto Completely different from Different Markets?24/7 World Buying and selling, No Closing BellWhy Crypto Trades Each Hour, Each DayWeekend and In a single day Strikes: When Liquidity Is ThinnestA Younger Asset Class with Evolving RulesSmaller Market Capitalization vs. Shares and ForexFewer Mature Safeguards and Circuit BreakersFaster-Altering Narratives (L1s, Memecoins, DeFi Waves)Why Bitcoin (BTC) Usually Drags the Entire MarketBitcoin (BTC) because the Reference Asset and “Crypto Index”Why Many Altcoins Observe BTC Up and DownCorrelation vs. Unbiased Strikes (When Alt Narratives Decouple)Crypto Asset Varieties: Bitcoin, Altcoins and StablecoinsBitcoin (BTC): Digital TrendsetterFixed Provide and the 21 Million CapThe Narrative of BTC as “Digital Gold” vs. RealityWhy BTC Tends to Be Much less Risky than Small AltcoinsAltcoins: Extra Upside, Extra ChaosWhat We Imply by Altcoins (L1s, L2s, DeFi Tokens, Memecoins)Smaller Market Caps, Thinner Liquidity, Extra SpeculationStablecoins: “Secure” Cash That Nonetheless Transfer MarketsWhy Merchants Park Funds in Stablecoins Throughout UncertaintyHow Flows Between Stablecoins, BTC and Altcoins Drive Worth SwingsStructural Worth Drivers: Provide, Demand and TokenomicsCirculating Provide and Demand for a CryptocurrencyDemand for a Cryptocurrency: Utility, Hypothesis, NarrativeWhy Worth Can Fall Even with a Fastened or Capped SupplyToken Provide Schedules and EmissionsToken Provide Schedule: Emissions, Unlocks, VestingInflationary vs. Deflationary Token ModelsHow Upcoming Unlocks or Cliffs Can Stress PriceBitcoin Halving and Related EventsBurns, Staking and Lock-UpsHuman Psychology: Sentiment, FOMO and FUDMarket Sentiment: The Crowd’s MoodFOMO: Worry of Lacking OutFUD: Worry, Uncertainty, and DoubtMeasuring Sentiment: Worry & Greed and BeyondMarket Members and Market Construction: Who Strikes the Worth?Who Is Truly Buying and selling?Exchanges and Venues: CEX vs. DEXOrder Books, Spreads and Market MakersMarket Manipulation vs. Regular VolatilityLeverage, Derivatives and Liquidation CascadesWhat Is Leverage in Crypto Buying and selling?Crypto Derivatives at a GlanceForced Liquidations: When the Change Closes Your TradeExternal Forces: Regulation, ETFs, Curiosity Charges and Macro NewsRegulation and Coverage: Bans, Crackdowns and ApprovalsSpot Bitcoin ETFs and Entry ProductsInterest Charges, Inflation and Threat AppetiteGeopolitical Shocks and World EventsOn-Chain Knowledge, Adoption and Actual-World UsageHow Learners Can Handle Threat in a Risky Crypto MarketPosition Sizing and “Cash You Can Afford to Lose”Time Horizons: Dealer, Investor or Explorer?Easy Instruments for Taming VolatilityEmotional Guidelines for YourselfFinal Ideas

How Any Market Decides Costs

Each market follows easy guidelines: worth varieties the place consumers and sellers agree. That time displays market worth. Merchants estimate truthful worth, however the precise worth depends upon exercise.

Provide, Demand, and Worth: The On a regular basis Story

At its core, worth comes from provide and demand. Provide is how a lot of one thing exists. Demand is how many individuals need it. When demand will increase, consumers compete, and costs rise. When curiosity fades, costs fall.

Many components affect this stability, from hype to utility.

Excessive demand pushes costs up quickest when provide is proscribed. In crypto, some property have a set provide, that means no further cash can seem to satisfy demand. Bitcoin is a transparent instance: solely a restricted variety of new bitcoins enter circulation over time, and the entire provide is capped.

Think about it like a sold-out live performance. The venue releases a set variety of tickets. At first, the costs are regular. Then demand spikes, followers rush in, and resale costs climb quick. Nothing in regards to the ticket modified. Solely demand did.

Why “Extra Patrons than Sellers” Pushes the Worth Up

When consumers outnumber sellers, urgency takes over. Patrons settle for excessive costs simply to get crammed. Sellers discover and lift their asks. Every accomplished commerce confirms the brand new stage. Worth begins to achieve momentum.

If a big quantity of consumers retains coming in, worth doesn’t cease at one stage. It steps greater as sellers modify. Because of this markets can rise shortly even with out main information. Stress alone can transfer worth.

Why “Extra Sellers than Patrons” Pushes the Worth Down

When sellers rush to exit, consumers decelerate. Sellers undercut one another to get crammed. Worth drops till demand returns. That reset is a worth correction.

Throughout corrections, many cryptocurrencies lose worth directly. It doesn’t at all times imply one thing is damaged. It typically means the market moved too quick and must rebalance.

What an Order Ebook Is in Plain Language

An order e-book is a reside checklist of intentions. One facet reveals purchase orders. The opposite reveals promote orders. Every entry features a worth and an quantity.

When a purchaser agrees to a vendor’s worth, a commerce occurs. The order e-book updates immediately. That is provide and demand in actual time.

Market Orders and Restrict Orders

A market order trades instantly at the very best out there worth. A restrict order waits at a particular worth.

Market orders “hit” the order e-book. Restrict orders wait to be hit.

Heavy market orders enhance buying and selling quantity and transfer worth sooner. Quiet markets rely extra on restrict orders and transfer slowly. How merchants place orders impacts how wild worth swings really feel.

How the “Final Traded Worth” Is Determined

The worth you see is straightforward. It’s the newest commerce. Nothing extra.

Charts, tickers, and apps all pull this quantity from market knowledge. When trades occur quickly, worth updates consistently. When exercise slows, worth barely adjustments. There’s no secret method. Simply the final settlement between purchaser and vendor.

Liquidity and Slippage: Why Skinny Markets Swing More durable

Image a store with full cabinets. Prospects come and go. Costs keep secure. That’s robust market liquidity.

Now think about practically empty cabinets. One shopper clears stock and forces costs up. Crypto markets behave the identical means. Fewer orders imply larger worth jumps.

Market liquidity measures how simply you may commerce with out pushing worth round. Deep markets take in giant orders easily, and skinny markets don’t.

Low liquidity means fewer orders to soak up strain. Excessive liquidity retains worth motion managed. Many sharp crypto strikes come from skinny liquidity, not sudden information.

Learn extra: What Is Liquidity in Crypto?

Slippage: Why Massive Market Orders Transfer Worth

Slippage seems when your order is bigger than close by liquidity. Your commerce consumes a number of worth ranges. The ultimate fill finally ends up worse than anticipated.

This hurts most throughout quick strikes and in smaller markets. Restrict orders assist management slippage, however they could not fill if worth strikes away.

Why Small-Cap Cash with Low Buying and selling Quantity Are Additional Jumpy

Small cash commerce much less typically. Low buying and selling quantity means fewer consumers and sellers are energetic. One commerce can transfer worth sharply.

That’s why crypto volatility spikes in small caps. Huge candles don’t at all times sign huge information. Generally it’s simply skinny liquidity doing the injury.

Volatility: The Dimension and Pace of Worth Strikes

Volatility measures how briskly and much costs transfer. Excessive worth volatility means giant swings briefly timeframes. Crypto volatility stays excessive as a result of markets are younger, liquid at occasions, and pushed by sentiment.

What Makes Crypto Completely different from Different Markets?

Crypto follows primary market guidelines, however the context is completely different. The cryptocurrency trade continues to be younger, fast-moving, and world by default. You don’t commerce shares or bonds right here. You commerce digital property inside a rising cryptocurrency ecosystem, the place costs react sooner to information, sentiment, and flows than conventional markets.

24/7 World Buying and selling, No Closing Bell

Crypto by no means sleeps. There’s no opening bell, no closing public sale, and no weekend pause. Buying and selling runs nonstop, throughout time zones. This fixed exercise shapes market traits in a different way. Strikes don’t anticipate Monday. They occur each time folks react, wherever they’re.

Why Crypto Trades Each Hour, Each Day

Crypto markets keep open as a result of blockchains by no means shut down. Anybody can commerce at any time. When market information breaks, worth reacts instantly. There’s no delay and no after-hours hole. This makes crypto really feel sooner and, at occasions, extra chaotic than shares.

Weekend and In a single day Strikes: When Liquidity Is Thinnest

Weekends typically see low liquidity. Fewer merchants keep energetic. Order books skinny out. Small trades can transfer worth greater than traditional. That’s why sharp weekend strikes are frequent, even with out main information.

A Younger Asset Class with Evolving Guidelines

Crypto hasn’t had a long time to stabilize. Many tokens behave like speculative property, not mature investments. Costs swing more durable. Narratives shift sooner. That’s why crypto typically appears like a riskier asset in comparison with shares or bonds.

Smaller Market Capitalization vs. Shares and Foreign exchange

Crypto markets are small in comparison with conventional monetary markets. Even Bitcoin’s market capitalization is tiny subsequent to world equities or foreign exchange. Much less capital means costs react extra sharply to inflows and outflows.

Fewer Mature Safeguards and Circuit Breakers

Conventional markets depend on a centralized authority. Exchanges can halt buying and selling, and regulators can step in.

Crypto lacks many of those brakes. That openness permits innovation, however it additionally permits sooner crashes and rallies when sentiment flips.

Sooner-Altering Narratives (L1s, Memecoins, DeFi Waves)

Crypto runs on tales. Basic curiosity shifts shortly from one theme to a different. These narrative waves pull capital across the market, typically sooner than fundamentals can catch up.

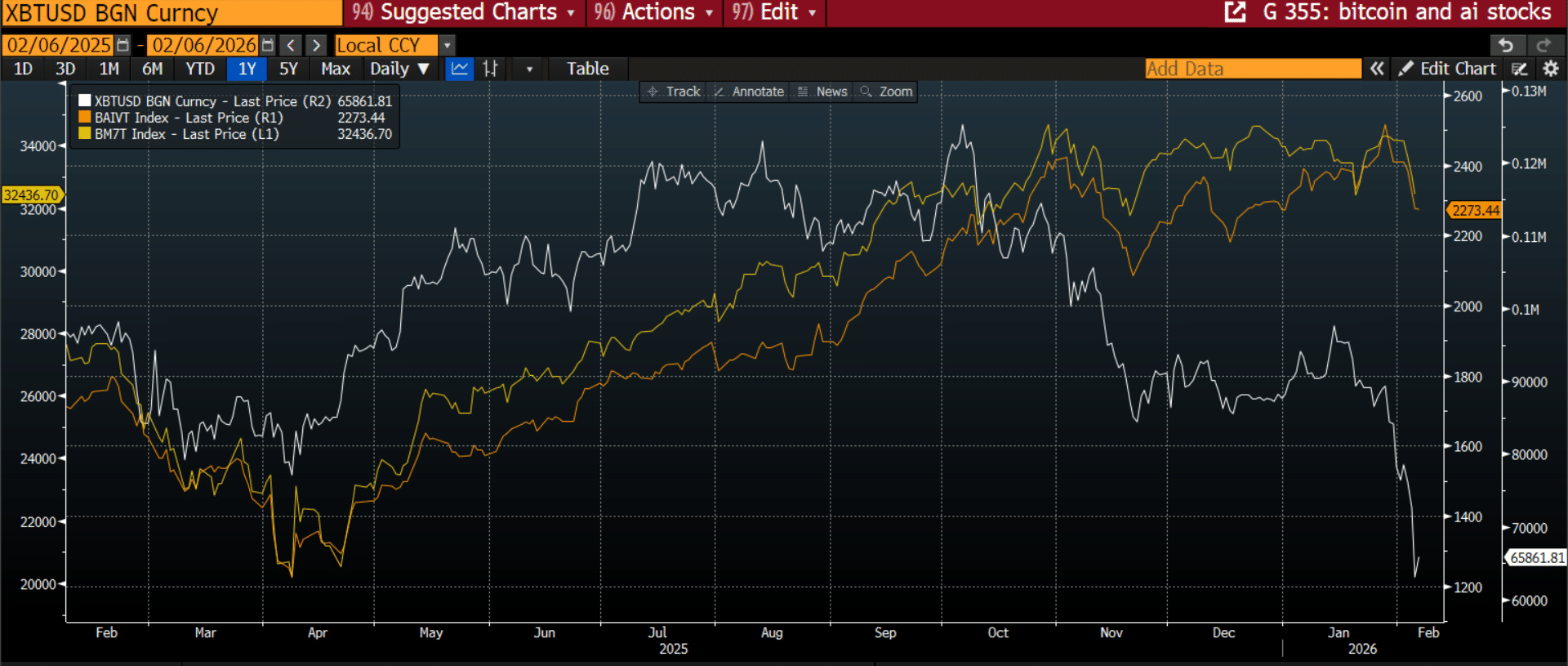

Why Bitcoin (BTC) Usually Drags the Entire Market

Bitcoin nonetheless units the tone: when Bitcoin (BTC) strikes, the remainder of crypto pays consideration. Even merchants centered on Bitcoin options watch BTC first earlier than making choices.

Bitcoin (BTC) because the Reference Asset and “Crypto Index”

Bitcoin acts like a market benchmark. Many deal with the Bitcoin community as crypto’s base layer.

Merchants typically monitor Bitcoin dominance to see how a lot capital sits in BTC versus the remainder of the market.

When the BTC worth rises, confidence spreads. When it falls, concern follows. It’s not official, however Bitcoin features like an index for crypto.

Why Many Altcoins Observe BTC Up and Down

Most altcoin buying and selling pairs rely on Bitcoin or stablecoins. When BTC drops, liquidity pulls again in all places. Even robust tasks fall throughout broad sell-offs. Correlation isn’t about high quality. It’s about shared capital and sentiment.

Correlation vs. Unbiased Strikes (When Alt Narratives Decouple)

Generally altcoins break free. New tech, launches, or hype can override BTC strikes for some time. Merchants typically describe these durations as “altcoin seasons.”

Instruments just like the relative power index assist spot short-term power. Decoupling occurs, however it not often lasts endlessly.

Learn additionally: Bitcoin vs. Altcoins

Crypto Asset Varieties: Bitcoin, Altcoins and Stablecoins

Crypto markets revolve round a number of core asset sorts, every enjoying a distinct position in how costs transfer.

Be taught extra about cryptocurrency sorts in our devoted article.

Bitcoin (BTC): Digital Trendsetter

Bitcoin (BTC) sits on the heart of the market. It’s the oldest and most generally tracked digital asset in crypto.

Fastened Provide and the 21 Million Cap

Bitcoin has a set provide. Solely a restricted variety of cash will ever exist: 21 million. This difficult cap makes Bitcoin structurally completely different from property that may develop provide when demand rises.

The Narrative of BTC as “Digital Gold” vs. Actuality

Many examine Bitcoin to gold, however that narrative has limits. Bitcoin’s truthful worth isn’t anchored to money flows or dividends. Worth depends upon adoption, perception, and market demand. The story issues, however markets nonetheless resolve.

Why BTC Tends to Be Much less Risky than Small Altcoins

Bitcoin often strikes lower than smaller tokens as a result of it’s extra liquid and broadly held. Nonetheless, worth volatility stays excessive in comparison with conventional property.

Altcoins: Extra Upside, Extra Chaos

Something that isn’t Bitcoin is an altcoin. These property typically promise sooner development, however additionally they carry greater danger. Costs can transfer shortly, in each instructions, with far much less warning.

What We Imply by Altcoins (L1s, L2s, DeFi Tokens, Memecoins)

Altcoins span your entire cryptocurrency ecosystem. They embrace base-layer blockchains, scaling options, DeFi protocols, and pure memecoins. Markets not often deal with all of them the identical means.

Smaller Market Caps, Thinner Liquidity, Extra Hypothesis

Most altcoins have decrease market capitalization than Bitcoin. Meaning fewer consumers and sellers. Low liquidity amplifies strikes. These circumstances entice speculative asset habits, that means sentiment can outweigh fundamentals for lengthy stretches of time.

Stablecoins: “Secure” Cash That Nonetheless Transfer Markets

A stablecoin goals to carry regular worth, however its market impression is something however static.

Stablecoins monitor fiat currencies, most frequently the US greenback. Issuers use reserves, collateral, or algorithms to maintain costs near $1. They scale back volatility, not danger.

Why Merchants Park Funds in Stablecoins Throughout Uncertainty

Throughout uncertainty, merchants transfer into stablecoins to cut back publicity. That is danger tolerance shifting, not confidence disappearing. Capital typically waits on the sidelines as an alternative of leaving crypto totally.

How Flows Between Stablecoins, BTC and Altcoins Drive Worth Swings

Cash strikes consistently between stablecoins, Bitcoin, and altcoins. These shifts form short-term market traits. When funds go away stablecoins, costs rise. Once they return, markets cool.

The right way to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero price

Structural Worth Drivers: Provide, Demand and Tokenomics

Underneath the floor, long-term crypto worth comes from how tokens are issued, distributed, and absorbed by the market over time.

Circulating Provide and Demand for a Cryptocurrency

Worth reacts to the out there provide of a cryptocurrency and the present demand for a cryptocurrency at any given second.

Demand for a Cryptocurrency: Utility, Hypothesis, Narrative

Not all demand is equal. Some comes from actual use, like funds or apps. Some comes from hypothesis. Some comes from tales folks imagine. The demand impression depends upon which kind dominates.

Utility-based demand tends to develop slowly and stick round.

Speculative demand strikes quick and leaves simply as shortly.

Narratives sit in between.

They’ll pull in capital quick, however solely final whereas folks keep satisfied. When demand shifts from one sort to a different, worth habits adjustments with it.

Why Worth Can Fall Even with a Fastened or Capped Provide

A set provide doesn’t assure rising costs. If demand drops, worth falls. General, provide limits form long-term habits, not short-term strikes.

Shortage solely issues when consumers care. When sentiment fades or capital leaves, worth adjusts downward, even when no new cash seem.

Token Provide Schedules and Emissions

Past whole provide, timing issues.

Token Provide Schedule: Emissions, Unlocks, Vesting

A token provide schedule defines how tokens are launched.

Emissions add new tokens progressively.

Unlocks launch beforehand restricted tokens.

Vesting controls when early holders can promote.

These occasions enhance circulating provide with out warning informal traders: when new tokens hit the market, promote strain rises. If demand doesn’t develop on the identical time, worth typically weakens.

Inflationary vs. Deflationary Token Fashions

Some tokens inflate provide over time. Others take away tokens by way of a token burn mechanism.

Inflation rewards participation however will increase promote strain. Burns scale back provide however don’t create demand by themselves.

Neither mannequin ensures greater costs: construction issues, however habits decides outcomes.

How Upcoming Unlocks or Cliffs Can Stress Worth

Massive unlocks can shock markets. Merchants anticipate promoting and modify early. This typically triggers a worth correction earlier than the unlock even occurs. By the point tokens unlock, the transfer might already be priced in.

Bitcoin Halving and Related Occasions

Bitcoin’s provide adjustments observe a strict schedule: the Bitcoin halving cuts issuance roughly each 4 years. Every occasion reduces what number of new bitcoins enter circulation. This doesn’t pressure costs up immediately, however it tightens provide over time.

Market reactions rely on demand, not the occasion alone.

Learn extra in our devoted article: The Bitcoin Halving Impact on Altcoins

Burns, Staking and Lock-Ups

Burns and staking change circulating provide dynamics.

A token burn mechanism removes tokens completely.

Staking rewards (by way of lock-up and inflation) encourage holders to lock tokens as an alternative of promoting.

Lock-ups scale back short-term provide, whereas rewards add long-term inflation.

Worth reacts to how these forces stability out in observe, not in concept.

Human Psychology: Sentiment, FOMO and FUD

In crypto, market sentiment can matter as a lot as fundamentals, particularly throughout quick strikes.

Market Sentiment: The Crowd’s Temper

Market sentiment describes how merchants really feel general.

Optimistic markets entice consumers. Fearful markets push folks to promote or sit out.

Sentiment spreads shortly as a result of merchants watch one another. When confidence rises, folks take extra danger. When confidence breaks, promoting accelerates. Sentiment doesn’t change worth, however it strongly shapes short-term worth motion.

FOMO: Worry of Lacking Out

FOMO kicks in when costs rise quick.

You see charts going up. Others are bragging about their income. You’re feeling late. That strain pulls new consumers in at worse costs. FOMO-driven demand can push costs far above sustainable ranges. It fades as soon as momentum slows, typically leaving late consumers uncovered.

FUD: Worry, Uncertainty, and Doubt

FUD works the other means. Unhealthy headlines, rumors, or unclear information scare folks into promoting.

Worry spreads sooner than info. Costs drop as merchants rush to cut back danger. Generally the considerations are actual. Generally they’re not. Both means, FUD amplifies draw back strikes.

Measuring Sentiment: Worry & Greed and Past

Merchants use instruments to trace emotion. The concern and greed index combines volatility, momentum, and exercise into one sign. Excessive greed suggests overheating. Excessive concern indicators panic. These instruments don’t predict worth, however they assist you perceive crowd habits.

Market Members and Market Construction: Who Strikes the Worth?

Worth strikes don’t come from charts. They arrive from choices. In crypto, worth varieties when traders with completely different sizes, time horizons, and incentives work together. What issues isn’t just what number of, however who these many traders are.

Who Is Truly Buying and selling?

Crypto markets combine very completely different gamers.

Retail traders react shortly and commerce emotionally. Institutional traders deal with liquidity, execution, and danger limits. Early traders typically sit on giant, low-cost positions and resolve when provide enters the market.

Massive holders, aka whales, management a big quantity of provide. Their significance isn’t a thriller—it’s plain math. Massive positions want liquidity. When whales act, markets modify to soak up their measurement. Generally that appears dramatic, even when no manipulation exists.

Worth displays how these teams overlap at any second.

Exchanges and Venues: CEX vs. DEX

Construction shapes habits. A centralized change (CEX) concentrates liquidity and permits quick execution. A decentralized change (DEX) spreads liquidity throughout swimming pools and chains. The identical commerce can transfer costs in a different way relying on venue, depth, and execution mechanics.

Learn additionally: CEX vs. DEX

Order Books, Spreads and Market Makers

An order e-book reveals the place liquidity sits proper now. Market makers provide that liquidity by inserting steady bids and asks. When circumstances are secure, they slim spreads. When danger rises, they pull again. Wider spreads imply worth reacts sooner to strain.

On a CEX, an organization runs the platform and matches consumers with sellers. On a DEX, sensible contracts deal with trades with no central operator. Completely different instruments, identical rule: worth strikes the place consumers and sellers meet.

Market Manipulation vs. Regular Volatility

Quick strikes don’t mechanically imply foul play. Market information can shift expectations immediately, and skinny books amplify reactions. Most sharp swings fall below regular volatility, pushed by positioning and exits by different traders. True manipulation exists, however it’s far rarer than panic and crowd habits.

Leverage, Derivatives and Liquidation Cascades

A few of crypto’s sharpest strikes don’t begin within the spot market. They arrive from amplified bets. Leverage and derivatives amplify each beneficial properties and losses, turning small worth adjustments into huge reactions.

What Is Leverage in Crypto Buying and selling?

Leverage allows you to management a bigger place with much less capital. A small worth transfer then has a much bigger impression in your revenue or loss.

This cuts each methods. Positive aspects develop sooner, however losses do too. As a result of leverage will increase danger, merchants should handle place measurement fastidiously. When many leveraged merchants sit on the identical facet, even modest strikes can set off speedy sell-offs or squeezes.

Crypto Derivatives at a Look

The derivatives market consists of futures, perpetual swaps, and choices. These devices monitor worth with out proudly owning the asset. They entice merchants due to leverage, low capital necessities, and straightforward shorting.

Derivatives typically commerce extra quantity than spot. Meaning worth discovery can occur there first, then spill into the spot market.

Pressured Liquidations: When the Change Closes Your Commerce

When losses attain a preset restrict, exchanges shut positions mechanically. This prevents accounts from going adverse. Throughout quick strikes, many closures can occur directly, making a liquidation cascade. Every compelled promote pushes the value decrease, triggering extra liquidations. The result’s a pointy, self-reinforcing transfer that appears sudden however follows strict guidelines.

Exterior Forces: Regulation, ETFs, Curiosity Charges and Macro Information

Crypto doesn’t transfer in isolation. Costs additionally reply to macroeconomic components that form world danger, capital flows, and investor habits throughout all markets.

Regulation and Coverage: Bans, Crackdowns and Approvals

Authorities choices matter. A single regulatory motion can change how markets behave in a single day. When a central authorities or nation state tightens guidelines, entry shrinks and danger rises. When readability improves, confidence follows.

Regulation doesn’t resolve worth instantly, however it reshapes who can take part and the way.

Spot Bitcoin ETFs and Entry Merchandise

Entry adjustments demand. Spot Bitcoin ETF approval opened crypto to traders who couldn’t or wouldn’t purchase cash instantly. ETFs plug Bitcoin into conventional brokerage accounts, retirement funds, and portfolios. That broader entry doesn’t assure greater costs, however it widens the customer base and adjustments how capital enters the market.

Curiosity Charges, Inflation and Threat Urge for food

Macro circumstances form risk-taking. Rising rates of interest make money and bonds extra enticing, whereas falling charges push traders towards development.

Excessive inflation largely reduces buying energy and shifts habits.

Many traders imagine that when conventional property really feel unstable, crypto can profit. When conventional investments supply yield, speculative property lose their enchantment.

Geopolitical Shocks and World Occasions

Wars, sanctions, elections, and crises transfer markets quick. Geopolitical occasions can set off sudden risk-off habits or capital flight. Crypto reacts not as a result of it’s particular, however as a result of traders reassess danger in all places directly.

On-Chain Knowledge, Adoption and Actual-World Utilization

In contrast to fiat currencies, crypto lets anybody confirm utilization. On-chain metrics present what truly occurs on the blockchain. You may monitor this knowledge on platforms like Glassnode, CryptoQuant, Dune, and blockchain explorers akin to Etherscan or Blockchain.com, which make on-chain exercise publicly seen.

Rising community adoption indicators actual demand, whereas stalled exercise raises questions.

Mass adoption doesn’t occur in a single day. It depends upon customers, apps, and venture builders constructing issues folks need. For long-term crypto investments, on-chain knowledge helps separate short-term noise from actual progress.

How Learners Can Handle Threat in a Risky Crypto Market

Place Sizing and “Cash You Can Afford to Lose”

Threat begins with measurement. Your danger tolerance decides how a lot you need to allocate. Smaller positions scale back emotional strain and restrict injury when markets transfer quick. If a loss would stress you out, the place is simply too giant.

Time Horizons: Dealer, Investor or Explorer?

Resolve your position early:

Merchants deal with short-term strikes.

Traders care about future efficiency over years.

Explorers be taught by experimenting.

Mixing kinds results in errors. Worth predictions tempt everybody, however investing includes danger regardless of the horizon.

Easy Instruments for Taming Volatility

These instruments don’t predict the longer term. They assist handle entries and exits.

Emotional Guidelines for Your self

One factor is price noting: feelings transfer markets, and so they transfer you too. Set guidelines earlier than buying and selling. Stick with your funding technique, not impulses.

Last Ideas

Crypto costs really feel wild as a result of crypto is completely different. In contrast to conventional currencies, crypto doesn’t sit behind a central financial institution that smooths volatility. That freedom makes crypto quick, world, and unpredictable. When you perceive how costs kind, react, and reset, chaos begins to appear to be construction—and danger turns into one thing you may handle, not concern.

Disclaimer: Please word that the contents of this text are usually not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.