XRP’s value crash earlier this week has stored many bullish traders within the XRP neighborhood on edge, however one outspoken voice locally believes the transfer will not be as random because it seems to be.

A crypto pundit generally known as Stellar Rippler has inspired XRP holders to tug their cryptocurrencies off centralized exchanges instantly, with the outlook that the latest volatility isn’t just one other routine market dip however a warning signal of what’s to return.

Associated Studying

Engineered XRP Crash?

Stellar Rippler’s place relies on the concept that XRP is being handled in another way from most digital property behind the scenes. He pointed to previous remarks from David Schwartz, co-creator of the XRP Ledger, the place XRP was described as a type of pre-allocated liquidity for institutional use, in addition to statements suggesting that XRP at the moment held in escrow might be offered to establishments however is not going to be circulated till NDAs are disclosed.

He went additional to call giant monetary gamers, together with BlackRock, JPMorgan, Financial institution of America, and establishments linked to the BRICS, the United Arab Emirates, the UK, and European central banking constructions. Based on the pundit, all these establishments have purchased the correct to purchase the XRP at the moment held in escrow by Ripple.

On the time of writing, there aren’t any public filings that verify coordinated shopping for of XRP escrows by these entities, however the argument has discovered receptive ears amongst traders unsettled by the latest sell-off.

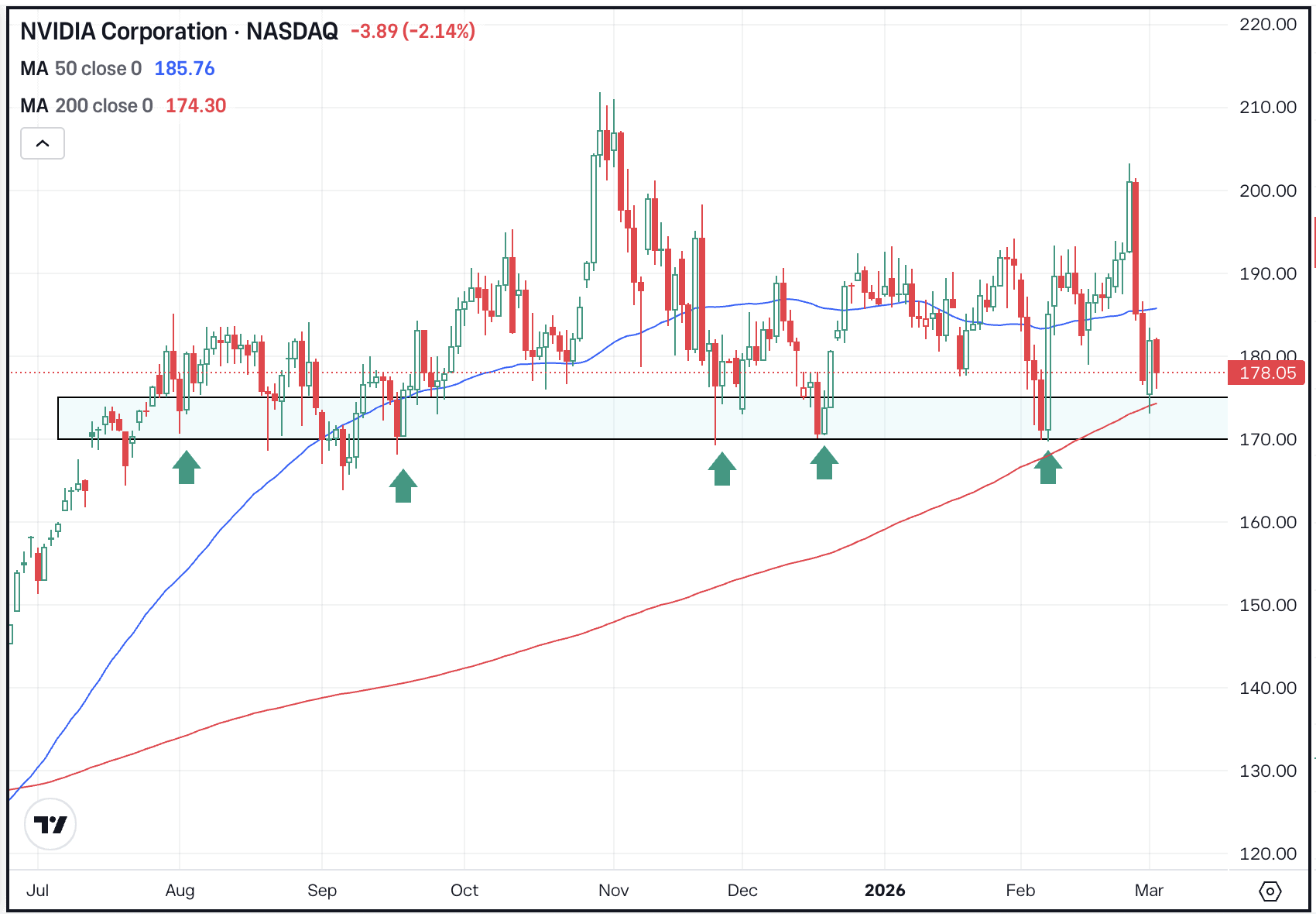

From that angle, the pundit famous that sudden draw back strikes, comparable to the latest drop to $1.15, are engineered. By “engineered,” this implies the worth crash serves a strategic function of making alternative for big monetary gamers to build up XRP at decrease costs earlier than any market repricing takes place.

Ought to You Take Your XRP Off Exchanges?

One other a part of the warning centered on consumer expertise at main crypto exchanges. Based on the pundit, Binance and Coinbase customers have reportedly been going through difficulties getting their crypto off the exchanges. This, in itself, is a warning for XRP holders to get their cryptos off crypto exchanges and into a chilly pockets. That message faucets into dialog in crypto about self-custody versus retaining holdings on crypto exchanges.

Calls to be your individual financial institution are likely to resurface at any time when value motion turns unstable. The alarm was sounded towards the backdrop of a Bitcoin value crash under $70,000 that pulled most cryptocurrencies decrease. XRP, specifically, dipped to round $1.15 throughout the sell-off earlier than rebounding.

Associated Studying

On the time of writing, XRP is buying and selling close to $1.42, easing some quick strain however not totally restoring confidence. With regards to confidence, sentiment surrounding XRP on social media is comparatively optimistic. Information reveals XRP is drawing extra constructive commentary than different large-cap property comparable to Bitcoin and Ethereum regardless of the latest market-wide crash.

Featured picture from Unsplash, chart from TradingView