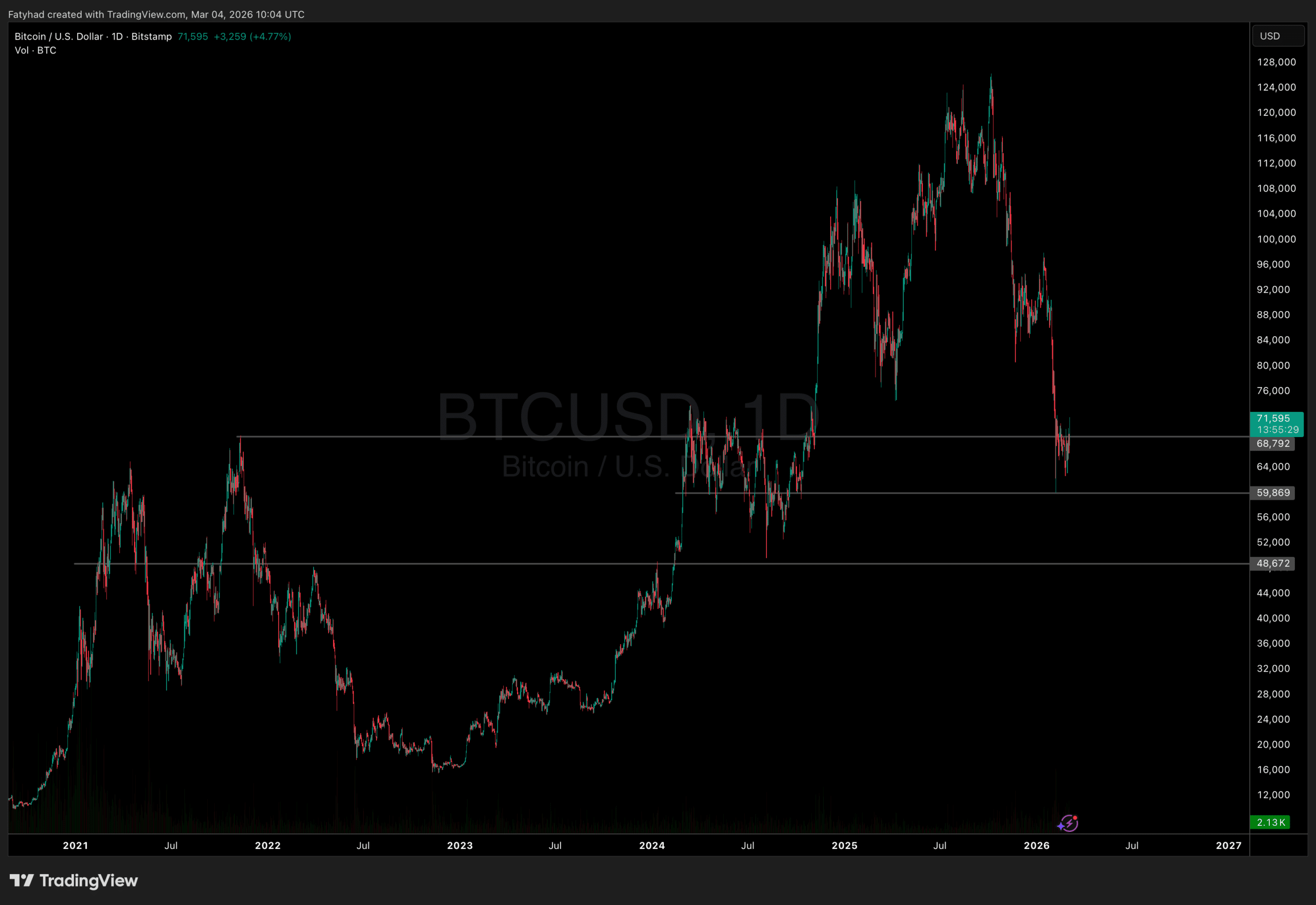

Since reaching its present all-time-high worth of $126,000 in October final 12 months, the Bitcoin market has been on a sell-off, translating into surmounting bear stress. In consequence, the flagship cryptocurrency has maintained a gradual decline, falling till it lately reached $60,000 — a deviation of greater than 52% from its all-time excessive.

Bitcoin at present appears to be seeing a rebound, however worth motion alone displays that it may as properly be certainly one of its short-term recoveries. Apparently, a latest on-chain analysis means that the present upward motion could also be pushed by a big underlying metric.

What The Bitcoin Sharpe Ratio Is Saying

In a Quicktake publish on CryptoQuant, Darkfost reveals that the Bitcoin Sharpe Ratio is now at a zone traditionally related to the ends of bear markets.

The Sharpe Ratio is a risk-adjusted efficiency metric that measures how a lot return an asset (Bitcoin, on this case) generates for threat taken. A excessive ratio indicators that returns are sturdy in relation to dangers taken; a declining ratio, then again, displays weakening returns, whereas threat stays elevated. On the extreme finish of the metric, a really low or unfavorable Sharpe Ratio is an indication that market members are taking very excessive dangers for poor or unfavorable returns. It’s value noting that very low Sharpe ratios are steadily seen throughout deep bear markets and even capitulation phases.

In line with historic knowledge, Darkfost explains that the Sharpe Ratio is at present at a stage so low as to be paying homage to the ultimate phases of previous bear markets. Which means the Bitcoin worth holds a better sensible threat, in comparison with returns, for present traders. Notably, the Sharpe ratio is not only at a low level, however continues in a gradual state of decline. This, based on the market quant, is an indication that Bitcoin’s efficiency is but to be engaging to any prepared risk-taker.

Nevertheless, it’s this particular dynamic that units the tempo for a turnaround in Bitcoin’s worth. It is because sustained poor returns sometimes drive capitulation occasions, the place weaker arms are flushed out; this ultimately units the stage for renewed accumulation amongst stronger arms.

Two Major Approaches To Take into account In This Situation: Analyst

Seeing as the present market situation remains to be largely unsure, Darkfost provides two methods to have interaction the present state of affairs. First, the analyst states that traders may start growing publicity progressively, and consistent with the ratio’s motion in the direction of decrease threat zones.

Second, Darkfost explains {that a} market participant may resolve to attend for clear enhancements within the Sharpe Ratio earlier than getting into the market in any respect. That is to function a affirmation technique for the aim of investor security.

Nevertheless, Darkfost notes that the current bear section may final a pair extra months earlier than any true reversal is seen, whatever the sign being flashed by the Sharpe Ratio. As of this writing, Bitcoin stands at a $69,064 valuation. CoinMarketCap knowledge displays a 1.71% loss over the previous day.