Ethereum’s outlook for 2026 has grow to be more and more contested after the most up-to-date downturn in all the crypto market. Earlier this yr, analysis from Customary Chartered prompt that Ethereum may finish 2026 close to $7,500, a goal that suggests important upside from present ranges. Nonetheless, current value motion, with ETH languishing round $2,000 and missing clear bullish momentum, places such projections towards a really totally different sensible outlook.

Customary Chartered’s Ethereum Lengthy-Time period View

In a January analysis notice, Customary Chartered’s digital belongings workforce trimmed its medium-term outlook for Ethereum whereas holding a extremely optimistic imaginative and prescient for the years forward. The financial institution now sees ether closing 2026 close to $7,500, down from an earlier forecast of round $12,000, and expects the asset to climb to $15,000 in 2027, $22,000 in 2028, and ultimately $40,000 by the top of 2030.

Associated Studying

In keeping with the notice, the change is because of weak efficiency from Bitcoin dragging broader dollar-denominated crypto valuations, even because the financial institution pointed to Ethereum’s strengths in stablecoins, decentralized finance, and tokenized belongings as positives to carry on to.

Within the analysis notice, digital belongings analyst Geoff Kendrick famous that 2026 is essential not only for value but in addition for Ethereum’s efficiency relative to bitcoin. Due to this fact, crucial factor for beneficial properties is a rebound within the ETH/BTC ratio to ranges final seen in 2021.

The Odds – Present Worth Motion Towards Bullish Case

The trail from roughly $2,000 to the mid-$7,000s appears to be like very robust in comparison with what it was firstly of the yr. This, in flip, has seen the percentages of the Ethereum value reaching $7,500 cut back drastically. Ethereum began 2026 on an excellent foot, with a rally to $3,370 within the first two weeks of the yr. Notably, it did not maintain this rally and has since fallen by about 40% up to now 30 days.

Associated Studying

Because it stands, Ethereum is now buying and selling round $2,000, and the value has repeatedly failed to shut convincingly above the $2,100-$2,150 zone in current periods. Though the main altcoin is now again to buying and selling above $2,000 after a break beneath throughout final week’s sell-offs, bulls are but to ascertain any management of value momentum.

On-chain knowledge additionally reveals the switch exercise surrounding Ethereum is pointing to elevated stress circumstances. Thankfully for bullish merchants, it’s nonetheless too early within the yr to rule out the potential of Ethereum buying and selling at $7,500 in 2026. A number of issues would wish to alter for an consequence near Customary Chartered’s 2026 estimate to grow to be believable. One among them is the return of demand and regular inflows into Spot Ethereum ETFs.

On the time of writing, Ethereum is buying and selling at $2,025. Proper now, the cryptocurrency must clear the $2,150 resistance and maintain above it in an effort to proceed the regular push up.

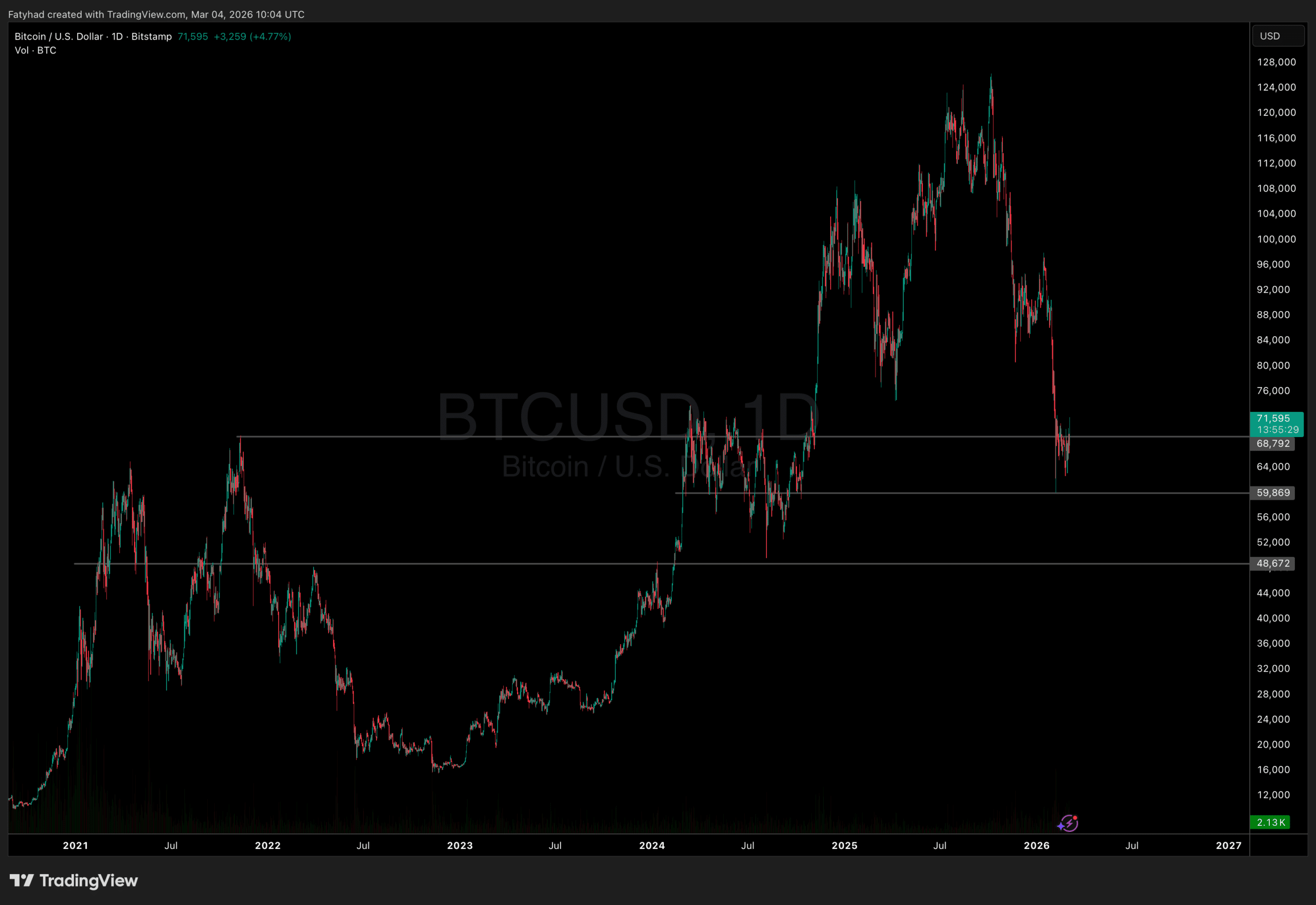

Featured picture from Pxfuel, chart from Tradingview.com