South Korean regulators have introduced an inspection of native crypto exchanges and improved measures to deal with regulatory “blind spots” following Bithumb’s $40 billion Bitcoin (BTC) fee error.

New Job Pressure To Evaluate Crypto Exchanges’ Practices

On Monday, South Korean monetary authorities introduced they may step up their efforts to control the crypto business and foster a reliable buying and selling setting for digital belongings, native information retailers reported.

Following the “ghost Bitcoin” incident at Bithumb, South Korea’s second-largest cryptocurrency alternate, the Monetary Supervisory Service (FSS)’s Governor Lee Chan-jin revealed an inspection of native exchanges and emphasised the necessity for improved laws.

As reported by Bitcoinist, Bithumb by accident distributed 620,000 Bitcoin, price over $40 billion, to 249 customers collaborating within the alternate’s “random field” promotional occasion as a result of an worker’s mistake.

Though 99% of the BTC had been recovered, the incident raised critical issues in regards to the crypto alternate’s inner controls. Notably, Bithumb held 175 BTC in its personal books, and fewer than 50,000 Bitcoin between its personal belongings and customer-held belongings, in keeping with a regulatory submitting from final yr.

Because of this the alternate’s system failed to dam the irregular transaction, distributing belongings that didn’t truly exist to customers and distorting market costs.

“The so-called ghost Bitcoin incident clearly revealed that, past a mere enter error, there are structural weaknesses in inner controls and ledger administration programs of cryptocurrency exchanges,” stated Kim Jiho, a spokesperson for the ruling Democratic Get together, in a Saturday briefing.

In the meantime, the FSS Governor affirmed that the “incident bluntly uncovered the structural flaws in digital asset buying and selling programs,” including, “There are numerous features of the case that we view as extraordinarily critical.”

In consequence, the FSS, alongside the Korean Monetary Intelligence Unit (KoFIU), the Monetary Supervisory Service (FSS), and the Digital Asset eXchange Alliance (DAXA), fashioned an emergency activity power to arrange follow-up measures and overview industrywide practices.

The stories famous that the duty power plans to look at Bithumb and different home exchanges’ digital asset reserves, administration practices, operational circumstances, and inner management programs.

“We’ll perform deliberate investigations into main high-risk areas within the digital asset market the place unfair buying and selling practices, similar to market manipulation and the dissemination of false data, are a priority,” Lee acknowledged.

Regulators To Handle ‘Structural Vulnerabilities’

The FSS Governor additionally warned that the method might be escalated right into a full investigation if any unlawful actions are revealed, including that the incident can be mirrored within the long-awaited Second Part of the Digital Asset Person Safety Act, which is anticipated to function a complete framework for the whole business.

“Whereas we’re drawing up the second section of digital asset laws, measures to deal with structural vulnerabilities at exchanges, uncovered by the current Bithumb incident, will likely be mirrored,” Lee declared.

“As digital belongings are being integrated into the legacy monetary system, there stays the duty of strengthening the regulatory and supervisory framework. This might function a chance to place the system in place correctly,” he continued.

It’s price noting that South Korean monetary authorities are reportedly contemplating introducing a system to forestall suspects from hiding or withdrawing unrealized earnings from market manipulation associated to crypto belongings.

The Monetary Companies Fee (FSC) revealed final month that it’s exploring the proposal for prosecution measures towards suspects of crypto asset value manipulation, as some officers take into account that there’s a necessity “to enhance the present Digital Asset Person Safety Act by implementing measures for the confiscation of legal proceeds or the preservation of restoration funds upfront.”

The measure would restrict fund outflows, similar to withdrawals, transfers, and funds from a crypto-related account suspected of acquiring illicit good points by typical market manipulation ways.

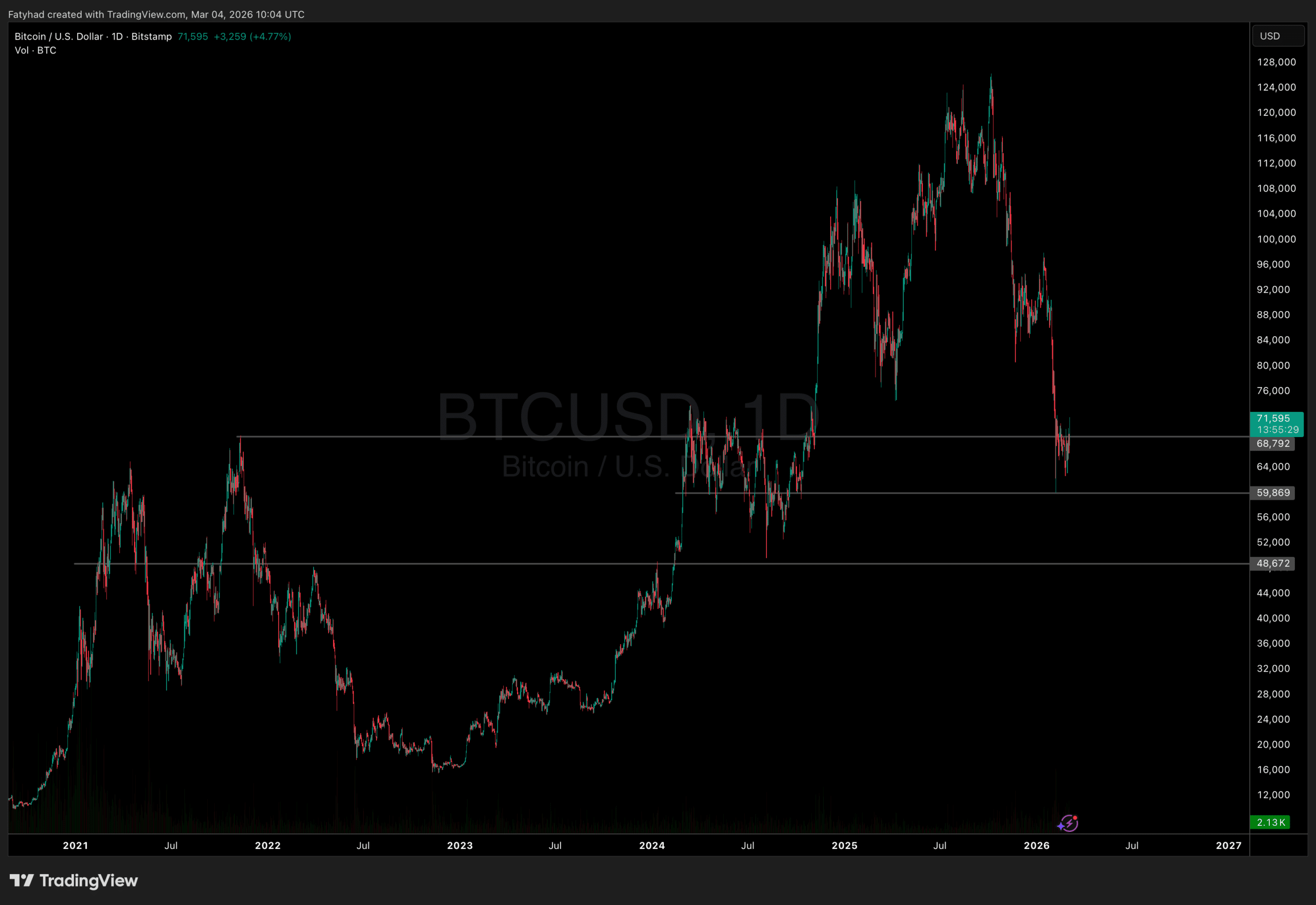

Bitcoin trades at $69,010 within the one-week chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.