Personal credit score is without doubt one of the largest — and least understood — markets in world finance.

It doesn’t pattern on X.It doesn’t transfer with Bitcoin.And most of the people by no means get entry to it at all.

But over the past decade, non-public credit score has quietly grown from $300B to roughly $2.5T, delivering double-digit returns with low correlation to public markets.

So why hasn’t it mattered to crypto till now?

That’s the query on the coronary heart of this dialog with Tomer Bariach, CEO of Textile, and Dr. Mark Richardson, Challenge Lead at Bancor, and the rationale non-public credit score is lastly beginning to transfer onchain.

https://medium.com/media/54fae1006f5689bac2fa8142a808e949/href

What’s non-public credit score, actually?

At its core, non-public credit score is straightforward.It’s lending cash instantly — outdoors of public bond markets.

No inventory change.No public prospectus.No tradable bonds.

As an alternative, capital strikes by non-public agreements between corporations, lenders, and intermediaries.

https://medium.com/media/1e85dd828d2bc182467503f0b8309542/href

In follow, this typically appears to be like like:

Fintech corporations borrowing capital to fund loans they difficulty themselvesBusinesses financing invoices, stock, or commerce flowsCredit preparations structured round actual money flows, not hypothesis

It’s nearer to “mates lending to mates” than Wall Avenue buying and selling desks — however at a world, institutional scale.

https://medium.com/media/1c0cb8a9b329301b5b68aad0b101d897/href

And critically:

A lot of the World South doesn’t run on public markets — it runs on non-public credit score, the place entry is usually relationship-driven and opaque. Excessive-growth fintechs with actual traction can keep invisible to world non-public credit score allocators just because they aren’t in the appropriate networks.

The capital that fuels provide chains, payrolls, and commerce typically by no means touches a public change.

Which ends up in the true downside.

Why non-public credit score stays unique

Personal credit score works — however it’s inefficient and closed.In order for you publicity at this time, you don’t purchase an index.

You analyze each single deal:

Who’s the borrower?What’s the collateral?What’s the danger?What occurs if issues go fallacious?

That’s the alternative of how fashionable investing scales.

Evaluate it to the S&P 500

You don’t consider 500 corporations individually.You belief the construction.

Personal credit score has by no means had that construction.And there’s one foremost purpose why.

https://medium.com/media/036249afea79dd0484dc88f4d717e91b/href

Why non-public credit score by no means got here onchain

Personal credit score didn’t keep offchain due to regulation alone.

It stayed offchain as a result of current onchain markets had been the fallacious form.

DeFi liquidity was designed round belongings that:

Commerce constantlyHave 1000’s of participantsRequire steady two-sided markets

Personal credit score has none of these properties.

Credit score positions are:

SparseTime-boundIntentionally heldBought with the expectation of finality

Conventional AMMs assume perpetual re-trading. Personal credit score requires trades to settle as soon as.

Till that mismatch was resolved, bringing non-public credit score onchain wasn’t simply tough — it was structurally unattainable.

The liquidity downside

Personal credit score is illiquid by design.

As soon as capital is deployed, it’s locked till maturity.

In order for you out early, you normally have one choice: ask the borrower to repay you.

That makes:

Portfolio rebalancing practically impossibleIndex-like merchandise unworkablePassive publicity unrealistic

Liquidity right here isn’t a “good to have.”

With out it, structured merchandise merely can’t exist.

And that is the place blockchain — and Carbon DeFi — change the equation.

https://medium.com/media/3bc64481b07d6b524432ead078d81eb8/href

What modifications when non-public credit score goes onchain

Tokenizing non-public credit score is about unlocking secondary markets with out breaking the first settlement.

Onchain, a credit score place turns into:

A programmable assetTransferable with out renegotiating the loanPriced by market contributors, not gatekeepers

Meaning:

Positions might be bought earlier than maturityDuration danger might be priced dynamicallyLiquidity can emerge organically

Not fixed, pressured liquidity — however intentional liquidity.This distinction issues.

Why Carbon DeFi makes this attainable

Personal credit score uncovered a blind spot in DeFi liquidity design.

Conventional AMMs assume one thing that personal credit score doesn’t have:steady two-sided markets.

Personal credit score positions are:

SparseAsynchronousHeld deliberately

Carbon DeFi was constructed for precisely one of these market.

https://medium.com/media/9dd803aef491f19b6f097cf6d872ba58/href

On Carbon DeFi, contributors outline:

After they’re keen to buyWhen they’re keen to sellAt what priceAnd solely at these costs

There’s no obligation to cite either side. No automated re-selling. No pressured publicity.

A commerce settles as soon as — cleanly.

That’s essential for credit score markets, the place consumers don’t need their place instantly traded again towards them.

This mannequin permits:

Secondary liquidity with out fixed churnPrice discovery with out quantity gamesExit choices with out breaking mortgage phrases

Carbon DeFi offers the market construction non-public credit score has all the time wanted — however by no means had.

Textile’s position: opening the system

Textile isn’t a lender.

It’s a personal credit score community — a manufacturing facility for creating onchain credit score markets.

Anybody can:

Open a credit score poolDefine the termsTokenize credit score publicity

However Textile doesn’t depend on blind belief.

As an alternative, it introduces underwriters.

https://medium.com/media/31d310be23b24cf6a6b60b9deb697792/href

Underwriters: measured, priced, and rewarded.

In Textile, underwriters matter greater than debtors.

They:

Carry real-world offers onto the networkPerform due diligenceStake capital as first-loss riskEarn extra when offers carry out nicely

Their rewards scale with:

Lively credit score volumeRepayment performanceLongevityCapital at danger

Good underwriting earns extra.Dangerous underwriting earns much less — or loses capital.

https://medium.com/media/5ba2c14f4e0105eba8287444f1f01267/href

What sorts of markets are rising?

Textile doesn’t dictate which credit score markets win.

Underwriters do.

That’s why early markets embrace:

Crypto-backed lendingTrade financeOn/off-ramp liquidityInvoice-backed creditWorking capital for fintechs

Some are world.Some are native.Some are denominated in USD stablecoins.Others in native currencies — typically with greater yields as a result of misunderstood FX danger.

The market decides.

Why this issues

Personal credit score already runs a big a part of the worldwide economic system.

What it’s lacked is:

TransparencyLiquidityAccessibilityProgrammability

Blockchain offers the rails.Textile offers the credit score layer.Carbon DeFi offers the mandatory liquidity infrastructure.

Collectively, they flip non-public credit score from a closed “buddy circle” into an open system.

Bancor

Bancor is a pioneer in decentralized finance (DeFi), established in 2016. It invented the core applied sciences underpinning the vast majority of at this time’s automated market makers (AMMs) and continues to develop the foundational infrastructure vital to DeFi’s success — specializing in enhanced liquidity mechanics and strong onchain market operation. All merchandise of Bancor are ruled by the Bancor DAO.

Web site | Weblog | X/Twitter | Analytics | YouTube | Governance

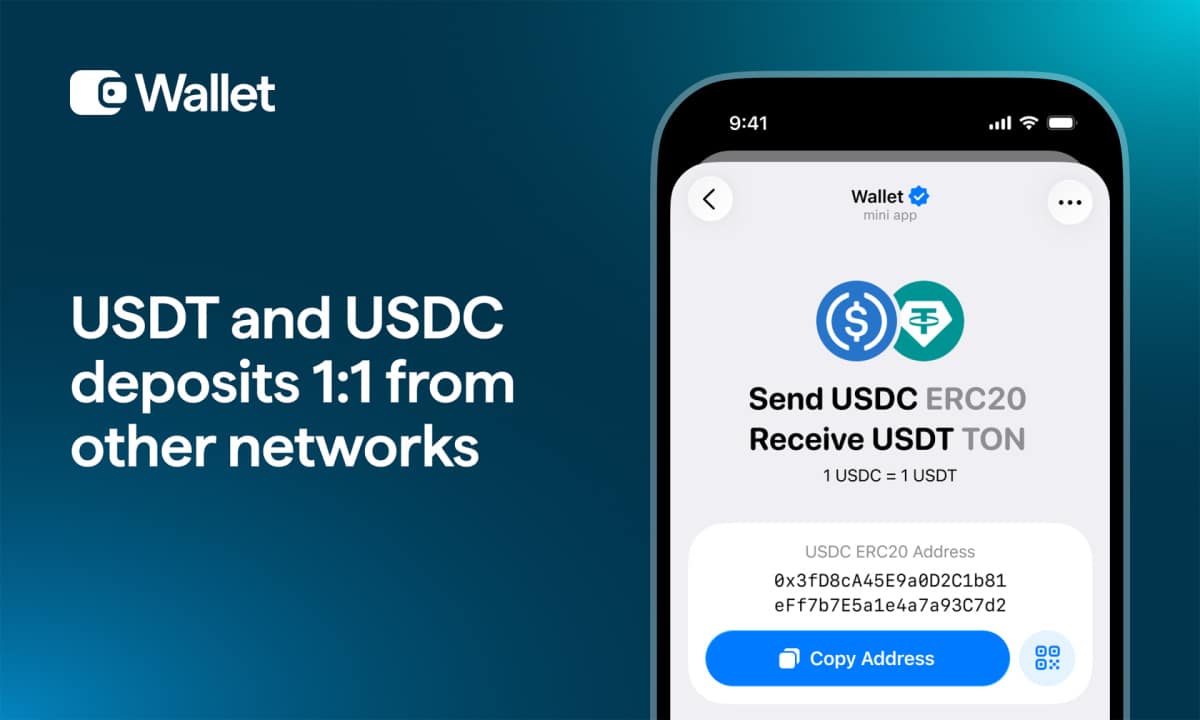

Carbon DeFi

Carbon DeFi, Bancor’s flagship DEX, permits customers to do the whole lot attainable on a conventional AMM — and extra. This contains customized onchain restrict and vary orders, with the power to mix orders into automated purchase low, promote excessive methods. It’s powered by Bancor’s newest patented applied sciences: Uneven Liquidity and Adjustable Bonding Curves.

Web site | X/Twitter | Analytics | Telegram

The Arb Quick Lane

DeFi’s most superior arbitrage infrastructure powered by Marginal Worth Optimization, a brand new technique of optimum routing with unmatched computational effectivity.

Web site | Analysis | Analytics

How a $2.5 Trillion Personal Credit score Market Is Transferring Onchain was initially printed in Bancor on Medium, the place persons are persevering with the dialog by highlighting and responding to this story.