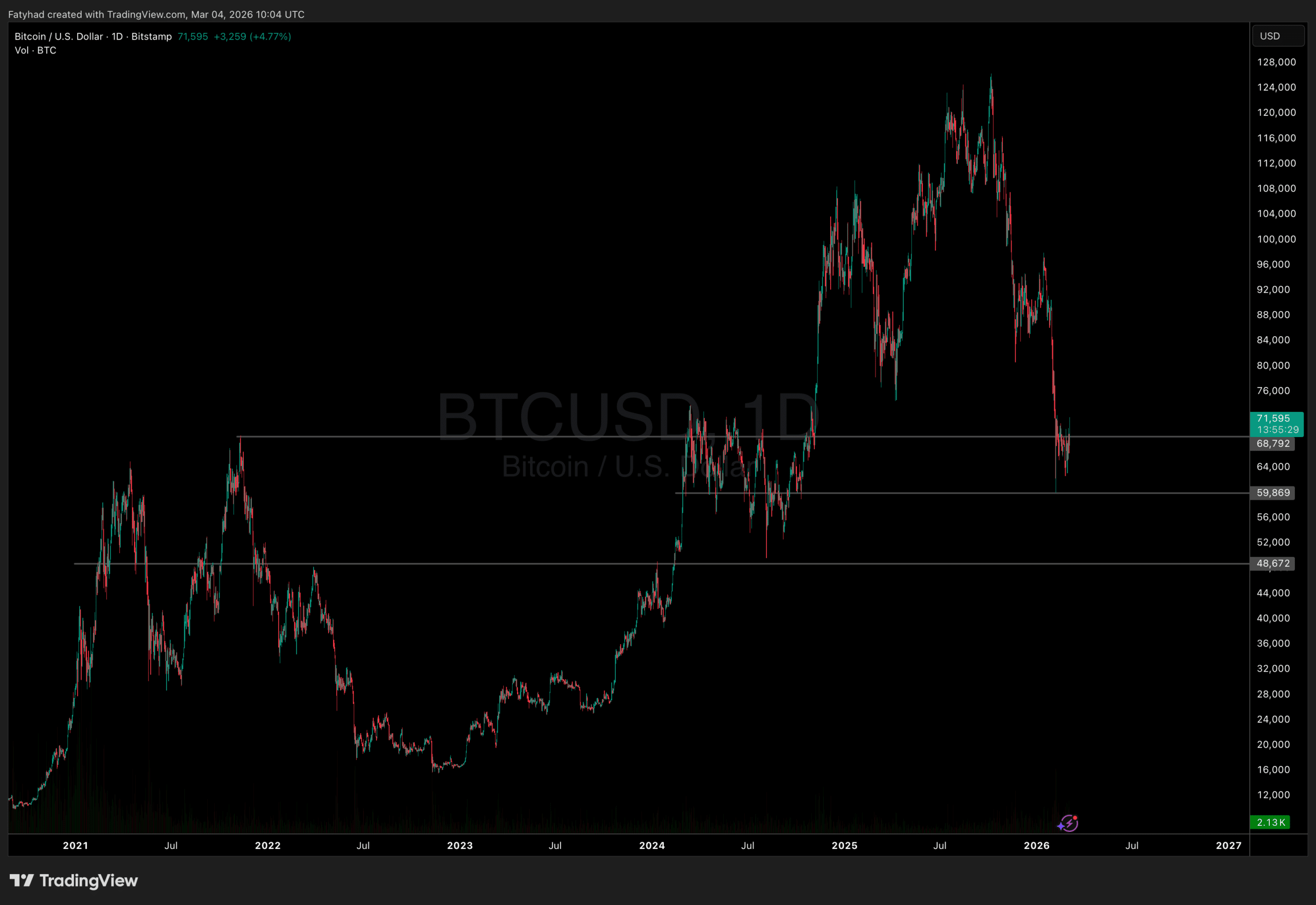

Bitcoin and Ethereum, the 2 largest cryptocurrency property, proceed to face persistent draw back strain, with BTC caught under the $70,000 degree and ETH under the $2,000 mark. With BTC and ETH recording regular losses, BlackRock has began to cut back its publicity to each property, promoting an enormous chunk of its holdings over the previous few days.

BlackRock Adjusts Bitcoin And Ethereum Publicity

Within the risky cryptocurrency panorama, a number of establishments are not doubling down on Bitcoin and Ethereum, as evidenced by a pointy sell-off on the institutional degree. BlackRock, the most important asset administration agency, is taking the crypto highlight after its latest strikes to dump each cash.

When giant corporations like BlackRock are promoting, it usually raises issues in regards to the stability of the asset, as they trim positions and shift danger situations. Though opinions differ and causes regarding the promoting exercise are but to be decided, sentiment and liquidity may be impacted even by how institutional distribution is perceived.

Latest flows and on-chain knowledge present that the main asset supervisor lately deposited one other $234.3 million price of Bitcoin to Coinbase Prime. On the identical time, BlackRock moved over $60.83 million price of ETH to the identical platform. In complete, each transactions had been valued at roughly $295.13 million.

In accordance with Milk Highway, a market professional and investor, when property migrate to Coinbase Prime, it normally signifies that they’re on the point of promote. This substantial sell-off from BlackRock demonstrates how attentively markets monitor main individuals and the way inclined costs are to indications of institutional repositioning.

As the value of each property continues to maneuver sideways, the transfer factors to gradual weakening conviction of their near-term prospects. Nevertheless, this isn’t totally a adverse second for the main property. This is because of the truth that any promoting might doubtlessly be utterly offset by the purchase strain of the day.

On Monday, February 9, BlackRock moved BTC and ETH valued at $247.71 million to Coinbase Value. Nevertheless, there have been bullish flows throughout the Alternate-Traded Funds (ETFs) marketplace for the day. The identical day, Bitcoin ETFs recorded over $144.90 million inflows, whereas Ethereum ETFs noticed greater than $57.00 million inflows.

BTC And ETH Dropping To XRP

Given the promoting exercise round Bitcoin and Ethereum, their buying and selling volumes have fallen behind that of XRP, implying a shift towards the altcoin. In Asia, notably South Korea, XRP has flipped BTC and ETH when it comes to quantity as reported by X Finance Bull on X. The leap suggests elevated speculative exercise and renewed curiosity from Asian merchants, as liquidity facilities round XRP slightly than the bigger market leaders.

Many analysts are starting to place XRP forward of BTC and ETH, claiming it’s going to lead the market within the upcoming years. Veteran investor and entrepreneur Patrick L Riley acknowledged that if Bitcoin doesn’t break $150,000 this 12 months and reclaim its 12-year development line, it’s more likely to retest the $1,000 mark.

Regardless of the situation, Riley is assured that XRP will grow to be the crypto chief throughout the subsequent 6 years. After that, Bitcoin will likely be diminished to a collectible for nostalgia for these people who find themselves within the macabre.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.